Wondering how to build a payment app like PayPal? Do market research, define your audience, pick a tech stack, and hire developers. Sounds solid… but let's be honest, that's just the surface.

Because here's the truth: if you really want to compete with giants like PayPal, you need more than just an app.

If all it took were a list of features, there'd be a hundred PayPal by now. What you really need is a strategy, one that blends trust, compliance, UX, and revenue thinking from day one.

In this guide, we'll go beyond the basics and break down what actually makes a payment processing platform like PayPal successful, and how you can build one that stands out in a crowded, high-stakes market.

Let's dive in

History of PayPal- A Quick Overview

Before the rise of Apple Pay, Google Pay, and dozens of other fintech players, one name revolutionized online transactions: PayPal.

Launched in 1998, PayPal began as a cryptography-focused company called Confinity.

It merged with Elon Musk's X.com in 2000 and rebranded fully as PayPal-becoming one of the first major digital payment apps to gain global trust.

Its IPO in 2002, followed by an acquisition by eBay, positioned it as the go-to platform for secure online payments.

Over the decades, PayPal has scaled across 200+ countries, integrating with banks, eCommerce, and mobile platforms worldwide.

Today, entrepreneurs and startups aiming to develop a mobile payment app like PayPal often study its journey for key lessons.

After all, understanding its roots is essential if you're building your own digital payment app like PayPal.

Now that we've explored how PayPal began and evolved into a global payment giant, let's dive into what truly set it apart- what made PayPal so famous and trusted across the world?

What Made PayPal So Famous?

PayPal's rise wasn't accidental; it earned global trust by solving real problems at just the right time.

From intuitive design to rock-solid security, it redefined how people viewed digital transactions and set the bar high for anyone who wants to create an eWallet app similar to PayPal.

Here's what truly made it stand out:

1. First-Mover Advantage

As one of the earliest players in the online payments space, PayPal quickly became the go-to choice, long before the idea to build an eWallet app like PayPal became mainstream.

2. Seamless eCommerce Integration

Its integration with eBay gave it explosive exposure, showing how a digital payment platform like PayPal could simplify online buying and selling for millions.

3. Strong Security & Buyer Protection

End-to-end encryption, fraud detection, and buyer safeguards helped build the trust that any modern digital wallet app like PayPal must replicate.

4. User-Friendly Interface

Clean design, quick onboarding, and one-click payments made it accessible even for non-tech-savvy users.

5. Global Reach with Multi-Currency Support

Its ability to handle international transactions with ease positioned it as a truly scalable digital payment platform like PayPal, anticipating today's trend in eWallet app globalization.

Statistics For a PayPal App

Here are some of the statistics showing PayPal-like app market growth:

-

- PayPal had 434 million active users as of December 2024.

- Over 10.3 million live websites across the globe support PayPal.

- With a 45% market share, PayPal is the leading global payment solution.

- In 2024, PayPal processed $1.68 trillion in total payment volume (TPV).

- The company generated $31.8 billion in net revenue in 2024.

- PayPal entered 2025 with $6.8 billion in free cash flow.

- The platform is available in more than 200 markets worldwide.

Ready to build an app like PayPal and ride the digital payments wave? Now’s the time to turn your fintech idea into a scalable product. But, remember those looking to start an eWallet business should focus on compliance and features from day one.

Talking about features, this is what we are going to discuss in the next section:

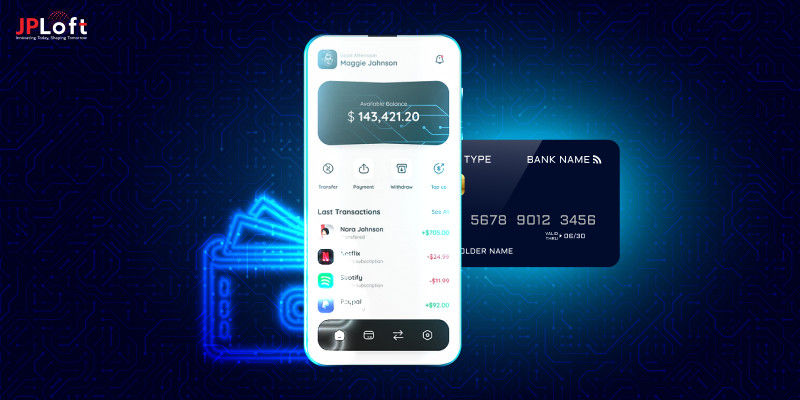

Key Features to Have in PayPal-like App

Anyone looking to develop a payment platform like PayPal must prioritize innovation, compliance, and user engagement.

These core digital wallet features lay the foundation for a powerful app that rivals other apps in performance and trust.

|

Feature |

Description |

|

User Registration & KYC |

Secure onboarding with email/phone verification and identity authentication. |

|

Wallet Integration |

Allows users to load money into their in-app wallet for quick transactions. |

|

Bank Account Linking |

Enables users to connect and manage multiple bank accounts or cards. |

|

Peer-to-Peer Transfers |

Instant money transfers between users using phone number, email, or QR code. |

|

Merchant Payments |

Users can pay on eCommerce websites or in-store using QR codes or payment links. |

|

Transaction History |

Real-time logs of all transactions with filters and downloadable receipts. |

|

Currency Conversion |

Support for multi-currency transactions and real-time exchange rates. |

|

Security & Encryption |

Multi-layered security with 2FA, SSL encryption, and fraud detection systems. |

|

Push Notifications |

Real-time alerts for successful payments, receipts, offers, or login attempts. |

|

In-App Support |

Chat or ticket-based support to resolve payment or account-related issues. |

|

Admin Dashboard |

Complete control panel for managing users, transactions, fees, and analytics. |

|

API Integration |

Seamless integration with third-party services, banks, or payment gateways. For faster deployment, consider Wallet as a Service (WaaS) solutions. |

With this out of the way, let's find out how to create an app like PayPal.

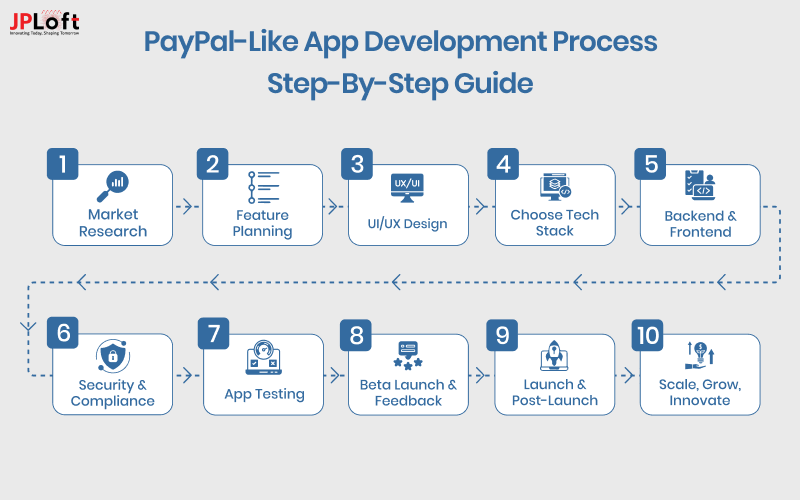

PayPal-like App Development Process: Step-by-Step Guide

So, you're ready to create a payment app like PayPal and take the fintech world by storm? Smart move!

But here's the deal, this isn't just about writing a few lines of code and calling it a day.

The process to develop an app like PayPal is part art, part science, and a whole lot of strategy.

Let’s break it down, step by step to understand how to create a mobile payment app like PayPal, with a blend of logic, creativity, and that "next unicorn" energy.

Step 1: Market Research & Opportunity Mapping

When you consider how to create a payment app like PayPal, you need to understand the battlefield. Study your target audience, top competitors, market gaps, and user pain points.

Ask: What do users hate about current payment apps? What do they wish existed? This step fuels every part of the app development process, from core features to monetization strategy.

Solid research ensures you’re building something people need, not just another fintech clone.

Step 2: Feature Planning & Regulatory Compliance

Now, list must-have features: P2P transfers, wallet integration, fraud alerts, currency conversion, etc.

While you’re at it, align with legal frameworks, PCI DSS, GDPR, KYC/AML laws- based on your target regions. You’re not just building an app; you’re building financial infrastructure.

This step in the guide to develop a payment platform like PayPal also helps you visualize an accurate app wireframe, setting the foundation for what users will experience on screen.

Step 3: UI/UX Design

Here’s where ideas take shape. Your designers will turn research into reality with intuitive layouts, clean screens, and effortless user journeys.

If you're wondering how to create a payment app like PayPal, this is the phase where the user experience gets mapped—starting with low-fidelity sketches and evolving into a clickable app prototype that mimics real interaction flow.

This not only streamlines design but gives developers and stakeholders a visual benchmark before a single line of code is written. Think of this as your fintech blueprint.

Step 4: Choosing the Right Tech Stack

Behind every smooth app is a top tech stack. Decide on front-end (React Native, Flutter), backend (Node.js, Python), and cloud (AWS, Azure).

Don’t forget APIs for payments, notifications, and analytics. The digital wallet tech stack you chose influences performance, scalability, and future upgrades.

It’s a vital piece of the PayPal-like app development process that balances budget, speed, and long-term flexibility. Choose wisely- it’s the engine of your PayPal-like dream.

Step 5: Backend & Frontend Development

Time to bring your prototype to life. Developers start coding both the backend logic (transactions, wallet balance, user verification) and frontend interactions.

This is where your app becomes functional and starts feeling real. Every piece should be modular and scalable to handle spikes in traffic and transaction volumes-key challenge in eWallet app development that separate temporary solutions from lasting platforms.

Think big now- because success won’t wait. This is the heartbeat of the process to create an app like PayPal.

Step 6: Security & Compliance Integration

A fintech app without security measures? That's a hard no. From data encryption and tokenization to 2FA and real-time fraud alerts, this phase focuses on building user trust.

Integrating compliance protocols like PCI-DSS and KYC flows at this stage prevents costly overhauls later.

Secure login systems and suspicious activity alerts are must-haves when you develop a payment app like PayPal that's meant for millions.

Step 7: App Testing & Bug Fixing

Before launch, your app goes through rigorous app testing- functional, performance, security, and usability tests.

Simulate real-world transactions. Test across devices, networks, and payment scenarios. The goal? Zero crashes, zero errors, zero frustration.

App testing ensures that your platform doesn't just work- it works flawlessly. Because in fintech, even a tiny glitch can lead to enormous mistrust.

Step 8: Beta Launch & Feedback Collection

Your app’s ready-but don't go global just yet.

Launch a private beta for a limited user base. Track real usage, gather feedback, and fine-tune features. It’s like test-driving a race car before the big race.

This phase is critical in the process to make an app like PayPal, as it offers live data to polish UX, optimize flows, and improve performance before the public spotlight hits.

Step 9: Launch & Post-Launch Optimization

Go live with a bang! But your job isn't over. You'll need analytics, A/B testing, bug monitoring, and performance optimization to keep the app running smoothly.

At this point, offering app maintenance services becomes crucial.

The market moves fast- features that work today might feel outdated tomorrow. Keep improving based on real-time usage and stay ahead of the curve.

Step 10: Scale, Grow, Innovate

Once you’ve established a stable user base, it’s time to scale.

Add new currencies, geographies, integrations, and even features like crypto wallets or expense analytics.

Growth is not just about adding users- it's about evolving your ecosystem.

This final phase of the process to build an app like PayPal turns your product from a simple payment tool into a full-fledged fintech empire.

We believe you understand how to build an app like PayPal from scratch, moving on to the next step, the Cost to create a mobile payment app like PayPal.

How Much Does it Cost to Develop a Payment Platform like PayPal?

If you want to make your own PayPal-like App, one of the most important questions you might have in your mind is- "How much does it cost to create an app like PayPal?"

The cost to develop a payment app like PayPal isn't just about writing code- it's about building a foundation of compliance, scalability, and trust.

On average, creating a basic MVP ranges from $80,000 to $150,000, while a full-scale, feature-rich solution with bank-grade security, multi-currency support, and global reach can exceed $300,000+.

What truly influences the cost is your app's complexity: real-time fraud detection, biometric logins, and AI-driven analytics can drive the price higher.

Much like the cost to develop an eWallet app, these platforms demand thoughtful planning, legal certifications (like PCI-DSS), and seamless user experiences.

You're not just building software- you're creating the future of digital finance.

|

Component |

Estimated Cost (USD) |

Description |

|

MVP Development |

$80,000 – $150,000 |

Basic features like user registration, wallet, and P2P transfers. |

|

Full-Scale Platform |

$200,000 – $300,000+ |

Includes advanced features like multi-currency, KYC, and real-time analytics. |

|

Security & Compliance |

$20,000 – $50,000 |

Covers integration of encryption, 2FA, and legal compliance like PCI-DSS. |

|

UI/UX Design + Wireframes |

$10,000 – $25,000 |

Custom designs and smooth user experience flow. |

|

3rd-Party Integrations (APIs) |

$15,000 – $40,000 |

For payment gateways, banking APIs, identity verification, etc. |

Factors Affecting the Cost to Develop an App like PayPal

When figuring out the cost to develop a payment app like PayPal, it's not just about screens and features-it's about the tech smartness, airtight security, and strategic planning that powers it all.

From the backend engine to global compliance, every decision you make shapes the final budget.

1] Feature Complexity

Your feature list decides whether you're building a sleek MVP or a full-fledged powerhouse like PayPal.

If you're planning to develop a multi-currency wallet with recurring billing, fraud detection, and AI-driven transaction insights, be ready for a steeper investment.

The more intelligent and versatile your features, the more you’ll need to invest to stand out in the fintech arena.

|

Feature Set |

Estimated Cost Impact |

|

Basic Transfers Only |

Low |

|

Advanced Wallet + Reports |

Medium |

|

Full Suite + AI/Analytics |

High |

An app development company can help you scale features smartly, so you don’t overspend on Day 1.

2] Target Region

Launching in a single country is one thing; building for 150+ markets like PayPal? That’s a whole different game.

Localization, currency support, tax regulations, and banking integrations vary per country-and so does your budget.

|

Launch Scope |

Impact on Cost |

What It Means |

|

Single Country Launch |

Low |

Basic setup with localized compliance and one currency. |

|

Regional Expansion (5–10 countries) |

Medium |

Requires multi-currency support, translations, and local laws. |

|

Global Rollout |

High |

Full-scale international launch with high scalability and support. |

The cost to build a peer-to-peer payment app like PayPal skyrockets if you’re going international from day one.

3] Security Standards

PayPal thrives on trust. So, emphasis on digital wallet security is a must.

To match that, you'll need military-grade encryption, 2FA, biometric login, secure cloud infra, and compliance with PCI-DSS, GDPR, and KYC laws.

Building this layer of digital armour isn't cheap, but it's non-negotiable.

|

Security Features |

Budget Range |

|

Basic SSL + Login |

Low |

|

PCI Compliance + 2FA |

Medium |

|

Full Stack + AI Security |

High |

For the cost to develop a payment app like PayPal, security is the golden ticket.

4] UI/UX Design

A confusing interface is a dealbreaker.

Users expect clean, intuitive screens that feel easy even if the backend is super complex.

High-quality design involves multiple iterations, wireframes, and testing. The more refined the UI/UX, the higher the engagement (and yes, the cost).

|

Design Type |

Design Investment |

|

Basic Functional UI |

Low |

|

Custom App Wireframe + UX |

Medium |

|

Premium Fintech Design |

High |

5] Third-Party Integrations

You’re not building alone.

You’ll need to connect payment gateways, bank APIs, identity verification services, and analytics tools.

Each integration takes time and licensing, adding to your bottom line.

|

Integration Level |

Cost Estimate |

|

Basic APIs |

Low |

|

Standard APIs |

Medium |

|

Complex Systems |

High |

The cost to make an online payment system like PayPal goes up with every extra plug-in you want.

6] Development Team & Location

Hiring a Silicon Valley agency? You'll pay a premium.

Outsourcing to the best mobile app development company in Eastern Europe or India? More cost-efficient without compromising quality.

Your team's size, location, and experience can drastically affect your final price tag.

|

Development Team |

Cost Range |

|

Freelancers |

Low (but risky) |

|

Offshore Dev Team |

Medium |

|

In-House US/UK Agency |

High |

It’s not just who builds it, but how smartly they build it.

We laid the foundation of cost to create an app like PayPal. This is the time to know about the monetization strategies of digital wallets.

How PayPal-like App Can Make Money?

Building a PayPal-style platform isn’t just a tech flex- it’s a smart business move.

Beyond powering fast and secure transactions, this type of app opens the door to multiple revenue streams. From every swipe, tap, or transfer, there’s a golden opportunity waiting.

Let’s unpack some digital wallet app monetization strategies that go beyond the obvious.

► Transaction Fees

The OG of monetization.

Just like PayPal, you can charge users a small fee per transaction-especially for currency conversions, business payments, or instant transfers.

These micro-fees, when scaled, can snowball into serious revenue.

► Merchant Services

Offer value-added tools like invoicing, recurring billing, or inventory dashboards to business users.

These services can be bundled into premium plans or charged à la carte, adding another solid layer to your revenue model.

► Currency Conversion Margin

If your app supports cross-border payments, you can bake in a small markup on foreign exchange rates.

Users won’t mind paying a tiny premium for convenience, and you rake in margin with every currency switch.

► Subscription Plans

Introduce freemium tiers for both consumers and merchants.

Basic features stay free, while advanced ones-like AI-powered analytics or multi-user team access-are locked behind monthly or annual subscriptions.

► In-App Advertisements

Yes, even digital wallets can cash in on ads- if done right. Promote relevant financial products, insurance services, cashback deals, or local merchants through non-intrusive banners or sponsored sections.

Targeted ads can drive engagement and revenue, especially when paired with user data insights (ethically, of course).

How JPLoft Can Help You Develop a Fintech App like PayPal?

Want to create a payment app like PayPal? Well, take the help of experts.

Building the next big fintech disruptor? JPLoft brings the brains and the build. As a top-tier eWallet app development company, we don’t just write code-we craft secure, scalable ecosystems tailored for modern finance.

From intuitive UI to ironclad security and global payment integration, we cover every angle. Whether you're launching an MVP or a full-fledged PayPal competitor, our experts turn your vision into a fintech reality.

You bring the idea-we bring the innovation, compliance, and tech stack to match. Let’s make your app the one people can’t stop talking (or transacting) about.

Conclusion

Building a payment app like PayPal is a game-changing opportunity in the fast-growing fintech industry.

Success requires secure technology, regulatory compliance, seamless UX, and smart monetization.

By following the right development steps-market research, feature planning, robust security, and scalable architecture-you can create a payment app Like PayPal that stands out.

Partnering with an experienced fintech app development team ensures your platform is secure, user-friendly, and future-proof. The digital payments revolution is here-will your app lead the way?

FAQs

It typically ranges from $80,000 to $300,000+, depending on features, security, and launch region.

Start by defining features, creating an app wireframe, building a secure backend, integrating payment gateways, and partnering with an experienced app development company.

P2P transfers, digital wallet, multi-currency support, fraud detection, and bank integrations.

Yes! With the right tech team, security protocols, and compliance (like PCI-DSS), you can build a custom payment solution tailored to your business.

Transaction fees, currency exchange margins, subscriptions, and merchant services.

Share this blog