Are you inspired by the rise of MoneyLion and similar apps, you’ve probably thought about building your own fintech platform.

Well, it is definitely a great idea, because experts believe the global market is expected to reach $9.68 Billion by 2032.

Before taking steps forward, a big question is “How Much Does it Cost to Create an App like MoneyLion?”

Well, the MoneyLion Like App Development Cost can range from $40,000 to $150,000 or more.

Creating an app like MoneyLion is no small feat. It includes everything from financial planning to credit monitoring, and this isn’t cheap.

In this blog, we’ll break down the cost and give you a clear idea of the cost to create a cash advance app like MoneyLion.

Ready to find out?

Key Takeaways

- MoneyLion is a comprehensive personal finance app that offers services like budgeting, credit score monitoring, and even access to personal loans.

- The global fintech market is booming, making now the perfect time to build an app similar to MoneyLion and tap into this growing market.

- App development costs can range from $40,000 to $150,000 or more, depending on the features and complexity.

- Several factors influence development costs, including app features, design, security, and legal compliance.

- The time to create an app like MoneyLion can be from 2 to 10 months and is affected by the development cost factor.

- Monetization strategies such as interest on loans, subscriptions, or in-app purchases can help generate consistent revenue for a MoneyLion-like app.

This is what we are going to talk about in the following section so brace yourself to go all in the blog.

What is MoneyLion?

MoneyLion is an innovative fintech app designed to offer users comprehensive suits of Financial Services.

From Managing personal finances and budgeting to improving credit scores and offering instant loans.

MoneyLoan simplifies complex financial tasks in one convenient platform is what makes this app unique.

Thinking of creating an app like MoneyLion? If you plan to start a money lending business or provide users with easy access to credit, MoneyLion offers a solid model to replicate.

With millions relying on fintech apps for everyday financial decisions, now is the perfect time to tap into this market.

Talking about the market, we find it the right time to discuss with you the growing money lending app market that includes apps like MoneyLion.

Growing Market of Money Lending App Market: An Overview

To develop a cash advance app like MoneyLion, we need to know about the growing market.

This will help you make better decisions, especially the ones that are favorable to the market.

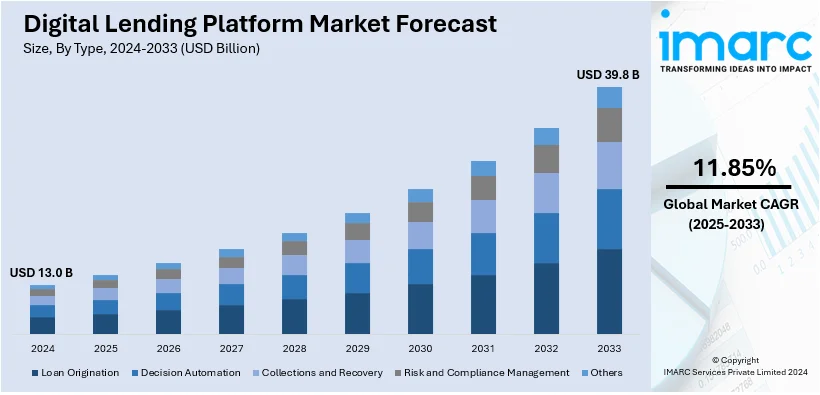

- The market size for digital lending platforms globally was USD 13.0 billion in 2024.

- For the future, the market is expected to come up to USD 39.8 billion in 2033 with a CAGR of, 11.85% from 2025-2033.

- According to the Market segment analysis based on the regions as of 2024, North America is the largest market having a market share of more than 31.2%.

- This dominance has been attributed to the strong financial environment in the region, as well as the increased use of solutions that are based on the technologies.

- Talking Just about MoneyLion, For FY 2024, MoneyLion total revenue was between $536 million and $541 million– an increase of 27% to 28%bn compared to FY 2023 from the previously guided range of $525 million to $535 million for FY 2024.

The stats paint a promising picture of the market, clearly indicating the potential for developing a money lending app.

With this in mind, let's explore the key features that can help promote and elevate your app.

Features to Incorporate in MoneyLion like App

To create an app like MoneyLion that truly stands out, you need to incorporate some amazing loan lending app features.

Include these features to elevate your app and offer users something meaningful:

1. Easy Registration

First thing first, in order to Build an App MoneyLion, you need to focus on user-friendly registration. Make sure not to trouble them with too lengthy processes, so that they can get onboard as soon as possible.

2. Personalized Recommendation

To make recommendations to the users, your app should incorporate a feature that would give users a set of recommendations as per their aims & values. The one is useful for everyone to make it possible for them to feel like they own their financial lives.

3. Credit Score Monitoring

Features like Credit score monitoring are the best for anyone who wants to monitor credit score in real-time or has an intention of enhancing credit status.

Users realize they can make better choices about their financial status by receiving recommendations based on their scores.

4. Budgeting & Expense Tracking

Expense categorization makes it easier for users to understand the proportions of money spent. In this case, users thus can set budget plans and track their financial situation so as not to exceed such set limits.

5. Personal Loan Lending

Integrating personal loan options helps users gain access to immediate funds in times of need. Providing various loan plans based on credit scores to enhance user satisfaction and drive app engagement.

6. Savings & Investment Instruments

Offer Customer opportunities to increase their funds by using simple tools for saving & investment. One can survive and even thrive on providing only a “robot device’’ for investing and low-risk portfolios as well for experienced customers.

7. Security and Privacy

The security of the people’s financial information should be of paramount importance.

So, when you develop an app like MoneyLion, make sure to have features like encryption, multi-factor authentication, and timely security inspection, so users will feel secure with their individual and financial data locked down securely.

8. Instant Loan Approvals

Having a fast loan approval process with little documentation ensures that whenever a user requires a task, they can acquire it within a short period. The more efficient it is, the better it will be for the service user.

9. Push Notifications and Alerts

Users want to be reminded when it is time to pay the bills, save money, or when the loan is due. They should be notified to help users manage financial issues including timely payment without being charged with late fees.

10. Referral Programs

The best kind of reward should appeal to the user to invite friends and family to the site and engage with it. Using bonuses or rewards, you can always attract a large number of users to your app and build a base of regular customers.

Now that you have a clear picture of the features to have in an app like MoneyLion, it is time we discuss how much it cost to create an app like MoneyLion.

Average Cost to Make an App Like MoneyLion

Building an app like MoneyLion needs a significant investment due to its complex features, security needs & smooth user experience.

So, “How much does it cost to create a cash advance app like MoneyLion? “

MoneyLion-like app development cost can be somewhere from $40,000 to $150,000 or more.

Factors such as the scope of features (like loan applications, financial analytics, and credit score monitoring), and security (for handling sensitive data) can change the price.

Here’s the potential breakdown of loan lending app cost:

|

Feature |

Cost Estimate |

|

Basic App (MVP) |

$40,000 - $60,000 |

|

Advanced Features |

$60,000 - $100,000 |

|

Custom Design & UI/UX |

$10,000 - $30,000 |

|

Security & Compliance |

$15,000 - $25,000 |

|

Total Estimated Cost |

$40,000 - $150,000+ |

This is not the true cost to make a cash advance app like MoneyLion, it is just an estimate.

To obtain the right cost, consult with an experienced mobile app development company like JPLoft.

As much as a full-fledged app is costly, the potential returns in the booming fintech industry make it a worthwhile investment.

Factors Affecting the Overall Cost to Build a Cash Advance App like MoneyLion

As we have repeatedly shared several factors affect how much does it cost to develop a cash advance app like MoneyLion.

Once you get to know these factors it is easier to plan ahead.

So, without any delay, let’s get to know these key elements that can affect the cost to make an app like MoneyLion.

► Features

The features that you plan to incorporate in your app are one of the biggest factors that affect the cost to build a money lending app like MoneyLion.

Whether it is a simple budgeting or a comprehensive loan approving system, the more functions integrated, the more it will cost to develop.

Simple features like easy user sign-up, loan calculator, basic dashboard, etc can be cost-friendly.

However, extra features such as credit score tracking, financial planning, and marketplace lending create tremendous value but include considerable investments.

Here is a breakdown of the cost to make an app like MoneyLion:

|

Feature Type |

Estimated Cost Range |

Details |

|

Basic Features (e.g., sign-up, profile management) |

$5,000 - $15,000 |

Includes essential functionalities like account creation, login, and user profile management. |

|

Advanced Features (e.g., credit score tracking, budgeting tools) |

$10,000 - $40,000 |

Adding tools like personalized financial insights, budget planners, and credit score monitoring. |

|

Marketplace Lending & Loans Feature |

$15,000 - $50,000+ |

Integrating loan systems, loan approval workflows, and peer-to-peer lending features. |

|

Investment & Savings Tools |

$10,000 - $40,000 |

Tools to help users invest, save, and track wealth accumulation, including automated investment advice. |

► Design & User Experience

Let’s be real, the design is what attracts users to your app.

With so many top loan lending apps out there, you need to keep a user-friendly interface to keep users engaged.

However, the complexity and quality of the design are what increase the overall cost to build an app like MoneyLion.

Simple designs are not costly, however, custom UI/UX designs with easy navigation and engaging visuals will need more time and better expertise.

|

Design Element |

Estimated Cost Range |

Details |

|

Basic Design |

$3,000 - $10,000 |

Simple design with minimal user interface elements, focusing on functionality. |

|

Custom Design |

$10,000 - $20,000 |

High-end, tailored design with custom graphics, smooth animations, and personalized UI/UX for a better user experience. |

|

User Testing & Prototyping |

$2,000 - $5,000 |

Prototyping and testing phases to optimize user navigation and interface before full-scale development. |

► Platform (iOS vs. Android vs. Both)

Whether you choose to develop your iOS, Android, or both platforms, it will affect the cost.

Developing for both platforms usually requires building differernt codebases, which doubles the workload and in turn, increases the overall MoneyLion-like app development cost.

Cross-platform app development reduces costs but may not offer the same level of performance and customization as native apps.

We suggest, decide as per your target audience.

|

Platform |

Estimated Cost Range |

Details |

|

Single Platform (iOS or Android) |

$20,000 - $40,000 |

Development for either iOS or Android, focusing on one platform's requirements. |

|

Cross-Platform (React Native, Flutter) |

$15,000 - $30,000 |

A cost-effective option for developing apps for both platforms using a single codebase. |

|

Native Development for Both Platforms |

$30,000 - $50,000 |

Developing separate codebases for both platforms (iOS and Android), ensuring better performance but at a higher cost. |

► Security & Compliance

With so many cyber-attacks happening all over the world, it is more than necessary to work on top-notch security.

Financial apps like MoneyLion have strong security to protect sensitive user data.

Besides, making sure to be compliant with regulations like GDPR & PCI-DSS for handling financial transaction adds to Cost to develop a Cash Advance app like MoneyLion.

On top of that, implementing encryption, multi-factor authentication, and other security measures requires both time & expertise.

|

Security/Compliance Aspect |

Estimated Cost Range |

Details |

|

Basic Security (Encryption, Data Protection) |

$2,000 - $10,000 |

Basic encryption protocols and ensuring user data privacy. |

|

Compliance (e.g., GDPR, PCI-DSS) |

$3,000 - $10,000 |

Ensuring your app meets legal and regulatory standards for data security and financial transactions. |

|

Advanced Security (2FA, Biometric Authentication) |

$5,000 - $15,000 |

Implementing advanced authentication methods, such as two-factor authentication or biometric login. |

► Third-Party Integrations

Third-party integrations are important to boost your app’s functionality.

Integrating third-party services such as payment gateways, credit score APIs, or loan management tools can add more to the cost.

These integrations typically come with their own fees and require developers to ensure compatibility.

Doing all this can further increase the overall MoneyLion clone app development cost.

|

Integration Type |

Estimated Cost Range |

Details |

|

Payment Gateway Integration |

$2,000 - $5,000 |

Integrating payment processors like Stripe, PayPal, or other gateways for financial transactions. |

|

Credit Score API Integration |

$3,000 - $8,000 |

Incorporating credit score APIs such as FICO or Experian for real-time score tracking. |

|

Loan Management Systems |

$5,000 - $15,000 |

Integrating third-party loan management systems for seamless loan application, approval, and disbursement. |

► App Maintenance & Updates

Once the app is launched, the work is not over!

It is now time for app updates. This is where the maintenance & updates cover you.

Regular updates & maintenance are essential for fixing bugs, adding new features, and ensuring the app remains secure.

But, investors often overlook this factor, so should be considered when estimating the total cost to build a cash advance app like MoneyLion.

|

Maintenance Type |

Estimated Cost Range |

Details |

|

Bug Fixes & Minor Updates |

$2,000 - $10,000/year |

Routine bug fixes and small feature updates after app launch. |

|

Major Updates & New Features |

$5,000 - $15,000/year |

Adding new features, updating user interfaces, or releasing major new versions of the app. |

|

Security Patches |

$1,000 - $5,000/year |

Regular security updates and patches to maintain user data safety. |

► Backend Systems

The backbone of any loan lending app lies in its backend.

After all, the backend development handles user data, transactions, and third-party systems.

Simply put, the tech stack of a loan lending app, including high-performance servers, databases, and APIs for real-time data processing, can increase the overall cost to develop an app like MoneyLion.

But, how does this affect the cost?

A complex backend that is scalable and robust will require more resources, making it more expensive to develop as well as maintain.

|

Backend Component |

Estimated Cost Range |

Details |

|

Basic Backend (User Data Management) |

$5,000 - $15,000 |

Simple server setup to store user data and manage basic transactions. |

|

Advanced Backend (Real-time Data Processing, APIs) |

$10,000 - $30,000 |

Real-time data management, complex API integrations, and third-party service connections. |

|

Scalable Backend Infrastructure |

$15,000 - $50,000 |

Creating a highly scalable backend for handling increased user activity and large data sets. |

► Team Location & Expertise

The experience and location of the development team are something we want to shed light on.

If you hire mobile app developers from countries with a higher cost of living (like the USA or Western Europe) will naturally raise the overall cost.

Conversely, outsourcing to regions with lower labor costs such as Eastern Europe or India may help reduce the price.

However, it can come with some communication challenges and quality control.

|

Development Team Location |

Estimated Cost Range |

Details |

|

North America |

$100,000 - $150,000 |

Higher costs for developers in North America due to the advanced skills and higher living expenses. |

|

Western Europe |

$60,000 - $120,000 |

Cost-effective compared to North America but still high due to experienced developers in the region. |

|

Eastern Europe |

$40,000 - $80,000 |

A more budget-friendly option with skilled developers in regions like Eastern Europe. |

|

India & Philipines |

$30,000 - $60,000 |

The most cost-effective solution, with a large pool of talented developers at lower rates. |

Knowing these factors will assist you in deciding how much does it cost to build an app like MoneyLion.

With this out of the way, we are going to know another important aspect that is……….

How Long Does it Take to Develop an App like MoneyLion?

Wish to develop an app like MoneyLion? – it’s like creating your financial tool, and it will take as much time as you want… How?

In the case of a simple loan lending app with basic functionalities, it will take about 2 to 6 months to complete.

However, if you’re going to add features that will require credit score tracking, real-time data processing, and complicated third-party connection; be ready to plan your development time to 6 to 10 months or more.

Oh, and remember — after having deployed your app, ongoing improvements and enhancements will make the clock run!

|

Phase |

Estimated Time |

Details |

|

Planning & Research |

2-4 Weeks |

Market research, feature set, and technical requirements gathering. |

|

Design & Prototyping |

4-6 Weeks |

UI/UX design and wireframing for better user experience. |

|

Backend & Frontend Development |

10-12 weeks |

Coding and integration of essential features. |

|

Testing & QA |

4-8 Weeks |

Bug fixing, performance testing, and user feedback analysis. |

|

Launch & Post-Launch |

2-6 weeks |

Final testing, app store submission, and marketing. |

Basically, the factors that affect the cost to build an app like MoneyLion also affect the development time.

So, this is clear that the time provided can increase or decrease as per your project needs. Now, with this being clear, we are going to talk about ways your app can make money.

How MoneyLion App Can Make Money?

See, MoneyLion-like app development cost can be overwhelming.

To recover the cost and make great revenue, you need to implement top monetization models in your app. Let’s find out about them:

1] Interest on Loans

The major source of the MoneyLion-like app’s income is the loan interest rate.

By allowing users to borrow money in the form of personal loans, the app can earn interest on the money borrowed.

The interest rates can be a little higher depending on the credit score, loan amount, and repayment period making it a regular income-generating marketplace.

2] Subscription Plans

Subscription models are valuable because they create a base of recurring revenue for the firm, as well as improve clients’ experiences through personalized financial services.

MoneyLion-like apps come with premium features that are beneficial for your user including tracking credit scores, or financial tips.

The advanced features can be made available in exchange for a monthly or annual subscription fee.

3] Partnering with Financial Institutions

By partnering with banks and financial institutions, apps like MoneyLion can generate revenue through referral fees or commissions.

For example, the app could offer users exclusive financial products or services, such as credit cards or investment options.

This way, you can earn a percentage of the profits from the partnerships, creating a win-win for both users.

4] Transaction Fees

Another revenue model is to earn transactional fees from issued services such as loans, repayments, or money transfers.

Even though each of these fees might be relatively low, such a scale could considerably grow due to the increasing number of users.

This shows that the app can then be profitable without placing too much load on its users in terms of transaction fees.

5] Affiliate Marketing

Another way to monetize the app is to add relevant ads and sponsored content to the app.

Companies in the financial services industry, insurance companies, investment solutions, or any firm in the financial markets may seek to sponsor their products on your app.

These can be done preferentially based on the users and hence can be more effective and give a hidden way of monetizing the app.

JPLoft- Your Partner to Create an App Like MoneyLion

Do you want to develop an App like MoneyLion? Well, it’s a great idea!

But, this idea needs the help of an expert team which is where JPLoft, the best loan lending app development company comes.

We have experience of 10+ years to deliver loan lending apps that exceed expectations. With top designers, developers, and experts on the team, we can successfully convert a mere idea into something exceptional.

Are you ready to make a mark in the fintech market? Then, connect with us!

Conclusion

MoneyLion can easily become a unique project with countless opportunities in the emerging market of fintech applications. As we know, the development process costs a lot and may range more depending on the features, security, and platforms, but the outcome may be high.

Some important features, such as budgeting tools, credit score tracking, and granting of loans within a short period, make your application rival the competition. Moreover, using other revenue-generating models including loan interest, extra subscription fees, or partnerships with financial institutions will ensure steady revenues.

If you are ready to commit, finding a reputable development partner like JPLoft can go a long way in turning your dream into reality.

FAQs

The cost of developing an app like MoneyLion can range from $40,000 to$150,000, depending on the complexity, platform & security requirements.

Some top feature to have in the MoneyLion-like app is a Credit score monitoring, budgeting tools, instant loan approval, saving and investing, and security through encryption and multifactor authentication.

Revenue is generated from interest on the loans, subscription plans, transactions, affiliate marketing, and partnerships that involve banking institutions for some exclusive products.

The development time depends on features, security, and tests involved: approximately 2 months to 10 months or more than a year.

The factors that affect the cost include the level of complexity- UI/UX Design, choosing platforms-both or iOS or Android, and Security integrations & maintenance.

Share this blog