Are you planning to develop a loan lending app?

If so, you’re already on the path to transforming how people access loans in a hassle-free way.

But here’s the deal: the features you choose will make or break your app.

From essential MVP features to advanced functionalities, this guide will help you understand what makes a loan lending app successful.

Let’s dive in and explore the must-have features to build an app that’s not just functional but loved by your users.

Why Are Features Important in Loan Lending Apps?

Features are the backbone of any loan lending app.

They define how smoothly your app functions, how secure it is, and how effectively it serves both lenders and borrowers.

Imagine an app where users can’t track their loans or make payments easily.

Would they stick around? Probably not.

That’s why the right loan lending app features are critical, they create a seamless experience that builds trust and keeps users coming back.

Whether it’s offering borrowers instant access to loans or enabling lenders to monitor repayments, every feature plays a role in ensuring your app’s success.

The better the features, the stronger the foundation for your app.

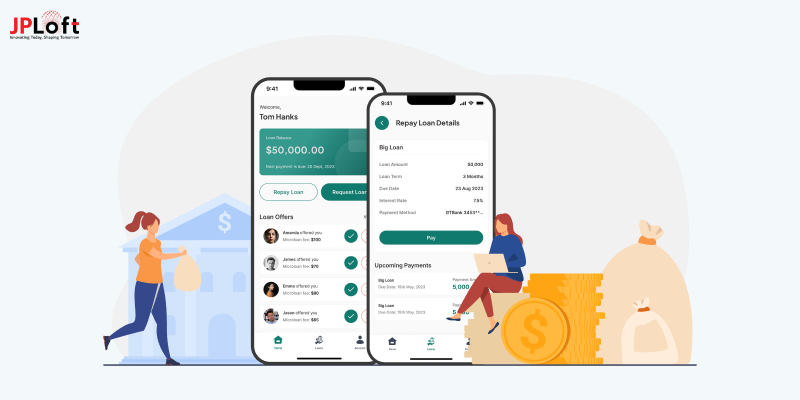

Understanding Loan Lending App Panels

If you want to create a loan lending app, it’s a good idea to understand it’s different panels.

A loan lending app operates through three core panels, each serving a unique purpose to ensure smooth operations and excellent user experience.

Let’s break them down:

1. Admin Panel

This panel is the brain of your app. It helps you manage users, monitor transactions, and oversee the app's performance.

Think of it as your control room, where you can keep everything in check and running smoothly.

Key Functions:

-

Manage user data (lenders and borrowers)

-

Generate detailed reports

-

Oversee loan approvals and repayments

-

Monitor app activity for security and compliance

2. Lender Panel

The lender panel caters to individuals or organizations providing loans.

It’s where they can list loan options, review applications, and track repayments.

Key Functions:

-

Create and customize loan offerings

-

Set interest rates and terms

-

Monitor borrower repayments

-

Access borrower credit details and profiles

3. Borrower Panel

This panel is all about the borrower.

It provides an intuitive space to browse loans, apply, and manage repayments.

Key Functions:

-

Apply for loans with ease

-

Upload required documents

-

Monitor loan status and repayment schedules

-

Receive notifications for payments and updates

These panels form the foundation of a loan lending app, ensuring that every stakeholder - admins, lenders, and borrowers - has a tailored experience.

Loan Lending App Essential (MVP) Features

Below is a comprehensive table of 15 essential loan lending app features for the Admin Panel, Lender Panel, and Borrower Panel:

|

Admin Panel |

Lender Panel |

Borrower Panel |

|

User Management |

Loan Offer Creation |

User Registration |

|

Loan Tracking |

Application Review |

Loan Application |

|

Analytics and Reporting |

Interest Rate Calculator |

Loan EMI Calculator |

|

Notifications Management |

Loan Status Monitoring |

Credit Score Check |

|

Data Security Tools |

Document Verification Tools |

Document Uploads |

|

Transaction History |

Repayment Scheduling |

Payment Tracking |

|

Loan Approval System |

Payment Tracking |

Loan Status Updates |

|

Role-Based Access Controls |

In-App Messaging |

Notifications |

|

Multi-Language Support |

Dynamic Dashboards |

User Dashboard |

|

Fraud Detection Tools |

Automated Notifications |

Push Notifications |

|

Profile Management |

Revenue Tracking |

Multi-Currency Support |

|

Payment Gateway Management |

Rating and Feedback System |

FAQ Section |

|

API Integration |

KYC Compliance Tools |

Loan Agreement Generation |

|

Performance Monitoring |

Multi-Currency Support |

Account Management |

|

Advanced Search Filters |

Data Export Options |

In-App Chat Support |

These features ensure your app's functionality and usability for all stakeholders.

Advanced Loan Lending App Features

It’s time to look at advanced feature for loan lending apps. Let’s get right into it, starting at:

► Biometric Authentication

Enhance the security of your app with fingerprint or facial recognition technology.

This advanced feature for loan lending apps ensures that only authorized users can access their accounts, adding an extra layer of security to sensitive financial data.

► AI-based Credit Scoring

Integrate artificial intelligence to calculate borrower credit scores based on their financial behavior.

This loan lending app feature improves accuracy in assessing creditworthiness and speeds up the approval process.

► Multi-Tier User Access

With multi-tier access, your loan MVP app features can include role-specific permissions for admins, lenders, and borrowers.

This helps maintain data security while giving users access to only the tools they need.

► Blockchain for Transactions

Implement blockchain technology to provide tamper-proof records of all financial activities.

This advanced loan lending app feature ensures transparency, making your app more trustworthy for lenders and borrowers.

► Personalized Loan Recommendations

Leverage machine learning to suggest loan options based on a user’s credit profile and preferences.

This advanced feature for loan lending apps enhances the borrower’s experience while increasing lender conversions.

► Real-Time Analytics

Provide lenders and admins with live data on loan performance and repayment trends.

This loan lending app advanced feature enables better decision-making by offering instant insights into financial activities.

► Smart Contract Integration

Use blockchain-based smart contracts to automate loan agreements and repayments.

This innovative loan lending app feature reduces paperwork and ensures transparency by enforcing terms digitally.

► Voice Search Capabilities

Enable borrowers and lenders to navigate the app and perform tasks like searching for loans using voice commands.

This accessibility-focused loan lending app feature makes your app user-friendly for all demographics.

► Chatbots for Customer Support

AI-powered chatbots offer 24/7 assistance to borrowers and lenders, resolving common queries and guiding users through the loan application process.

This advanced feature for loan lending apps enhances customer satisfaction.

► Gamified User Experience

Add gamification elements, such as progress bars and rewards for timely repayments.

This engaging loan lending app feature encourages users to interact more frequently with your app.

► Loan Restructuring Tools

Allow borrowers to renegotiate repayment terms during financial difficulties.

This feature for loan lending apps demonstrates empathy and improves borrower retention during challenging times.

► In-App Currency Conversion

Integrate real-time currency conversion to facilitate cross-border transactions.

This loan lending app advanced feature is essential for apps operating in multiple countries, making it easier for international users.

► Loan History Graphs

Provide visual representations of a borrower’s repayment history with graphs and charts.

This essential feature for loan lending apps simplifies complex data and helps users track their financial progress.

► Social Media Login

Simplify registration by allowing users to sign up using their social media accounts.

This loan lending app feature improves user onboarding and reduces friction for first-time users.

► Integration with Credit Bureaus

Automatically fetch credit reports during loan applications for faster decision-making.

This feature for loan lending apps streamlines the lending process and reduces manual effort.

► Multi-Platform Synchronization

Enable seamless access across devices like smartphones, tablets, and desktops.

This loan lending app advanced feature enhances flexibility, ensuring users can interact with your app anytime, anywhere.

► Machine Learning for Fraud Detection

Prevent fraudulent activities by using machine learning algorithms to analyze patterns and flag suspicious behavior.

This security-focused loan lending app feature protects users and lenders from potential risks.

► White Label Capabilities

Offer a customizable app that lenders can rebrand with their logos and colors.

This feature for loan lending apps is ideal for enterprises looking for tailored solutions without building an app from scratch.

► Automated Payment Scheduling

Allow borrowers to schedule automatic EMI payments, reducing the risk of missed deadlines.

This convenience-driven loan lending app feature improves repayment consistency and user satisfaction.

► Custom Loan Calculator

Provide an interactive loan calculator that lets borrowers experiment with interest rates, loan amounts, and repayment terms.

This essential feature for loan lending apps empowers users to make informed decisions.

► Augmented Reality Loan Visualization

Introduce an AR-based tool to visualize loan repayment timelines or interest savings.

This loan lending app advanced feature educates and engages users, making financial planning more interactive.

These advanced features transform a basic app into a comprehensive and competitive solution.

How to Select Features for Your Loan Lending App?

Choosing the right loan lending app features is crucial to meeting user expectations and the top loan lending app.

Here’s how you can decide which features to include:

1] Understand Your Target Audience

Start by identifying your audience.

Are you catering to personal loan borrowers, businesses, or financial institutions?

Knowing your users will help you prioritize features.

For example:

-

Borrowers might value features like credit score checks and EMI calculators.

-

Lenders may focus on analytics, loan tracking, and reporting.

2] Start with MVP Features

Focus on loan MVP app features to launch a minimum viable product.

These essential features form the foundation of your app, such as:

-

Loan application forms

-

Payment tracking

-

User dashboards This allows you to test the app in the market while saving time and budget.

3] Assess Your Budget and Timeline

Advanced loan lending app features like blockchain or machine learning might require significant investment.

Prioritize features that align with your budget and development timeline.

Start small and scale later by adding advanced features as your app grows.

4] Keep Scalability in Mind

Choose features that are scalable.

For example, if your app supports local lending today, consider integrating multi-currency support or in-app currency conversion later to expand to international markets.

5] Consider Security as a Priority

In financial apps, app security features like biometric authentication, blockchain, and fraud detection are non-negotiable.

These ensure trust and compliance with regulatory standards.

6] Include User Feedback

If you’re enhancing an existing app, gather feedback from current users to understand what they need.

This will guide you in adding relevant loan lending app advanced features.

7] Competitive Analysis

Research your competitors to identify industry-standard features.

Add unique functionalities like AR loan visualization or gamified user experiences to stand out in the market.

By carefully evaluating these factors, you can ensure your loan lending app features are not just functional but also user-centric and market-ready.

Build Your Loan Lending App with JPLoft!

Looking for a reliable loan lending app development company?

JPLoft specializes in crafting custom solutions tailored to your business needs.

Whether you need essential features for a loan lending app or advanced functionalities like blockchain and AI, our team delivers seamless development and support.

Let us help you build an app that drives success!

Conclusion

Selecting the right features for your loan lending app requires a balance of user needs, technical feasibility, and scalability. By starting with MVP features and gradually integrating advanced functionalities, you can create a robust and competitive app. Partner with JPLoft to bring your app vision to life.

FAQs

MVP features include loan applications, payment tracking, and credit score checks. These form the foundation of your app.

Integrate features like biometric authentication, fraud detection, and blockchain for transaction security.

Consider adding AI-based credit scoring, AR loan visualization, and smart contract integration for a competitive edge.

Start with essential features to create an MVP, then add advanced features as your app scales and gains users.

Scalability ensures your app can handle future updates, such as multi-currency support or integration with credit bureaus, as your business grows.

Share this blog