“Trends”- If you Google this word, you will find this simply means a general direction in which something is developing.

In every industry, be it Healthcare, Fitness, Fintech, or e-wallet, there are always evolving trends that shape these industries for the future.

This way, people look forward to something new and exciting that adds to their convenience & ease.

Knowing these trends is not limited to users but also to businesses who want to jump on the bandwagon.

So, if you are also on the same boat, we must say you should understand these eWallet app development trends so that you make the right decision.

Taking this on us, we are here with a blog that explains details about the digital wallet app development trends and how they can make your app more valuable for your users.

Let’s get right into it:

What is an eWallet App?

Let’s not skip the basics, “What is eWallet App & Why People are Talking So Much About It?”

An eWallet app, known as a digital wallet, is a game changer in how we manage finances today.

It allows users to securely store payment information, including debit/credit cards, bank details, and even cryptocurrencies, all–in–one easy platform.

Gone are the days of carrying cash or multiple cards-everything you need for quick payments, money transfers, and managing finances is right in your pocket in the form of a digital wallet.

There are several digital wallets present right now in the market including PayPal (You must have used it or heard about it), Cash App, Venmo, and many more.

The trend of creating eWallet apps is booming as the world moves more towards a cashless society. It’s no longer a future thing, but instead an ongoing change.

We will share several digital wallet app development trends of 2025 that are powering this change.

For those who looking to capitalize on the financial revolution and create an eWallet app, a smart move for those entrepreneurs is to know these trends.

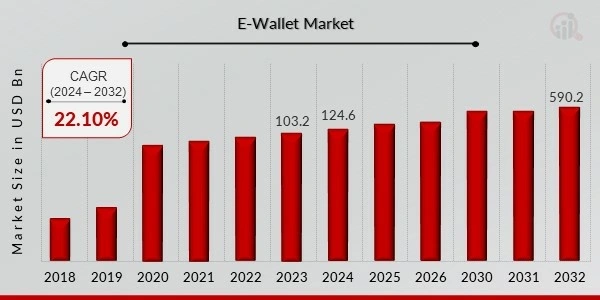

eWallet Market Statistics: The Future is Evolving

Before diving into the details of these trends, let’s take a look at some key eWallet market statistics.

These stats offer a clearer picture of the promising future ahead.

-

The E-Wallet Market is set to grow at a compound annual growth rate (CAGR) of 22.10% between 2024 to 2032, multiplying its value from USD 124.6 Billion to USD 590.2 Billion.

-

Today, one of the major classifications is the QR code segment, and based on our data, it occupies 47% of the market and has a revenue of 78.48 Billion.

-

Of all the e-wallet types, semi-closed remains the outright market leader.

-

Near-field communication (NFC) is far ahead in the payment mode segment.

-

Mobile Commerce takes the largest share in the application segment.

-

Currently, Asia Pacific sits at the top of the global market as the highest shareholder.

Now that we’ve covered the essential market stats, we should shift our focus to knowing the eWallet app development trends that will help you turn your eWallet idea into a cutting-edge solution.

eWallet App Development Trends in 2025 & Beyond

The eWallet app is constantly evolving as we have already seen from the above market stats.

As more users turn to top eWallet apps for their day-to-day transactions, it is important for businesses and investors must stay on top of digital wallet development trends.

So what are these trends that are set to shape the future of eWallet apps:

1. Biometric Authentication Takes Over Security

When it comes to eWallet apps, security is one of the huge concerns.

That is obvious because people share and save their financial information on these apps. As a result, these apps are on the target of cyber-criminals.

Just a few years back, at least 42 million records were exposed for data breaches. With the growing technologies, these threats and ways of breaches are also changing.

This is why security measures are such a huge digital wallet app development trend people look forward to.

Some of the top measures people look forward to are Biometric authentication, facial recognition, and fingerprint scanning.

These trends enhance the overall user experience and provide users peace of mind to ensure that your app is safe from fraud and shows you care for their experience.

-

Face ID and Fingerprints offer faster and more secure login methods.

-

Enhance user trust by ensuring data protection.

-

Growing adoption across payment & banking apps.

2. Blockchain Technology for Enhanced Transparency

Let’s be honest here, Blockchain is a game changer for financial transactions.

This is why, it is gaining momentum as one of the top eWallet app development trends that are slowly becoming a part of new eWallet apps.

But, why this sudden surge?

Blockchain provides not only top security but transparency as well. By using a decentralized ledger, eWallet apps can reduce risks and increase consumer confidence.

Besides, the global blockchain technology market is going to grow by $4.67 bn in 2023 to 69.04 bn by 2030. The reason is Blockchain makes it easier to track transactions, giving users better visibility and control.

-

Blockchain-powered wallets are offering more secure transactions.

-

Transparency ensures trust in digital transactions.

-

Reduces reliance on centralized banking systems.

3. AI to personalize User Experience

AI development is growing like crazy.

Every business wants to leverage this technology to make sure that their user is getting the best from their solutions.

As a result, it is also a growing trend in eWallet app development.

And, it is transforming the eWallet app space by offering a highly personalized experience.

These AI tools are integrated into the apps in such a way that they can offer better and personalized recommendations, notifications, and promotions that keep users engaged and coming back for more.

-

Personalize offers based on spending habits.

-

AI algorithms predict user needs and preferences.

-

Enhances user satisfaction through customized services.

4. Cryptocurrency Integration is the Future

We all know, that Bitcoin has kind of drawn everyone’s attention to crypto.

As digital currencies like Bitcoin grow in popularity, integrating cryptocurrencies has become a huge mobile wallet development trend.

As a result, Nearly 20% of eWallets are predicted to have integrated cryptocurrency payments in their wallets by 2025.

This way, you can offer users the ability to store, trade, and transfer cryptocurrencies like Bitcoin, Ethereum, and others within their wallets is gaining momentum in eWallet solutions.

-

Enable users to hold fiat and cryptocurrencies.

-

Seamless trading and transfer of digital currencies.

-

Provides access to the growing crypto economy.

5. Contactless Payment is on the Rise

Contactless Payments are becoming a new norm.

A significant challenge in eWallet apps is to ensure security in contactless transactions and maintain interoperability across different devices.

So, it needs some work but still, it is expected to see 40% of annual growth in contactless payment over the next few years, driven by increased consumer acceptance.

Meaning, we are going to see some expansion in the adoption of contactless payments.

And, to make sure you stay ahead with this eWallet app development trend, we suggest giving it a thought to improve user experience.

-

Tap to Pay functionality is becoming standard in eWallets.

-

Increasing adoption across public transport, retail, and restaurants.

-

Reduces contact and enhances the speed of transactions.

6. Multi-currency Wallet

Yes, so where were we? On eWallet app development trends, right?

So, in the list, the next trend to look for is a multi-currency wallet.

As international trade and travel continue to rise, eWallet apps are continuously improving to handle cross-border payments more efficiently. This is where the Mutli-currency wallet can be of help.

Your eWallet app has to be a multi-functional tool for users allowing them to handle different currencies with ease.

Provide users with the ability to store, exchange, and manage multiple currencies in a single digital space.

-

Effortless management of both local and international currencies.

-

Real-time conversation rates, enabling cross-border transactions with ease.

-

Simplifies travel and online shopping by handling different currencies in one wallet.

7. Loyalty & Reward Programs are Gaining Traction

Loyalty programs are no longer just for physical cards.

Now, they are seamlessly integrated into digital wallets. So, how this works is, that you can reward users with points, cashback, or discounts, and they can redeem these rewards directly within the app for future services.

eWallet app trends are showing that businesses are leveraging such loyalty systems to boost engagement and retention.

-

Easily redeem loyalty points directly through eWallet apps.

-

Encourages users to engage with the app more frequently.

-

Drives customer retention through personalized rewards.

8. Voice Payments- A New Way to Pay

Imagine paying for coffee or groceries just by speaking, wouldn’t that be great? That is what your user wants.

Voice Payment is about to reach 16.1 Billion by 2032. As a result, it is one of the exciting trends in eWallet app development.

Integration with voice assistants like Alexa, Siri, and Google Assistant will make payments simpler and more accessible for users.

-

Users can make payments hands-free using voice commands.

-

Integration with smart speakers and other voice-enabled devices.

-

Voice payment technology makes transactions faster and safer.

9. Peer to Peer payments Make Sending Money Easy

The growing demand of Peer to Peer payment market is what makes this trend.

Slowly, it is becoming one of the most in-demand features in eWallet today.

Users simply want the ability to send money instantly to friends, or businesses, and such trends in eWallet app developments make the process smoother than ever.

A recent study shows that 84% of consumers have used P2P services, with 44% of users engaging with them at least once a week.

With the cost to make an eWallet app becoming more efficient, integrating P2P payments is an increasingly affordable and important feature for developers.

-

Instant money transfers between users with minimal fees.

-

Increasing integration with social media platforms.

-

Makes group payments & splitting bills much easier.

10. Payment through QR Scanner

Last but not least. QR code scanner payments are taking over the eWallet space.

With just a quick scan and a simple code, users can make payments instantly eliminating the need for physical cards or cash.

This trend in eWallet apps is gaining momentum, especially in retail, restaurant, and public transport.

You should invest in it to provide businesses with speed and security. It has become a go-to feature for digital wallets.

-

Instant payments with just a quick QR code scan.

-

Simplifies the payment process and reduces friction for users.

-

Widely adopted across businesses, enhancing cross-industry interoperability.

As we laid the foundation of mobile wallet app development trends that are shaping the digital payment landscape, time to talk about some top eWallet apps that are breaking the barriers and riding the wave with these trends.

Top eWallet Apps Harnessing the Latest Trends

eWallet apps are now the center to make payments.

With amazing eWallet app features, users get amazing benefits from contactless payments to international transfers, all from the palm of their hand.

Let’s take a look at some of the top eWallets and how they are embracing these innovations, this might inspire you to harness the trends.

► PayPal

PayPal is the OG in digital payments and continues to leverage the latest eWallet trends to stay ahead.

-

Cryptocurrency Integration: Lately, PayPal has embraced the world of cryptocurrencies by launching the purchase, selling, and holding of BTC.

-

Buy Now, Pay Later: Using this feature, consumers can pay for purchases in installments, provided that the overall amount is reasonable.

-

Global Transactions: Online PayPal is perfect for cross-border payment since it's global and has a one-click payment platform.

► Venmo

Heard of Venmo? The app is famous for Peer-to-Peer payments but continues to innovate by integrating new trends in the eWallet app.

-

Peer-to-Peer Payments: This app is designed to make P2P transfers of money instantly to cover expenses, which are divided between friends.

-

Contactless Payments: It is now possible to pay with Venmo at millions of merchants by using QR codes for the contactless payment system.

-

Social Integration: Payments made through Venmo appear on a social feed, which gives more visibility to transactions and makes them more social.

► Skrill

Skrill has positioned itself as a leader in the global digital wallet app space with some innovative features.

-

Multi-Currency Support: Skrill allows users to hold different currencies, which makes payment in international borders to be so easy.

-

Global E-Commerce Payments: The app accepts numerous online merchants, increasing the utility of the app for cross-border transactions.

-

Fast & Secure Transfers: Skrill makes transactions fast and secure all the time.

► Google Pay

Google Pay is more than just a payment app; it’s a tool that integrates seamlessly with the Google ecosystem.

-

AI-Driven Finance Tools: Google Pay is personalized, and devices use AI to enable the tracking of a person’s expenditure.

-

Digital Receipts: The receipts are now saved for further use and are incorporated in the trend of simplifying financial management-related tasks.

-

Contactless Payments: Customers can also use their mobile phones to purchase products from the physical store by use of NFC technology.

► Alipay

Alipay occupies a very large portion of the mobile payment market in China, and it is rapidly integrating the innovative tendencies of the eWallet world markets.

-

QR Code Payments: Alipay allows secure and convenient payments by scanning QR codes making it suitable for all forms of payments small and big.

-

AI-Powered Customer Service: Artificial intelligence enables customers to get instant help with their concerns at Alipay.

-

Smart Budgeting: The app has features to enable users to monitor expenses and create saving and spending plans.

► Samsung Pay

Samsung Pay is a well-known name among top eWallet apps. The one that provides versatile, safe & rewarding payment options.

-

MST Technology: This means you can use Samsung Pay on machines that lack NFC compatibility, opening it to a broader field compared to other eWallets.

-

Loyalty Programs: This cuts out the need for consumers to physically carry around their loyalty cards, as it is incorporated within Samsung Pay itself.

-

Security: Samsung Pay takes some measures of security measures such as tokenization and others to protect users’ funds during transactions.

By diving into these top eWallet apps, we hope to spark new ideas and inspire you to embrace the exciting trends of eWallet app development in 2025.

With these insights, you’ll be ready to take your app to new heights and set the bar higher than ever before.

JPLoft: Your Partner in eWallet Innovation

Looking for a hand to create an eWallet app? Well, look no further than JPLoft.

JPLoft is a well-known name as a top eWallet app development company.

With 10+ years of experience, and 1100+ projects delivered, we have the tools & expertise to turn your idea into a successful solution.

We have deep expertise in developing secure, scalable, and user-friendly eWallet apps, integrating advanced technologies like AI, Blockchain, & Cryptocurrencies to enhance user experience and improve ROI.

Have an idea in mind? Connect us to make it a reality.

Conclusion

Looking into the future of 2025, development trends of the eWallet app such as biometrics, blockchain, artificial intelligence, and the integration of cryptocurrencies into the platform are now affecting the market of digital payments.

So by adopting these trends, your eWallet apps become relevant for future use. Be informed, and be prepared since cross-border payments, user engagement, and more have never been in demand.

Professionalism is a core concept at JPLoft for developing secure, scalable, and innovative apps for eWallet. Are you ready to launch a new concept in digital wallet? Transform your vision with us.

FAQs

Some of the important features of the eWallet application are biometric identification, support of multiple currencies, contactless payment, adaptation based on artificial intelligence, and interconnection with cryptocurrencies. These features make a system more secure and easier to use and provide an advantage over the competition in the marketplace.

The additional security features include fingerprint or facial identification, blockchain technology for openness, and end-to-end encryption. Other concern that is crucial for user security includes security auditing and following financial regulations.

Blockchain makes use of the decentralized ledger in doing transactions and this will reduce the level of insecurity. It offers enhanced confidence to the users as well as lower cases of fraud by enhanced tracking of financial activities.

By integrating use patterns, AI can recommend relevant content, provide recommendations regarding intelligent spending, and include various predictive functionalities tailored to the users. They assist in the creation of an improved functional and human experience in the applications.

With the increase in the usage of digital currencies such as Bitcoin and Ethereum, the integration of cryptocurrency payment systems into eWallet apps makes it efficient for users to store, trade, and transfer cryptocurrencies. As well as, with other conventional currencies improves the increase of app usability and customer base.

Share this blog