In 2025, digital wallets are no longer just a convenience-they’re a necessity.

From simplifying everyday transactions to enabling secure international payments, eWallet apps have become an integral part of our lives.

The growing reliance on these platforms has fueled competition, resulting in innovative features, seamless experiences, and robust security measures.

In this blog, we’ll explore the top digital wallet apps leading the charge in 2025.

Each app has carved a unique space in the digital payment ecosystem, catering to diverse user needs.

Whether you're looking for an app to manage personal finances, make contactless payments, or conduct business transactions, our list will introduce you to the best eWallet platforms to watch this year.

So, are you ready to find out which eWallet app could be your go-to in 2025? Let’s dive in!

20 Best Digital Wallet Apps of 2025

The digital payment landscape is buzzing in 2025 with a variety of popular digital wallet apps making transactions seamless and secure.

These apps stand out for their innovative features, ease of use, and reliability.

Let’s dive into the best digital wallet platforms leading the charge this year.

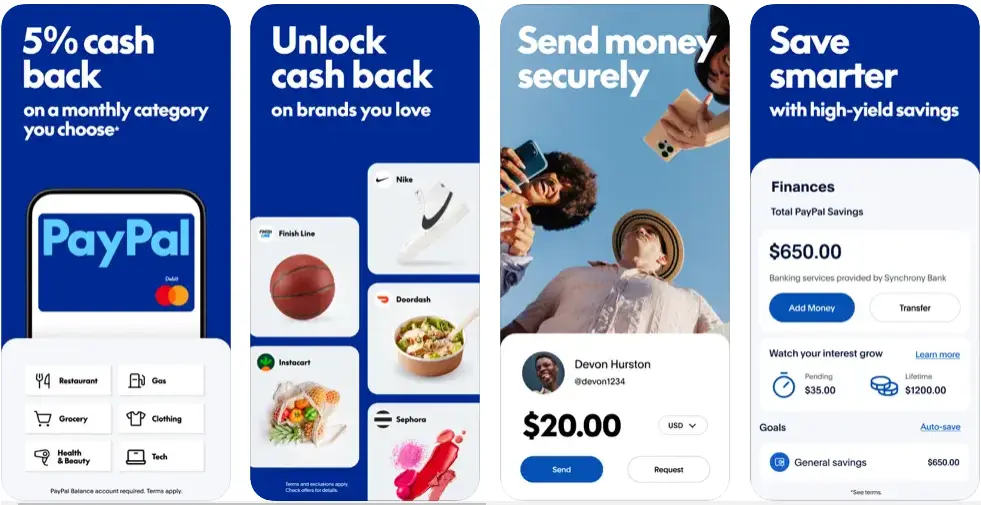

1. PayPal

PayPal continues to dominate the top digital wallet apps list with its global reputation and user-centric approach. Offering multi-currency support and robust security, it’s the go-to app for international transactions. Its adaptability with both personal and business use makes it a must-have for anyone handling payments online.

- Unique Features: Global reach, multi-currency support, and integration with e-commerce platforms.

- Subscription Models: Free for personal use; businesses pay transaction fees.

- User Base: Over 400 million active users worldwide.

- Why It’s Favored by Users: Trusted brand, intuitive interface, and versatile payment solutions.

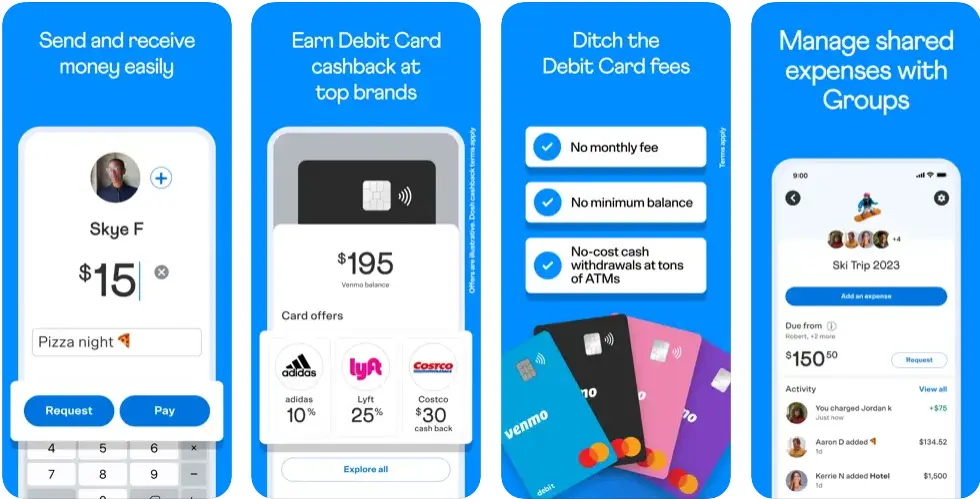

2. Venmo

Venmo has carved a niche in the best eWallet platforms for its social payment-sharing features. Loved by millennials and Gen Z, Venmo combines payments with a fun, interactive interface that resembles a social media app. It’s perfect for splitting bills or making payments among friends.

- Unique Features: Social payment sharing, QR code support, and instant transfers.

- Subscription Models: Free basic usage; fees apply for instant transfers or credit card payments.

- User Base: Over 70 million users, primarily in the USA.

- Why It’s Favored by Users: Fun and social way to manage payments among peers.

3. Apple Pay

Apple Pay stands tall as one of the leading eWallet apps in 2025, offering seamless integration with Apple devices. With its focus on privacy and advanced security measures, such as Face ID and Touch ID, Apple Pay is a favorite for contactless payments across the globe.

- Unique Features: Contactless payments, advanced security with Face ID and Touch ID, and compatibility with Apple devices.

- Subscription Models: Free for personal use; merchant fees apply for businesses.

- User Base: Millions of iPhone and Apple device users globally.

- Why It’s Favored by Users: Convenient, secure, and widely accepted at stores and online.

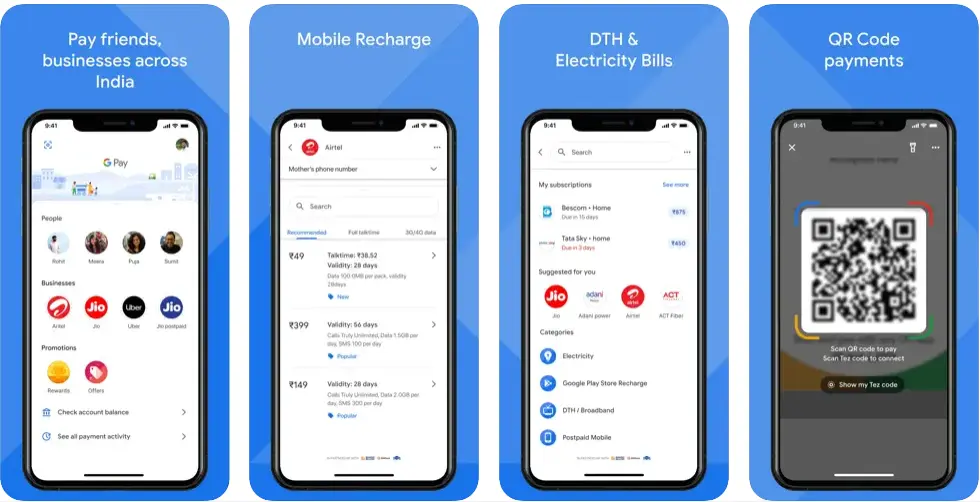

4. Google Pay

Google Pay has revolutionized the way people make payments by offering a simple and fast platform. It provides secure transactions, rewards, and integration with Google services, making it an excellent choice for Android users.

- Unique Features: Fast transactions, rewards for purchases, and seamless integration with Google ecosystem.

- Subscription Models: Free for personal use; businesses pay a small fee for transactions.

- User Base: Billions of Android users globally.

- Why It’s Favored by Users: Ease of use, rewards system, and broad acceptance in online and offline stores.

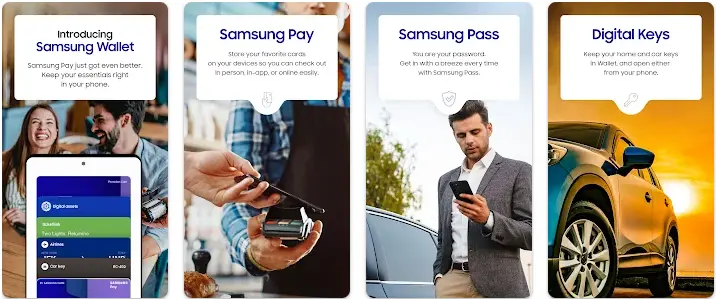

5. Samsung Pay

Samsung Pay is a favorite for Samsung device users, offering innovative features like MST (Magnetic Secure Transmission) that make it compatible with virtually all card terminals. It’s a versatile app perfect for contactless payments.

- Unique Features: MST technology, loyalty card storage, and exclusive rewards.

- Subscription Models: Free for users; businesses incur transaction fees.

- User Base: Millions of Samsung users worldwide.

- Why It’s Favored by Users: Compatibility with older terminals and seamless Samsung integration.

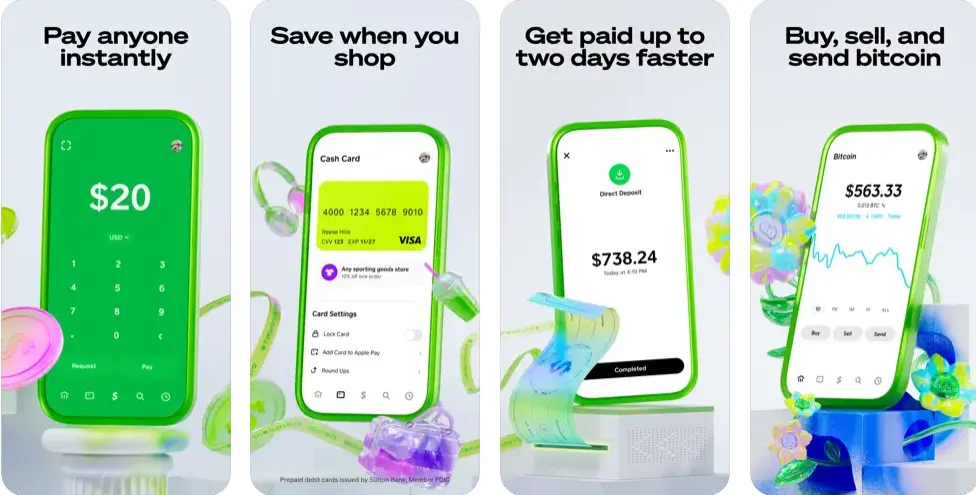

6. Cash App

Cash App is one of the leading eWallet platforms, offering peer-to-peer money transfers, investment options, and even Bitcoin transactions. It’s popular for its simplicity and added financial features.

- Unique Features: Bitcoin trading, investing in stocks, and peer-to-peer payments.

- Subscription Models: Free for standard transfers; fees apply for instant transfers and investing.

- User Base: Over 50 million users, mainly in the USA.

- Why It’s Favored by Users: Combines payments with investment features for a holistic financial experience.

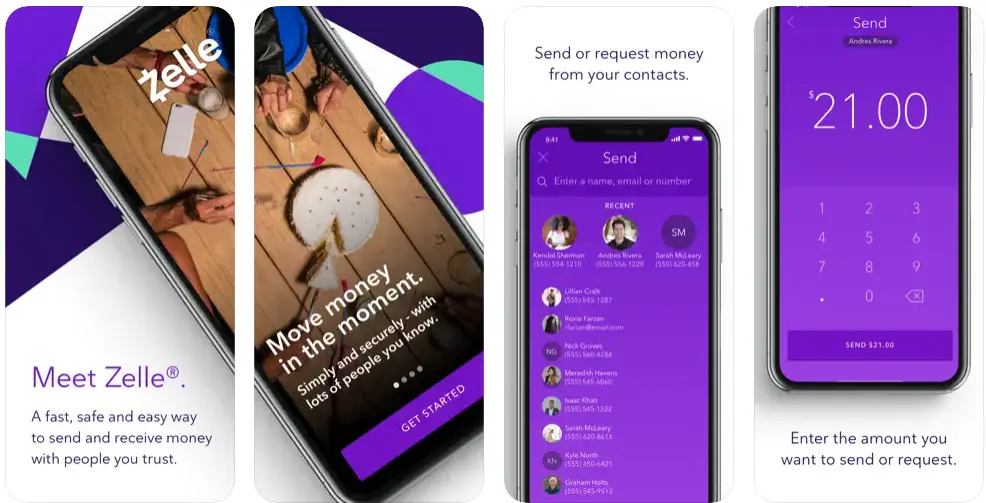

7. Zelle

Zelle has become a popular eWallet app due to its instant money transfer capabilities, especially between US banks. It’s designed for direct bank account-to-bank account transfers, eliminating the need for external wallets.

- Unique Features: Instant bank transfers, no fees, and integration with major US banks.

- Subscription Models: Free for all users.

- User Base: Tens of millions of users in the USA.

- Why It’s Favored by Users: Speed and convenience for bank transfers.

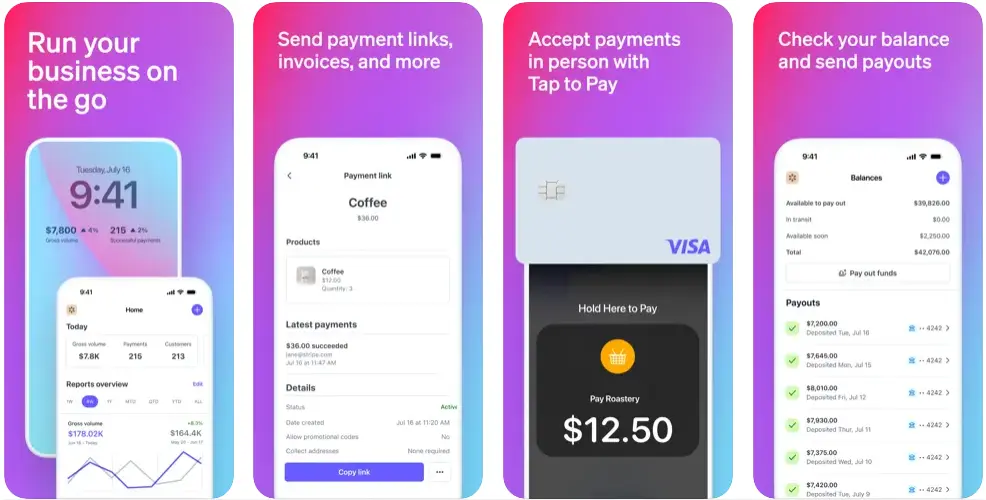

8. Stripe

Stripe, a global payment gateway, is a top choice for businesses looking for comprehensive payment solutions. It’s known for its reliability, customization, and robust APIs that enable seamless integrations.

- Unique Features: Advanced API, global payment solutions, and recurring billing options.

- Subscription Models: Pricing based on transaction fees and custom plans for enterprises.

- User Base: Businesses of all sizes worldwide.

- Why It’s Favored by Users: Flexibility and scalability for business needs.

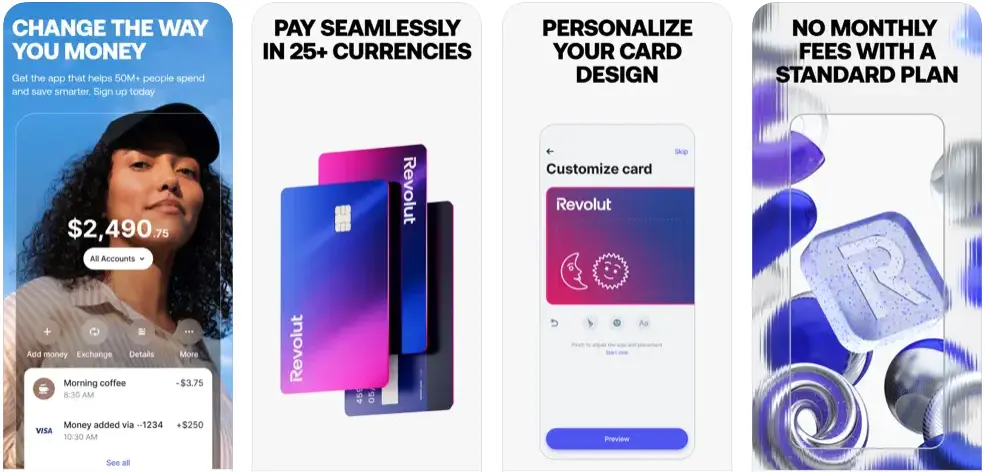

9. Revolut

Revolut is a game-changer in the best digital wallet apps, offering everything from payments to international money transfers and even cryptocurrency trading. It’s perfect for globetrotters and tech-savvy users.

- Unique Features: Multi-currency support, budgeting tools, and crypto trading.

- Subscription Models: Free basic account; premium options with added features.

- User Base: 30+ million users globally.

- Why It’s Favored by Users: All-in-one platform for payments and financial management.

10. Alipay

Alipay is a dominant force in the leading digital wallet apps space, especially in Asia. With extensive features like bill payments, ride-hailing, and shopping, it’s an everyday companion for its users.

- Unique Features: Comprehensive ecosystem, loyalty programs, and QR code payments.

- Subscription Models: Free for personal use; fees apply for merchant services.

- User Base: Over 1.3 billion active users globally.

- Why It’s Favored by Users: Wide acceptance and robust ecosystem.

11. WeChat Pay

WeChat Pay is integrated into the WeChat app, making it incredibly convenient for messaging, shopping, and payments. It’s one of the best eWallet apps in the Chinese market and beyond.

- Unique Features: In-app payments, social media integration, and QR code support.

- Subscription Models: Free for users; merchants pay fees.

- User Base: Over 1 billion active users.

- Why It’s Favored by Users: All-in-one platform for communication and transactions.

12. Wise (formerly TransferWise)

Wise is a revolutionary eWallet app for international money transfers, offering mid-market exchange rates with no hidden fees. It’s a top choice for freelancers, businesses, and travelers looking to save on cross-border payments.

- Unique Features: Real exchange rates, borderless accounts, and multi-currency support.

- Subscription Models: No subscription fees; charges a minimal percentage for transfers.

- User Base: Over 15 million users across 70+ countries.

- Why It’s Favored by Users: Transparent pricing and cost-effective international transactions.

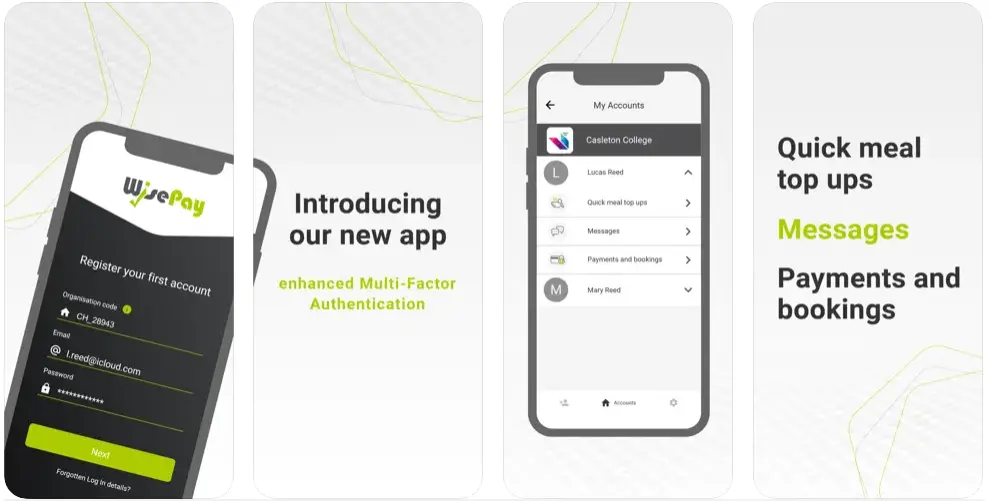

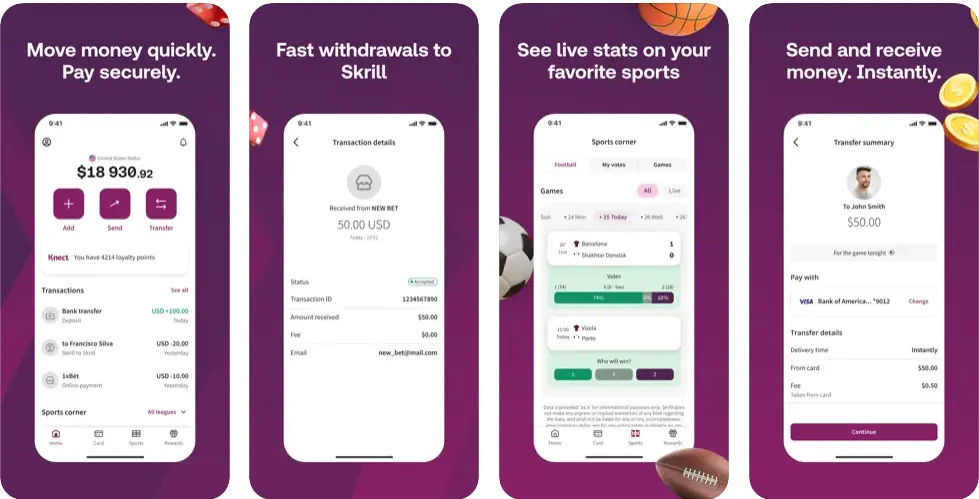

13. Skrill

Skrill has become a leading eWallet app for online transactions, especially in gaming and forex trading. Its secure platform supports multiple currencies, and users can send money instantly to bank accounts or other wallets.

- Unique Features: Prepaid debit cards, cryptocurrency support, and rapid transfers.

- Subscription Models: Free for basic accounts; transaction fees apply for premium features.

- User Base: Over 40 million users globally.

- Why It’s Favored by Users: Convenience for online transactions and cryptocurrency enthusiasts.

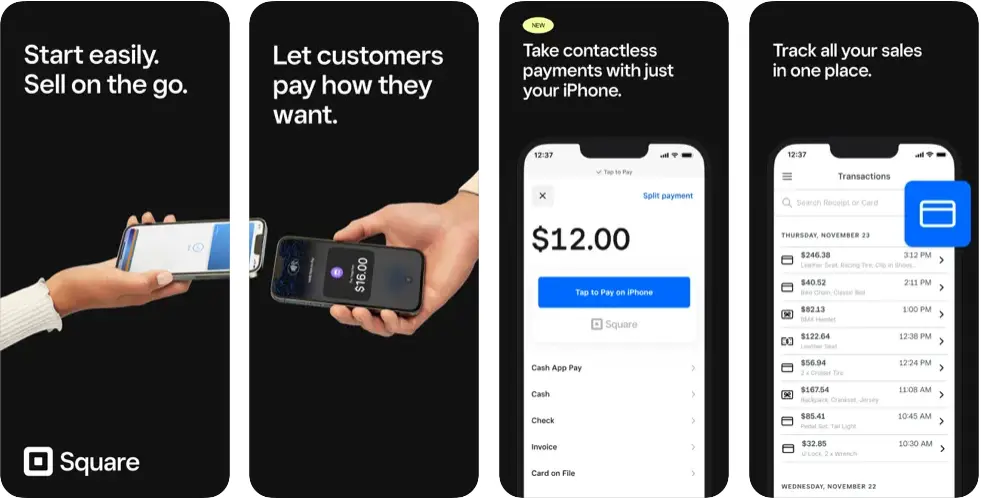

14. Square Cash for Business

Square Cash for Business, a variant of Cash App, is tailored for small businesses looking to accept digital payments. It’s streamlined and efficient, allowing businesses to accept payments without the need for hardware.

- Unique Features: Quick setup, direct deposits, and no hardware dependency.

- Subscription Models: Transaction-based fees for businesses.

- User Base: Thousands of small businesses across the USA.

- Why It’s Favored by Users: Cost-effective and easy-to-use platform for businesses.

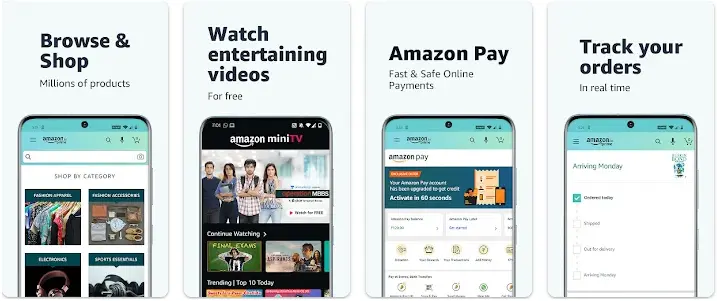

15. Amazon Pay

Amazon Pay brings the convenience of shopping on Amazon to other online stores, allowing users to make quick and secure payments using their Amazon credentials. It’s perfect for those who prefer fewer payment touchpoints.

- Unique Features: Seamless checkout, integration with Amazon accounts, and voice payments with Alexa.

- Subscription Models: Free for consumers; merchants pay transaction fees.

- User Base: Millions of Amazon customers globally.

- Why It’s Favored by Users: Trust in Amazon’s security and ease of use.

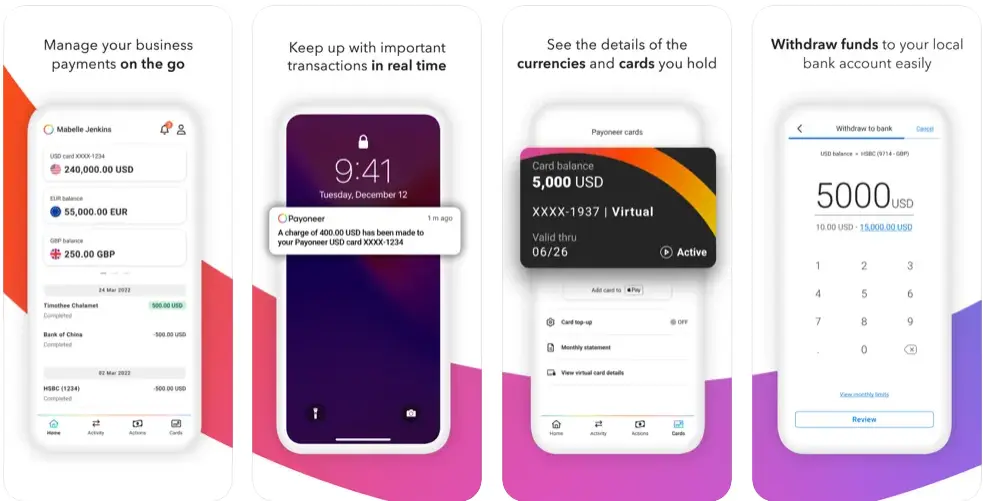

16. Payoneer

Payoneer is a top eWallet app for freelancers and businesses operating internationally. It allows users to send and receive money globally, with features like prepaid MasterCard options for easy withdrawals.

- Unique Features: Cross-border payments, multi-currency accounts, and prepaid cards.

- Subscription Models: Free for basic services; small fees for specific transfers.

- User Base: Over 5 million businesses and professionals worldwide.

- Why It’s Favored by Users: Reliable and cost-effective for global transactions.

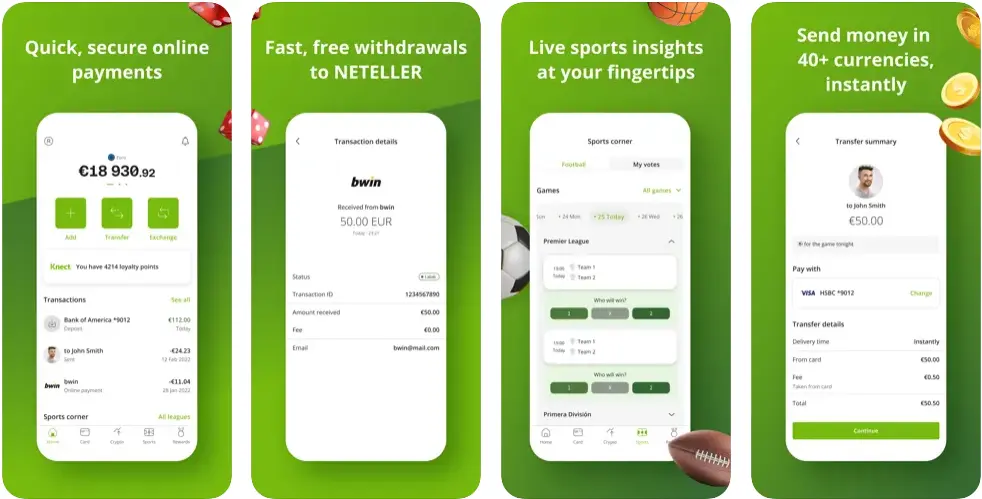

17. Neteller

Neteller is a trusted eWallet app for payments, online shopping, and cryptocurrency trading. Known for its advanced security and loyalty programs, Neteller has a strong foothold in markets like gaming and trading.

- Unique Features: High limits for transactions, loyalty rewards, and crypto support.

- Subscription Models: Free for personal use; certain transfers incur fees.

- User Base: Millions of users in over 200 countries.

- Why It’s Favored by Users: High transaction limits and extensive global reach.

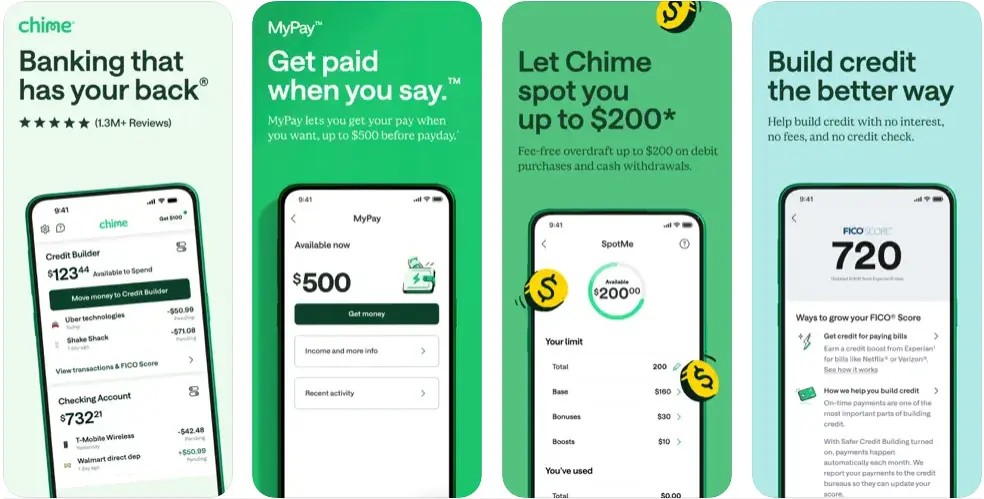

18. Chime

Chime is a modern mobile banking app that doubles as a digital wallet. With features like no monthly fees, early direct deposits, and overdraft protection, it’s ideal for personal finance management.

- Unique Features: Early paycheck access, no monthly fees, and automatic savings.

- Subscription Models: Free to use; optional premium services available.

- User Base: Over 12 million users in the USA.

- Why It’s Favored by Users: Banking simplicity and budgeting tools.

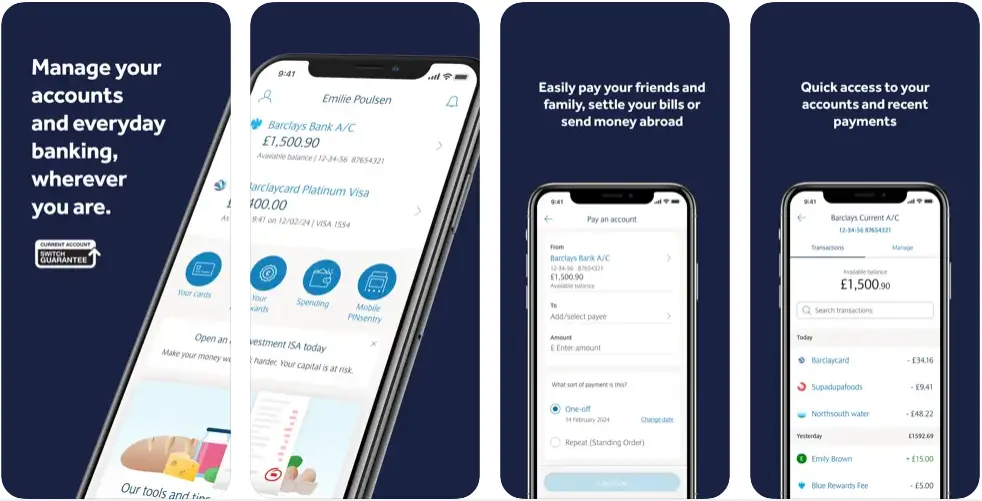

19. Barclays Pingit

Barclays Pingit is a versatile app that caters to peer-to-peer payments and small businesses. Known for its quick transfers and bill payment options, it’s a reliable eWallet solution.

- Unique Features: Direct bank transfers, QR code payments, and bill splitting.

- Subscription Models: Free for personal use; charges apply for business accounts.

- User Base: Millions of Barclays customers in the UK and beyond.

- Why It’s Favored by Users: Ease of use and integration with Barclays banking.

20. EcoPayz

EcoPayz is a popular eWallet app for users who prioritize security and anonymity. It supports multiple payment methods and is widely accepted in industries like online gaming and trading.

- Unique Features: Anonymous transactions, ecoVirtualcards, and currency versatility.

- Subscription Models: Free for basic accounts; premium plans offer additional benefits.

- User Base: Active in over 150 countries with millions of users.

- Why It’s Favored by Users: Privacy-focused and highly secure transactions.

Here’s Why You Should Develop an eWallet App

If you’ve been considering entering the digital payment space, now is the time.

The popularity of eWallet apps is soaring, and for good reason.

Let’s dive into three compelling reasons why you should develop an eWallet app and we’ll back it up with some real-time statistics.

► Exploding Market Demand

The global eWallet market is expected to surpass $3.4 trillion by 2025, with a growth rate of 20% year-on-year.

With consumers shifting toward cashless transactions, the demand for top digital walllet wallet apps is at an all-time high.

Whether it’s online shopping, peer-to-peer payments, or in-store purchases, eWallet apps have become a necessity.

► High User Retention and Engagement

eWallet platforms are known for their high engagement rates.

Features like cashback, loyalty rewards, and seamless payment experiences keep users coming back.

For example, apps like PayPal boast a retention rate of over 80%, proving that once users adopt an eWallet, they rarely switch.

► Growing Consumer Preference for Security

In a survey, 70% of users stated they prefer using digital wallets because of their advanced security measures, such as two-factor authentication and biometric verification.

This makes eWallet apps a preferred choice for secure, hassle-free transactions, especially in an age where cybersecurity is paramount.

By developing an eWallet app, you can tap into this booming market, create a loyal user base, and offer secure, innovative solutions to meet modern payment needs.

JPLoft Is Here to Help You

At JPLoft, we specialize in building secure, scalable, and user-friendly digital wallet apps tailored to your needs. Whether you’re looking to create a robust platform with advanced features or launch a simple, intuitive app, our team has the expertise to make it happen.

As a trusted eWallet app development company, we combine cutting-edge technology with industry insights to deliver solutions that stand out. Let us help you tap into the growing digital payment market with a custom-built app designed for success.

Conclusion

The world of digital payments is thriving, and the top eWallet apps of 2025 showcase how technology is revolutionizing the way we handle money. From PayPal’s global reach to Venmo’s social integration and Apple Pay’s advanced security, these apps are setting benchmarks for innovation and convenience.

If you’re inspired to develop an eWallet app, there’s no better time to start. With a growing market, high user engagement, and the increasing demand for secure payment solutions, your app could become the next big thing.

FAQs

An ideal eWallet app should include secure payment options, multi-currency support, QR code integration, loyalty rewards, and a user-friendly interface. Advanced features like biometric authentication and crypto trading can also add significant value.

The cost of developing an eWallet app depends on factors like complexity, features, platform (iOS, Android, or both), and development time. Typically, it ranges from $30,000 to $150,000 or more for high-end apps.

Security is crucial because eWallets handle sensitive user data, including financial details. Robust security measures like encryption, two-factor authentication, and fraud detection are essential to build trust and protect users.

Share this blog