The eWallet app market will rise from $124.6 bn in 2024, to $590.2 bn by 2032. So, if you are ready to jump on the bandwagon, it is time to create an eWallet app.

But, to do so, remember, in current society, users crave three things: convenience, security & great user experience.

But, here’s the catch: crafting a unique eWallet app isn’t as easy as it sounds.

From safeguarding sensitive data to perfecting every touchpoint of the user experience, the road is filled with so many eWallet app development challenges.

Whether you are curious or considering developing an eWallet app, welcome!

Let’s better understand what challenges in developing an eWallet app you can encounter and how to prevent them and create an app people will like and trust.

eWallet App Stats: A Market Overview

Want to create an eWallet app? Let’s look at these growing market stats to get a better picture of how the industry is growing.

With the growth projected, it is now an ideal time to invest in developing a secure, friendly eWallet app to take up the increasing demand for digital payment solutions.

-

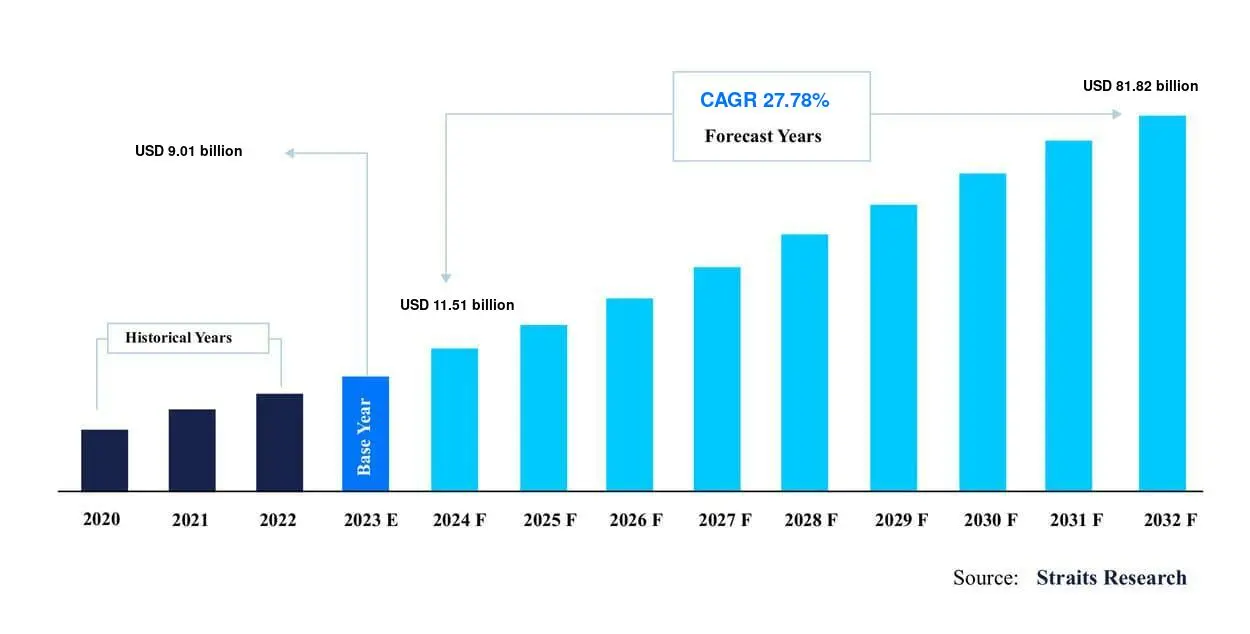

The worldwide mobile wallet market size was USD 9.01 billion in 2023, and it is estimated to expand immensely, USD 81.82 billion, by 2032.

-

This growth is a Compound Annual Growth Rate (CAGR) of 27.78% in the forecast period of 2024, and 2032.

-

Regarding the wallet type, the market is majorly partnered with semi-closed wallets.

-

While as per the payment mode, Near-field Communication (NFC) reigns the segment.

-

When it comes to the application, the primary usage is mobile commerce highlighting the gradual transition to the digital payment system within e-commerce.

-

The mobile wallet market is most prominent in the Asia Pacific, based on current developments, which confirm that this area is the most popular in using contactless payments.

Why Develop an eWallet App?

If you are considering entering the sphere of digital payments, creating an eWallet app is a wise decision. Mobile payments are continuing to grow at an incredible pace, and developing an app place one where a huge market is fast emerging.

Let’s find out some other amazing benefits of having an eWallet app:

1. The Rise in the Usage of Cashless Payments

Mobile payment and the use of cards are gaining popularity and the world is gradually shifting to a cashless society.

Worldwide mobile payment volumes are projected to go beyond $12.7 trillion per annum by the year 2027.

Users need to pay securely and conveniently, and the concept of an eWallet app presents a good chance to address this demand.

2. Financial Inclusion

eWallets provide financial access to underserved populations who may not have access to traditional banking.

Even today, more than 1.7 billion adults remain unbanked, and by using digital wallets, consumers have an opportunity to perform transactions without any risks.

3. Increased Convenience and User Satisfaction

Customers would appreciate it if they did not have to go to a bank to make a payment.

Instant payment for purchases, loyalty rewards programs, and easily transferable funding services, all can help to improve user involvement and keep your apps active indefinitely.

This can translate into more app launches and as a result, better revenues.

4. Market Growth Competitive Strategy

Since many customers are now using a cashless type of payment service, goods.

Those service providers with efficient, secure, fast, and easily accessible e-wallets will have a larger customer base.

It’s crucial to realize that with the creation of an app, you’ll be investing in a market that is expected to reach over 590 billion US dollars by 2032.

So, early entry enables an organization to cultivate brand popularity among customers while at the same time helping you to understand the preferences of the users of the product in the future.

Explore eWallet App Development Challenges

Creating an eWallet app has its own set of problems that need to be dealt with.

From establishing the highest levels of security to delivering a perfect user experience, there are many challenges in eWallet apps to navigate.

Understanding these key challenges of eWallet apps enables you to avoid common pitfalls in digital wallet app development and create an app that not only meets the highest requirements but also becomes a well-trusted and beloved utility for users.

► Security Issues and Data Privacy

When you are about to invest in an eWallet application, you know that app security has to be a top priority.

Since users share their financial records with your app, there should be no discussion about the chosen components.

Data breaches are always on the lookout, so there is a need to protect your app against them.

Implementing top-tier security measures including Encryption, two-factor authentication, and security audit is the need of the hour for maximum protection.

Solution: It is crucial to work with a preferred mobile app development firm that has a vast understanding of security issues that arise with the app and the ability to implement strict security features of current trends including anti-fraud features and/or end-to-end encryption.

Security is a fundamental concept that boasts user confidence, especially apps that are used regularly.

► User Experience (UX) Design

The top eWallet app development challenge is guaranteeing a great customer experience.

If the app is complex or there are too many changes on the interface then customers will leave the app immediately.

It has to be plain and easy to navigate, and this is especially important for those who are not very tech-savvy.

As for your app, it can and must make performing financial chores seem easy, fast, and fun.

Solution: Wherever possible, make navigation easy, instructions clear, and the site layout simple to increase the user’s interest and encourage repeat visits. We suggest choosing an Android or iOS app development company, with a professional approach that can help you create something unique with a minimalist design.

► Payment Gateway Integration

No payment gateway? No eWallet app. It’s as simple as that.

For the expansion of the eWallet, it is essential to connect to at least several payment channels, including credit/debit cards, P2P transfers, and bank accounts.

If any of the payment methodologies is not efficient, or if there is a delay in it, the users will be irritated.

This is one of the biggest digital wallet app development challenges to overcome often faced by developers and companies.

Solution: Since you are dealing with multiple platforms, you have to be very careful to help your customers achieve solid payment experiences.

This implies creating a solid system that supports different payment options and/or various currencies for maximum coverage.

► Regulation Compliance

The legal and regulatory landscape is one of the top eWallet app development challenges.

With regulations like KYC (Know Your Customer), and AML (Anti-Money Laundering) in play, staying compliant is non-negotiable.

Fail to do so, and you could be facing hefty fines, or worse yet, the shutdown of your app.

Compliance isn’t just a check box, -It isn’t the foundation of a trustworthy, long-lasting eWallet solution.

Solution: Your development team should know what financial regulations exist and are prevalent in various geographical areas.

Make sure to comply with legal frameworks and integrate KYC/AML procedures so that your app works well with global security standards.

► Multibrowser Compatibility

Having a flawless eWallet Android or iOS app has been difficult as well.

When developing mobile wallet apps, there is a need to make sure that performance will be uniform across devices, operating systems, and screen sizes.

This is why, we consider it a huge digital wallet app development challenge ahead of you.

Every app has its characteristics – some issues are connected with iOS, others with Android, and OS versions make it even worse because it is very difficult to create an identical predictable interface.

Sometimes it feels like juggling between two tunes, but getting it right is the only way to keep every user satisfied.

Solution: Work with a reliable iOS or android app development company that can design cross-platform solutions.

They will make sure to do proper testing of apps across various devices to improve the performance and enrich the user experience.

► Scalability

As your eWallet app grows, it is becoming more and more important to ensure that the system can scale up.

The biggest challenge in developing an eWallet app is building a system that can support more users and transactions over time.

If your app cannot support an unexpected increase in activity, it might crash or slow down and result in a bad user experience.

This becomes more noticeable when you start getting more users and transactions, which can impact the reliability and performance of the application.

Scalability is, therefore important not only to maintain functionality but also to accommodate future growth.

Solution: Scalability should be considered from the very beginning by designing a cloud-based infrastructure that would grow with the app. In terms of hosting solutions, ensure that they are scalable, thus your app may have higher traffic volumes and even transactions without performance breakdowns.

Your app will remain reliable if it has a solid foundation for further growth.

► Transaction Speed and Reliability

Customers are equally affected when there is slow transaction processing, or when the app is down.

Transaction speed is among those components that define whether the user will continue using your application or not.

If the payments take a long time to process or do not go through, the users will easily abandon your app in favor of an app that has better processing time.

Stability is also crucial – failure or freezing at certain intervals is also really off-putting and people will start to lose confidence in your application. The right level of optimization is imperative for customer loyalty.

Solution: Optimize the backend infrastructure of your app to handle a large transaction volume efficiently.

Focus more on minimizing downtime and on optimizing the code to ensure it processes transactions quickly.

Furthermore, test the application regularly to ensure it works effectively, even when the load is high, thus keeping users satisfied and loyal.

► Gain Users' Trust

One thing with financial transactions is the gain of users' trust in your app.

We consider it a top eWallet app development challenge ahead of you, convincing the user to trust your eWallet app, especially when they have to share their personal and financial data.

A significant portion of users would prefer sticking to established apps such as PayPal or Venmo.

It demands transparency and good quality service in regards to consumer clients along with a credibility track record.

Solution: Focus on following clear transparent communication about your security practices, and provide real-time support for any issues that arise.

Offer Guarantee your transactions so happen and share positive feedback from end-users about reliability along with their app.

► Cost of Development and Maintenance

The main eWallet app development issue is the cost to make an eWallet app. Wondering how?

Designing an elite-level app with smart functions, seamless interface and security at higher levels can soon turn into a costly affair.

Right after the launch you also should set aside funds for its maintenance, updating, and fixing of bugs.

Creating an optimum eWallet app can be very costly when you have to ensure that it incorporates numerous features, as is common in environments where one app must have it all.

This is always a dilemma between putting your money in the right places and getting your app to be unique in every way possible for users.

Solution: First of all, find out what eWallet app features should be implemented in the first version of the app and then add new ones with the growth of the audience.

It is cost-effective to develop apps with cross-platform tools such as Flutter and React native. Furthermore, it is always recommended to provide a maintenance budget in the longer term and make successive enhancements to meet competitor pressure.

► Handling Competition

Since there are already so many successful eWallet apps, the biggest mobile wallet app development challenge is differentiation.

Major players in the market include PayPal, Venmo, and Cash App, act as barriers to entry for other applications.

To acquire users and gain a competitive advantage, your app must possess features, better UX, or an unseen/unexplored market segment.

Solution: Suggest paying attention to the fact that not all of your competitors are offering those features as of your app.

For example, analyze your target audience and try to find out the gaps in the execution of tasks that existing apps cannot solve.

What happens if you offer something unique and meet a unique need or solve a certain problem, you create a niche for yourself.

How JPLoft Can Help You Overcome eWallet App Development Challenges?

Well, the market is growing for the eWallet app.

It is the right time to dip your toes in the market but to do so, there are several eWallet app development challenges that you need to overcome.

For this, JPLoft, the best eWallet app development company can help you Build a Digital Wallet platform that not only enhances user experience but attracts a huge ROI.

We have years of experience and developed many eWallet solutions that cater to a variety of demands. By offering a great experience, we can help you stand out in a competitive market.

Conclusion

An eWallet application can be a great idea for new businesses because it allows targeting the constantly growing need for digital payments.

Nonetheless, numerous challenges of eWallet app development have been discussed above to make a secure, easy-to-use, and reliable app.

You can create an effective plan that includes priorities, where you concentrate on critical aspects – security, UX, scalability; and consider problems – for instance, regulatory compliance and the competition – to get your app ready for success.

In this article, we will share with you the tactics that will help you design an app that will attract users and contribute to business success.

Do not be discouraged by these barriers; every problem is solvable provided one has the right plan and knowledge.

FAQs

Security, user interaction design, payment interface integration, legal requirements, and the ability to broaden the application are some of the problems encountered in eWallet application development.

Establish strong security features like end-to-end encryption, multi-factor authentication, and periodic security audits for customer data security and confidence.

Effective user interface and user experience design make it easy for them to perform monetary activities without assistance from anyone, and hence a large customer base is retained.

Integrate different forms of payment like; credit card/debit cards, bank transfers, and P2P payments to make it easier to meet the convenience of as many users as possible.

The eWallet market globally is projected to expand and attain a size of about USD 590.2 billion within the forecast of 2023-2032 due to the increased need for both cashless payments and mobile commerce.

Share this blog