In today's world, in which life moves fast, controlling the financial situation from anywhere is essential. Nothing is better than dropping it into the phones ubiquitous in the rapidly growing digital era. Therefore, it's not surprising that lots of users prefer apps for mobile banking and banking transactions. Since the banking industry is going digital, consumers are saturated with many applications that allow for banking on mobile devices, which is a profitable investment.

But, if you plan to get involved, you must know the basics of Mobile Banking App Development. The app requires meticulous design and technology to ensure users' security and a user experience that is pleasing to the needs of today's consumers.

This guide will take you step by step through the exciting process of developing a mobile banking app from concept to completion. Whether you're a financial institution looking to build an app or a programmer seeking to learn how to develop mobile banking apps, this guide is ideal for both.

We will learn more about mobile banking applications and how to design one that meets users' requirements and surpasses their expectations.

What Are Mobile Banking Apps?

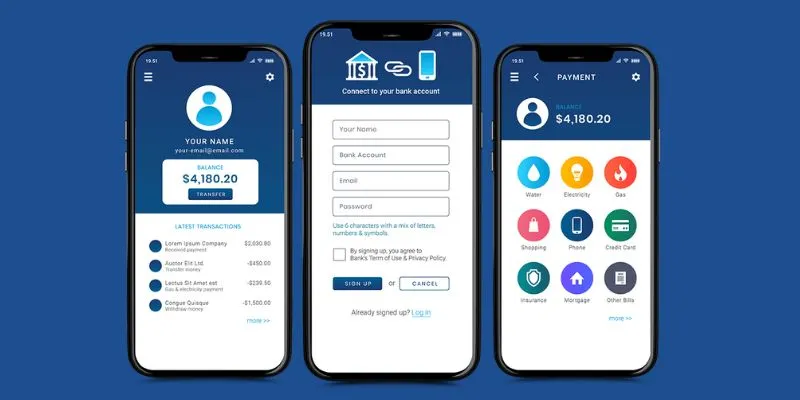

Mobile banking apps are designed to allow customers to manage banking transactions such as loans, money transfers, and bill pay on smartphones and tablets. These tech-driven applications give you the simplicity of handling various financial activities through your mobile phones or tablets. This means you'll be able to check your balance on your account, view your money from different locations, pay bills, and much more using just one tap from your phone. Furthermore, they're built with security and protection in mind.

Many banking apps permit users to check their account balance and transaction history. Deposit checks can be as high as a specific dollar. Another option is to make transfers to bank accounts other than your own and schedule payments, make payments to your bill, send personal payments to another person, and search for ATMs that are available for use.

Types Of Mobile Banking Apps

The most commonly used types are classic bank apps, neobank applications, and fintech apps.

-

Traditional Banking Apps

The significant banks prefer traditional banking applications, which provide customers access to the most basic banking options, including checking accounts, transfers, and bill payments.

-

Neobanks

The apps offer streamlined, digital-only banking with reduced fees, which provides great customer convenience for banking transactions.

-

Fintech-Related Apps

Fintech applications automate traditional banking processes and offer diverse new features like investment management tools, budgeting, and P2P payment.

Benefits Of Mobile Banking Apps

Banking App Development offers many benefits. We will examine how customers can benefit and what advantages banks could reap through mobile banking apps.

Improved Customer Experience

Mobile apps provide additional benefits for clients. They're secure and easy to use, and you cannot use your fingerprint to log in using a chatbot or put a computer inside your purse. Be aware that 6 of 10 customers prefer an app for mobile banking rather than a bank's website.

In addition, companies that create apps allow on-the-go access 24/7 to the entire digital banking solution. Access to all services at any time is time-saving. You can, for instance, check your deposits, view the most recent transactions, make schedules for bill payments, etc, regardless of whether you are at home or traveling abroad.

Higher Return On Investment (ROI)

Extensive analysis, research, money, and time are needed to turn a mobile banking app development idea into a reality. Everyone expects to get a favorable ROI on the investment they made in developing a mobile banking app development. An app's owner could anticipate results in a number of different ways.

These could take the form of greater user engagement, an increased number of customers, more revenue, and a better reputation in the market. Various case studies of major financial companies have seen significant results from developing and integrating mobile banking applications into their processes.

Better Security

Banks prioritize customer security. Internet and mobile banking have their own security risks. However, hardware security makes mobile banking more secure than online banking. Banks use gesture patterns, biometric information such as retina scans and fingerprints, traditional passwords, and two-factor authentication to increase security.

Most financial institutions use encryption to protect financial data and privacy, ensuring safe mobile banking. Additionally, increased encryption platforms make malware less likely to harm the app. If your customer does lose their mobile, your financial details are safe.

Additional Revenue Streams

Mobile banking applications boost returns on investment in various ways. According to the study, banks could witness a 72% rise in revenue by using mobile banking apps compared to customers who only utilize branches. Customers will likely boost the value and quantity of their credit and debit ATM, card, and ACH transactions after three months of using the mobile banking app. Banks can increase their income through mobile apps incorporating value-added products like loans, insurance, and the BNPL.

Advanced-Data Analytics

Continuously collecting data can produce incredible results. Advanced data analytics in customer care, sales, and marketing can help create product options that appeal to each individual at specific times. In addition, data management and analytics can provide companies with invaluable information about their clients' needs and problems, allowing them to address these issues more quickly and efficiently.

Better User Engagement And Retainment

In-app and push notifications bring many benefits for you and your customers. They help educate customers on appropriate discounts, offers, and more significant credit limits or rate details. Banks that have already implemented this feature have advantages over other banks.

Read About: Mobile Banking App ‘Current’ Sues Facebook

Mobile Banking App Development Must-Have Features

An app for mobile banking is designed specifically for users. The right features added to your app can increase its popularity and acceptability among customers. We'll look at the features that the mobile application must include.

Creation Of a New Account

It is essential to create an easy and safe authentication process. Multi-factor authentication is an effective logging method, but it takes time to complete the appropriate data. Alternatively, biometric authentication using physical metrics of the user (appearance or voice gestures) is much more efficient and enjoyable. The study suggests that users are more likely to utilize biometrics from their profiles for their passwords.

Management Of Accounts

It could also comprise a variety of banking options for mobile devices. Users can look up their card and bank accounts, as well as their balance, and keep track of their account history, for example. You can even add additional features. As an example, a mobile banking option that lets you customize managing accounts. The feature allows users to create a savings target, create investment plans, and make repeated payments.

Customer Support

Offering continuous support is among the most important features of mobile banking. Clients are expected to be able to contact bank representatives and ask questions at any time. Artificial intelligence in a chatbot can also enhance and customize the user experience.

ATM Branches Of Banks

Mobile Banking Application Development should not miss this crucial aspect of mobile banking. VR technology is feasible to improve customers' experiences. It's a distinctive aspect of mobile banking that was developed by RBC. This allowed the bank to boost the number of downloads of its apps by a significant amount.

Transactions And Payments That Are Secure

Payments made via P2P for services and fund exchanges must be handled securely and carried out at any time and from any place with a banking app. A different option for this option for mobile banking applications uses QR codes for payment for services and goods.

Scanning QR codes is an efficient and quick way to complete application transactions. A few banks have provided the mobile banking option for their customers.

Push Notifications

The development of mobile banking apps is a good time to use notifications and reminders to boost customer engagement and promote apps. It is essential to monitor this element and devise a communications strategy for your customers beforehand since the majority of users do not like receiving incessant alerts.

Read About: Guide to Create a Mobile Banking App

Advanced Mobile Banking Features

The features in the app mentioned previously are the basis of mobile banking application development. To increase the user's traction and curiosity, you need to consider some new mobile banking options that could end up being the most important factor for your app.

Trackers Of Spending

Mobile banking's development must focus on the user's needs regardless of whether they're not explicitly stated. The functionality allows users to manage individual budgets and set objectives for purchases they would like to make. It can also make a personalized dashboard for users based on their personal information to provide motivation and updates on their progress.

Users can also set the payment and bill dates ahead of time so that they don't miss the crucial transaction. The Simple App extensively uses mobile banking. It monitors customers' spending habits, creates budgets, and reduces expenditures.

Offers That Are Personalized

Making deals, discounts, or coupons through a mobile banking application is logical. There is a great opportunity to partner with cafes, restaurants, coffee shops, etc., to provide specific discount coupons or other discounts. This feature boosts sales while simultaneously engaging users using your mobile banking application.

Geolocation

Adding a branch or ATM Locator function helps people locate ATMs quickly by providing pertinent information about the contact information, times, and service availability. Furthermore, it will provide personalized promotions and offers depending on the user's location. It could also function as a security feature by tracking the user's location when the transaction begins.

Investing

Create a strong foundation of knowledge that lets users study investments, monitor their investments, and establish long-term goals for investment. Investors can track their investments using their mobile banking application. Using the app, you can either purchase a new investment or trade in an existing one at any time.

Cardless ATM Access

The system eliminates using physical cash cards to withdraw money at ATMs. Users are provided with the option of a QR card or a one-time authentication device that can be used at ATMs for cash withdrawals. It will stop frauds involving cards, such as skimming, and permit customers to make transactions using their mobile app.

Crypto Wallets

Crypto can be a controversial topic in bear markets; however, during the next bull market, everyone will discuss it. If you have customers who are looking into cryptocurrency, one thing you can do is partner with businesses that provide the most popular crypto coins, e.g., Bitcoin and Ethereum, as a means of trading.

Read Also: Benefits & Advantages of Mobile Banking Application Development 2024

Steps Of Mobile Banking App Development Process 2024

Mobile banking applications are extremely sought-after because they make users' lives easier. Creating your own mobile banking application is the process of creating a bank.

Research

This is among the crucial actions to be followed if you're contemplating getting a mobile app created. Doing an in-depth study of your market and the competition is vital. A thorough research will help you develop an effective plan. It is essential to write down every aspect, such as who the customers are, their issues, and the best way to deal with them.

Your output must be an extensive mobile banking application development strategy incorporating all estimates. An in-depth analysis provides every detail, from the user character to your value offering.

Build Prototype

Mobile banking apps can be complex, so knowing the specifications and developing prototypes is crucial. Once the prototype is approved, the following steps can be initiated. You must be aware of your requirements and expectations. Creating a prototype can be an extensive process that allows you to identify the scope of future projects and help design an item that meets customers' requirements.

Setting Up a Robust Security Base

Information Security is essential when creating a secure mobile banking application. Some companies hire Banking App Developers to develop apps with high security. Security is not a matter of course when it comes to banking. When developing an application for mobile banking, it is essential to follow strict authorization and encryption protocols, as well as two-factor authentication and additional security measures.

Work On User Experience

When this is done, it is the turn of the design team, or the designer needs to put on their work gloves and get to work. If you're building an app to assist your customers, offering the best user experience is crucial. It should have smooth navigation, and the application must be easy to use.

When handling any transaction requiring money handling, the app should not be prone to errors that could trigger users. When people are handling large amounts of cash, it is stressful for them. Creating an easy, simple, and easy-to-use interface is crucial.

App Development

This is the last stage of development. The entire research design, development, prototypes, and test results will end after the finalization. Then, you know exactly what you need and the correct strategy to create and market the mobile banking app development.

Add Integrations

Third-party integrations help your app become more user-friendly and practical. This helps create a user-friendly flow while increasing customer retention. Third-party integrations are payment aggregators, payment gateways, and more. Be careful when choosing them because they may help your app gain traction on the market or, ultimately, a disaster.

Launch

Once the application has been developed, it must adhere to the stringent criteria established by the Apple App Store and Google Play Market before being listed for sale or distribution. Following these rules can be crucial as they ensure high-quality copyrighted pictures and videos per the platform's policies. Promoting the app's popularity through descriptive videos and images and actively managing reviews and feedback could significantly affect its ability to climb the ranks in its field.

Maintenance

Keep in mind that expenses continue beyond that point, and ongoing costs such as servers, tech support, and the payment gateway constantly consume the budget. When users use the application, new requirements emerge, requiring the inclusion of new features, making the ability to adapt to future changes within the mobile banking app development that was initially essential.

Read Also: How Much Cost Mobile Banking App Development

What Is The Cost Of Developing a Mobile Bank Application?

The costs of developing mobile apps depend on various factors, including the technology you choose and the time you spend. However, the total cost is the time spent on development divided by the hourly rate of app developers.

Many factors influence the total costs of Banking Apps Development. Take a review of each one:

Wireframe

Wireframes are created using programs such as Figma or PhotoShop. They are the primary architecture or blueprint for the banking application's design. Following multiple test methods, the finalized wireframe with an unambiguous product view will be created.

UI/UX Design

Mobile banking applications typically contain information regarding accounts, money transfers, customer support services, an interactive chatbot feature, and various other elements that enhance the application's performance. Creating a simple design that can add all the information in one location. An uncluttered style is the best approach to take. It facilitates navigation, improves customer retention, and keeps customers interested.

App Platform

The app's primary platform influences the price it will cost. While choosing the iOS and Android platform has a minimal influence on the budget of the app, it's usually recommended for the first time due to its more significant customer base. It is possible to have your banking application initially developed for one platform before moving to cross-platform development when the app gains some recognition in the marketplace.

Team Size

The team size heavily influences the cost estimation. What you intend to accomplish largely depends on your company's financial condition. If you have an internal development team and funding is within your financial capacity. If not, you must contract out your app's development team or an individual. While they might start charging less, a reliable bank app development company is likely to provide a greater return on investment because of their superior quality of service.

Technology Integration

Technology integration is another crucial aspect directly related to the development cost of a banking application. Incorporating cutting-edge technologies such as blockchain and AI/ML is recommended because they will be beneficial in the long term. These technologies can increase the value of your application but also increase costs.

Features

The more options it contains, the more are likely to pay. The right combination of functions is one of the critical elements of developing mobile banking applications. Development costs will substantially rise as you add higher-level or sophisticated options.

Maintenance

It is an essential step to take even after you have launched the application. It is a critical element that affects the total development costs. Maintaining the high quality of your mobile banking app development is necessary to provide a fantastic user experience.

It's critical to recognize that once the app is launched, it will have users' data and the actions involved, so app maintenance will become vital. It will require regular cleaning, regular bug searches and removals, and frequent updates. Every time an enhancement is made to the software, its cost will rise accordingly.

Conclusion

Making a banking app can be a great solution to cater to your client's requirements and offer them an enjoyable user experience. Digital technology has completely changed the conventional banking system. This article can help you develop and turn your mobile banking app design ideas into reality. If you plan to create an app for mobile banking, this is the best time to use current developments and technology to build the most advanced application for your clients.

In the case of financial operations, the primary focus should be on data security. This is why choosing a trustworthy and experienced app development business with a history of creating robust software and helping businesses expand is crucial.

Share this blog