At our Loan Lending Mobile App Development Company, we understand the dynamic nature of lending operations. With our deep financial tech expertise, we offer development services that cater to diverse lending models, regulatory compliances, and user expectations. Our loan lending app development solution ensures fast approvals, transparent borrower interactions, and simplified collections.

Our expert team will work closely with you to tailor a digital platform that suits your brand, risk policies, and growth plans. From conceptualizing the UX to deploying the final product, we prioritize performance, scalability, and security. Whether you want to hire loan lending app developer resources on-demand or partner for full-cycle development, we provide you the flexibility and excellence you deserve.

The loan lending industry is evolving rapidly, offering huge innovation potential. Now is the perfect time to create a smart platform that simplifies the borrowing process.

The digital lending market is projected to grow to a massive $43.63B by 2032.

The global AI in lending market is projected to reach USD 58.1 billion by 2033.

Lenders benefit from a 99% accuracy boost after adopting AI for real-time data processing.

Mobile lending users are growing at a 25% annual rate, shifting towards digital-first solutions.

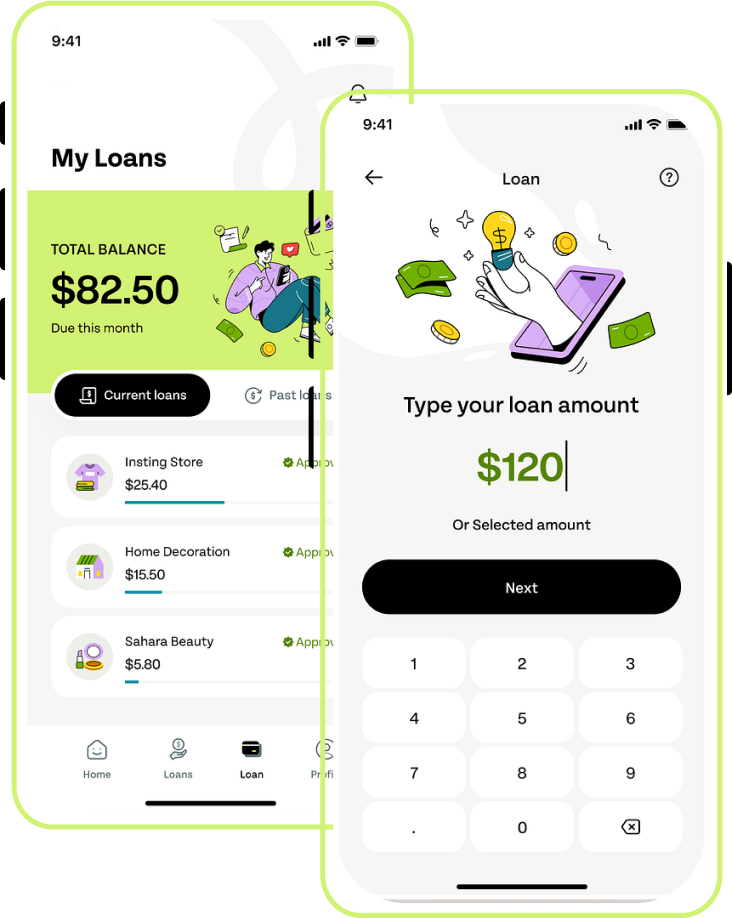

As a premier Loan Lending App Development Company, we deliver cutting-edge development services to cater to diverse financial models. Whether you're launching a money-lending app or expanding your services, we're here to offer a wide range of solutions. From custom loan-lending apps to AI-powered services, we provide it all, ensuring you make a strong impact in the market.

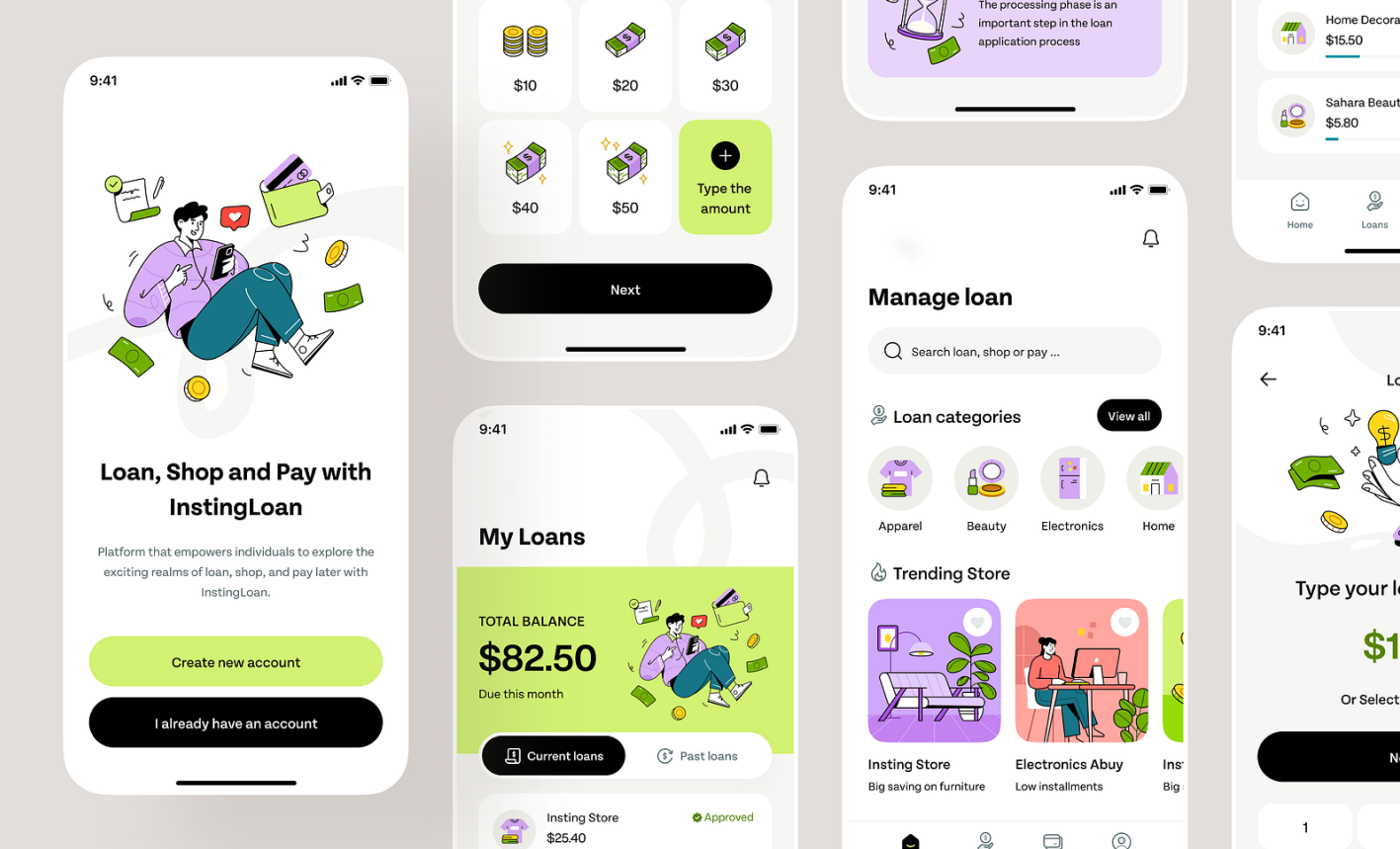

Our loan lending app development solution focuses on crafting tailored platforms that align with your business goals. From unique loan approval workflows to custom user interfaces, we create apps that reflect your brand and improve customer satisfaction.

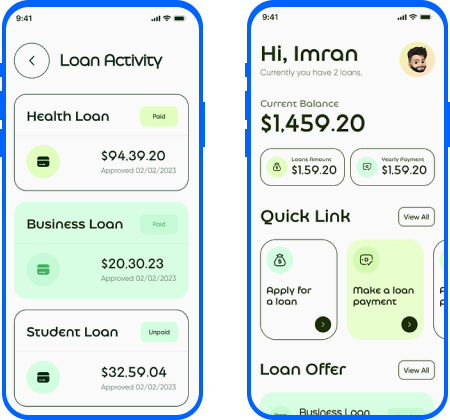

Our money lending mobile app development services enable seamless lending experiences on smartphones. We integrate key features like KYC automation, payment gateways, and loan tracking to enhance usability and ensure high performance.

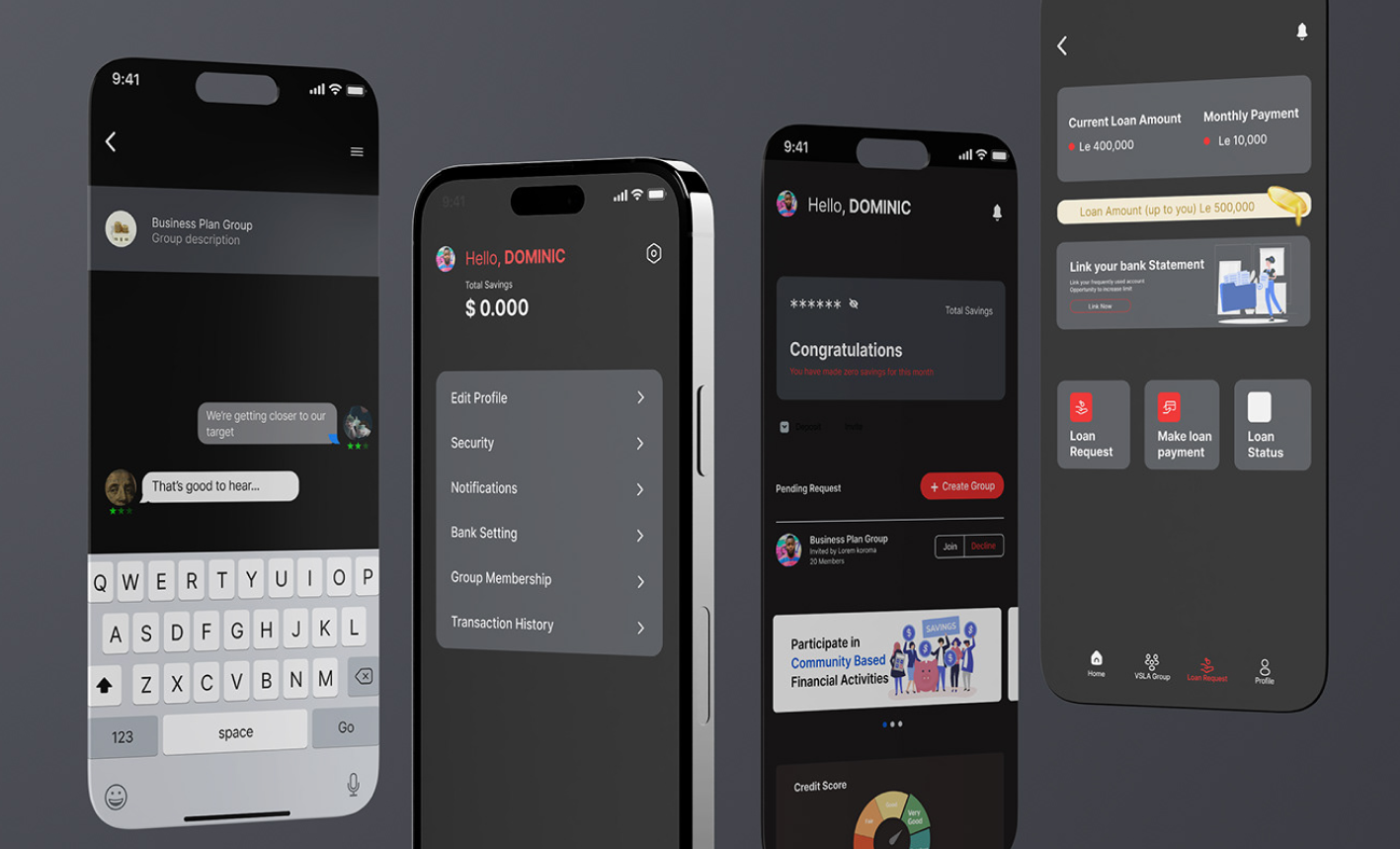

Enable direct connections between borrowers and lenders with P2P apps. Our P2P development services ensure that these apps are equipped with secure matchmaking, automated credit scoring, and interest calculation tools to build trust and streamline operations.

Revolutionize loan lifecycle management with loan-lending management app development. With our powerful software solution, we offer tools for tracking repayments, calculating interest, and handling defaults, all with minimal manual effort.

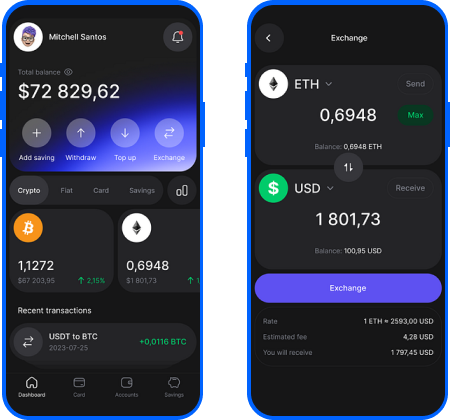

Boost accessibility and scalability with cloud-enabled platforms. Our Loan Lending software Development Services utilize the latest technologies to create secure, globally accessible lending apps that ensure uptime and efficient operations.

We provide seamless integration of third-party tools such as payment gateways, credit bureaus, and financial analytics software into your lending platform. Our lending software development services ensure smooth collaboration between all components for a hassle-free experience.

Revolutionize the way you handle loan processing with our cutting-edge money lending app development services. With our expertise, you can build a smarter, faster, and more reliable loan lending platform that delivers value to both lenders and borrowers.

Harness the power of AI to evaluate risk, predict creditworthiness, and make smarter, data-driven loan decisions.

Speed up the approval process with automated AI algorithms that instantly evaluate applications, ensuring faster service.

Protect your app from fraud with AI’s advanced algorithms that detect and prevent suspicious activities in real-time.

Leverage AI to streamline operations, reduce overhead costs, and optimize loan processing for greater business efficiency.

Offer personalized loan plans specifically tailored to the unique needs of each borrower, based on AI insights

AI delivers tailored experiences and smart recommendations, boosting customer satisfaction and fostering long-term borrower relationships.

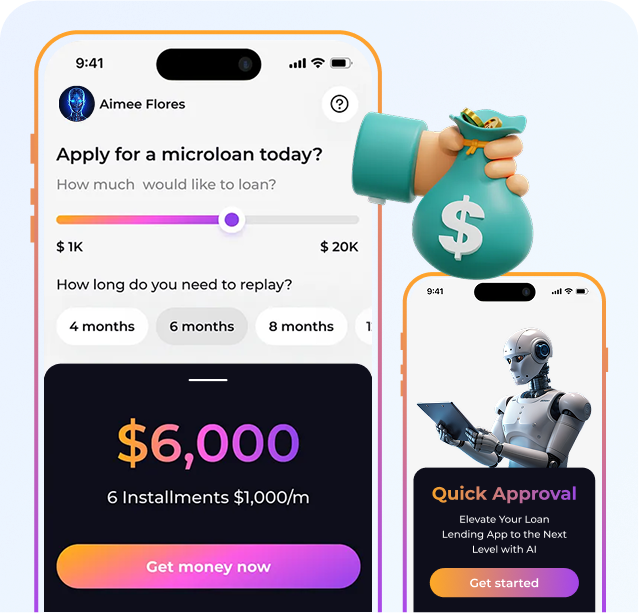

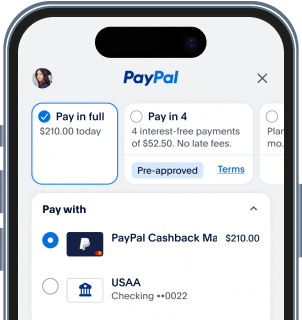

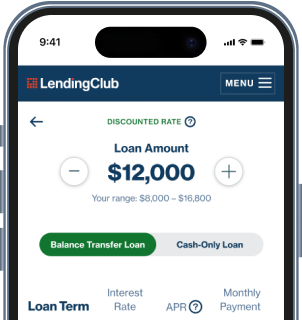

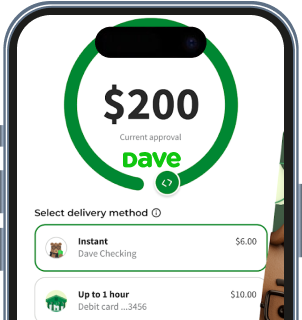

Want to launch a money-lending app quickly? Our loan lending clone app development services are your perfect starting point. We help you create a trustworthy lending experience for your users that fits their needs and increases your ROI.

Create a trusted and seamless lending platform with PayPal-inspired features. This clone enables efficient fund disbursal, borrower-lender communication, and secure payment handling with advanced financial tools.

Deliver efficient P2P lending solutions with transparent workflows. This platform includes automated matchmaking systems, streamlined credit evaluations, and intuitive dashboards to enhance lending operations.

Empower SMEs with a Dave-style lending platform tailored for quick credit access. The clone offers tools for comprehensive risk analysis, credit line management, and borrower financial health tracking.

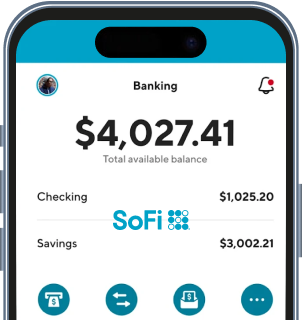

Build a robust platform for personal and educational lending inspired by SoFi. This solution integrates advanced refinancing tools, personalized borrowing options, and seamless user interfaces for both borrowers and lenders.

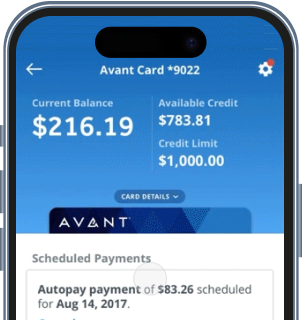

Launch a credit-builder lending platform with Avant-inspired capabilities. The platform focuses on improving user credit access, offering tailored loan structures, and detailed repayment tracking to meet user needs effectively.

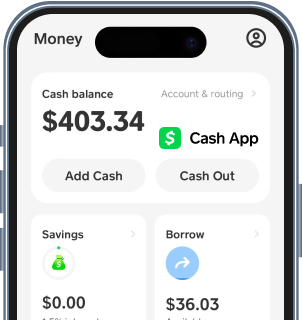

Develop a micro-lending app like Cash that facilitates small, fast loans for users. The app integrates borrower profile management, repayment plan structuring, and secure digital transaction features for smooth operations.

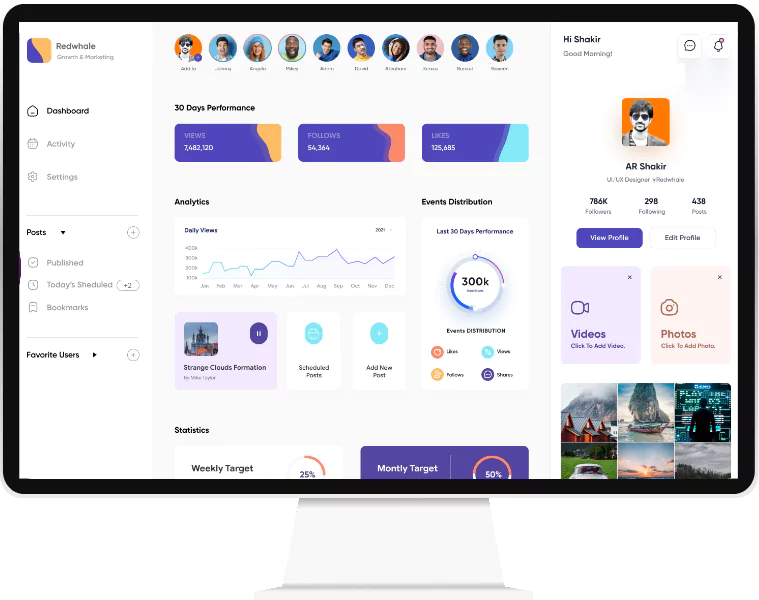

Our work spans from fully custom Lending software development company solutions to rapid software development services. Explore our portfolio for real-world examples of improved loan cycles, increased borrower satisfaction, and better ROI for financial institutions.

Experience effortless borrowing with LendLoom. Our loan lending app development solutions connect you to top loan options, offering clear terms and personalized advice to help you make the best financial choices.

Achieve financial clarity with LendSphere. Our custom loan lending app development services let you compare loan prices and terms conveniently, ensuring you find the right loan that meets your needs with transparency and simplicity.

We bring your loan-lending vision to life with custom loan-lending app solutions that are secure and efficient. That’s what makes us the best loan-lending mobile app development company. We help businesses like yours to take steps forward in the digital realm and build a loyal customer base.

Designed for individuals seeking quick financial aid, our loan lending platform development includes features like eligibility checks, document uploads, and instant approvals.

Empower small and medium enterprises with flexible and efficient lending tools.

Modernize traditional mortgage processes with digital tools for better efficiency.

Our Loan Lending App Development Services include secure P2P networks that match lenders and borrowers seamlessly.

Deliver inclusive financial services to underserved communities with advanced microfinance platforms.

With loan lending app development, we create platform that facilitate long-term financing with robust management systems.

Provide short-term financial relief with secure, fast, and reliable payday loan apps.

Support businesses with revolving credit systems to meet their dynamic funding needs.

We have a unique loan lending app development process where we go beyond traditional development and partner with you at every step, from ideation and personalized strategy sessions to continuous feedback loops, ensuring your app evolves with market needs.

We collaborate to understand your specific needs and goals, ensuring a clear development roadmap.

Our team designs intuitive user interfaces that provide seamless navigation and user satisfaction.

With robust backend systems, we ensure functionality, scalability, and security for your money lending mobile app development services.

From KYC automation to payment gateways, we integrate all necessary features to enhance platform usability.

Extensive testing ensures the platform is bug-free, secure, and performs optimally.

We deploy the platform and provide ongoing maintenance to keep your app updated with the latest advancements.

The global digital loan lending market will reach $889.99bn by 2030, and businesses like yours can tap into this opportunity with the right technology. At our Lending software development company, we connect you with skilled, experienced lending software developers who specialize in delivering highly customized solutions. Whether you're building a robust loan platform or enhancing an existing one, we ensure your app is secure, scalable, and ready for the future.

We offer flexible engagement models that allow you to hire loan-lending app developer teams designed to align with your project's scale, budget, and timeline. Our approach ensures you get exactly what you need, whether that’s a small team for a quick launch or a larger, even more specialized team for a complex, long-term project. Our goal is not just to deliver but to create an ongoing partnership that empowers your growth. So, why wait? Partner with the best money lending mobile app development company and flourish in the market.

When you choose JPLoft, you’re partnering with the best loan-lending app development company, committed to delivering exceptional results. Our team of experts blends industry insights with innovative technology to create secure, scalable, and user-friendly solutions. Here’s what sets us apart:

We have years of experience in lending app development services that enable us to deliver custom solutions.

From ideation to post-launch support, we cover every stage of loan lending app development.

Hire money-lending app developers from us and leverage cutting-edge technology to build secure and scalable platforms that drive success.

At JPLoft, we offer transparent loan lending app development costs that ensure you receive a top-quality app that fits your budget without compromising quality.

Our loan lending software Development Company offers ongoing maintenance and updates.

We prioritize your goals, ensuring high ROI and user satisfaction.

Let’s discuss your goals and build a lending solution that surpasses your expectations.

As a Loan Lending App Development Company, we offer end-to-end services that cover strategy, design, development, deployment, and ongoing support. Our expertise in Lending software development ensures we deliver secure, compliant, and user-friendly platforms. We tailor solutions to your business model, incorporate industry best practices, and focus on continuous optimization.

In Loan Lending App Development Services, we prioritize data security and regulatory compliance by employing top-tier encryption, regular audits, and adherence to standards like PCI-DSS and GDPR. Our platforms include automated KYC and AML checks to ensure trustworthy borrower-lender relationships, protecting both user data and your brand reputation.

We provides fully customizable solutions. Whether you need unique lending workflows, credit scoring models, custom dashboards, or integrations with third-party APIs, we adapt every element to align with your brand identity, operational needs, and long-term objectives, ensuring a truly bespoke product.

Absolutely. Our flexible engagement models allow you to hire loan lending app developer teams for specific tasks or ongoing support. Whether it’s adding features, optimizing performance, or handling maintenance, our dedicated professionals ensure your platform remains efficient, secure, and aligned with evolving market demands.

While costs vary based on complexity and features, a basic lending app can start around $20,000. Timelines range from a few weeks to several months. Our lending software development services team will collaborate with you to set realistic expectations, provide detailed cost breakdowns, and establish clear milestones for project completion.

Discover the stories behind the success and the partnerships we cherish.

Empowering 1000+ clients globally with innovative Web & Mobile App Development solutions.

Years of experience

Projects Successfully Completed

Users Trust Our Clients' Platforms

Secured by Our Clients

Every project tells a story of innovation, and mutual success.

Get the latest updates on development insights, technologies and trends.

United States(Denver, New York, Dallas, Chicago, Texas, Austin), United Kingdom, Australia(Melbourne, Sydney, Adelaide, Brisbane, Perth, Canberra), Singapore, Canada, United Arab Emirates(Dubai), Saudi Arabia, Netherlands, Switzerland, France, Africa, Europe, Middle East, etc.