Before the emergence of mobile banking apps, customers had to wait in line, complete several forms, and ensure everything was in order. Now, you only have to use your smartphone to transfer money or check balances. Once users are aware of applications for mobile banking, they can make managing their cash easier and more comfortable.

In the last few years, mobile banking app development services have gained importance. Continuous innovations and advancements in mobile banking have shaped how it will evolve in the coming years. Additionally, mobile banking technology offers speed, security, and ease of use for transactions. Yet, the new mobile banking trends, as well as shifts in consumers' expectations, require agility and foresight.

With the rise of digital payment options becoming more common, the development of mobile banking apps is also evolving to adapt to emerging developments. In this blog, we will examine the most important banking app development trends 2024.

Also Read : Top 13 Gamification Ideas For Banking App Engagement

What Is a Mobile Banking App?

Mobile banking offers a quick and safe method of managing your financial affairs using your phone or tablet. Using a mobile banking program makes it easy to log in to your bank account to check your balance, pay your bills, transfer money, and make deposit checks. In all, you have access to the majority of products and services that your bank offers. It's also convenient for the internet to access your account anytime and perform financial transactions or things whenever you're connected online.

That is to say, the bank controls your bank accounts, products, and services. Numerous banks have included robust features, such as getting loans, insurance, placing your money into mutual funds, fixed deposits, and more. All in one app, without going to the nearest bank branch.

In reality, you would have to seek assistance from customer support service to access or inquire about specific bank products. That is also provided through commonly requested questions (FAQs), online chat, or customer service calls directly through the application. However, each bank will provide its customers with a mobile banking app user's manual.

Why Invest In Mobile Banking App Development?

Banking app development solutions provide customers with many advantages, making banking easy and simple. People are more likely to remain loyal and content if they can manage their money seamlessly from their smartphones. These are a few of the most important reasons to invest in mobile banking apps.

Superior Service

There are no longer days when customers have to visit the bank to verify their balance, transfer funds, or perform another banking transaction. Nowadays, thanks to the advent of mobile banking, consumers can control their financial affairs from anywhere at any time. This eliminates the requirement to go to physical banks and stand for long wait times.

Reduced Costs

An excellent banking application streamlines processes and eliminates the need to build a large physical infrastructure and personnel. In the end, companies can save money. The company will not be tied to branches, regional centers, etc. Furthermore, it will reduce the cost of providing customer service. It is easier to manage fewer staff and don't have to lease offices or pay any other cost.

Paperless Operations, Precision, And Accuracy

Implementing a mobile banking application will eliminate the need for lengthy documents, allowing for precise and effective banking operations. Automating this process can reduce costs, make the business more efficient, and increase longevity.

High Return On Investment

Business owners expect a high return on investment when they create mobile banking apps. The return on investment can be seen in various ways, like improved customer satisfaction, increased reputation in the market, higher revenues, and larger customers. This means that businesses can anticipate long-term growth and profits.

Tailored Services

Companies can utilize banks to collect useful information about their clients and help them better tailor their marketing strategy and products. Personalized banking apps can provide specific financial plans, products, and personalized services that meet each client's preferences.

Also Read : Mobile Banking App Development a Comprehensive Guide In 2024

Mobile Banking App Development Trends 2024

Following this pioneering technology, the world of banking is changing. Banks provide a variety of online banking services to customers and create mobile banking applications to offer an unbeatable user experience. In 2024, this staggering figure is projected to triple and rise to 3.6 billion.

Conducting Market Research And Planning Projects

The users are more likely to fill out surveys and comment on the app, making it ideal for testing new financial products. The app can gather statistics about functional updates and then improve them. You can classify users by different parameters and create specific deals based on the analysis data.

Bonus and cashback custom mobile banking software development features benefit every customer and serve as an argument in favor of choosing your online banking application. Find out what users think regarding the app, record information, and enhance the services.

Cardless ATM Service

Cardless ATM services have become increasingly commonplace in recent years because more banks allow their clients to withdraw money without needing to swipe a physical card. The only thing you'll need is a phone to open the app then scan the QR code, and it's instantly linked to your bank account for withdrawals. Studies suggest the cardless ATM market will increase to $2.11 billion in 2026.

The innovative solution also assists in decreasing the use of credit cards that could be stolen or lost, which makes banking transactions safer and safer. In addition, the usage of cardless ATM services makes it easier and faster for consumers to access their funds quickly enough to reach their destination. Ultimately, cardless ATM service is revolutionizing banking through its blend of security and convenience.

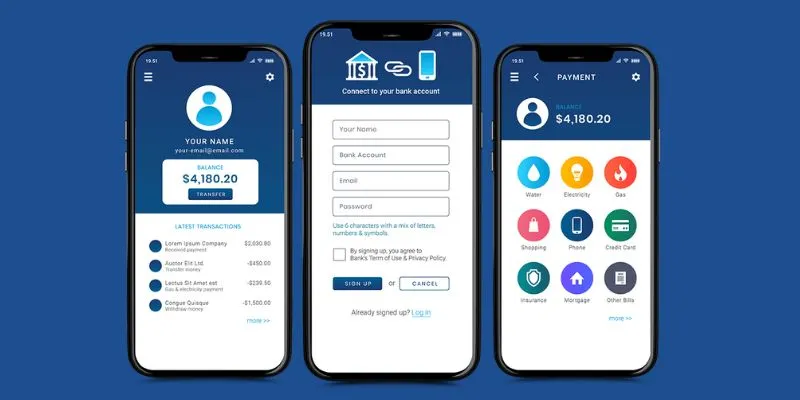

User-Friendly UX/UI

The more users you wish to attract to your site, the more user-friendly it will be. A simple navigation system and a minimalist layout of the mobile banking application help users comprehend and use your online wallet and mobile banking service.

Be aware that not all app users will have a background in technology, and you need to ensure that every person who downloads the banking app can access it easily. So, making it simple is the most effective method to find the best mobile banking applications. The UI/UX style should be contemporary and easy to use.

People don't like going to banks because they are difficult and slow. Digital banking has revolutionized the rules of play and proved that managing money can be enjoyable. Develop a banking program that's easy to operate and appealing with an attractive and uniform layout. Additionally, a well-designed interface can ensure that users are satisfied with the app and bring benefits to the whole start-up.

Biometric Authentication

The landscape of mobile banking changes constantly, and biometric authentication is among the most recent trending technologies that are gaining attention. Customized web application development services now offer fingerprint and facial scanning to provide additional security to their clients.

This authentication method guarantees safe access to banking on mobile devices as it relies on an individual's physical features for access. The worldwide market for biometrics used in financial and banking services will be $8.9 billion in 2026.

With biometric authentication, mobile banking is now more secure for financial transactions. Because of the ease of use and security, this innovative technique provides mobile banking using biometric authentication is rapidly gaining acceptance among mobile users and businesses.

From Mono-Functional To Super-App

As the mobile banking trend continues to develop, it's becoming more apparent that banks need mobile banking applications. Customers want more features in their banking applications and do not want to be limited by the basics offered by web banking. They would like a complete account with access to every financial service. Future trends suggest creating an environment of features and services tailored to the customer's needs.

Try offering options such as alerts for bill payments and account settlements, budgeting, tracking expenses and loan payments, and online shopping. In addition, if the mobile banking app you use offers other services not associated with the banking mentioned earlier. Your bank will be closer to customers via different channels, which will boost your bottom line and the top line for the foreseeable future.

Blockchain Technology

Banking software development services are becoming increasingly widespread as blockchain technology develops as an important device for banks. Blockchain technology allows mobile banking app customers to make secure transactions without the requirement for a physical third party.

Blockchain technology used in finance can allow for the commercialization of information in a secure manner, and statistical analysis can take on an increasingly important role in mobile banking. As the technology is based on cryptography banks, Fintech giants can easily ensure the safety of sensitive data. In addition, blockchain can provide advantages such as automated transactions and data authenticity.

AI-Powered Customer Service

The incorporation of bots in mobile banking applications is anticipated to become the main way to adopt chatbots in the near future. Mobile banking applications for BFSI utilize this innovative technology to provide better customer service through artificial intelligence and machine-learning algorithms that anticipate user needs. It allows mobile banking customers to have instant support to address their most basic needs and access personalized offers and assistance quickly.

Additionally, mobile banking customers will be able to communicate faster and more effectively with their bank via AI-enabled virtual assistants, as technology is advanced enough to detect the human voice and natural conversation. The mobile banking trend makes it simpler for customers to connect with their bank on smartphones and experience quicker responses than ever.

Personalized Data

One of the biggest changes shaping the market by 2024 is a much greater utilization of the latest Personal Finance Management (PFM) instruments. They have gone from being merely add-ons to essential elements of mobile banking applications.

PFM instruments provide personalized advice on finances, precise budget tracking, and smart spending categorization. Gen X and Millennials Gen Z, who focused on the importance of financial education and proactive handling of their money, are the main drivers in the rise of these tools. In addition to more control over your financial situation, you can enjoy more personalization and a more customized banking experience.

The modern-day customer expects the app they use to respond to their specific requirements and preferences in financial matters by providing a personalized banking experience that follows their daily lives and changes in their needs. It is in the forefront. Flexible interfaces that can be customized, personalized messages, and customized information on finances make it simpler for customers to establish and meet their financial objectives.

Voice Payments

The latest trends in banking include banks offering voice-based payment online through their banking apps. The biometric method is being implemented, using sensors within mobile phones to enhance security further.

Rapidly growing in popularity, investment management software development is allocating resources to this type of technology to serve their clients better and ensure that their customers are at ease with transferring money on an encrypted platform. The option of using voice payments is expected to remain central to the future of mobile banking, offering convenience, accessibility as well as features that stand out from the traditional mobile banking experience.

AI, ML Technology

Initially, mobile banking mostly focused on providing customers with account balances and money transfers. However, mobile banking options can now offer targeted advertising campaigns based on personal user experiences and opportunities to upsell.

Utilizing the strength of AI and ML technology, apps for online banking can improve the user's overall experience with mobile banking, giving them specific and contextual recommendations for services that will meet their particular requirements. These capabilities create a personal mobile banking experience for the customer, which results in improved customer satisfaction in general.

API integration

If your goal is to offer customers a smooth and seamless experience, that's the model to follow. Third-party firms can incorporate your API for banking into their software and vice versa. The integration will enable your bank services to be accessible to the customers of associated businesses.

API banking is beneficial to both sides in that it expands their services and specialties to enhance one or the other. In keeping with the trend of APIs, small banks work with businesses that have improved capabilities to increase their brand awareness and improve their customers' experience.

A-B-C-D Verification Process

We've discussed several interesting mobile banking developments. But what about security? The most user-friendly features will not matter if users do not trust the security of their personal, private financial data. This is where the A B C D verification comes in, providing a reliable solution to ensure security is balanced with an easy user experience. Verifying A-B-C-D is a major technological advancement in the transformation of digital banking. It offers a new future where solid security and an effortless user experience are in sync.

Gamification

Whatever features hire banking app developers integrate into your mobile banking applications, if they're difficult to use and engage, you won't be able to keep your customers. By incorporating gamification features, you can include engaging and interactive elements in your app and enhance the banking experience of users with an element of fun and enjoyment, which can increase participation.

In this case, users can collect points while accomplishing activities, such as splitting the bill with a mate and spending money overseas. Earn virtual rewards to achieve milestones, practice good financial habits, or in certain behaviors in the financial world. This will make users more enjoyable and help you be relevant, increase conversion rates, and attract new users.

Also Read : Benefits & Advantages of Mobile Banking Application Development 2024

Mobile Banking App Development Challenges

Due to the increasing use of digital technology, banks must be mobile. Neo-banks have all the characteristics of reliable banks; however, how long can the trend endure? Since competitors are constantly introducing new products and services. Furthermore, financial startups are doing their best to be as innovative as their competitors and often much greater.

Regulatory Challenges

The trend is global in the banking world that is becoming increasingly tightly controlled. Banks are required to comply with more and more rules and regulations to stay "reliable." It is essential in the case of mobile banking because their operations involve rather unusual methods of identifying customers, signing contracts, storing records, etc. If the current procedures are executed simply, they can get increasing attention in the course of time.

Licensing

The past couple of years have seen the introduction of mobile banks, which were previously operating based on identified financial institutions. Similarly, those who need an EMI license to issue electronic currency have received legitimate bank licenses.

This has increased the variety of products and services banks provide to family members. However, it has also exposed them to security risks and regulations that support the increasing strictness of international law. Neobanks operating using the EMI electronic payment license or having licensed payment marks aren't restricted by banks yet. In the near future, we could see new rights and possibilities for banks similar to this.

Open Banking

Many mobile banking institutions have open APIs in hopes that they will be able to exchange data with larger financial institutions and gain access to their customer bases. The neobanks of the future will soon have to meet the new regulations from the PSD2 Directive.

For online and transfer transactions, you need to use at least three parameters: a password, a phone number, and a biometric sign. Neobanks who have transferred the entire transaction process to mobile phones must have the new identification system.

Data protection And Security Protocols

For both iOS and Android app development for banking requires more than a thorough knowledge of financial regulations; however, it also requires robust security—the utilization of the most advanced encryption methods to protect the user's sensitive information in storage and transmission.

Strong encryption protocols, like SSL/TLS, safeguard data from being accessed by unauthorized persons. Cyber security includes constant monitoring, penetration testing, and the application of best practices to minimize the threat of data breaches, hacking, and other cyberattacks.

Anti-Money Laundering

Therefore, banks are preparing for a fresh version of legislation on money laundering (AML, Anti-Money Laundering). Additionally, countries must integrate the 5th Anti-Money Laundering Directive (5MLD) into their law. Banks will have to decide how they plan to apply the rules of the new directive within their compliance procedures. One of them is verifying who the main beneficiary of firms is and further verifications for clients from high-risk nations. These requirements are also applicable to banks that incorporate smartphones.

Additionally, mobile banks that accept prepaid cards need to be aware that this new regulation will require stricter checks and the introduction of new rules for these financial instruments. The experts believe that, unlike conventional banks, it's harder for financial institutions operating on mobiles to attain AML compliance and maintain the balance between expansion and security.

Also Read : How Much Cost Mobile Banking App Development

Understanding The Strategic Impact Of Emerging Technologies Banking App Development

The latest technologies significantly impact the rapid evolution of mobile banking. These developments aren't just altering the existing world of mobile banking but also defining the direction to shape the future of mobile banking. The strategic impact of these innovations is significant because they redefine efficiency, security, and overall user experience.

Innovative developments regarding AI and machine learning, real-time analytics, blockchain, and cybersecurity are of note. These advancements enhance the capabilities of mobile banking applications to provide customized services, safe transactions, and real-time solution segment solutions.

Technological advances are now enabling banks and financial software development company to offer features that were once considered advanced. In particular, AI-driven chatbots for customer support and fraud prevention, blockchain technology, and advanced analytics to provide personal financial guidance are now being made standard on mobile banking applications. This increases the efficiency of operations and boosts customer service to new heights.

In the future, the application of new technologies to mobile banking will increase in depth. We expect greater sophistication in AI applications for managing personal finances and a wider adoption of blockchain technology for safe cross-border transactions. The development of quantum computing will provide unparalleled capacity for processing data. Furthermore, constant advancements in cybersecurity are essential for defending against ever-changing cybersecurity threats and ensuring confidence and compliance with regulatory requirements.

The Future Of Mobile Banking Apps

The future of mobile banking is built on the trends of today and is set to take on new technologies and innovations that we're only starting to imagine. As the years progress, mobile banking may extend beyond financial transactions and accounts management, becoming integral to a broader and interconnected digital ecosystem.

The vision of an integrated and seamless connection to technology like the Internet of Things (IoT) means that banking services are available to you and integrated into everyday life, responding to calls from the voice or wearable tech and connected cars. Furthermore, it will not limit itself to transaction or financial management and will grow into an essential hub to support an entire digital life. It will allow banks to study offline and online activities and immediately provide highly customized services tailored to each customer's desires and needs.

The banking concept may be expanded to include managing money and administrating digital assets, identities, or even one's carbon footprint. This is reflected in an increasing emphasis in society on the importance of sustainability and individual responsibility. Blockchain and other decentralized technologies may redefine the notion of confidence in banking and allow the creation of more open and fair banking systems.

Artificial Intelligence (AI) will most likely evolve by providing predictive information about financial behavior and other life events and recommending financial strategies that can be adapted to the individual's life path. This advancement could signal an evolution towards the more proactive tools for financial planning that banks provide, anticipating the requirements and providing solutions before the client even recognizes the need.

Bank's role in the wider social and economic system could change dramatically. They could orchestrate many different options and extend beyond conventional banking to encompass health, education, and government services—all available through mobile banks. This could mean an encompassing way of providing customer services, with financial health being just one element of the more extensive variety of health issues that mobile banking addresses.

Security, privacy, and digital literacy challenges are likely to become more urgent, requiring creative solutions and flexible regulation frameworks. Therefore, when mobile banking app development company consider the future of mobile banking, they must expect technological advances and rethink what banking is in a more connected, digital, and conscious globalized world.

Final Thoughts

Developing a banking application is a fantastic solution to cater to your client's requirements and provide them with an enjoyable bank experience. Digital technology has disrupted the traditional financial system. It's not a secret that mobile apps are now the mainstay of every industry. Mobile banking applications are helping financial service companies reach the multi-billion users of smartphones. What is essential to providing digital banking services or products is listening to customers' needs, being aware of their concerns, and showing the desire to address their problems.

Through time and research, as time passes, new mobile banking apps trending areas could be revealed. But, if you've implemented the trend mentioned previously, it's not difficult to implement the most recent developments in the coming years. So, keep yourself updated with the most recent trends and technologies in the marketplace.

Share this blog