If you believe gaming only serves enjoyment, it's an ideal time to think again. Although it is considered only used in video games, gaming elements have begun to alter how businesses function and deliver the value they offer. Gamification in digital banking can be a thrilling and highly efficient method to improve service quality. Gamification brings the challenge of friendly competition and a sense of fun into routine tasks of managing funds. It's not just that, the fun: gamified Mobile Banking App Development surpasses all records regarding client acquisition.

Incorporating game mechanics into software increases engagement and retention by 5 percent and boosts revenues by 25% up to 95%. Have you had the opportunity to experience gamification within banking? It is true that a field with the attributes of being private and heavily controlled, such as the banking app development industry, may be more engaging with using gamification features. In creating engaging and challenging customer-facing challenges in the digital banking app development industry and rewarding them with attractive rewards. Mobile banking apps inspire customers to adhere to sound financial habits and boost their loyalty.

Quality is certainly the most important factor in the performance of a gamified app for banking. Innovative business concepts can also be crucial in attracting prospective customers at the beginning stage. What exactly are they? What is the role of gamified systems within the banking app development industry? This post will explain the entire story.

What Is The Term Gamification?

Simply put, it takes aspects from games and applies them to other circumstances. It's all about making the process more fun and interactive by incorporating rewards, badges, points, or challenges in mobile and web banking. What is the reason it does operate in this manner?

The mechanism of games and gamification relies on psychological factors:

-

The satisfaction of completing a task and earning rewards through gamification releases dopamine. This experience is pleasant, and we're more motivated to keep going.

-

Using points or progress bars plays in our denial to lose progress. Imagine a bar progressing within your bank app telling you the distance you are from achieving your objectives. Don't be tempted to give up even if you have an average of 13% savings distance between your goal and your vacation.

-

Gamification may create the "flow" state of deep involvement, which makes activities fun and keeps us focused.

Also Read: Mobile Banking App Development a Comprehensive Guide In 2024

How Gamification Is Transforming The Banking Experience?

The idea of playing has existed for quite many years, beginning in the 1950s. In the past, gaming was primarily viewed as a means of entertainment and allowed players to enjoy leisure. However, the current landscape is changing, thanks to the introduction of several technological advancements and the rapid increase in smartphone usage in recent times. This has dramatically expanded the options for gamification to go beyond entertainment.

As with all fields, the introduction of game elements in banking is completely changing the financial services landscape with a positive outlook. Game-like elements and parts like badges, rewards, and challenges have aided banks in engaging their customers through immersive experiences. They also encouraged customers to develop good financial habits such as budgeting and saving.

However, the ultimate goal of gamification within banking does not involve turning banks into entertainment places. But rather enriching traditional banks by using games that make transactions more enjoyable and encourage desirable behaviors.

Benefits Of Gamification In Banking Industry

Gamification within the banking industry transforms the banking experience to provide the better. Gamification within banking can bring about numerous business advantages, including:

More Customer Engagement

Banking app users typically stay with the app longer by gaming. They are also more willing to use the solutions. Switching providers to find a better customer-oriented solution is less likely. The use of games in finance can make everyday actions more enjoyable and offer customers a reason to stick with their financial institution of choice. The right points or rewards system can lead to regular customers and a lot of money invested. Indeed, using gamification as a method of engagement could result in an average 22% customer loyalty boost.

New Clients Acquisition

Gamified Banking App Development can generate good word-of-mouth about banks. Customers who are already enjoying the interaction aspect of their experience are more likely to endorse the product. In turn, banks can gain new customers without increasing marketing costs.

The impact of gamification in the retail sector is an astounding 700% rise in the number of customers acquired. Of course, nothing stops banks from "leveling up" their own with gamification within banking app development services. Customers who are bored with traditional competitions may be already looking for alternatives.

Financial Education

The gamified tutorials for banking could be the future of financial education. One glance through the investment dictionary will reveal how complicated things can be. Finding ways to make money work - and even managing one's funds isn't something that can be done in a day. This is where games-based tutorials and courses could make a difference.

According to research findings, the study shows that students can retain more than 90% of details from a game. This is an incredible feat in comparison to the 10% for reading and 20% for hearing. Thus, digital banking education is much more efficient, with no traumatic "back to school" experience for clients.

New Service Promotion

Gaming in the banking sector has a knack for spreading awareness about the latest features and offerings. The reason for this is that, in contrast to pop-ups and banners that users are able to ignore, this makes the process of discovery fun. Presenting virtual characters or an opportunity to play an item as a test can be more attractive.

The gamification aspect of trial software increased its use by 54%. Furthermore, it increased purchases by 15%. This alone demonstrates the value of these techniques for increasing consumer awareness and generating profits.

Customer Data Collection

Customers' interactive engagement is an important information source for client data. Gamification of banking can provide a wealth of information on customers' behavior and preferences. Simply put, banks can discern what clicks or does not click with customers.

The next step is to analyze the information and then use it effectively thoroughly. These types of data can benefit discussion sessions with colleagues and improvement plans. Don't bother your clients with numerous questionnaires or polls. It's all in the system.

Read About: Benefits & Advantages of Mobile Banking Application Development 2024

important Principles Of Gamification

Gaming is an integral part of human psychology. Various experts have attempted to decode the reasons why people enjoy playing using game-like interfaces. They offer a variety of reasons, ranging from a person's desires for recognition, rewards, or status to the human need for self-expression and altruism.

Research has helped identify important principles in gamification that can make it fun and exciting.

The Narrative Or Story

The app creates a narrative, which gives users an incentive to be interested and gets people to feel more involved. Ultimately, bringing the story to life is a great incentive to open the app repeatedly.

Interactive Graphics And Improved Visuals

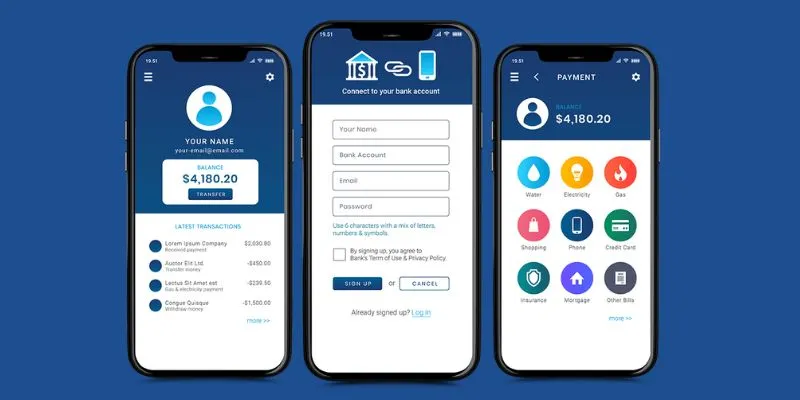

Visually appealing features draw users' attention and encourage engagement. The more logical and user-friendly the user interface is, the less time a user has to search for the right button or move. This will impact customers' satisfaction and retention.

Regular Feedback About Progress

Allow users to control their actions and offer immediate feedback and tips for achieving your goal. This timely feedback and helpful strategies will help you form more trust with the users and gain insight into their behavior patterns.

A Sense Of Satisfaction

In order to keep motivation high, it is essential to reward or award badges to those who have achieved objectives and goals. The majority of apps come with games and tests that encourage users to finish more activities to earn incentives.

Must Read: Guide to Create a Mobile Banking App

Top Gamification Ideas For Banking Apps 2024

Using games in banking will significantly increase your odds of success if you play the right way (no pun meant). This approach focuses on making important consumer activities enjoyable and fun, such as financial literacy, saving, and driving. This is achieved through integrating gamification components and mechanics in products and services that engage customers and motivate consumers.

What exactly can banks do to use gamification to increase the customer experience? We've collected several strategies to help financial institutions use gamification to keep their customers happy and engaged.

Savings Goal Achievements

Gamification of savings goals to achieve savings goals in banking is the creation of modern-day systems that reward users when they progress toward their savings goals. This is not only used to aid in monitoring the growth of your savings account; however, this idea of gamification provides motivation and makes completing the financial goal more enjoyable.

A different approach is to allow users to set savings goals, like saving for an emergency fund or taking a trip. Savings goals comprise various smaller events. When users advance and get closer to achieving these tiny goals, they are awarded rewards or virtual badges as tangible evidence of their achievements.

In addition, you could integrate an option that prevents streaks and rewards participants who save money consistently over a few weeks, days, or months.

Budgeting Challenges

The emergence of various online stores offering a wide range of merchandise allows consumers to be in a state of excessive shopping, leading to budget deficits. Imagine a feature customers can utilize to encourage an efficient way of managing expenses. This is why budgeting challenges can be a logical game concept.

Budgeting is a powerful strategy for improving financial health. It involves creating engaging budgeting tasks that allow people to establish their own personal budget targets for different expense types. The reward mechanisms available to those who stick to budgetary limits are numerous, including actual-life rewards, redemption points, and additional rewards linked to banking accounts.

Cashback Competitions

The limit is no longer just to individual customers. You can extend the reach of gamification to banking by introducing challenges between customers, and cashback competitions are one instance. Creating a competitive atmosphere focused on cashback rewards will encourage participants to participate actively in their banking, try to make the most of their cashback, and increase customer satisfaction with their credit union or bank.

In order to implement this idea of gamification for your financial services institution, it is essential to look at the rules of competition, the system to track and calculate cash back rewards, the channels of communication, and rewards systems. The cashback incentive can integrate into a digital bank platform that can provide real-time monitoring and display of leaderboards and generate a feeling of enthusiasm.

Investment Game Simulations

Many people would like to take on the investing path but are unsure where to begin because of the lack of information and the high risk. Why don't you do Banking Apps Development with an interactive risk-free investment environment for users to explore investments?

In providing knowledge and expertise in market dynamics, investment concepts, and portfolio diversification strategies and techniques for managing risk via virtual investments, Investment game simulations improve the financial literacy of the user and trust in their investment decisions. The rewards for successful investing strategies in these simulations can be various, from virtual badges to appreciation within the app community, as well as tangible rewards like discounts on the prices of services.

Referral Contests

"Referral code" is probably the most common game feature within today's technology-based games. But what do you know? Gamification concepts like "referral code" can even apply to online banking apps as the form of a competition. This strategy encourages users to compete by making the best referrals for friends to the banking application. Once friends become new users, verified by the successful download of the app or opening an account, existing users are rewarded with similar benefits.

The element of competition helps promote participation among the participants, ultimately taking home the highest prize. The competition for referrals not only offers existing users an entertaining and enjoyable relationship but also aids users in expanding their customer base through word-of-mouth suggestions.

Personalized Financial Avatars

Incorporating gamification into banking doesn't require much effort. You can instead enhance your app's financial features to make it attractive by adding a little information, such as allowing users to change their avatars on the app by changing their avatars, for instance.

Beginning with various appearance choices, the concept of personalizing avatars in finance allows users to design avatars with unique designs that represent their financial goals, actions, goals, and dreams. When they reach their financial goals, their custom avatars will grow to provide more opportunities for personalization and rewards. By allowing personalized experiences in the banks they use daily, the avatars create a closer emotional and personal connection to their finances.

It is most effective when combined with additional features related to the issues and tasks, including budgeting difficulties and achieving savings goals.

Virtual Financial Advisor

Integration of AI chatbots and virtual assistants within banking apps is an increasingly common method for banks to assist clients on demand all day long. Utilizing AI-driven technology, AI chatbots deliver tailored financial guidance based on particular situations and actions.

To transform this digital assistant into a game-like feature, it is necessary to include an incentive and reward system that encourages users to take the recommended actions suggested by the digital assistant. By taking proactive steps toward their financial health, users may earn rewards such as badges, points, or other virtual incentives. This will eventually help them develop healthy financial habits and make decisions.

Establish goals And establish KPIs

The ability to track progress is vital for the success of your life, particularly in financial matters. Many people aren't aware of what to do! Yet, they want to improve their knowledge and ensure their savings and spending habits have changed.

Another issue is that many individuals fall for the trap, believing, "If I save more, I'll get richer!". The idea leads them to think that having the most money they can is essential. They don't think of any plans to maximize it.

The hope of the best, but not having an organized plan, will not suffice. Life is prone to throwing curveballs in the form of accidents or illnesses that strike suddenly and could scuttle the financial goals of anyone. It's an unfortunate lesson that we must learn: Our dream isn't always the case, especially when we're prepared for what could happen. A great way to ensure your success over the long term is to create budget goals and Key Performance Indicators (KPIs) that will allow you to track your progress.

Make Use Of Gamification When Introducing New Services Or Products

The development of products continues even after you've finished developing your product. It's only the beginning of an extensive but rewarding journey. The next stage is to create a solid marketing plan to ensure your clients receive your offer promptly. It will require factors like determining your product's importance, its audience, and the best way to launch it properly. If you do this step correctly, you'll be one step closer to having a successful venture.

Remember that at the base, sales and marketing are all about communicating. Your marketing staff could have an abundance of innovative ideas. However, what they're all going to have in common is the need for excellent communication skills to achieve results and success.

Gamification can tap into this potential through human needs like ownership, accomplishment, Social influence, scarcity, and interest. The process works by incorporating the mechanics of gamification and other elements in your marketing and product launch initiatives. When done correctly, it will help you push your customers to try your new service or product more effectively. In addition, it will ensure that customers are more likely to participate in it rather than passively consume it.

Virtual Financial Events

Make your bank's union an interactive, educational platform. Do you agree? Instead of arranging financial seminars, such as investment seminars or budgeting training, which takes time and money, you can conduct them directly on your banking gamified application.

These virtual events could cover a range of subjects, such as investing strategies, budgeting advice, retirement planning, and various other financial literacy topics, and help users increase their understanding of the app's network. To boost engagement and create excitement, it is possible to offer incentives and exclusive in-app rewards to those who participate in screening.

Create The Customer's Trust

The obvious conclusion is that effective customer engagement is a significant factor in the growth of a business. An analysis conducted by Gallup indicates that those engaged in the retail banking app development industry generate around 37% more in revenue per year. This proves that when your customers feel engaged with your brand, they're not just customers and are now avid advocates of your business.

Keeping customers happy has grown increasingly important, especially with the proliferation of different banking options competing to attract customers' interest. Bringing in new customers may indeed seem easy initially—simply provide them with something more than the current offerings. If they don't have loyalty, then you'll be able to easily draw customers to your service and get them to sign up for the service you offer.

Encourage User Interaction And Feedback

Having users provide their feedback regarding their experience can provide you with the necessary information for improving your app. Also, it gives the users the satisfaction of hearing their opinions, which is becoming more critical in the digital age.

Feedback in-app typically has a better response rate and offers information based on context. Requesting ratings and surveys to uncover critical aspects of your application is possible. What's Your Net Promotor Score? What did users think of your company? Ultimately, think about your overall user experience, and don't overburden your customers with questions.

Develop And Grow

You must continue working on your app to create more user-friendly experiences. There are numerous principles to follow here. Start by creating a minimally viable app to build additional capabilities within the existing features. As you go through each iteration, the app gets better, and users become more involved. Utilize A/B testing to evaluate various approaches to your users.

Read Also: How Much Cost Mobile Banking App Development

Gamifying Banks Implementation Rules

The banking app development industry is extremely competitive, so focusing on customer engagement and retention is not the best option. This section discusses gaming strategies to retain and draw new customers, eventually increasing profits. Banks and Banking App Developers must select wisely what user experience elements are used. Privacy and data security are also important to remember when gaming in banking applications.

The fundamental outline of games-based solutions is as follows:

Establish Objectives

Are you trying to improve customer engagement, develop specific behaviors in clients, or improve your clients' financial literacy? All of these objectives would require a distinct approach to design and execution. Be careful not to use too many games and gamification methods: there's an element of truth to every aspect, even enjoyment, of banking.

Research Your Audience

The most successful gamification strategies focus on users' needs and desires. It's important not to duplicate what's available on the market but to create the perfect product. Your gamified product will appeal to clients and address their issues.

Design The Layout

Take note of the features that will be part of your solution. Each element must align with your overall business plan and objectives. The gamified financial app you choose is worth it and gives you an advantage over the competition.

Take Into Account The Risk

The game-like nature of apps has specific risks that are important to be aware of. Gamers could be tempted to abuse the system or become hooked on an excessively immersive game. Additionally, the user's privacy and the security of personal data should always be the highest goal.

Apply The Solution Technically

Be sure your approach to gamification meets all technological requirements. Banking app development requires factors such as scalability, customization/integration options, and security features.

Review The Data That You Have Received

Keep your banking application updated. Use your collected information to improve the user experience and create new business opportunities. Ultimately, this approach will enable you to provide customized solutions to your customers, which can increase the brand's loyalty and motivate repeat clients.

Conclusion

Banking gamification isn't an entirely new idea. It is everywhere, in the various services and applications related to finance. It also slowly influences users' spending habits. The era of gamified financial services is only getting started.

Many bank apps on the web are adding innovative gamification features, leading to the rapid growth of the global market for gamification. In the forecast timeframe (2024-2029), Asia Pacific will be expected to see the most significant CAGR. The ferocious battle between those who want to be the dominant players is not over. Combining modern technologies like artificial intelligence and big data opens the possibility of a new future in which gamification can be used within banking.

Innovative business concepts are essential for a successful new venture. The presence of a professional team with enough experience and skills is a crucial factor when it comes to the design and quality of software.

Share this blog