Technology-based financial solutions have drastically made our lives easier in numerous areas. A decade ago, there was a time when you had to visit a bank branch and stand in line to complete simple transactions such as paying your bills, transferring money, or transferring your money. The more complex deals, such as investing in insurance or making a contract to purchase, could require weeks or even months. Compared with internet banks, Mobile Banking App Development is far more user-friendly.

Today, one tap with a mobile banking app allows you to improve your lifestyle by making it more straightforward. The primary reason for this is that 90% of millennials and 99% of the majority of Gen Z are utilizing portable mobile banking software. They are not only doing the usual things such as checking how much money they have, looking through bank accounts, or transferring cash.

The apps also help them budget and save money, which older people rarely do. Online banking is secure, and using the latest technologies can assist banks in making their clients happy, earning more money, and spending less on their services. This article will show you how to create a mobile banking app that lasts years and helps your bank lead the technological world.

This post will help you discover mobile banking and how it functions.

Read About: Guide to Create a Mobile Banking App

Understanding Mobile Banking App Development

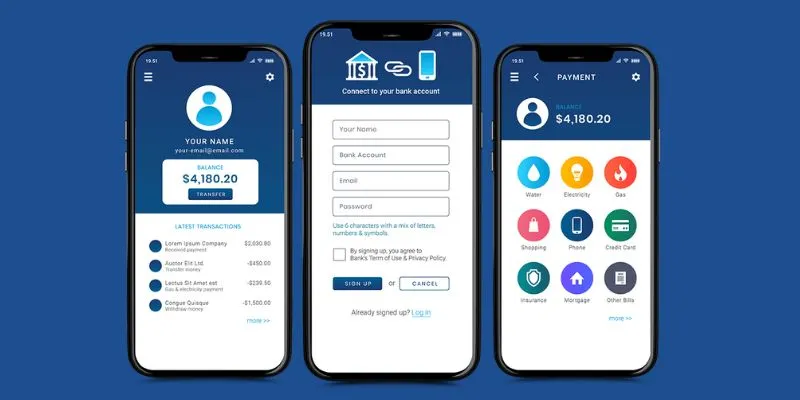

Understanding Mobile Banking App Development is a broad method of creating apps that change the financial industry. It's not just about writing code. The process also involves a strategic plan and design centered on users. Technology integration offers safe, user-friendly banking services for mobile devices. The impact of this innovation is significant because it changes how customers interact with their banks, providing unbeatable convenience and effectiveness.

Mobile banking is not just an app; it's a fundamental shift in how people manage their money. The capability to create and use mobile banking apps opens new possibilities for the financial inclusion of people, particularly in the emerging market. Fintech and mobile banking are continuously developing. It is, therefore, essential to check recent reports and articles to obtain the latest information and insight. According to a study focusing on mobile transactions, the markets will reach 2 trillion dollars by 2027, highlighting the massive potential for mobile banking.

Advantages Of Mobile Banking Application Development

The mobile banking application needs to be secure and straightforward, more than anything else, to make people feel comfortable using it often. To accomplish those objectives, banks must test various aspects.

Improved Customer Experience

Mobile applications provide additional advantages for clients. They're safer and more convenient as you cannot use the fingerprint feature with chatbots or put a computer in your pockets. Be aware that 6 of 10 users prefer an app for mobile banking rather than a web-based mobile banking site. In addition, companies that create apps allow 24/7 on-the-go access to all banking solutions via digital solutions. Access to all services at any time is time-saving. You can, for instance, check your deposits, view recent transactions, and plan the payment of your bill, for example, either at home or traveling abroad.

Higher Return On Investment (ROI)

Extensive analysis, research, cash, and time will be required to make a mobile bank app idea a reality. Each business hopes to see a positive profit from Banking App Development. The owner of a mobile banking application may anticipate positive outcomes through a range of methods. These could be in the form of greater customer participation, a more significant number of customers, more revenue, and a better reputation in the market.

Various case studies of major financial companies that have seen great results from developing and integrating mobile banking applications into their processes exist.

Better Security

The security of customers is among the highest concerns. Internet and mobile banking come with their own sets of security risks. However, the added hardware security makes mobile banking safer than banking online. Banks use gesture patterns, biometric data like retina scans and fingerprints, traditional passwords, and two-factor authentication to increase security.

Nearly all banks use encryption to secure financial information and privacy, ensuring secure banking on mobile. Additionally, due to the increasing popularity of mobile platforms and apps, malware is less likely to harm the app. If a user loses their mobile, their financial details are protected.

Additional Revenue Streams

Mobile banking apps can boost ROI in various ways. The study found that banks could get a 72% boost in earnings through mobile banking customers compared to customers who only utilize branches. Customers who use the mobile banking app are also more likely to increase the amount and value of credit, ATM, and ACH transactions following three months of use. Banks can increase their income through mobile apps incorporating value-added products like loans, insurance, and the BNPL.

Advanced-Data Analytics

Continuous data collection could yield excellent results. Utilizing advanced analytics for sales, customer care, and marketing can help create a customized product offering that will appeal to each customer's needs at specific times. In addition, data analysis and management provide firms with crucial insight into customers' needs and issues and help them resolve problems more efficiently and speedily.

Better User Engagement And Retainment

In-app and push notifications offer numerous benefits to both you and your customers. They inform customers about the correct discounts and deals and provide more credit limits or rates. The banks that have implemented this feature enjoy an advantage over other banks. In one instance, BNP Paribas reports that when it implemented targeted pushes and notifications in the app, its App Store score improved by 60 percent.

In short, using mobile Banking Application Development provides valuable benefits for the bank and the customer.

Read Also: How Much Cost Mobile Banking App Development

Key Mobile Banking App Features And Functionalities

As you prepare to design an application, consider the features included in your mobile banking app. This information can guide you when collaborating with an innovative app development firm for mobile banking.

Account Management

It is easy to monitor your transactions with just a few swipes. This app gives users an overview of their finances at any moment, giving them access to information typically via bank statements or visits to a branch.

Fund Transfers

Mobile banking applications provide the fastest and most secure method for money transfers. This is among the most important benefits offered by mobile banking. Whether transferring money between your private accounts, sending money to family members and relatives, or even paying for business transactions, these apps easily enable financial transactions. It is all about the convenience of navigation and speed. This allows users to transfer money with ease.

Bill Payment

Paying bills is only some people's notion of fun; however, an online banking app will make the process as simple as possible. Through features that allow for the setting of single-time or regular payment options, customers can handle the entire bill in one app. This can reduce time, improve financial management, and avoid late fees. Integrating bill payments into the Banking Apps Development Solutions can testify to their function as a one-stop center for financial transactions.

Mobile Check Deposits

The introduction of check deposit options via mobile devices has revolutionized check handling. Checks can be deposited using a simple photo of them on smartphones. This eliminates the requirement to make a trip to the bank and offers a faster option to access the funds. This technology is based on high-end image processing technology and security checks to verify the authenticity and accuracy of the checks.

Security Measures

The security aspect is crucial for mobile banking applications. The apps employ various security methods to secure user data and financial details, such as biometric encryption, and login procedures. The authentication process ensures the user can be confident in their money transactions.

Push Notifications

Push notifications on mobile banking applications function as individual financial aid, with real-time notifications of account balances, transaction alerts, and reminders for bill payments. This feature keeps customers informed and active, allowing them to keep track of their financial situation without constantly checking their account balances.

ATM Locator

If electronic money isn't enough to cover the cost, the ATM Locator is a great feature to help. It helps users locate the closest ATM and saves both time and stress. It is helpful in uncharted areas and during travel. It ensures that users will never be more than a few steps away from accessing their money.

Budgeting And Financial Insights

Mobile banking applications have evolved to provide more than transactional features. These apps now offer features for making budgets and providing insights into financial results. They help users monitor the amount they spend, create budget targets, and get individualized insights into their economic practices. The aim is to provide all the information they require and tools that will give them the confidence to make informed financially sound decisions.

Dedicated Customer Support

Customers expect prompt and quick access to assistance when they face issues or queries. This can be anything from support for chats in the app to the ease of accessing customer service via chat, phone, or live chat. Ensuring users are supported and heard is crucial for maintaining confidence and satisfaction.

Card Management

Card management functions permit users to control their credit and debit cards from their application. The app allows users to activate new card accounts, set transaction limits, block cards, and notify stolen or lost cards. This control level adds an extra layer of security and ease of use, making it more straightforward for customers to control their credit cards in an increasingly rapid-paced environment.

Development of Mobile Banking Apps

.webp)

Making a mobile banking application requires several critical steps. Each step plays an essential part from the beginning until the release of the app and above. This section will discuss the significant steps of developing a mobile bank application.

Conceptualization

The process of developing mobile banking apps starts with conceptualization. This phase involves delving into the app's purpose, target user base, and core functionality. The focus is on determining the issues that the app can solve and the value it could provide to customers. Analysis of competitor research, market research, and a thorough understanding of the user's preferences are vital during this stage to guarantee the app's effectiveness and competitiveness.

Team Formation

When the idea is established, the next step is to create the best development team. The team must comprise competent professionals such as developers, project managers, designers, UI/UX designers, and QA experts. The team must remain cohesive and cooperative and have a joint project idea.

Prototype Building

Prototyping is the initial concrete step of the creation process. It involves creating a simple prototype of the app to understand its layout, style, and functions. The prototype will be used for the initial test and feedback, helping refine the design before the development phase's launch. Interacting with potential users and stakeholders is essential for verifying its design and functionality.

Security Implementation

Implementing security early is essential for mobile banking software development. This includes integrating encryption, encrypted communication protocols, and data security methods. Security issues should be considered throughout the application's design to protect users' data and financial transactions.

Design UI/UX

Making a visually attractive, user-friendly, simple, and easy app requires creating a slick and user-friendly UX/UI. This phase involves defining the layout, graphics, and navigation. It is followed by ensuring the design aligns with users' requirements and preferences.

Development

In the development process, experienced programmers create the required code to bring the application to life by making its functions and functions. This process involves front-end and back-end design, ensuring it is functional, effective, efficient, and extensible. The development process must be fluid, which allows for iterative adjustments based on continuous evaluation and feedback.

Integration With 3rd Party Services

Integration of third-party applications, including payment gateways, analytics tools, and cloud services, is essential to enhance the capabilities of your app. This ensures that the connections are seamless and won't affect the application's performance or security. This also involves ensuring that the app is in that the app complies with regulations regarding financial transactions as well as standards.

Testing

Testing is an ongoing procedure conducted in tandem with the development process. It encompasses various tests, such as unit, integration, security, and user acceptance tests.

Release

The final stage of release is deploying the application in the live world and then opening it to the public. This involves compiling the app store's listings, metadata, and descriptions. Planning the release and considering factors like timing, marketing, and customer support is essential.

Post-launch Support

Development does not stop with the app's release. Support after launch is essential in ensuring the app's efficiency, addressing user feedback, and implementing changes. The process involves monitoring the app's performance, fixing any issues, and releasing updates that include new features or enhance existing ones.

These key actions must be taken when developing a mobile banking app. They emphasize the careful planning, execution, and constant support required to build a reliable and safe app. Each stage is vital to ensuring that the application meets the highest standards required in the highly competitive field of mobile banking.

Challenges Faced During Banking App Development & Their Solutions

After you've learned the most essential and valuable capabilities for creating banking applications, it is time to examine some of your problems and how to tackle them.

Compliance With The Regulations

Apps used for banking must comply with Know Your Customer (KYC) guidelines as set by appropriate authorities and with any legal obligations. Your bank must be subject to various regulations based on its location. Your online bank application could have more or fewer guidelines, depending on where you conduct your business. The expertise of a software and legal team will assist you in confirming every regulation and making sure that the app is compliant with all applicable regulatory requirements.

Security-Related Concerns

This is an issue for banks and financial institutions when designing the system to utilize its maximum potential. Security measures like these can increase the security of your mobile banking app and the level of confidence in the service. So, do not hesitate to inform them about the steps to safeguard your accounts and personal information.

User-Friendliness

A confusing user interface and a complicated navigation interface make managing your finances, which are already stressful, even more stressful. This applies to experienced smartphone users and those who struggle to learn new ways of using your application. Therefore, it is essential and something you should never be able to ignore. Professionally trained UX/UI designers will ensure that the components of your application include clear elements and straightforward navigational logic.

Also Read: Different Opration in Fintech Vs Traditional Banks

Trends In Mobile Banking Software Development

In the past few decades, the fintech sector and mobile banking have shifted to incorporate new technology. The latest trends that are being used in mobile banking, mainly concerned with security and user experience, comprise these:

BaaS (Banking-as-a-Service)

Banking institutions are increasingly transparent and automatized, forming the infrastructure of a distribution system. BaaS is an industry that relies upon open banking APIs, which let banks lend their license and infrastructure to companies in the technology field. The lease of infrastructure for banking (license payments processing, license cards, compliance, and card issuance) rather than creating it or purchasing it from others is a relatively recent phenomenon. Still, it is quickly increasing due to the growing quantity of Fintech startups.

Work On Big Data And High Load Systems

It is a field characterized by high-load projects, requiring experts in Big Data or high-load systems. Because the system works with financial data, many preservation and analysis concerns exist. What impact will this have on the outsourcing and development industry? First, it requires people who have the right strategy for transformation. It is all about those who think differently. There is also an increasing demand for high-quality service.

AI Will Continue To Grow

Technology was an essential factor in the security of financial assets for individuals in the wake of the shutdown; technology will serve a significant role for banks over the years. Future agencies will utilize mobile banking applications and development tools to improve efficiency and enhance performance. As a source for growth and development, the application of artificial intelligence will rise, mainly to automate routine and tedious tasks, allowing them to better satisfy client expectations.

AI can be used to give cash flow forecasts and prevent equipment maintenance. It can also study customer behavior through facial recognition. This technique will enable banks to decide on the best way to communicate with customers and determine the products to advertise and when. That's why AI is required to be integrated with Mobile App Development for Banking.

Video-Banking And Remote Banking

Invariably, the client experience has to be put at the top of the list, and banks should not be content with giving the customer access through more than just one single channel. The combination of various platforms must be thought about. Mobile banking app advancement services have made it possible for certain groups of people not to interact personally with their bank. This infrequent interaction results in customer disengagement.

Banking institutions will also benefit from technology that has already proven its value, such as video conferencing banking services, to increase customer satisfaction and improve the customer experience. They're using new technology and re-designing employees' roles at bank branches. Customers can speak with an agent from a call center via chatbots or even in the branch using a machine if-service terminal. This means that the automation of all banking functions with self-service technology, aided by video banking, will increase.

The future agency Of Tomorrow Will Be More Innovative

The present crisis is likely to encourage the development of new ways to use the Internet. According to an analysis, one in five customers could be disengaged from their bank branches. Therefore, tackling this problem with innovative, flexible, and nimble designs is crucial. The new generation of banks will require a more logical control of expenses, become more automated and intelligent, and provide a complete service available 24 hours a day.

In search of a way to improve their operations, banks are attempting to establish new branches focusing on customers by utilizing new automated self-service equipment installed within and outside branches. These branches are open all day, seven days a week. Additionally, remote support allows you to conduct tasks that need approval regardless of whether the branch is shut. In the near future, the bank branch may also be transformed into a white-label app. Like white-label distributors, banks could arrange to share the expenses for making these offerings.

Provide Advanced Data protection

Online banking applications facilitate security by offering the same protection you get when logging in using a password or SMS verification on a web-based device. Users can use biometric verification, such as face scanning or fingerprint authentication, along with two-factor authentication. The data the application transmits is encrypted and secure. Any operations must be performed only following the entry of one-time passwords, using a QR code, or having fingerprints or faces. Also, think about adding an auto-lock feature if your smartphone is damaged or there are multiple failed login attempts.

Additionally, reducing security risks is essential for those who work with users' money. Hacks or leaks could instantly discredit customers from your site. So, you should find out beforehand if your mobile app development team is familiar with cybersecurity. It also knows how to develop a banking application with proper security features.

Building A Successful Mobile Banking App: Tips And Best Practices

We'll discuss techniques and tips to build a successful mobile banking application.

Provide Convenience

Mobile banking apps must be developed so that users can easily access their accounts at banks and conduct transactions online, even when traveling. Features like account balances and transaction history, including bill payment history, transfer, ATM locator, depositing, and checking with pictures, are all essential. The app must also function so that users can easily access it and manage banking via smartphone.

Ensure Top-Notch Security

The security of your information is the primary aspect of any bank system. Banking App Developers must incorporate security features like encryption and two-factor authentication into the design of their apps to protect customers' accounts and transactions. Biometric logins aren't just an additional security measure; they also provide practicality. Testing and regular updates provide a way to find and fix any potential security weaknesses of any device.

Personalize The Mobile Banking App Experience

A great mobile banking solution provides a unique personal experience to each customer. It should be able to offer personalized recommendations and content specifically tailored to an individual's preferences and needs. Options like purchasing limits, goal-setting, and budgeting tools enable individuals to modify their financial strategies and uniquely manage their money. Mobile banking apps will also offer services based on location, such as offers, suggestions, and other services.

Continuous Improvement

Technology and consumer expectations are constantly changing. The apps that have proved effective are upgraded continuously to include new features, correct issues, and enhance the overall experience. Feedback from customers on their requirements, issues, problems, and suggestions can help guide the development process. It is possible to learn about what the app does to satisfy customers' needs by studying primary indicators like customer reviews or ratings, the rate of adoption, and retention levels.

Read About: Mobile Banking App ‘Current’ Sues Facebook

Final Thoughts

The trip through the diverse bank mobile application development industry is a vast landscape of possibilities and challenges. One of the critical factors to the successful development of mobile banking apps is understanding and addressing customers' needs, keeping at the forefront of technology advancements while balancing revenue and experience. Key attributes, from simple user interfaces to seamless transactions, comprise the core of a well-performing mobile banking app.

Robust security protocols should back the features, protecting user information from the digital world's ever-changing threats. Additionally, it is essential to evaluate the development cost to ensure that investments in technology will yield tangible rewards for both banks and their clients.

The banking industry continues to navigate the digital age, and mobile app development innovation is emerging as a critical driving force. The challenge is not only about adapting to changing times but also about taking the lead. Banks that use technology's potential to improve the user experience and security have set new standards for customer care and operational efficiency.

Ultimately, the constant evolution of mobile banking apps is not just a trend. It's evidence of the industry's dedication to innovation in security, user-centeredness, and accessibility, setting the stage for an era where banking is more than a necessity but an aspect of everyday life.

.webp)

Share this blog