Imagine a world where payments happen with a single tap. Wallets are entirely digital, and transactions are completed in seconds.

That’s the promise of eWallets. And that’s the world we are living in.

A technology that’s quickly becoming the backbone of the modern financial ecosystem.

Today, eWallet apps are transforming not only how we pay but also how we manage and interact with our finances on a daily basis.

For businesses, building an eWallet isn’t just a response to shifting trends; it’s a strategic move to offer customers unmatched convenience and security.

As digital wallets gain traction globally, companies choosing to create one now are positioning themselves as leaders in the financial landscape.

Whether it’s paying bills, transferring funds, or shopping online, eWallets deliver everything with efficiency and ease that traditional methods can’t match.

In this eWallet app development guide, we will learn everything related to it.

From research to testing and deployment, you’ll know how to create an eWallet app by the end of the blog.

eWallet Market Statistics

The eWallet industry has experienced remarkable growth in recent years. Here are some key digital wallet market statistics from 2024:

-

-

The eWallet market is projected to reach $140.6 billion by 2028, growing at a CAGR of 21.49% from 2023 to 2028.

-

The number of digital wallet users worldwide is expected to exceed 5.2 billion by 2026, up from 4 billion in 2022, indicating a 53% growth.

-

Global digital wallet transactions are projected to grow from $9 trillion in 2023 to over $16 trillion by 2028.

-

In India, the eWallet market is anticipated to reach $1.3 trillion by 2024, reflecting the country’s rapid adoption of digital payment solutions.

-

Over 65% of U.S. citizens have used digital wallets at least once in the past month, highlighting the growing preference for digital payment methods.

-

Retail and eCommerce sectors are the largest beneficiaries of the eWallet market, holding a 30% global market share.

-

In 2022, 32% of global point-of-sale transactions were made via digital wallets, making it the most popular method.

-

These figures underscore the significant role eWallets play in the evolving digital payment landscape, offering both consumers and businesses a convenient and secure transaction method.

Understanding eWallets

Let’s answer this big question first, what’s an eWallet app?

An eWallet, also known as a digital wallet or mobile wallet, is a secure, software-based solution that allows you to store and manage your payment information digitally.

Think of it as a virtual version of your traditional wallet, only more versatile.

With an eWallet, users can save their credit card details, debit card info, bank account data, and even loyalty points, all in one place.

These digital wallets operate by storing sensitive financial information in a way that makes transactions quick and secure.

Most eWallets use encryption and tokenization to protect user data, transforming your payment details into a unique code for each transaction.

This process ensures that personal information is not compromised, making eWallets a safe choice for everyday transactions.

From splitting bills with friends to shopping online or in-store, eWallets streamline the entire payment experience.

Many people now prefer the simplicity and speed that comes with mobile payments, making eWallets a must-have for businesses looking to meet modern consumer expectations.

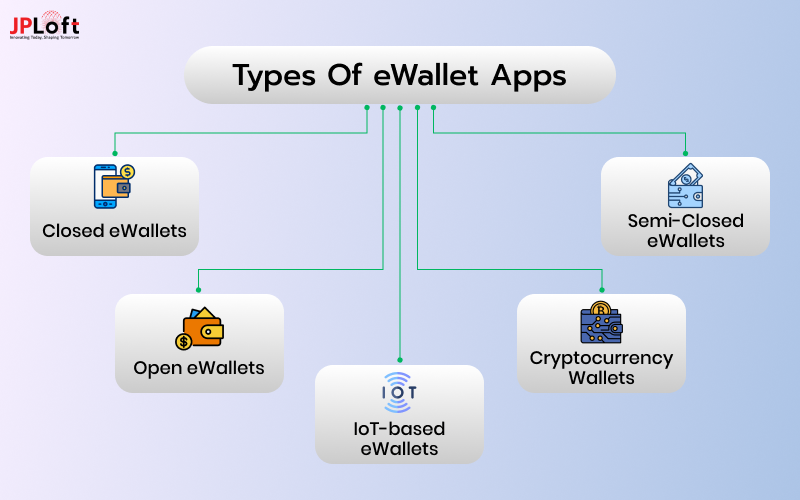

Types of eWallet Apps

Digital wallets come in several forms, each catering to different needs and use cases.

Here’s a breakdown of the main types of eWallet apps, with popular examples to illustrate each one:

1. Closed eWallets

These wallets are tied to a specific merchant or service provider, allowing users to make purchases only within that ecosystem.

Closed eWallets often include loyalty and rewards programs for customer retention.

-

- Examples: Starbucks Wallet, Walmart Pay

2. Semi-Closed eWallets

Semi-closed wallets offer more flexibility.

Thus, allowing users to make transactions with multiple partnered merchants, but they still have limitations regarding withdrawals and transfers.

This type of wallet is popular among online retailers and eCommerce platforms.

-

- Examples: Paytm, Venmo

3. Open eWallets

Open wallets are the most versatile, offering users the ability to make payments, transfer funds, and even withdraw money from bank accounts or ATMs.

These wallets are usually linked to a user’s bank account, providing a full range of financial services.

-

- Examples: PayPal, Apple Pay, Google Pay

4. Cryptocurrency Wallets

Cryptocurrency wallets are specialized digital wallets used for buying, storing, and transferring digital assets like Bitcoin, Ethereum, and other cryptocurrencies.

They focus heavily on security and encryption to safeguard user assets.

-

- Examples: Trust Wallet, Coinbase Wallet

5. IoT-based eWallets

With the rise of the Internet of Things (IoT), certain eWallets are now integrated into smart devices.

Therefore, they are enabling contactless payments through wearables, vehicles, or other connected devices.

-

- Examples: Samsung Pay (integrated with Samsung smartwatches), Garmin Pay

Each of these wallet types offers unique features tailored to specific user needs.

Understanding the distinctions among them is essential for businesses aiming to develop an eWallet app that aligns with their market goals and customer expectations.

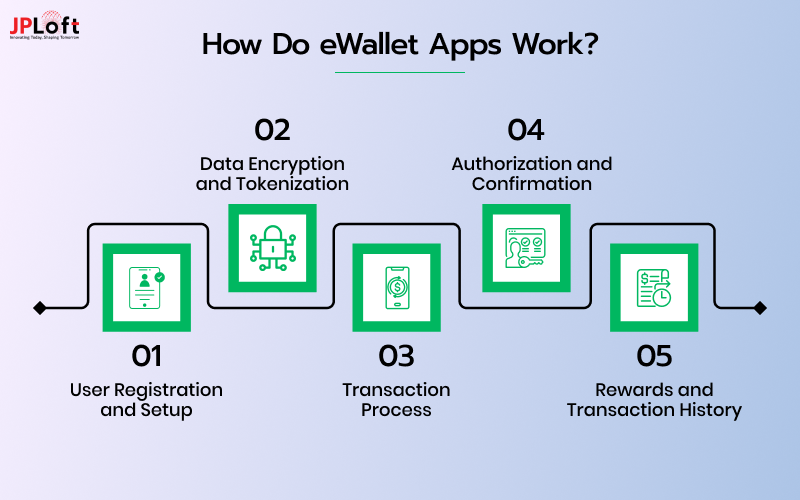

How Do eWallet Apps Work?

At their core, eWallet apps operate as digital intermediaries, securely storing your payment information and facilitating transactions with just a few taps.

But what exactly happens behind the scenes when you make a purchase with an eWallet?

Let’s break down the process in simple terms:

1. User Registration and Setup

Users first download the eWallet app and create an account, entering their details and linking a preferred payment method (credit card, debit card, bank account, or cryptocurrency wallet).

Most apps also require verification steps, such as SMS or email authentication, for security purposes.

2. Data Encryption and Tokenization

Once user data is added, eWallets use encryption and tokenization to secure it.

Encryption scrambles the sensitive data, while tokenization replaces it with a unique token for each transaction.

This means your actual card or bank details are never exposed during the payment process.

3. Transaction Process

When a user initiates a transaction, the eWallet app generates a one-time unique token tied to that specific purchase.

The app then communicates with the merchant’s payment processor, using this token to validate and authorize the transaction without revealing the user’s actual payment information.

4. Authorization and Confirmation

After the payment processor verifies the transaction with the bank or card issuer, the funds are transferred, and the user receives a confirmation.

This process typically takes just a few seconds, thanks to secure, automated protocols that eWallets follow.

5. Rewards and Transaction History

Many eWallets track transaction history and offer reward points or cashback options, providing users with a complete overview of their spending patterns and incentives for ongoing use.

By understanding these steps, it’s clear how eWallet apps offer a seamless, secure, and user-friendly payment experience.

This behind-the-scenes process is what makes digital wallets so popular, as they remove the hassle of carrying cash or physical cards.

Best eWallet Apps in the Market

Here’s a closer look at top eWallet apps, each with its unique set of features that attract different user bases.

Below each app’s main feature list, you’ll find a quick takeaway to understand why it stands out.

1. PayPal

-

- Allows online payments, transfers, and bank withdrawals.

- Provides buyer and seller protection for added security.

- Accepted globally across various merchants.

- Supports multi-currency transactions.

Takeaway: PayPal’s vast global reach and robust security features make it a go-to platform for international transactions.

2. Apple Pay

-

- Exclusively available on Apple devices (iPhone, iPad, Apple Watch).

- Contactless payment for both online and in-store purchases.

- Secure transactions through Face ID, Touch ID, and device passcodes.

- Loyalty cards and boarding passes can be stored within the app.

Takeaway: Apple Pay is a top choice for Apple users, thanks to its security and seamless integration with Apple’s ecosystem.

3. Google Pay

-

- Available on Android devices and integrates with other Google services.

- Supports in-store, online, and peer-to-peer payments.

- Tracks loyalty programs and offers.

- Connects with multiple bank accounts and cards.

Takeaway: Google Pay is ideal for Android users seeking a multi-functional eWallet that covers a broad range of payment options.

4. Samsung Pay

-

- Supports both NFC and MST technology, allowing it to work with almost any payment terminal.

- Compatible with Samsung devices, including wearables.

- Offers Samsung Rewards points on purchases.

- Built-in security with Samsung Knox and biometric authentication.

Takeaway: Samsung Pay’s compatibility with older terminals gives it an edge for in-store transactions, especially in regions with mixed POS technologies.

5. Venmo

-

- Peer-to-peer payment platform with social sharing features.

- Split bills and request money from friends and family.

- Supports quick payments to and from linked bank accounts.

- Accepted at select merchants in the U.S.

Takeaway: Venmo is highly popular for casual payments among friends, especially for its social component and easy fund transfers.

6. Cash App

-

- Peer-to-peer payments with no need for a traditional bank.

- Users can invest in stocks and purchase Bitcoin within the app.

- Offers a customizable physical debit card linked to the account.

- Fast, simple interface with minimal setup.

Takeaway: Cash App stands out for its simplicity and additional investment features, making it more than just a payments app.

7. Zelle

-

- Integrated with many U.S. bank apps for instant transfers.

- No separate account setup if you use a participating bank.

- Real-time money transfers between domestic bank accounts.

- No transaction fees, making it highly cost-effective.

Takeaway: Zelle’s banking partnerships provide instant, fee-free transfers, making it ideal for direct bank-to-bank payments in the U.S.

8. Alipay

-

- Offers mobile payments, loans, and financial services.

- Widely used in China with QR code payment options.

- Features “mini-programs” within the app for added services.

- Advanced security with facial recognition and dynamic passwords.

Takeaway: Alipay dominates in China, combining payments with a variety of financial services, and creating a comprehensive mobile financial platform.

9. WeChat Pay

-

- Integrated within the WeChat messaging app for easy access.

- Supports in-store, online, and peer-to-peer payments.

- Users can pay bills, order services, and transfer money seamlessly.

- Advanced security with options for payment verification.

Takeaway: WeChat Pay integrates seamlessly into daily life in China, blending social and financial functions into a single app.

10. Trust Wallet

-

- Securely stores a variety of cryptocurrencies.

- Enables users to buy, sell, and exchange digital assets.

- Provides private keys stored locally for added security.

- Easy-to-use interface for both beginners and experienced users.

Takeaway: Trust Wallet is ideal for cryptocurrency users, focusing on security and asset management within a user-friendly environment.

11. Coinbase Wallet

-

- Offers a secure, self-custody wallet for crypto assets.

- Allows buying, selling, and transferring cryptocurrencies.

- Multi-asset support for various coins and tokens.

- Emphasizes security with two-factor authentication and biometric access.

Takeaway: Coinbase Wallet’s focus on security and multi-crypto support makes it an attractive option for digital asset holders.

These apps exemplify a range of innovative features tailored to different user needs, from social payment options to cryptocurrency management.

Understanding these unique aspects can guide you in selecting the best features to incorporate into your own eWallet app.

20 Core eWallet App Features You Can’t Miss

Creating a successful eWallet app requires a robust set of features that enhance functionality, security, and user experience.

Below are essential eWallet app features, each briefly described to highlight its role in delivering a top-notch eWallet experience:

-

-

User Registration and Profile: Enables users to sign up, log in, and manage their profile details easily, ensuring a smooth onboarding experience.

-

Multi-Factor Authentication (MFA): Provides an extra layer of security through SMS or email verification to protect user accounts.

-

Account Linking: Allows users to link bank accounts, credit cards, and debit cards for seamless transactions.

-

Balance Inquiry: Users can check their wallet balance instantly, keeping them informed of their spending capacity.

-

QR Code Payments: A quick payment feature where users scan a QR code to complete transactions instantly.

-

Peer-to-Peer Transfers: Facilitates easy money transfers between users, a critical feature for social payments.

-

Transaction History: Displays past transactions, enabling users to track and manage their spending.

-

Push Notifications: Sends alerts for successful transactions, promotions, or security updates, keeping users informed.

-

Digital Receipts: Provides transaction receipts in digital format, promoting a paperless experience.

-

Multi-Currency Support: Allows international transactions by supporting multiple currencies within the app.

-

Spending Limits and Controls: Users can set spending limits, helping them control their expenses effectively.

-

Bill Payments: Enables users to pay utility bills, mobile recharge, and more directly through the wallet.

-

Rewards and Cashback: Offers loyalty rewards, points, or cashback incentives to increase user engagement.

-

Budgeting and Analytics: Includes features to track expenses and provide insights into spending habits.

-

In-App Chat Support: Allows users to resolve queries quickly via a built-in support chat, enhancing customer support.

-

Geolocation Services: Helps users find nearby merchants or ATMs that accept eWallet payments.

-

Automatic Payment Reminders: Notifies users of upcoming bills or subscription payments to avoid missed payments.

-

Biometric Authentication: Adds a high level of security through fingerprint or face recognition.

-

Loyalty Program Integration: Supports integration with loyalty programs, allowing users to collect and redeem points.

-

Customizable Themes: Allows users to personalize the app’s look, making it more engaging and user-friendly.

-

These core features cater to various needs, from security and personalization to ease of transactions and budgeting.

Including these functions helps create a well-rounded app that users will find valuable in managing their finances.

Should You Develop a Digital Wallet in 2025?

Considering the rapid evolution of financial technology, developing a digital wallet in 2025 presents a strategic opportunity.

Here are three compelling reasons to embark on this venture:

1. Surging Market Demand and Growth

The global eWallet market is experiencing unprecedented growth.

Projections indicate that the market size will reach $140.6 billion by 2028, with a compound annual growth rate (CAGR) of 21.49% between 2023 and 2028. (Technavio)

In addition, the number of digital wallet users worldwide is expected to grow by 53%, reaching 5.2 billion by 2026.

This surge is driven by consumers’ increasing preference for digital payments over traditional methods, highlighting a significant shift towards cashless transactions.

2. Enhanced Customer Engagement and Loyalty

eWallets offer businesses the ability to integrate personalized experiences, such as rewards programs, cashback offers, and loyalty points.

These features not only attract new users but also foster customer retention.

Studies have shown that companies integrating eWallets report a 30% increase in sales, underscoring the effectiveness of digital wallets in boosting customer engagement and loyalty.

3. Diverse Revenue Streams

Developing an eWallet opens up multiple monetization avenues, including transaction fees, subscription models, and partnerships with other financial services.

The global digital payments market is expected to exceed $10 trillion by 2026, providing ample opportunities for revenue generation.

By tapping into this expanding market, businesses can create sustainable income streams through their digital wallet offerings.

In summary, the escalating demand for digital payment solutions, coupled with opportunities for enhanced customer engagement and diversified revenue, makes 2025 an opportune time to develop a digital wallet.

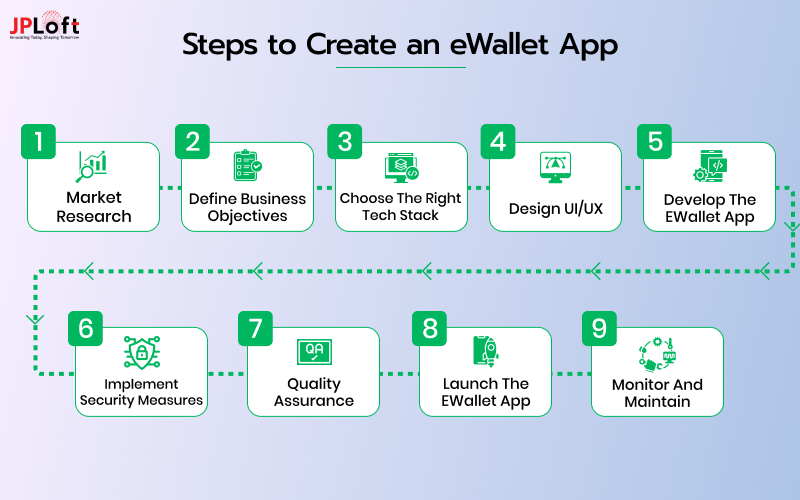

Steps to Create an eWallet App

Embarking on the journey to develop a custom eWallet app involves a structured approach to ensure a secure, user-friendly, and efficient digital wallet platform.

Here’s a comprehensive guide to the eWallet app development process:

Step 1: Conduct Market Research and Analysis

Begin by analyzing the current digital wallet landscape.

Identify your target audience, study competitors, and understand market trends.

This research will inform the features and functionalities to include when you create an eWallet app that stands out.

Step 2: Define Business Objectives and Requirements

Clearly outline your business goals and how the eWallet app will achieve them.

Determine the core functionalities, such as peer-to-peer transfers, bill payments, and integration with banking systems.

Establishing these requirements early on will guide the development process and keep the project aligned with your vision.

Step 3: Choose the Right Technology Stack

Selecting the appropriate technology stack is vital for the app’s performance, scalability, and security.

Decide between native (iOS app development, Android app development) or cross-platform development frameworks like React Native or Flutter.

|

Component |

Technology Options |

Purpose |

|

Frontend Development |

React Native, Flutter, Swift (iOS), Kotlin (Android) |

Builds the user interface and experience |

|

Backend Development |

Node.js, Django, Ruby on Rails, Java Spring Boot |

Manages server-side operations and logic |

|

Database |

PostgreSQL, MongoDB, MySQL |

Stores user data and transaction history |

|

Payment Gateway |

Stripe, PayPal, Braintree, Razorpay |

Processes payments and facilitates transactions |

|

Security |

OAuth 2.0, JWT (JSON Web Token), SSL/TLS encryption |

Ensures data security and encryption |

|

Authentication |

Firebase Authentication, Auth0, Okta |

Manages user login and authentication |

|

APIs for Banking Integration |

Plaid, Yodlee, TrueLayer |

Connects with banking systems and accounts |

|

Push Notifications |

Firebase Cloud Messaging (FCM), OneSignal |

Sends notifications to users |

|

Cloud Storage |

AWS S3, Google Cloud Storage, Azure Blob Storage |

Stores media and other app-related files |

|

Analytics |

Google Analytics, Firebase Analytics, Mixpanel |

Tracks user behavior and app usage stats |

|

Compliance Management |

Secureframe, Drata, Vanta |

Assists with compliance requirements like PCI DSS, GDPR |

|

Cryptocurrency Support |

Coinbase API, Blockchain.info, BitGo |

Enables cryptocurrency transactions (if needed) |

|

Geolocation Services |

Google Maps API, Mapbox |

Enables location-based services |

Consider backend technologies, databases, and third-party integrations that will support your app’s features and future growth.

Step 4: Design User Interface (UI) and User Experience (UX)

A seamless and intuitive UI/UX design is essential for user satisfaction.

Create wireframes and prototypes to visualize the app’s flow and layout. Focus on simplicity, ease of navigation, and accessibility to ensure users can perform transactions effortlessly.

Incorporate branding elements to maintain consistency with your company’s identity.

Step 5: Develop the eWallet App

With designs in place, proceed to the development phase. This involves:

-

- Frontend Development: Building the client-side interface where users interact with the app.

- Backend Development: Setting up servers, databases, and application logic to handle transactions, user authentication, and data management.

- Integration: Connecting with payment gateways, banking APIs, and other third-party services to enable functionalities like fund transfers and bill payments.

Step 6: Implement Security Measures

Security is paramount in eWallet app development. Implement robust measures such as:

-

- Data Encryption: Protect sensitive information during storage and transmission.

- Two-Factor Authentication (2FA): Add an extra layer of security for user logins and transactions.

- Compliance with Standards: Ensure adherence to regulations like PCI DSS for handling payment information.

Step 7: Testing and Quality Assurance

Conduct comprehensive testing to identify and resolve any issues. This includes:

-

- Functional Testing: Verify that all features work as intended.

- Security Testing: Assess the app’s resilience against potential threats.

- Usability Testing: Gather feedback from real users to improve the interface and experience.

Step 8: Launch the eWallet App

After successful testing, prepare for deployment. This involves:

-

- App Store Submission: Follow guidelines for platforms like the Apple App Store and Google Play Store.

- Marketing and Promotion: Develop a strategy to attract users, including social media campaigns, partnerships, and incentives.

Step 9: Monitor and Maintain

Post-launch, continuously monitor the app’s performance and user feedback.

Regular updates, bug fixes, and feature enhancements are crucial to keep the app relevant and secure.

Establish a support system to address user queries and issues promptly.

By meticulously following these steps, you can build a custom eWallet app that not only meets market demands but also provides a secure and engaging user experience.

Cost to Build an eWallet App

Developing an eWallet app involves various factors that influence the overall cost.

On average, creating a basic eWallet app can range from $20,000 to $50,000, while a more complex app with advanced features may cost between $50,000 and $150,000.

Here are the main factors that influence the cost of building a custom eWallet app:

-

- App Complexity

- Platform Choice

- UI/UX Design

- Third-Party Integrations

- Security Measures

- Compliance Requirements

- Feature Set

- Maintenance and Updates

By understanding these cost factors, businesses can better eWallet app development budget and make informed decisions based on their specific needs and goals.

eWallet App Development Challenges and Their Solutions

Developing an eWallet app comes with its own set of unique challenges.

Understanding these industry-specific obstacles and preparing solutions will help create a secure, efficient, and user-friendly app.

Here’s a breakdown of the main challenges and how to address them:

1. Security Risks

Challenge: Since eWallets handle sensitive financial data, they are prime targets for cyber threats, including data breaches and fraud.

Solution: Implement multi-layered security protocols such as two-factor authentication (2FA), biometric authentication, data encryption, and tokenization. Regular security audits are also essential to identify vulnerabilities before they become threats.

2. Regulatory Compliance

Challenge: Financial apps must comply with stringent regulations like PCI DSS for payment processing, GDPR for data protection, and AML (Anti-Money Laundering) laws.

Solution: Work with a compliance team to ensure the app adheres to relevant laws and standards. Use compliance management tools to monitor and update requirements as regulations evolve.

3. User Trust and Retention

Challenge: Gaining user trust is critical, especially for an app that involves personal and financial information. If users don’t feel secure, they won’t adopt the app.

Solution: Communicate security measures clearly to users, offering assurances on data privacy and security. Adding features like instant customer support can further enhance trust.

4. Integration with Financial Institutions

Challenge: Integrating with banks and financial services is complex, involving various APIs, different data formats, and security standards.

Solution: Partner with reliable third-party providers like Plaid or Yodlee that specialize in secure banking integrations. These services simplify connectivity with multiple banks, saving development time and ensuring compatibility.

5. Scalability Concerns

Challenge: As the app’s user base grows, the infrastructure may face performance issues, affecting transaction speed and user experience.

Solution: Use scalable cloud solutions like AWS or Google Cloud, and design the app’s architecture to handle increased load. Implementing load balancing and caching mechanisms will ensure smooth performance even as the app scales.

6. Cross-Platform Compatibility

Challenge: Developing a consistent user experience across multiple platforms (iOS, Android, and web) can be technically challenging.

Solution: Opt for cross-platform development frameworks like React Native or Flutter, which allow you to create a uniform experience across different platforms without duplicating code.

7. User Education and Adoption

Challenge: Many users may be unfamiliar with digital wallets or hesitant to adopt new financial technology.

Solution: Offer a guided onboarding process with in-app tutorials that explain features step-by-step. Providing user-friendly documentation and a strong customer support system will also help users feel more confident in using the app.

8. Latency and Transaction Speed

Challenge: Slow transaction processing can lead to user frustration and lower app ratings.

Solution: Optimize backend processing to reduce latency and ensure fast, reliable transaction speeds. Consider partnerships with high-performance payment gateways to minimize delays.

By proactively addressing these challenges, you can learn how to create an eWallet app that not only functions smoothly but also instills confidence in users, ensuring a positive experience and building brand loyalty.

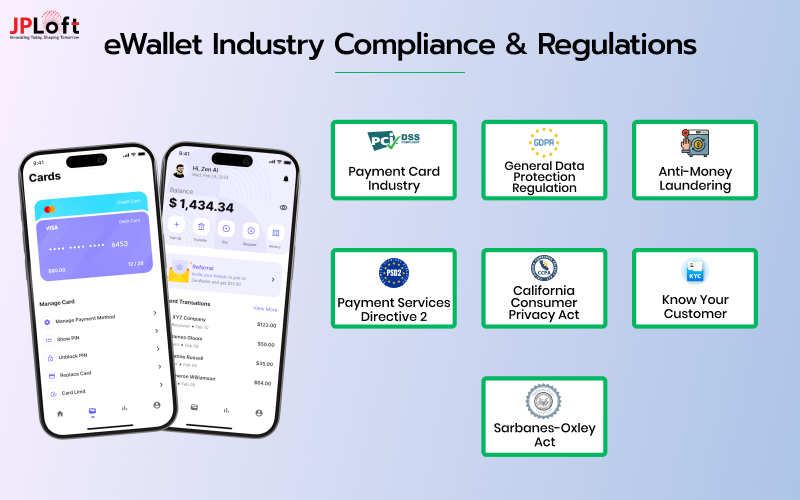

eWallet Industry Compliance & Regulations to Look Out For

Adhering to industry-specific regulations is essential for creating an mobile wallet, ensuring that sensitive financial data is protected and that the app complies with international standards.

Below are key regulations relevant to eWallets and strategies to maintain compliance.

1] PCI DSS (Payment Card Industry Data Security Standard)

PCI DSS is a critical standard for any app that processes, stores, or transmits credit card data, enforcing strict guidelines to ensure cardholder data security.

This includes requirements for data encryption, secure network architecture, and limited data access.

To maintain PCI compliance, integrate end-to-end encryption and tokenization into your app, protecting cardholder data during transactions.

Regular security audits and vulnerability assessments are also crucial to meet these standards, reducing the risk of breaches and safeguarding user data.

2] GDPR (General Data Protection Regulation)

The GDPR, applicable to users within the European Union, mandates transparency in data collection, processing, and storage.

It aims to protect user privacy by giving users control over their personal data, including the right to access, modify, or delete it.

To ensure GDPR compliance, design your eWallet app with privacy in mind from the start. Obtain explicit consent from users for any data collection, and clearly communicate how their data will be used.

In addition to this, consider appointing a Data Protection Officer (DPO) if your app serves users in the EU, ensuring continuous oversight of data practices and compliance.

3] AML (Anti-Money Laundering) Regulations

AML regulations are designed to prevent money laundering and illicit financial activities within digital financial systems, making them especially relevant for eWallets that handle transactions and fund transfers.

Compliance with AML regulations typically involves thorough user verification processes, transaction monitoring, and reporting of suspicious activities.

Implementing KYC (Know Your Customer) checks and real-time monitoring systems helps detect and prevent fraudulent activity, ensuring a secure and compliant platform.

4] PSD2 (Payment Services Directive 2)

PSD2 is a European regulation that aims to improve security in electronic payments by enforcing Strong Customer Authentication (SCA).

It mandates multi-factor authentication for online transactions, thereby reducing the risk of unauthorized access.

To align with PSD2, integrate multi-factor authentication in your eWallet app, requiring users to verify their identity through additional steps, such as one-time passwords or biometrics.

Partnering with PSD2-compliant APIs ensures secure, authorized data-sharing with third-party services and reinforces transaction security.

5] CCPA (California Consumer Privacy Act)

Similar to GDPR, the CCPA grants data privacy rights to residents of California, allowing them to know what data is being collected, access it, and request its deletion.

Compliance with CCPA involves clear communication about data collection practices and providing easy ways for users to control their data.

Ensuring CCPA compliance not only prevents legal issues but also builds user trust, as users are more likely to engage with apps that respect their privacy rights.

6] KYC (Know Your Customer) Requirements

KYC requirements help verify user identities, mitigating risks of identity theft, fraud, and other illicit activities.

Many countries mandate KYC compliance for financial services, including eWallet apps.

Implementing a KYC process as part of the app’s onboarding ensures that only verified users can access the platform.

Using third-party solutions like Onfido or Jumio simplifies the KYC process, offering automated identity checks and reducing the burden on users and your team.

7] SOX (Sarbanes-Oxley Act)

The Sarbanes-Oxley Act, while primarily applicable to publicly traded companies, impacts any financial service platform operating in the U.S.

SOX emphasizes financial transparency, record-keeping, and stringent access controls to protect financial data integrity.

For eWallet apps, SOX compliance involves maintaining detailed records of all transactions, implementing robust access controls, and conducting regular audits to ensure data accuracy and accountability.

Following SOX guidelines enhances transparency, offering users and stakeholders assurance of secure, compliant financial operations.

By proactively integrating these compliance measures, you can ensure your eWallet app adheres to industry standards, fostering user trust and maintaining a secure digital environment that meets regulatory requirements worldwide.

How to Monetize an eWallet App in 2025

Monetizing an eWallet app opens up various revenue opportunities, making the app a profitable venture beyond its core function of facilitating digital transactions.

Here are some of the major monetization strategies for eWallet apps, each tailored to meet business objectives and enhance user engagement:

1. Transaction Fees

One of the most straightforward ways to monetize an eWallet app is by charging a small fee for each transaction.

This model works well for peer-to-peer transfers, merchant payments, or currency exchanges.

Transaction fees can be a fixed amount or a percentage of the transaction value, depending on the service.

However, to remain competitive, it’s essential to keep these fees reasonable to retain users.

2. Premium Features and Subscription Plans

Offering a basic version of the app with optional premium features is an effective monetization strategy.

Users can subscribe to a paid version to access advanced functionalities like higher transaction limits, personalized customer support, or additional security features.

Subscription plans can be tiered, providing users with options that suit their needs, and create a steady income stream through recurring payments.

3. Interchange Fees from Merchants

eWallets can generate revenue by charging merchants a small fee whenever users make a purchase through the app.

Many merchants are willing to pay interchange fees because it opens up access to a wider customer base and reduces the need for physical cash handling.

This strategy can be particularly effective in partnerships with online retailers or local businesses.

4. In-App Advertising

Carefully integrated advertising can provide additional revenue without disrupting the user experience.

Ads for relevant products, such as financial services, local deals, or digital coupons, can be displayed within the app.

This approach allows for targeted advertising, making ads more valuable and potentially less intrusive to users.

Avoid overwhelming the app with ads, as this can negatively impact user retention.

5. Affiliate Marketing and Partnerships

Partnering with financial institutions, eCommerce platforms, or even other apps enables eWallet providers to earn commissions through affiliate marketing.

For example, if a user opens a bank account through the eWallet or uses the wallet for eCommerce purchases, the app could earn a referral commission.

Collaborating with other brands can add value to the user experience while generating revenue.

6. Cashback and Loyalty Programs (Sponsored)

eWallets that offer cashback and loyalty points can monetize this feature through sponsored partnerships.

Brands and retailers can sponsor rewards programs, paying the eWallet provider for each user redemption.

This partnership model not only generates revenue but also encourages frequent app use by providing users with rewards for transactions.

7. Data Insights and Analytics (Anonymized)

Aggregated and anonymized transaction data can be valuable for market research purposes.

eWallet apps can provide insights into consumer spending trends, payment preferences, and demographic behaviors to partnered businesses, while maintaining user anonymity and data security.

This approach requires compliance with data privacy regulations but can be an effective source of revenue.

8. Crypto Transactions and Exchange Fees

For eWallets that support cryptocurrency, charging a fee for crypto purchases, transfers, or conversions can be a profitable avenue.

As interest in digital assets grows, adding a secure crypto exchange feature with minimal fees can attract a new segment of users and provide a steady income source from transaction fees.

9. Loan and Micro-Credit Services

Some eWallets offer micro-loans or credit facilities to users, either independently or in partnership with financial institutions.

Users can apply for short-term loans directly through the app, paying interest or a service fee.

This model not only offers a unique service but also taps into an emerging market of users looking for convenient credit solutions.

By leveraging these monetization strategies, eWallet apps can create diversified revenue streams, maximizing their profitability while enhancing user engagement.

Balancing revenue generation with user experience is essential for long-term success, as users are more likely to stay loyal to an app that offers valuable services without overwhelming fees or intrusive ads.

Your Partner in Custom eWallet App Development

Looking to create a powerful digital wallet app that stands out in the competitive fintech market?

At JPLoft, a leading eWallet app development company, we specialize in developing custom eWallet apps, designed to meet the unique needs of your business and provide an exceptional experience for your users.

With our expertise in developing secure, scalable, and user-friendly financial solutions, we take care of everything from market research to post-launch support.

Conclusion

Building a digital wallet app in 2025 is an opportunity to tap into a thriving market while meeting the evolving needs of modern users.

With the rapid shift towards cashless payments and digital solutions, an eWallet app can provide convenience, security, and a seamless user experience that today’s consumers expect.

From market research and compliance to advanced features and monetization, each step of the development process contributes to creating a reliable and profitable app that users will return to regularly.

By following best practices, addressing industry-specific challenges, and incorporating a range of monetization strategies, you can develop a custom eWallet app that doesn’t just function well but also stands out in a competitive market.

Ready to take the next step?

Connect with a development partner who understands the nuances of eWallet app creation and start building a solution that positions your brand for success in the fast-growing world of digital finance.

FAQs

The cost varies based on complexity, platform, features, and security requirements. Typically, a custom eWallet app ranges from $50,000 to $200,000, depending on these factors.

Key features include user registration, peer-to-peer transfers, transaction history, security protocols (like 2FA), integration with payment gateways, and loyalty rewards.

Developing a fully functional eWallet app usually takes between 4 to 12 months, depending on the app’s complexity and feature set.

Essential security measures include data encryption, two-factor authentication, PCI DSS compliance, and regular security audits to protect sensitive data.

Effective strategies include transaction fees, premium subscriptions, in-app ads, affiliate partnerships, and loyalty programs, each providing diverse revenue opportunities.

Work with a development partner experienced in compliance standards like PCI DSS, GDPR, and AML. Regular audits and implementing user data control features are also important for compliance.

Share this blog