Are you looking for the best money lending apps in 2025? You're in the right place!

The convenience of borrowing money has reached new heights, thanks to these innovative platforms.

Money lending apps are making it easier than ever to secure funds, whether for personal needs, business expansion, or emergency situations.

In this blog, we'll explore the top money lending apps that are dominating the market in 2025.

From unique features to user-friendly interfaces, these apps are setting the gold standard for how borrowing works in the modern economy.

Stick around, and you might find the perfect app that suits your financial goals. Ready to dive in? Let’s get started!

Best Money Lending Apps of 2025

Let’s take a closer look at the best money lending apps that have been making waves in 2025.

Each app stands out for its unique features, subscription models, and ability to connect borrowers with lenders seamlessly.

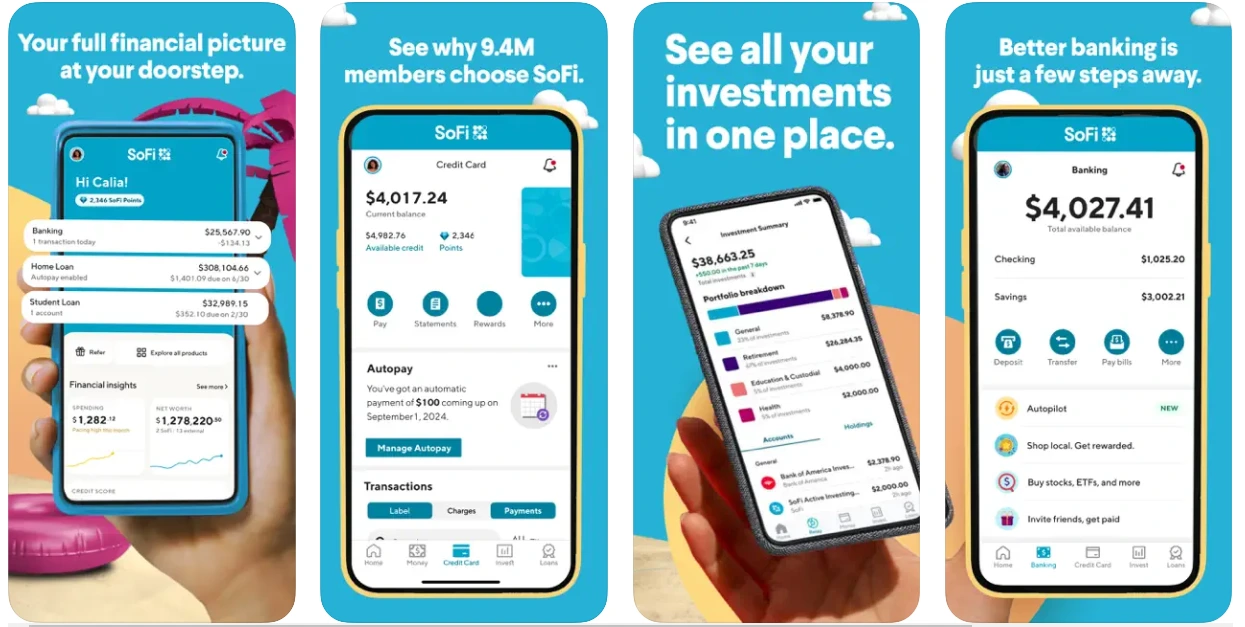

1. SoFi

SoFi is a household name among money lending platforms, celebrated for its all-encompassing approach to personal finance.

With offerings ranging from personal loans to student and home loans, it doesn’t stop at just lending money—it helps users manage their financial goals.

With added perks like career coaching and financial planning, SoFi redefines what a lending app can be.

-

- Unique Features: Offers personal, student, and home loans. Career coaching and financial planning included.

- Subscription Models: Free to download with optional financial advisory packages.

- User Base: Over 4 million active users.

- Why It’s Favored by Users: Competitive interest rates and no hidden fees.

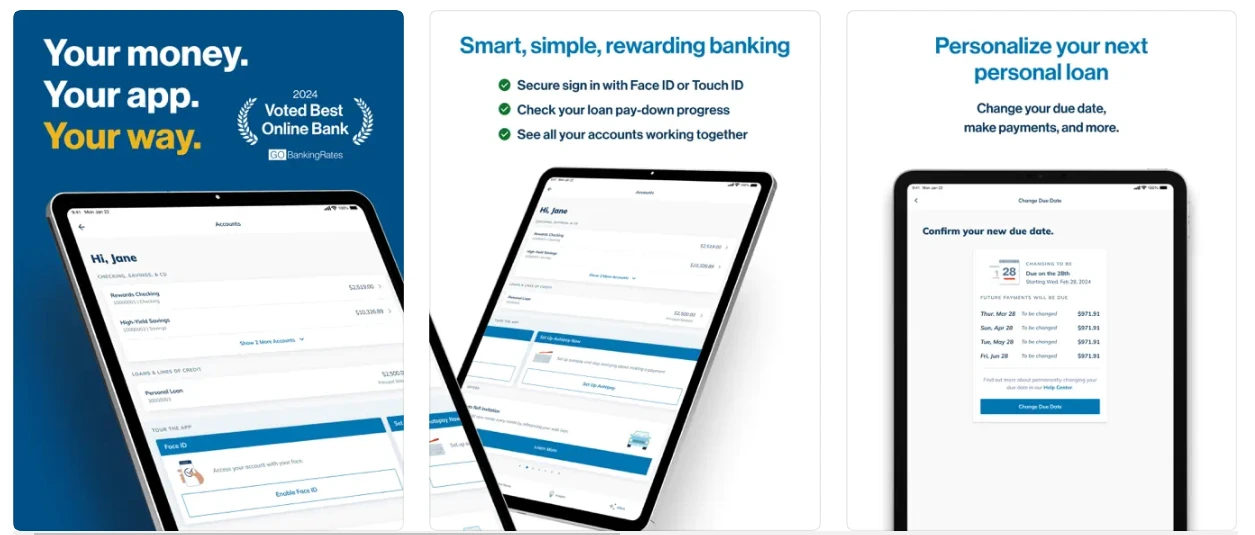

2. LendingClub

LendingClub is a standout in the money lending app space due to its innovative peer-to-peer lending model.

It acts as a bridge between borrowers and investors, enabling users to find funding on flexible terms.

The platform’s transparency and lack of hidden fees make it a favourite among users seeking reliable loan solutions.

-

- Unique Features: Connect borrowers directly with individual or institutional investors. Flexible repayment terms.

- Subscription Models: No membership fees; borrowers pay a one-time origination fee.

- User Base: 3 million+ registered users globally.

- Why It’s Favored by Users: Transparency and customized loan solutions.

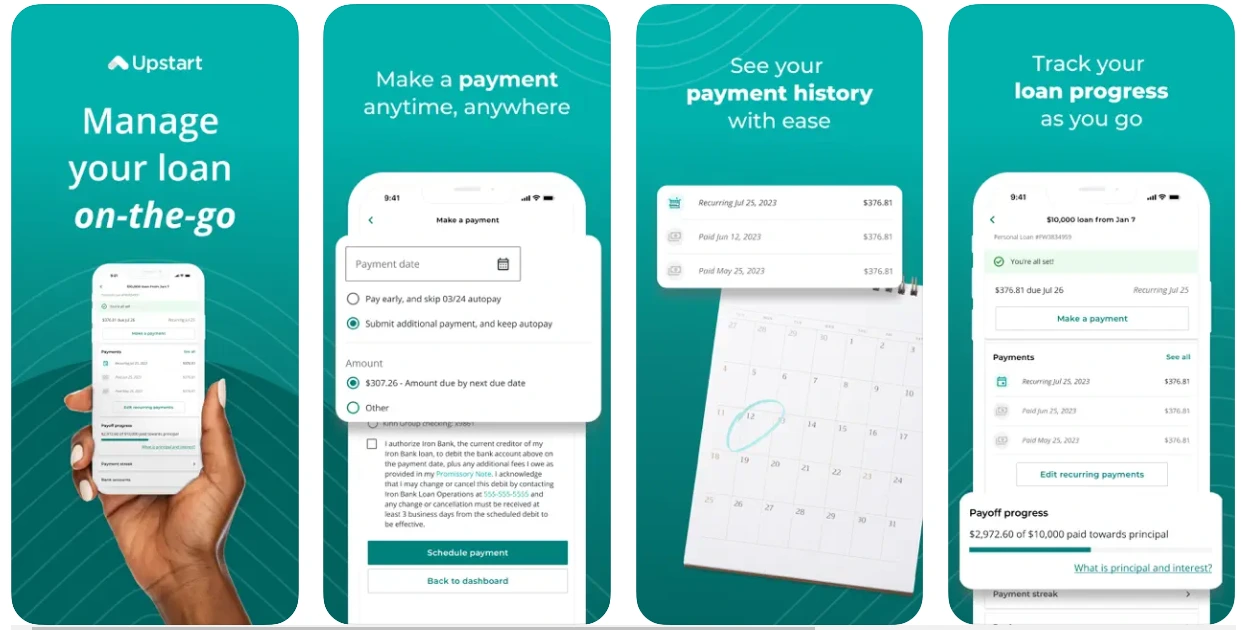

3. Upstart

If you're looking for a popular money lending platform, Upstart leverages AI technology to revolutionize loan approvals.

It’s particularly helpful for borrowers with limited credit history or unconventional financial backgrounds.

By using data like education and career potential, Upstart ensures fair lending opportunities for users who might otherwise struggle to qualify elsewhere.

-

- Unique Features: AI-powered credit assessment. Focuses on education and career-based loans.

- Subscription Models: Free platform; interest rates vary based on creditworthiness.

- User Base: Over 2 million satisfied customers.

- Why It’s Favored by Users: Faster approvals with fair terms for those with limited credit history.

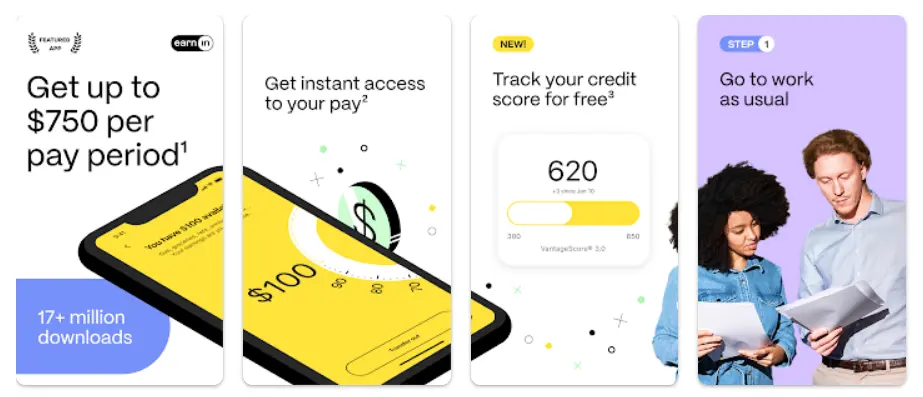

4. Earnin

Earnin is among the best money lending apps that cater specifically to users who need small cash advances before their paycheck.

Unlike traditional lenders, Earnin focuses on providing flexibility for workers, allowing them to borrow based on the hours they’ve already worked.

This makes it a go-to app for people managing expenses between paychecks.

-

- Unique Features: Borrow against earned wages without interest. Tip-based repayment model instead of fixed fees.

- Subscription Models: Free to use with an optional tipping feature for withdrawals.

- User Base: Over 1.5 million users in the United States.

- Why It’s Favored by Users: Immediate cash access without any credit checks or hidden charges.

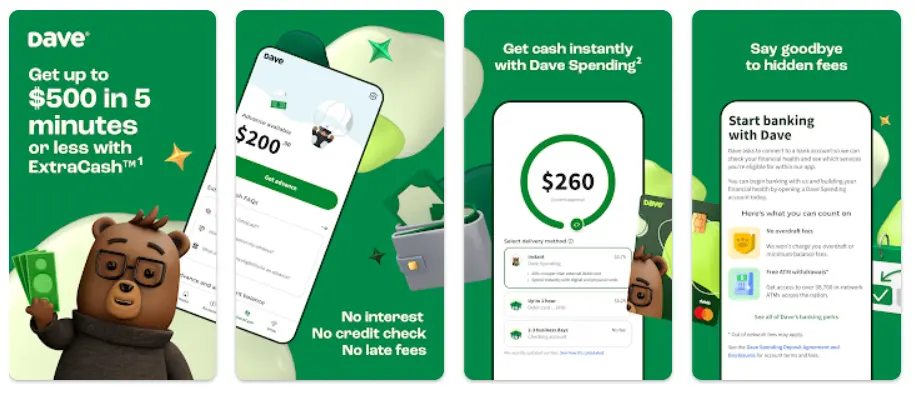

5. Dave

Dave is a leading money lending platform in the US, designed to provide small cash advances to help users avoid overdraft fees.

With added features like budgeting tools, it stands out as a holistic financial app that helps users manage their money smarter while offering quick loans when needed.

-

- Unique Features: Up to $500 cash advance with no interest or credit check. Built-in budgeting and spending tracking tools.

- Subscription Models: $1 monthly membership fee; cash advances have no additional fees.

- User Base: 10 million+ users across the US.

- Why It’s Favored by Users: Affordable and user-friendly with budgeting support integrated into the platform.

6. Chime

Chime is one of the best money lending platforms in the US, combining banking services with small, short-term loans.

Its feature-rich app allows users to save, spend, and borrow within one platform.

The SpotMe feature provides overdraft protection, effectively making small loans available to users without fees or high-interest rates.

-

- Unique Features: SpotMe overdraft protection up to $200. No minimum balance or overdraft fees.

- Subscription Models: Free banking services; optional fees for premium services.

- User Base: 12 million+ users in the US.

- Why It’s Favored by Users: Seamless combination of banking and lending with zero fees for basic services.

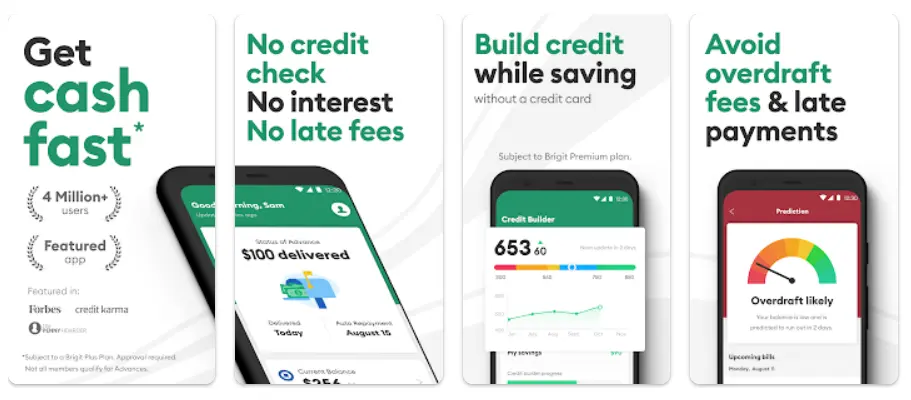

7. Brigit

Brigit is a popular money lending app designed for users who want more control over their financial health.

In addition to offering cash advances, Brigit provides financial insights, budgeting tips, and credit-building tools.

The app’s user-centric design makes it a favorite for those looking to improve their credit while managing expenses.

-

- Unique Features: Cash advances up to $250 with no interest. Credit-building tools and financial health reports.

- Subscription Models: Free version available; premium subscription at $9.99 per month for added features.

- User Base: Over 2 million active users in the US.

- Why It’s Favored by Users: Comprehensive financial management tools alongside lending features.

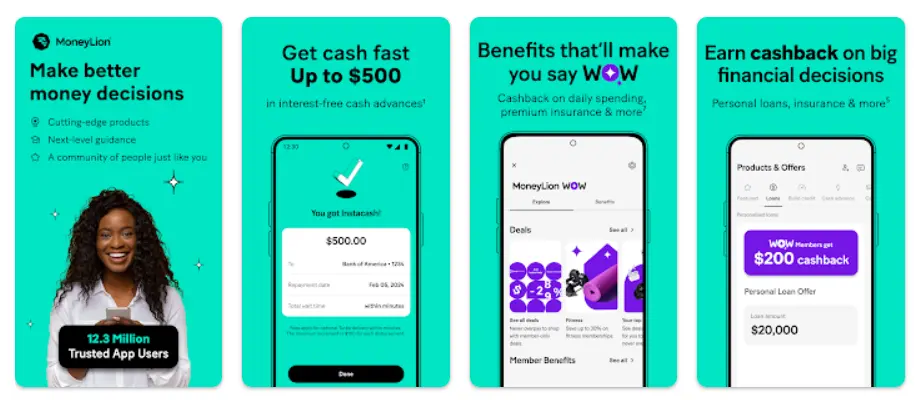

8. MoneyLion

MoneyLion is a comprehensive financial app that stands out as one of the best money lending platforms in the US.

By offering a suite of services, including credit-building tools, personal loans, and cashback rewards, it’s more than just a lending app.

MoneyLion helps users build long-term financial health while accessing the funds they need, making it a go-to platform for many.

-

- Unique Features: Provides personal loans, credit-builder loans, and cashback rewards.

- Subscription Models: Free version available; premium subscription at $19.99 per month for additional perks.

- User Base: Over 5 million active users in the US.

- Why It’s Favored by Users: Combines lending with credit-building tools, offering a holistic approach to personal finance.

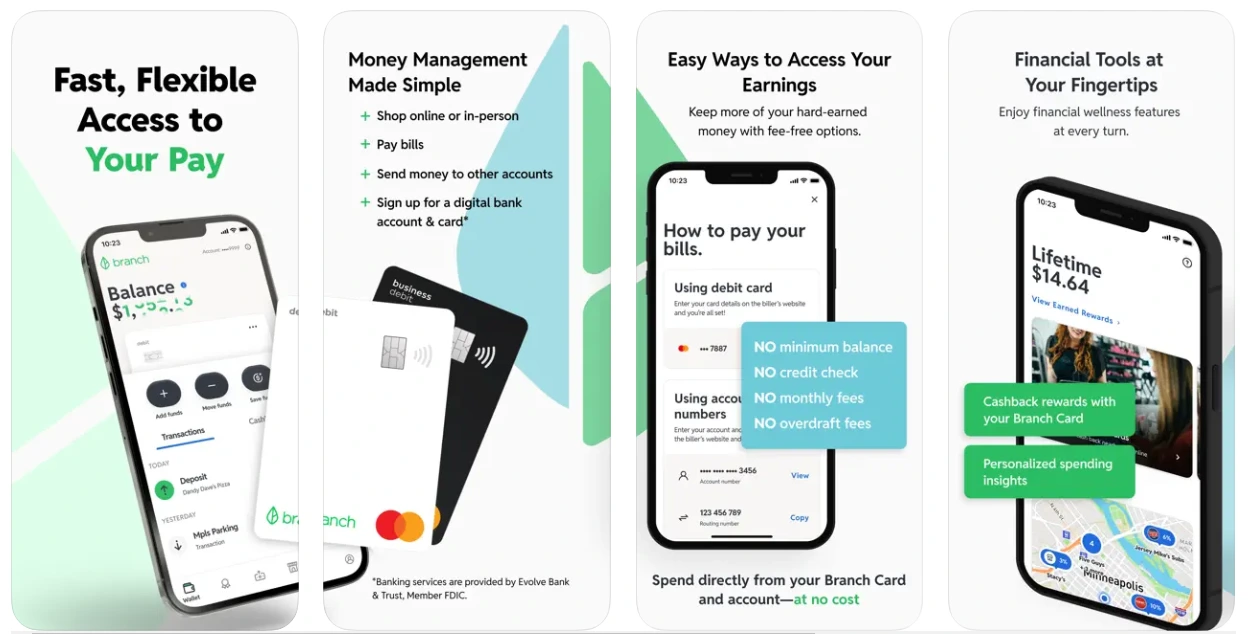

9. Branch

Branch is one of the leading money lending apps in the USA, designed to provide instant access to earned wages.

Ideal for users who need quick cash without relying on traditional loans, Branch offers a flexible solution for people to avoid payday loans and the associated high fees.

It's a popular choice for those looking for a fast and simple borrowing experience.

-

- Unique Features: Allows users to borrow against wages already earned, with no interest.

- Subscription Models: Free to use with a voluntary tipping option for withdrawals.

- User Base: Over 2 million active users in the US.

- Why It’s Favored by Users: Easy access to funds without credit checks or fees.

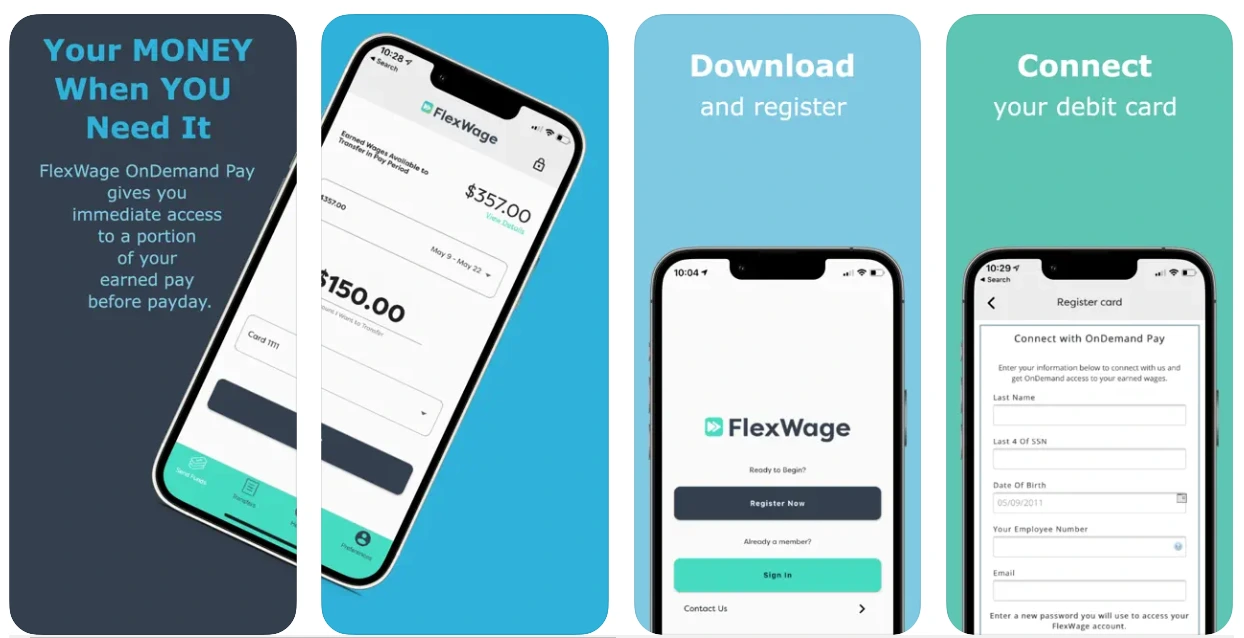

10. FlexWage

FlexWage is a unique money lending platform catering to users who need to access wages they've already earned.

It stands out for offering wage advance services with no hidden fees and is designed to be an easy-to-use solution for avoiding payday loans.

FlexWage helps employees manage cash flow with ease and flexibility.

-

- Unique Features: Instant access to earned wages, with no interest or hidden charges.

- Subscription Models: Free to use with a small fee for expedited withdrawals.

- User Base: Over 1.5 million active users in the US.

- Why It’s Favored by Users: Helps users manage short-term cash flow without resorting to payday loans.

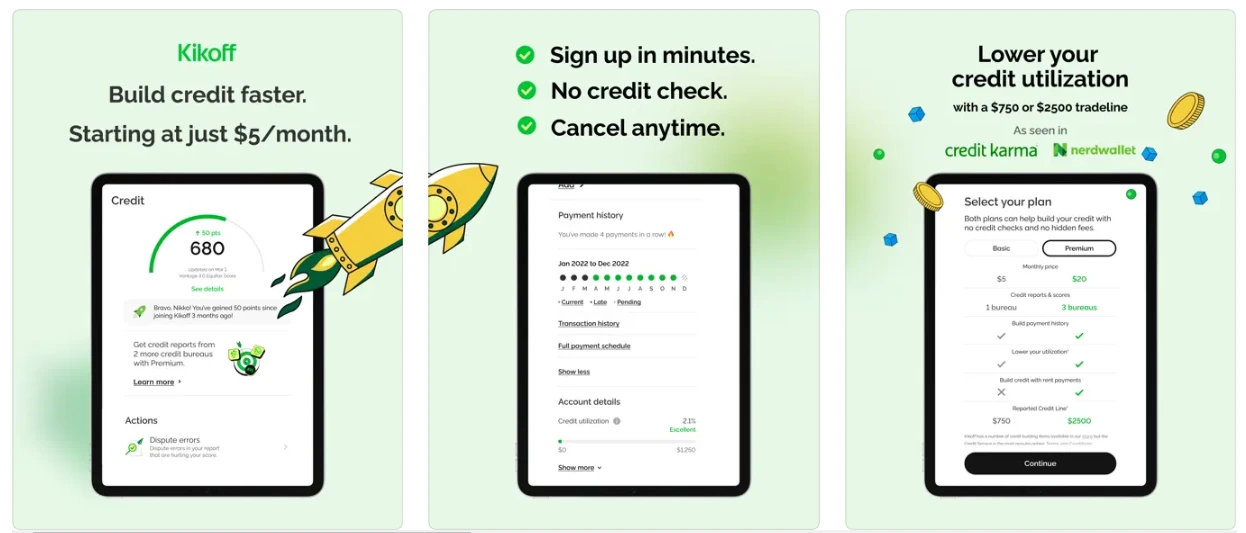

11. Kikoff

Kikoff is one of the leading money lending apps designed for users looking to build or rebuild their credit.

Kikoff offers a simple, no-fee credit-building loan, making it a great option for those new to credit or looking to improve their score.

It helps users establish a positive credit history without the hassle of high interest rates or long approval processes.

-

- Unique Features: Credit-building loans with no interest or fees.

- Subscription Models: Free to use, no membership fees or hidden costs.

- User Base: Over 500,000 active users in the US.

- Why It’s Favored by Users: No fees, no interest, and an easy way to build credit.

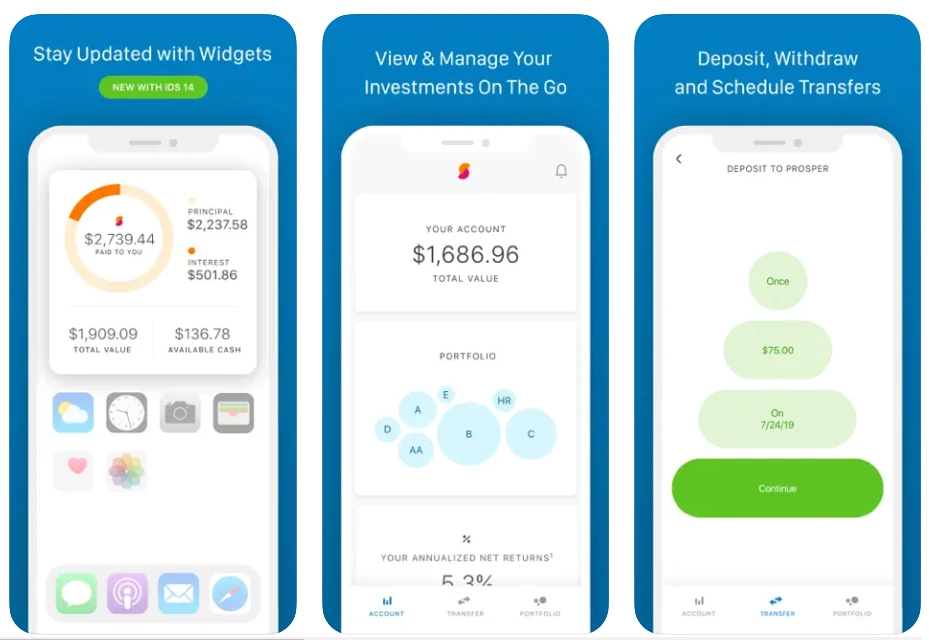

12. Prosper

Prosper is one of the most popular money lending apps in the US, providing personal loans with competitive interest rates.

As a peer-to-peer lending platform, Prosper connects borrowers with investors, offering a transparent and flexible loan process.

It's an excellent option for those who want a streamlined borrowing experience with a solid reputation.

-

- Unique Features: Peer-to-peer lending platform connecting borrowers with individual investors.

Personal loans with flexible terms. - Subscription Models: One-time origination fee applied, with no annual fees.

- User Base: Over 1.8 million users in the US.

- Why It’s Favored by Users: Transparency, competitive rates, and flexibility in loan terms.

- Unique Features: Peer-to-peer lending platform connecting borrowers with individual investors.

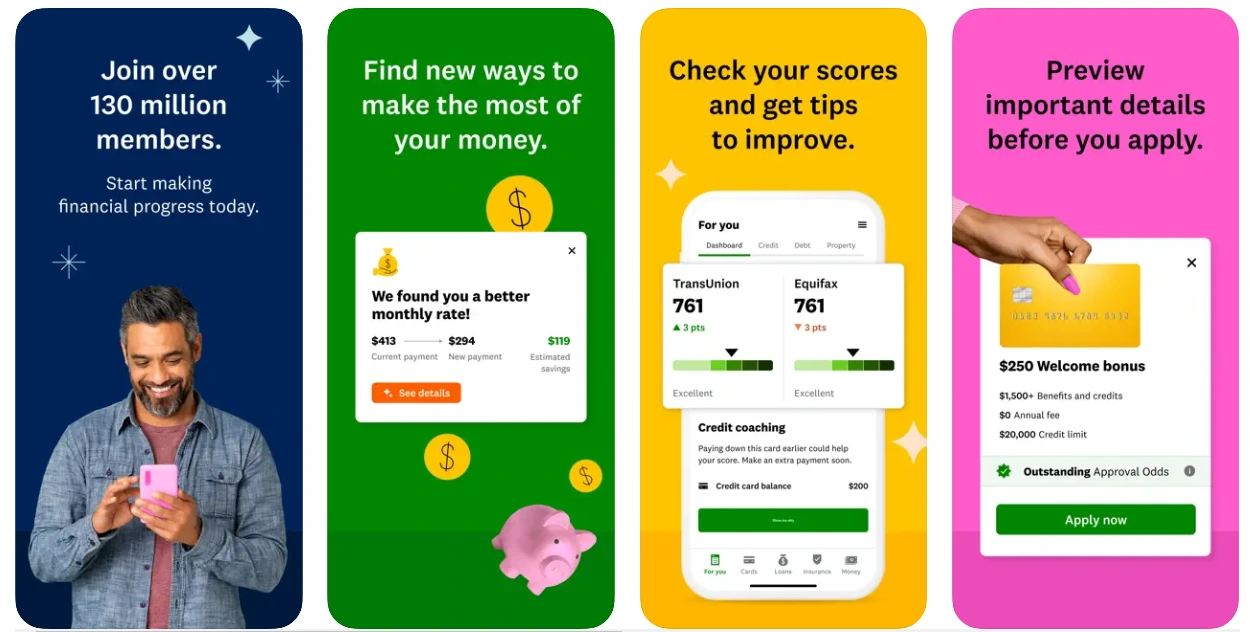

13. Credit Karma

Credit Karma isn’t just for credit score monitoring—it also offers personal loans with no fees and competitive interest rates.

By leveraging its vast user data, Credit Karma helps users find the best loan deals available to them.

It’s an excellent app for those looking for a fast and easy borrowing experience, especially for individuals trying to rebuild or maintain their credit.

-

- Unique Features: Offers personal loans with no fees. Uses data to help users find the best loan offers.

- Subscription Models: Free to use, with no membership fees.

- User Base: Over 100 million users globally.

- Why It’s Favored by Users: Free credit score monitoring and personalized loan recommendations.

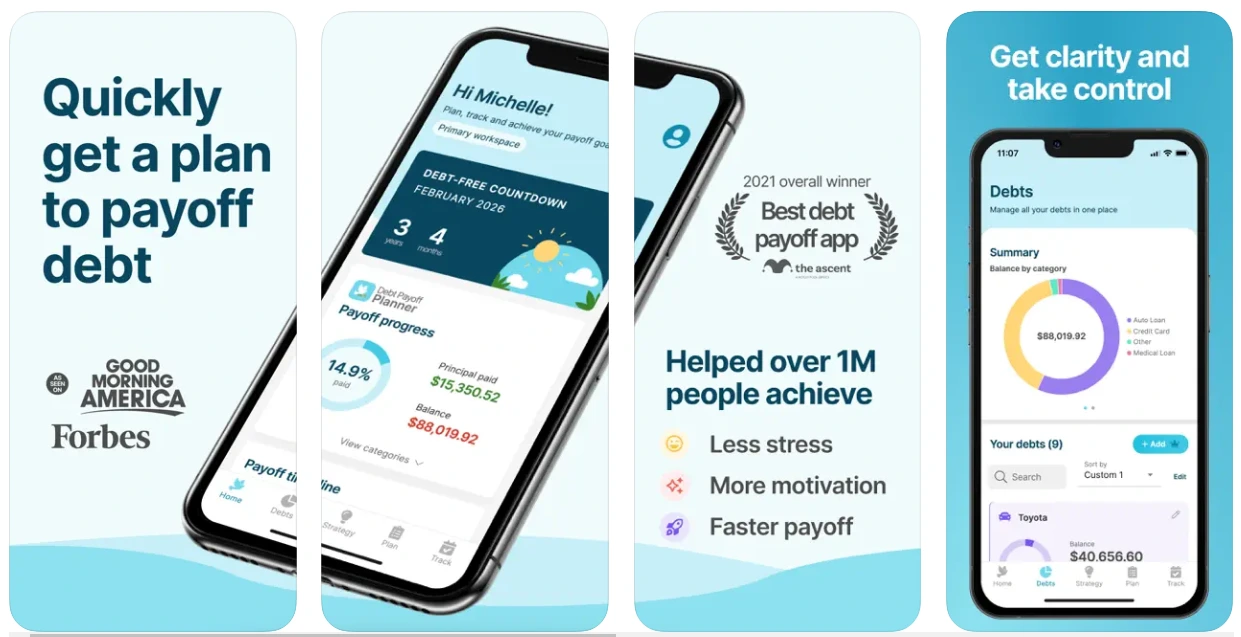

14. Payoff

Payoff is a popular money lending app focused on helping users pay off credit card debt with fixed-rate personal loans.

This app offers a structured and straightforward way to consolidate high-interest debt into a single, manageable monthly payment.

It’s ideal for users looking to take control of their finances and eliminate credit card debt.

-

- Unique Features: Focuses on credit card debt consolidation with fixed-rate loans. Offers financial counseling and debt management tools.

- Subscription Models: No fees for loan applications; interest rates depend on creditworthiness.

- User Base: Over 500,000 users in the US.

- Why It’s Favored by Users: Simplified debt repayment and financial management tools.

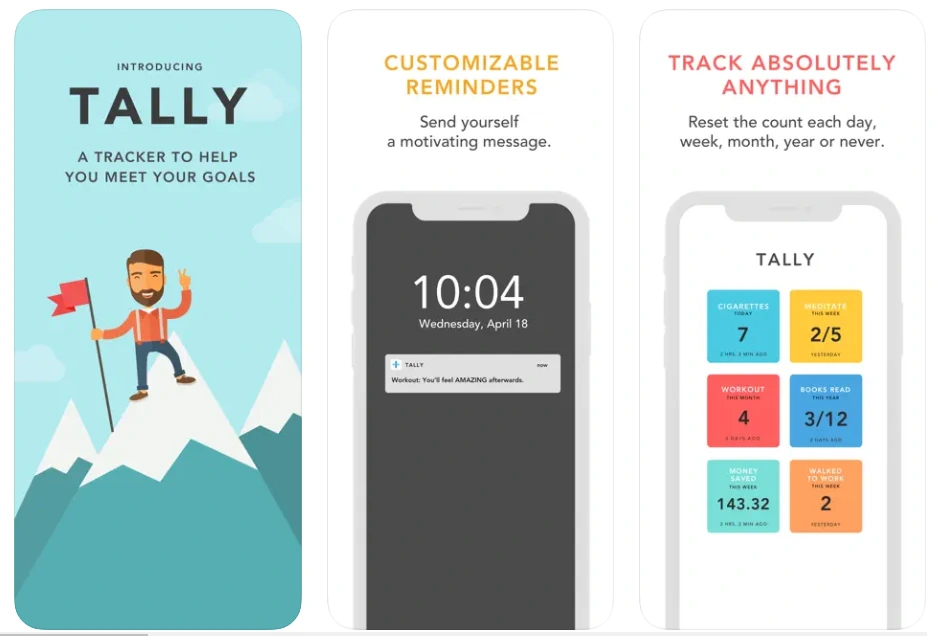

15. Tally

Tally is an app focused on simplifying credit card payments by consolidating multiple credit card balances into one manageable monthly payment.

It’s a great choice for users who struggle to keep track of multiple credit card due dates and interest rates.

Tally helps users save on interest and pay off debt faster.

-

- Unique Features: Consolidates credit card debt into one payment with lower interest rates. Credit management and automatic payment features.

- Subscription Models: No monthly fees for users; interest rates depend on credit scores.

- User Base: Over 1 million active users in the US.

- Why It’s Favored by Users: Simplifies credit card management and helps save on interest.

16. SpringFour

SpringFour is a financial wellness app that connects users with a network of financial assistance programs.

It’s not a traditional lending app but provides a valuable service by helping users find aid programs for housing, utilities, and other bills.

This app is especially useful for those in financial hardship seeking solutions to manage their expenses.

-

- Unique Features: Connects users with financial aid programs for various needs. Provides financial counselling and budgeting tips.

- Subscription Models: Free to use with no membership fees.

- User Base: Over 200,000 users in the US.

- Why It’s Favored by Users: Offers real solutions for users struggling with expenses and financial stress.

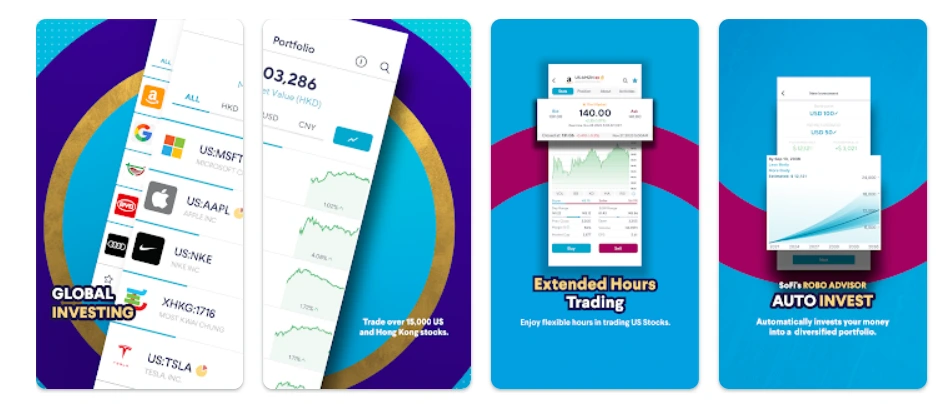

17. Sofi Invest

SoFi Invest is a newer offering from SoFi that allows users to invest in stocks, ETFs, and cryptocurrency.

Although not strictly a lending app, SoFi Invest helps users manage their finances by offering the ability to invest and grow their wealth, making it an attractive platform for anyone looking to enhance their financial position.

-

- Unique Features: Investment options in stocks, ETFs, and crypto. No fees for managing investments.

- Subscription Models: Free to use for basic investing; premium features available for $5/month.

- User Base: Over 500,000 users in the US.

- Why It’s Favored by Users: No fees, easy-to-use platform, and diverse investment options.

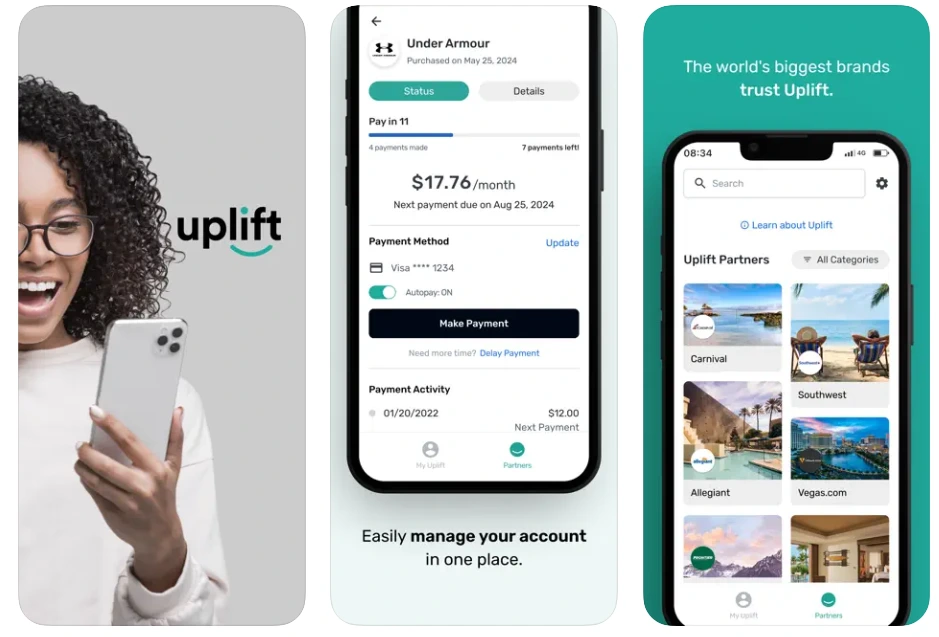

18. UpLift

UpLift is an online loan platform that specializes in financing travel, medical, and educational expenses.

It’s one of the top money lending apps for users looking to finance large purchases or unexpected expenses.

UpLift offers flexible loan options with transparent terms, making it a great choice for those looking to pay for big-ticket items.

-

- Unique Features: Focused on travel, medical, and education-related loans. Transparent terms with no hidden fees.

- Subscription Models: No fees for application; interest rates vary based on credit.

- User Base: Over 100,000 users in the US.

- Why It’s Favored by Users: Specializes in high-ticket loans with flexible terms and no hidden fees.

Here’s Why You Should Develop a Money Lending App

Are you considering entering the money lending market with your very own app?

The rise in demand for easy-to-use, accessible financial solutions makes 2025 the perfect time to develop a money lending app.

Here are three major reasons why you should take the plunge:

1. Increased Demand for Convenient Borrowing Solutions

As more people turn to smartphones for financial solutions, the demand for mobile money lending apps is skyrocketing.

In fact, the global digital lending market is expected to grow at a CAGR of 15.8% from 2023 to 2030.

With more users relying on mobile apps for personal finance management, developing a money lending app positions you at the forefront of this growing trend.

2. Easy Access to a Large User Base

money lending apps attract users from a wide demographic.

Whether it's individuals looking for personal loans, small businesses seeking capital, or people simply needing cash advances, money lending apps have a universal appeal.

By offering a platform that’s simple, transparent, and user-friendly, you can tap into a broad customer base, potentially reaching millions of users.

3. Innovative Technology to Drive Better Financial Decisions

money lending apps that leverage AI and machine learning, like Upstart, are changing the way loans are evaluated and processed.

These technologies not only improve loan approval times but also create more equitable loan terms for users.

By integrating such features into your app, you can provide smarter financial solutions, offer competitive interest rates, and reduce the risk for both borrowers and lenders.

Creating a money lending app is not just about providing a service—it’s about meeting the evolving needs of users and offering them a seamless, efficient way to handle their finances.

JPLoft Here to Help You

Ready to bring your money lending app idea to life?

At JPLoft, as a leading money lending app development company, we specialize in developing top-notch money lending apps that are not only user-friendly but also packed with innovative features.

Whether you’re looking to create a peer-to-peer platform, integrate AI-driven loan approvals, or offer flexible repayment terms, we’ve got you covered.

Our team of experts can help you build a secure, scalable, and reliable app that meets the needs of today’s borrowers and lenders.

With years of experience in app development and a strong portfolio of successful projects, we are the ideal partner to help you bring your vision to life.

Don’t wait to join the booming money lending industry—contact us today to get started on your money lending app development!

Conclusion

As we move further into 2025, the demand for efficient, flexible, and accessible money lending solutions continues to rise.

Whether you're an individual looking for a small cash advance or a business seeking a larger loan, money lending apps are transforming the way people borrow money.

By offering transparency, ease of use, and quick access to funds, these apps are setting new standards for the financial industry.

If you're considering developing your own money lending app, now is the perfect time.

The market is ripe for innovation, and with the right technology and user-focused features, you can create an app that stands out in a competitive market.

FAQs

The development time for a loan lending app can vary based on complexity and features. On average, it takes around 3-6 months to create a fully functional app.

Key features to include are loan application and approval processes, repayment tracking, user profiles, security protocols, and integration with payment gateways.

The cost to develop a loan lending app varies depending on the complexity and features. On average, it ranges from $30,000 to $100,000 or more for a custom-built app.

Share this blog