Leverage cutting-edge technologies such as cross-platform application development, GenAI core banking, or credit scoring to increase the efficiency of your operations. Be a pioneer in the world of finance. Discover how customized software solutions can help drive the success of financial institutions. Are you looking to enhance your banking operations? Learn why we're a perfect option to help you achieve it!

We provide custom bank app creation solutions, catering to highly effective smartphone apps for various industries. With years of experience in financial app development, we are a top bank and financial software development company. Our expert development team develops Android, iOS, and Cross-Platform mobile and financial applications, equipped to deliver solutions with all the features necessary to offer an unbeatable customer experience.

Leverage our development services for banking software to boost expansion and provide considerable value to the sector. We stand out due to our experience in developing sophisticated banking software, which has earned the trust of the major players on the market, who rely on us to manage their digital requirements.

Our services for modernizing software drive technology development as part of our dedication to ensuring your bank's infrastructure is future-proofed. Our expertise lies in smooth-moving legacy systems and revitalizing your business through modern, scalable, and highly technologically advanced solutions. We assure you that the systems you have in place for banking aren't just up-to-date but also capable of adapting to the constantly changing requirements of the financial market.

Our risk and compliance management software acts as your unwavering defender, ensuring full compliance with industry legislation, reducing risks, and exposing you to more vulnerabilities. Our customized software offers robust reporting capabilities, deep analysis, and monitoring in real-time to protect your business operations and provide the required information to handle difficult situations, thus promoting an efficient and secure financial climate.

Investment management services developed by our software developers have been meticulously designed to go beyond the norm and enhance your customers' investing experience. Our specialists create innovative, custom-designed banking solutions to help you gain competitive advantages that prop your company toward greater success. Our customized investment management software gives you the latest analytics in real-time and decision-making tools for strategic planning to ensure you remain ahead of the constantly changing landscape of financial markets.

Our customized lending software solutions easily streamline and automate the loan servicing process, improving lending solutions. They are designed to increase the speed and precision of your lending process by streamlining the application process to speed up approvals. Explore a fresh method of lending that provides the highest level of decision-making precision and speeds up procedures.

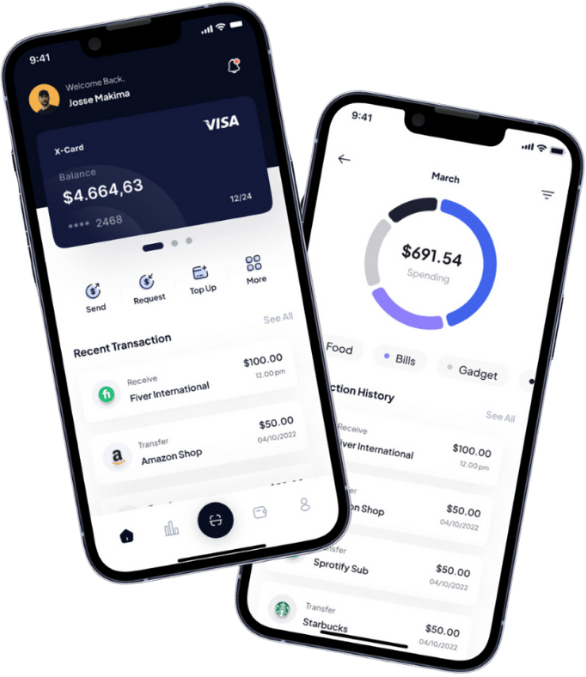

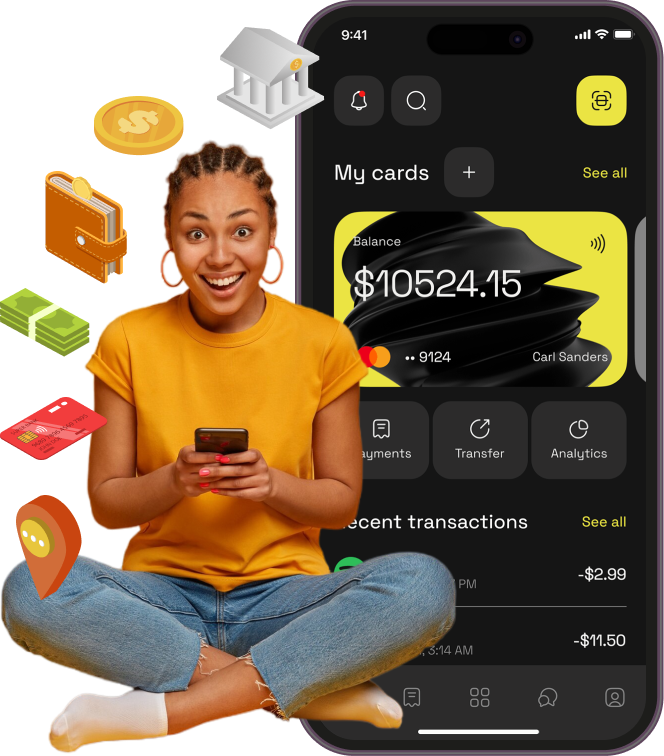

Our focus on meeting the ever-changing requirements of modern banking extends beyond secure and simple transactions. Our customized mobile banking software solutions allow users to benefit from extremely intuitive user interfaces, real-time account access, and specialized tools for managing finances. As a top banking software developer, we ensure convenience and accessibility by implementing our customized solutions, which provide an unparalleled user experience for mobile banking.

The sophisticated fraud detection system acts as a guardian that uses modern technology to recognize and fight dangers proactively. As a leader in bank software development services, we develop solutions that provide a solid security system and the best security for financial transactions. These solutions help you safely navigate the digital world with the least chance of being a victim.

Step into the future of fund transfer with our cutting-edge processing solutions, which change how transactions are handled. Our custom-designed advanced payment processing systems increase efficiency and security while allowing multiple payment options in one system. Our range of payment options provides an effortless and secure payment offerings for businesses and consumers, setting new standards for security, security, and reliability.

Take a journey of transformation to improve customer relations management using our top-of-the-line bank Development services for CRM. Moving beyond conventional methods, our approach encourages authentic and personal interactions that resonate deeply with customers. Keep ahead of the ever-changing financial sector, increase customer satisfaction, and build lasting relationships using sophisticated data analytics, allowing for precise, targeted communications.

Take advantage of the future of secure transactions by using our innovative EMV solution software, which effortlessly integrates modern technology to guarantee payment security and compliance. With our EMV-based solutions, customers can make secure transactions because we value security and adhere to the latest advances in payment technology, giving security and peace of mind with every transaction.

At JPLoft, we prioritize security by integrating security measures into each banking app solution we design. These factors ensure that your banking app is safe, reliable, and compliant with industry standards.

Our team of experts performs a thorough risk assessment and uses advanced encryption techniques to protect your app's security. When you partner with us, you will gain access to our vast experience in creating secure, flexible, scalable, and user-friendly banking solutions. Our dedication to security and compliance ensures you can be confident that your app will offer the most secure and seamless user experience, which gives you peace of mind and an edge in the market.

We use advanced encryption protocols to safeguard sensitive information while it is stored and in transit. This ensures that information about users, including transaction details and personal information, is protected against unauthorized access and data breaches.

To improve user verification, we integrate multiple-factor authentication techniques, such as biometric recognition, SMS verification, and email verification. MFA ensures an additional layer of security, making it difficult for unauthorized individuals to get access to accounts.

Our development process employs secure programming practices to reduce security risks and safeguard against common security threats, such as SQL injection, cross-site scripting (XSS), and Cross-site Request Forgery (CSRF). This makes for a more secure app.

We use advanced fraud detection techniques and real-time monitoring systems to detect and stop fraud. These tools examine transaction patterns and user behavior to detect suspicious transactions and block the possibility of fraud.

We use role-based access control to ensure that users only have access to the data and functions required for their jobs. This helps reduce the risk of access being unauthorized and ensures the integrity of data by restricting access based on the user's roles.

To ensure highest security standards, we regularly conduct security audits and penetration tests. These assessments can help identify possible weaknesses and vulnerabilities in the application, enabling us to tackle them early and ensure continuous protection.

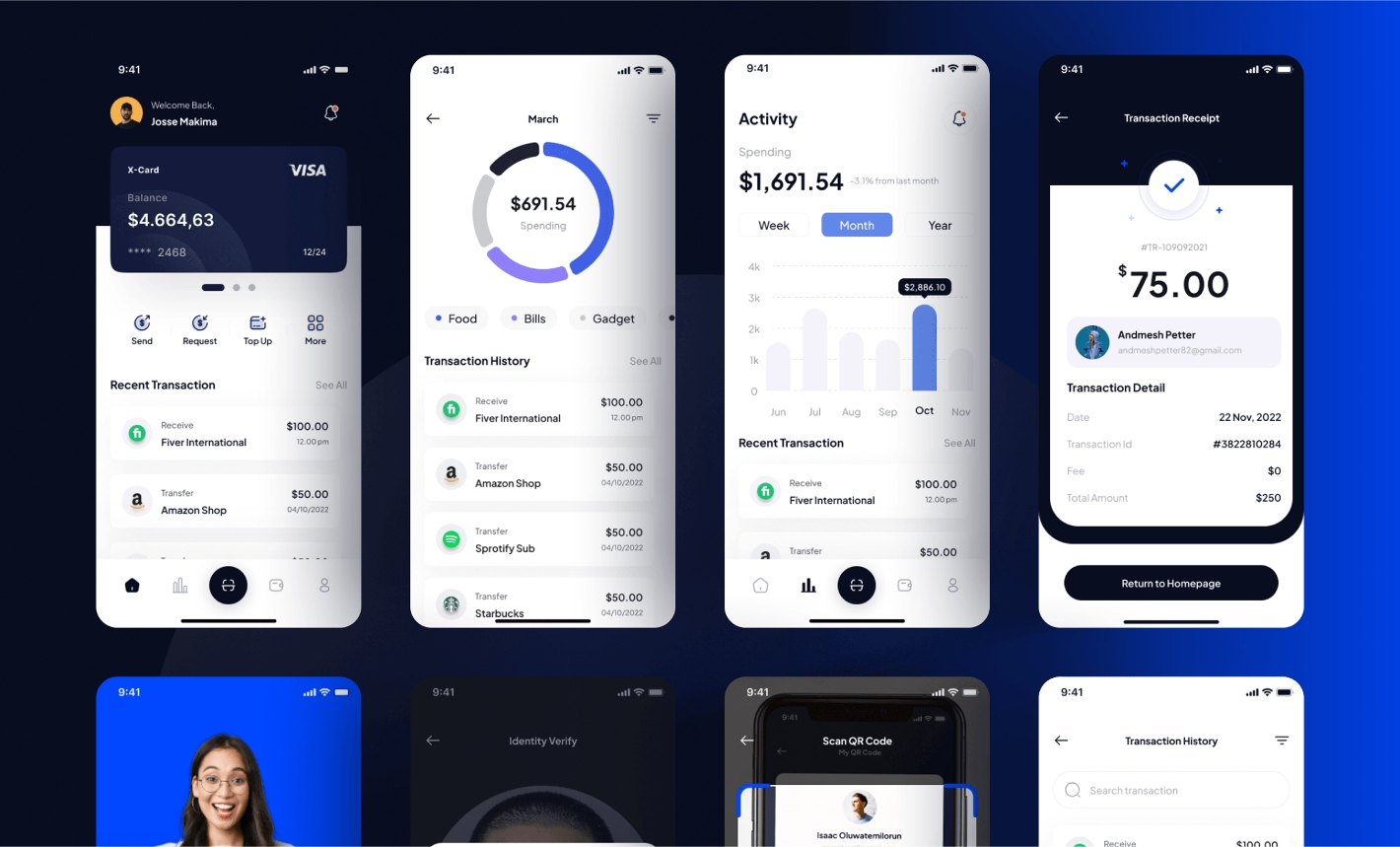

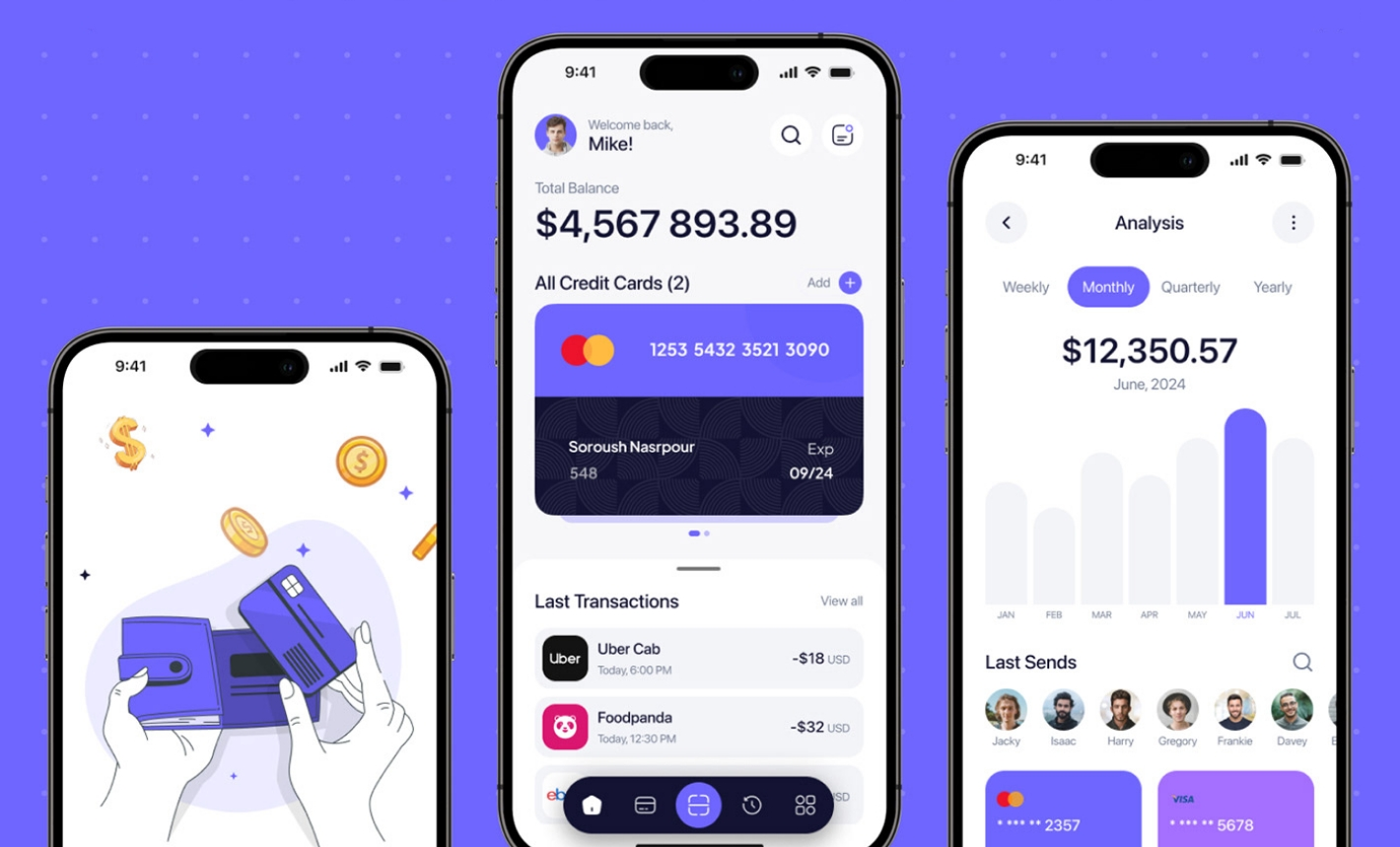

Explore innovative banking solutions our developers have crafted for our global clients. Our commitment to delivering high-quality banking solutions for our client’s highlights our skills and dedication to excellence.

The all-in-one fintech app for seamless money management, secure transactions, and personalized financial insights at your fingertips.

Empowering your financial journey with real-time budgeting, smart expense tracking, and personalized insights for smarter money management.

4.9 out of 5.0 by 1000+ clients globally for Web & Mobile App Development and Digital Marketing projects.

Employee Strength

Projects Delivered

Countries Served

Clientele Revenue

We specialize in creating complete banking software that combines fundamental and more advanced functions that meet the varied requirements of banks and their customers. Our solutions are created to improve the user experience, simplify administrative processes, and offer robust security measures.

Users are in complete control of their accounts, allowing them to check balances on their accounts and the history of transactions. Modify their details and control account settings from their dashboard.

Effective and secure funds transfer options allow users to transfer funds between accounts, pay their bills, and pay online. This feature ensures that customers can easily manage their finances.

Users can apply for a variety of loans right via the application. They can also effortlessly track the progress of their loan applications, submit the required documents, and track loan repayments.

Integrated tools aid users in budgeting, tracking expenses, and setting and achieving savings goals. This feature enables the users to better manage their finances.

Real-time notifications alert users of account activity, payment due dates, security alerts, and other important information. This helps ensure that customers remain informed about their financial health.

The app's support features, such as the live chat feature, FAQ, and ticket systems, assist customers with questions or issues, improving the overall experience.

Advanced security options, such as biometric authentication choices (fingerprint and facial recognition) and secure password protocols, safeguard users' accounts from unauthorized access.

The app lets users manage credit and debit cards, such as activating new cards, deactivating stolen or lost cards, setting spending limits, and viewing transaction histories.

Users can view and manage their portfolios, which include mutual funds, stocks, savings, and investment plans. This feature includes instruments for monitoring investment performance, making investment decisions, and rebalancing portfolios.

The panel of banks provides tools to manage multiple branches, including tracking employee performance, monitoring branch activities, and ensuring the same quality of service across all branches.

The advanced loan management tools allow banks to manage loan application processing, approval workflows, repayment processes, and disbursements. This allows for effective processing and management of loans.

Integrated CRM tools allow banks to manage customer interactions, track customer preferences, and improve customer service by delivering an individualized banking experience.

Advanced analytics tools allow banks to evaluate and manage financial risks efficiently. This includes market risk, credit risk, and operational risk, assuring the stability and conformity of banks.

Automated compliance tools help banks ensure they conform to all relevant laws and standards. This includes creating reports and keeping records to aid in audits.

Effective and secure payment processing systems can handle various payments, including ACH wire transfers and card payments. This ensures that you can make smooth and reliable transactions.

Advanced technology to detect and stop fraud is built within the banking panel. It employs machine learning and real-time monitoring to spot and reduce the risk of fraud.

Comprehensive audit logs with detailed auditing and reporting tools guarantee transparency and accountability in the bank system. This feature helps banks maintain accurate records while meeting regulations.

The seamless integration features let the banking app connect to various banking systems, other third-party services, and financial institutions. This allows for interoperability and improves the application's capabilities.

Administrators can comprehensively manage user accounts. This includes the creation of new accounts, modifying information on existing accounts account information, deactivating accounts, as well as monitoring users' activities to ensure security and conformity.

Real-time monitoring tools enable administrators to monitor all transactions within the system. This helps identify and prevent fraudulent transactions by alerting users of suspicious transactions.

The admin panel has advanced analytics tools that provide precise reports on metrics like transaction volume, user activity, and system overall performance. These reports aid in making well-informed decisions.

Enhanced security integrations, such as role-based access control, data encryption, and comprehensive audit logs, protect the banking app from breaches and unauthorized access.

Integrated customer support tools permit administrators to manage customer support tickets and inquiries efficiently, ensure prompt issue resolution, and improve customer satisfaction.

This feature ensures the app complies with all applicable banking rules and regulations. It has tools to monitor compliance and produce reports for regulatory authorities.

Administrators can customize and configure certain aspects of the application to meet the bank's specific requirements. This includes setting customizable transaction limits, customizable user interfaces, and notification settings.

Administrators can create, manage, and modify notifications and alerts within the application for various occasions and events. This will ensure that employees remain informed of important changes and problems.

A robust dashboard gives an overview of the system's status, key metrics, and alerts. This information is crucial for administrators to monitor and control the system efficiently.

We offer high-end financial and banking application development solutions using the latest technology. Our bank app developers utilize their expertise and imagination to create seamless solutions.

Are you planning to recruit developers for banking apps? If you're looking to become the best market leader or improve the efficiency of your operations, you'll need developers who are committed experts, skilled, and knowledgeable. This is exactly the type of app our team of application developers for mobile banking is recognized for with years of hands-on experience working on the most effective Fintech solutions. We understand the requirements for bringing innovations in the form of applications.

As a leading company in the market, our online banking app development services are known for their transparency, high quality, and prompt delivery. When you partner with JPLoft, you don't need to think about anything since our expert in mobile banking apps assists you from concept to implementation and after-launch maintenance. So, if you want to find bank software developers, we're ready to help you.

At JPLoft, we make securing top-quality bank Software developers easy to ensure your project succeeds. When you choose JPLoft to work with, you can access an array of skilled experts dedicated to helping you develop your banking software development project efficiently and precisely.

Begin with a comprehensive discussion of your specific banking software requirements, project goals, and technical requirements. Our team will help you understand your vision and determine the best way to accomplish your goals.

Work with our experts on the scope of your project, including the features, functionalities, and timeframes. We will provide a clear plan and proposal, ensuring that every project aspect has been thoroughly defined and negotiated.

Based on your project's requirements, we match you with banking software developers with the necessary skills and knowledge. You can examine the profiles of developers and pick the one best suited to your project.

When the developers have been chosen, we facilitate the onboarding process smoothly. Our team ensures that the developers are incorporated into your project seamlessly by providing transparent communication channels and access to all the necessary resources.

Our developers start on the banking software with you, following the established deadline and scope. We regularly update the project and conduct periodic reviews to ensure the development process aligns with your requirements.

Following the completion of development, our team will conduct rigorous tests to ensure that the software complies with all quality standards. We provide ongoing assistance and maintenance to resolve any issues and make needed updates, ensuring your banking app's long-term viability.

Because we provide reliable banking software development services for your business, keeping your requirements in mind. Here are a few key features that make us a perfect choice for you!!!

We provide the best banking solution with the help of our dedicated developers who provide the best automotive banking development services.

We understand your requirements and help you Hire Dedicated banking app developers to offer best-in-class services.

We provide professional support & maintenance services for your project that is based on banking software development.

We understand the value of not only your money but also your time. So, we believe in delivering a high-quality project on time.

We understand how precious your idea is so we create web projects and applications that are visually stunning and attract people that provide a higher user experience.

With the advancement of technologies on a daily basis, we understand that businesses need to be updated according to it. So we are experts in the latest technologies.

JPLoft uses cutting-edge technologies to develop unique solutions for your business. Our team’s deep expertise covers a vast range of technologies, making us stand above other companies.

Get the latest updates on development insights, technologies and trends.

United States(USA), United Kingdom(UK), Australia(Melbourne, Sydney, Adelaide, Brisbane, Perth, Canberra), Singapore, Canada, United Arab Emirates(UAE), Saudi Arabia, Netherlands, Switzerland, France, Africa, Europe, Middle East, etc.