If you're looking for fast, hassle-free cash when you're in a pinch, you’ve probably heard of Dave, the app that helps you avoid expensive overdraft fees with small cash advances.

But what if Dave isn’t the app for you? You may ask, “What other apps like Dave can be a great replacement?”

Apps like MoneyLion, Brigit, Earnin, Empower, EveryDollar, and more are some of the top Dave alternatives.

In this blog, we’ll dive into some of the loan apps like Dave that offer similar benefits like no-interest cash advances, budget tracking, and even better perks.

From apps with quicker payouts to those with unique rewards programs, we’ll introduce you to a variety of Dave alternatives that help you manage your finances on your terms.

Say goodbye to the stress of unexpected expenses and hello to easy access to your hard-earned cash!

Key Statistics on the Cash Advance Market

Before diving into money-borrowing apps like Dave, let’s take a quick look at the market landscape!

-

- Dave's User Base: As of now, it has 10 million users and the number of Monthly Transacting Members (MTMs) grew by 17%, reaching 2.5 million.

- High-Frequency Borrowing: 38% of users account for 86% of all advances, with many borrowers using multiple cash advance apps.

- Debt Cycle Concerns: Payday lenders generate 75% of their fees from borrowers who take out over 10 loans per year, often leading to a debt cycle.

- Market Growth: The global cash advance app market is projected to reach $23.9 billion by 2024, driven by increased demand for short-term loans and mobile app convenience.

- Cash Advance Market: North America represented 40% of the total revenue, with Asia Pacific contributing 30%, Europe at 15%, Latin America at 8%, and the Middle East & Africa at 7%.

The statistical data demonstrates that cash advance applications such as Dave are witnessing unprecedented market expansion.

The current pace of growth guarantees the imminent arrival of numerous groundbreaking applications into the marketplace.

Rest assured, we've attended to your needs by assembling leading money loan apps like Dave which are transforming financial management practices.

Top 30 Best Apps like Dave: Explore Below

If you’re tired of relying on traditional loans or constantly worrying about unexpected expenses, you’ve probably considered using a cash advance app like Dave.

These apps give you quick access to small amounts of money without the fees that usually come with overdraft charges.

Now, the question comes: “What apps are like Dave with their unique features?”

Whether you need cash urgently or are just looking for a better financial solution, there are many money apps like Dave out there that can help.

Let’s take a look at some of the top options, complete with their pros, cons, and pricing details.

► Early Paycheck Apps

There are several cash advance apps, or should we say early paycheck apps like Dave that are available:

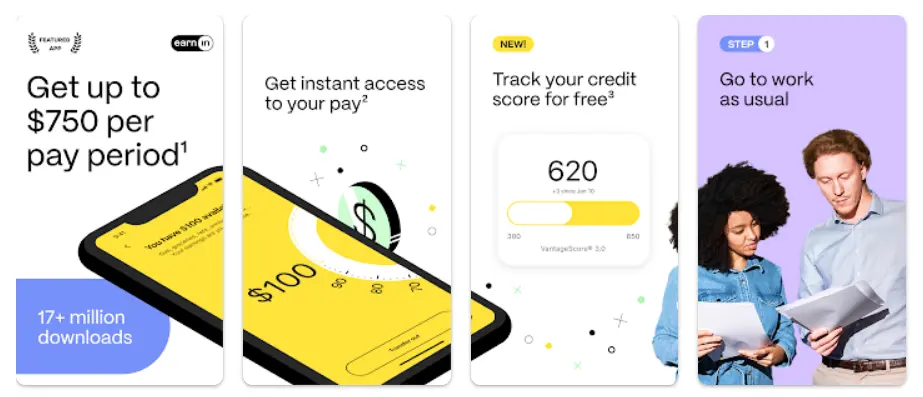

1. Earnin

Need cash before payday? Earnin is here to help you get access to your hard-earned wages. This is why it is famous as a top money-lending app.

This app like Dave, allows you to cash out up to $150 a day without interest or hidden fees.

It’s perfect for avoiding payday loans and late fees. Earnin also tracks your hours worked and offers flexible repayment options, making it an easy solution to keep your finances in check.

Features:

- No Interest or Fees

- Hour Tracking

- Flexible Repayment Options

|

Pros |

Cons |

|

No interest or hidden fees. |

Available only in selected regions. |

|

Tracks work hours for accurate payouts. |

Requires location services for accurate tracking. |

Pricing:

- Optional tip for service.

- Free-to-use, optional tipping.

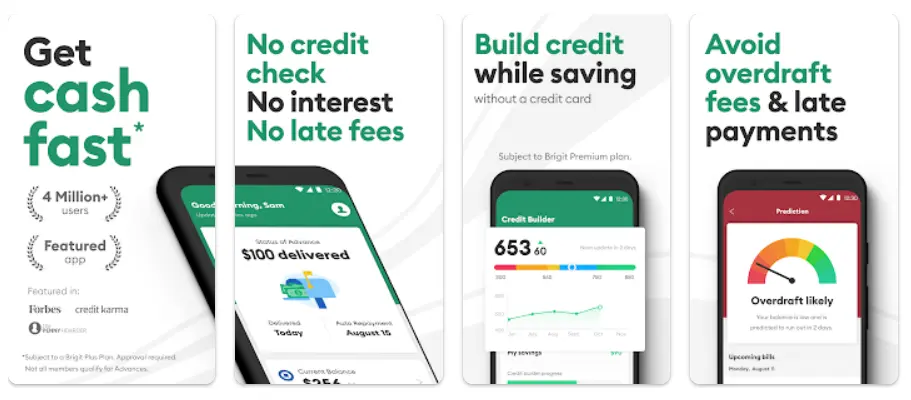

2. Brigit

Brigit is your go-to money app like Dave, offering fast cash advances of up to $250.

It goes beyond just offering funds; it provides budgeting tools and alerts to keep you on top of your spending.

You don’t have to worry about interest rates or credit checks, making it one of the easiest and most reliable cash advance apps like Dave for quick financial relief.

Features:

-

- Up to $250 Advance

- Budgeting Tools

- No Credit Checks

|

Pros |

Cons |

|

No interest or hidden fees. |

Cash advances may take up to 2 business days. |

|

Helps track spending and savings goals. |

Limited availability in some areas. |

Pricing:

-

- Free version available,

- $9.99/month for premium version.

3. Chime

Say goodbye to overdraft fees with Chime.

Chime’s SpotMe feature allows you to spend up to $500 more than your balance without fees.

Whether you’re using it as an emergency cash advance app like Dave or simply for daily expenses, Chime offers flexibility and ease.

Many Believe Building an app like Chime is like crafting the future of banking.

It’s an ideal solution for avoiding those pesky overdraft charges and staying in control of your spending.

Features:

-

- No Monthly Fees

- Early Direct Deposit

- Automatic Savings Features

|

Pros |

Cons |

|

No monthly fees or hidden charges. |

Limited to Chime account holders. |

|

No minimum balance is required. |

Cash advances limited to $500. |

Pricing:

- Free to use.

- No minimum deposit is required.

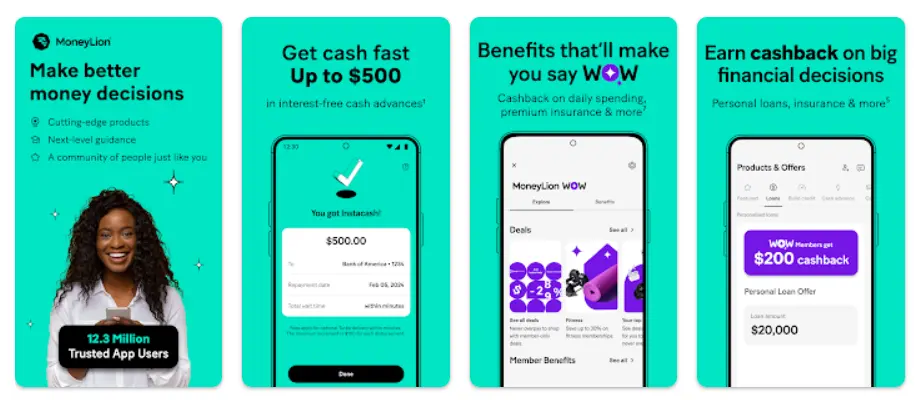

4. MoneyLion

MoneyLion offers a unique twist on traditional cash advance apps like Dave by combining loans with financial tools.

With MoneyLion, you can access cash advances and invest in your future, all in one place.

The app offers automatic savings tools, credit monitoring, and personalized financial tips, making it a powerful resource for those wanting to grow their financial wellness.

Many people get inspired to make an app like MoneyLion.

Features:

-

- Allow Money Tracking.

- Cash Advances with no credit checks.

- Personalized Financial Insights.

|

Pros |

Cons |

|

Offers credit monitoring and investment tools. |

Requires a membership for premium features. |

|

Automatic savings and budgeting tools. |

Premium features for paid members. |

Pricing:

-

- Free Basic Account.

- Premium: $19.99/month

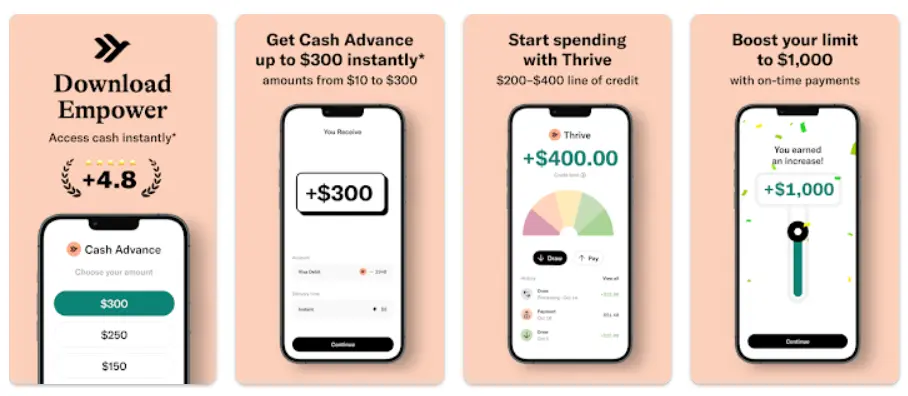

5. Empower

Empower is a money app like Dave that makes managing your money fun and simple.

With Empower, you can access up to $350 in cash advances and track your spending. It also helps you avoid overdraft fees by providing intelligent budgeting and savings tools.

Whether you need a quick cash boost or long-term financial guidance, Empower is a great way to stay ahead.

Features:

-

- Cash advances up to $350.

- Automatic Savings & Budgeting Tools.

- No interest or fee.

|

Pros |

Cons |

|

No credit checks or interest. |

Requires connection to your bank account. |

|

Tracks your spending to improve your finances. |

Limited to U.S. bank accounts. |

Pricing:

- Free to use.

- Premium: $8/month for extra features

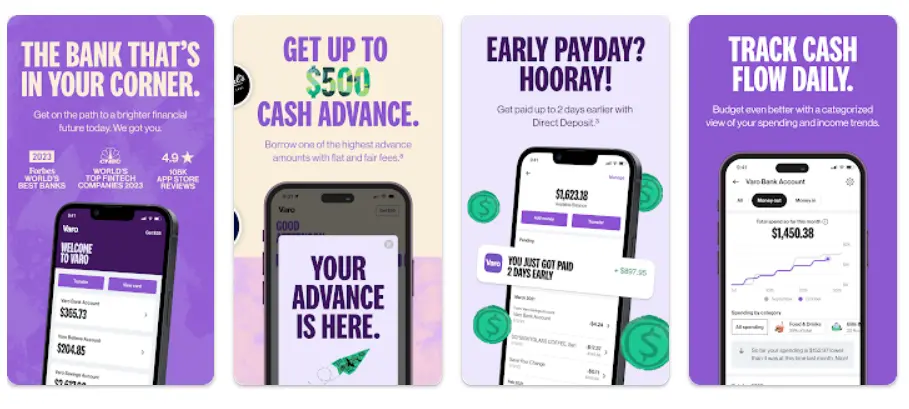

6. Varo

With Varo’s Advance feature, you can get access to cash advances like Dave in minutes.

Varo lets you access up to $100 per day, helping you cover those last-minute expenses without the hassle of credit checks or high fees.

Varo’s easy-to-use mobile app also offers savings and budgeting tools to help you manage your finances effectively.

Features:

-

- Fee Free ATM access

- Cash advance up to $500

- No interest fees for advances.

|

Pros |

Cons |

|

No credit checks are required. |

Only available for direct deposit customers. |

|

Instant transfers to your Varo account. |

Limited availability for non-Varo users. |

Pricing:

- Free to use.

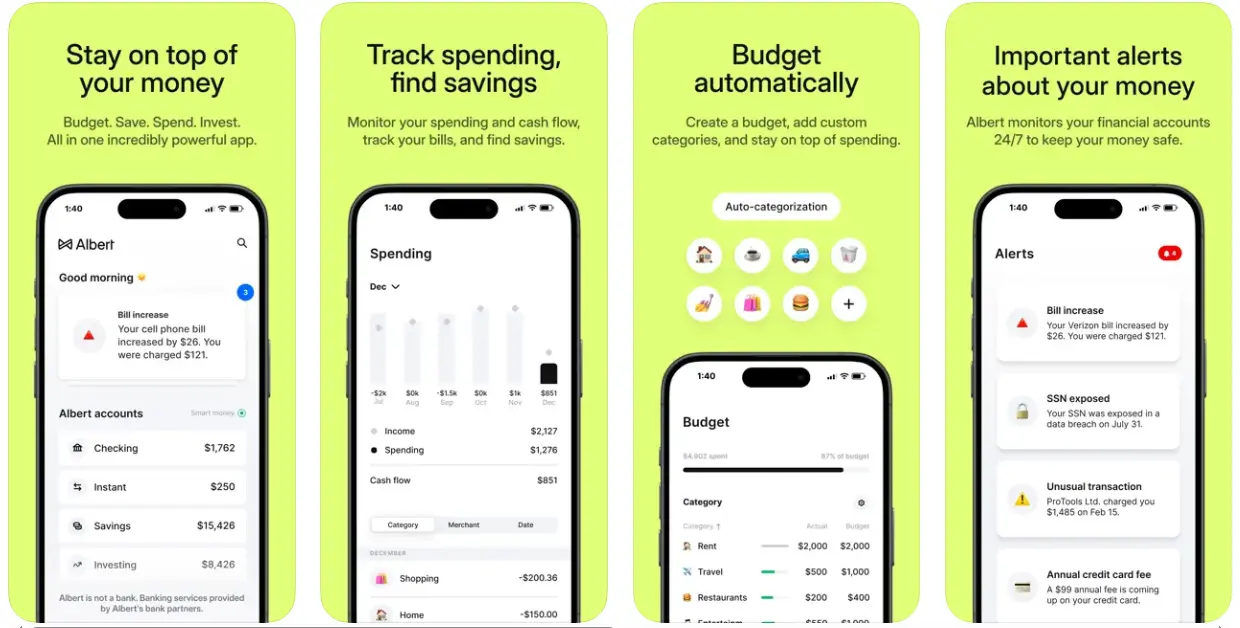

7. Albert

Albert is cash advance app like Dave that lets you access up to $250 instantly.

It connects to your bank account and analyzes your spending, helping you avoid overdraft fees.

Albert also gives personalized financial advice, helping you make smarter decisions and avoid overspending in the future.

Feature:

-

- Cash Advances up to $250

- No Interest or Fees

- Automatic Savings

|

Pros |

Cons |

|

No interest or hidden fees. |

Premium features require a subscription. |

|

Budgeting tools and alerts. |

Limited to U.S. residents. |

Pricing:

- Free for the basic version, Premium is $11.99/month.

8. Cleo

Looking for a little financial guidance? Cleo AI is a fun and quirky money app like Dave that helps you track your spending, set up budgets, and even get cash advances.

Cleo makes it easy to see where your money is going and offers instant cash advances when you need them, all while making financial management less stressful.

Features:

-

- Personalized Budgeting

- Cash Advances up to $100

- Spending Insights & Alerts

|

Pros |

Cons |

|

An AI-powered budgeting assistant. |

Limited features without a premium membership. |

|

Fun and easy-to-use app. |

Requires access to bank data. |

Pricing:

- Free basic version, $5.99/month for advanced features

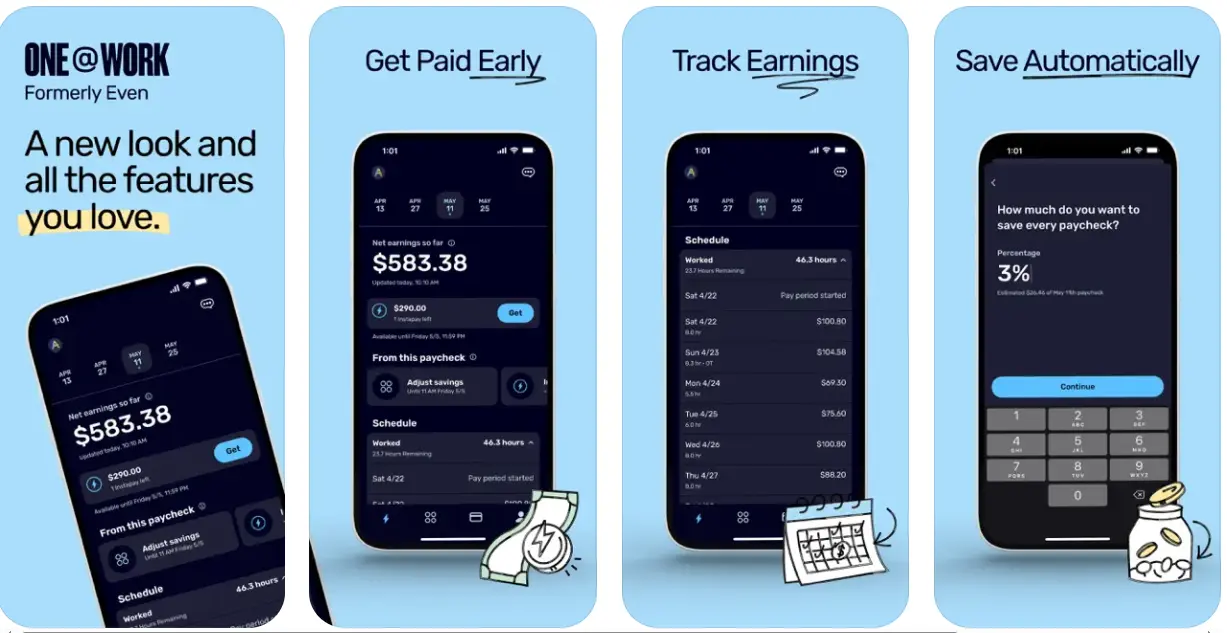

9. ONE@Work

ONE@Work, formerly known as Even, makes managing your finances simple by offering cash advance apps like Dave that allow you to access your earned wages before payday.

With Even, you can get paid as you work and avoid the stress of waiting until the end of the month.

These instant cash apps like Dave also provide budgeting and savings tools.

Features:

-

- Instant access to earned wages.

- Budgeting and savings tools.

- Flexible repayment methods.

|

Pros |

Cons |

|

No interest or hidden fees. |

Limited to participating employers. |

|

No credit checks. |

Available only for certain employers. |

Pricing:

- Fee through participating employers.

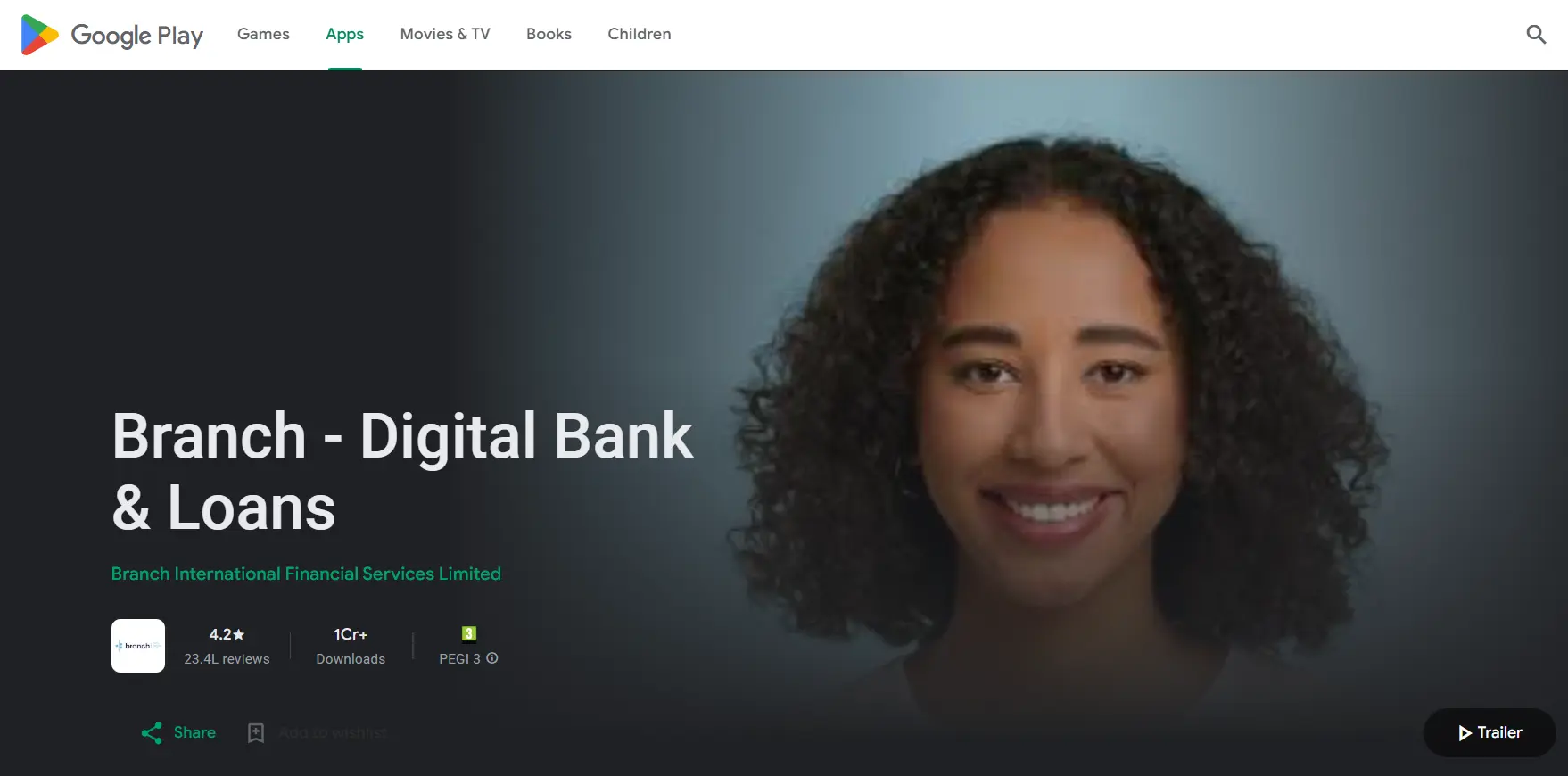

10. Branch

Branch is a flexible money-lending app like Dave that allows workers to access their wages before payday.

This loan app like Dave, is great for people who want to avoid high-interest loans and fees, offering a fast and easy way to get paid early.

Branch also provides budgeting tools and direct deposit features to help users stay on top of their finances.

Features:

-

- Easy Repayment Options.

- No hidden fees.

- Easy sign-up and application process.

|

Pros |

Cons |

|

No interest or fees for cash advances. |

Only available through certain employers. |

|

Direct deposit features. |

Limited availability for non-participating employers. |

Pricing:

- Fee through employers participation.

► Budgeting & Financial Management Apps

Let’s get to know the best budgeting and financial management apps like Dave in 2025:

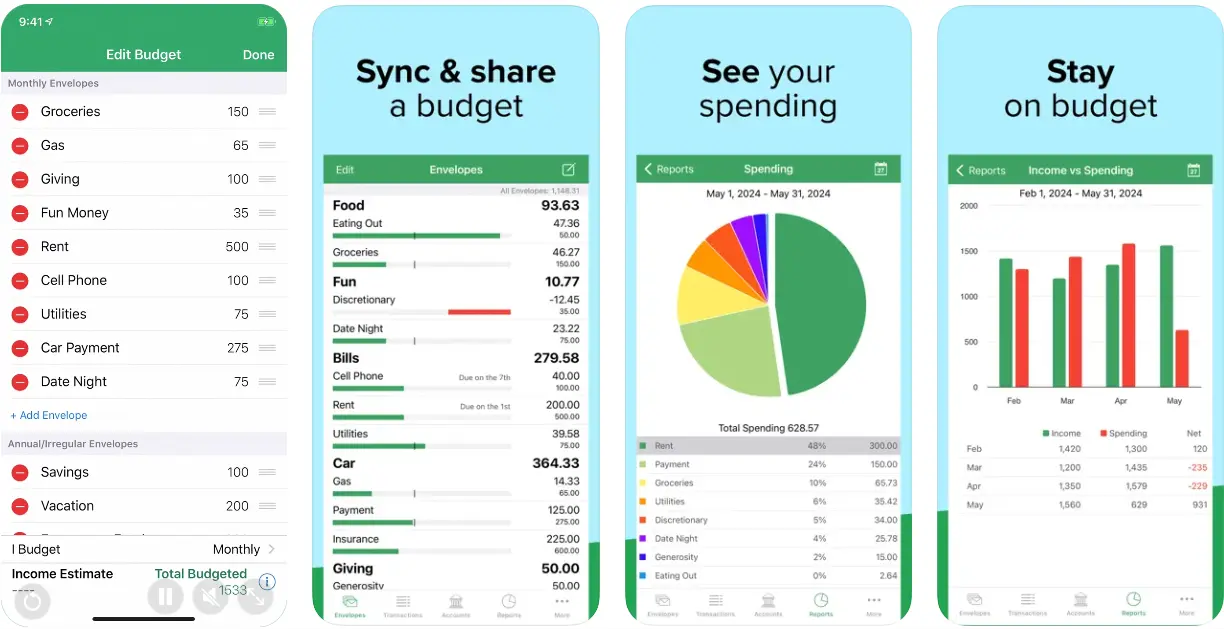

11. YNAB (You Need A Budget)

Looking to take control of your finances? YNAB (You Need A Budget) is a top-tier budgeting tool that helps you give every dollar a job.

From managing day-to-day expenses to saving finances, YNAB helps you covered.

Whether you're searching for apps like Dave to keep track of your finances or need a budgeting system that works, YNAB is a strong contender.

Features:

-

- Detailed Reporting.

- Goal Tracking for Savings.

- Zero-based budgeting system.

|

Pros |

Cons |

|

Helps you build and follow realistic budgets. |

Learning curve for new users. |

|

Detailed reports and financial tracking. |

Some features may require manual input. |

Pricing:

- Free for the first 34 days, then $9.08/month

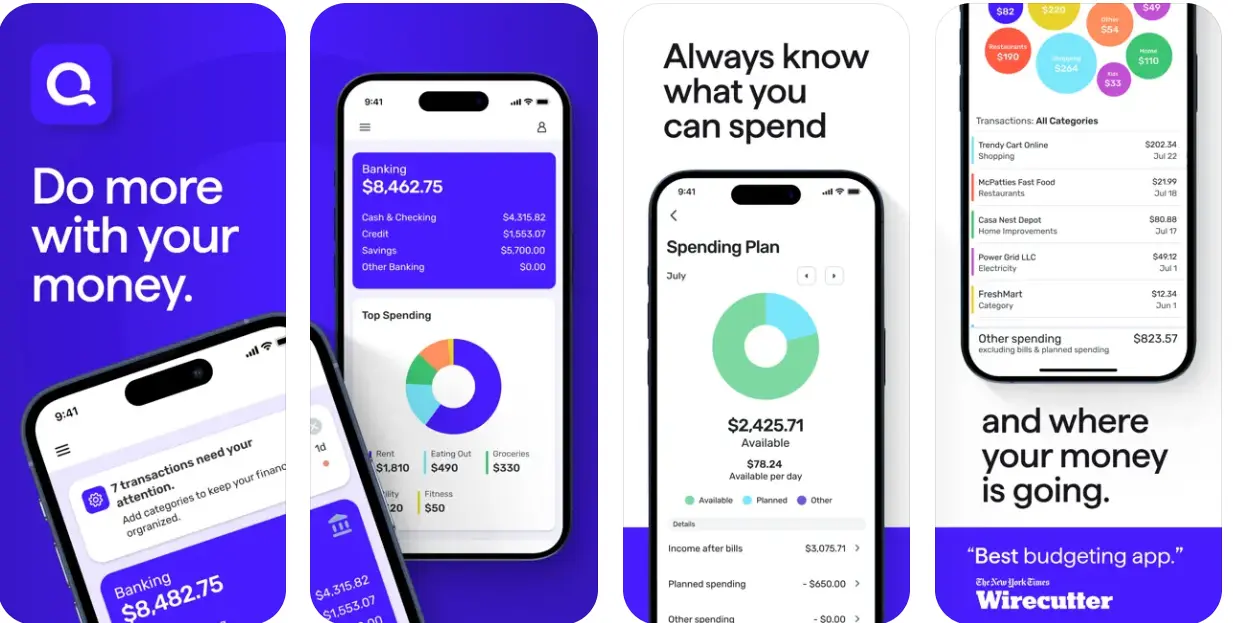

12. PocketGuard

If you're trying to avoid overspending, PocketGuard is one of the best cash advance apps like Dave.

It shows you how much disposable income you have after paying bills and covering savings goals.

If you're looking for an app that will help you stick to a budget without any surprises, PocketGuard is an excellent choice.

Features:

-

- Tracks and analyzes spending.

- Provides savings tips based on spending.

- In-app budgeting.

|

Pros |

Cons |

|

Helps prevent overspending. |

Limited customization for some users. |

|

Simple, easy-to-use design. |

Some features are locked behind the premium plan. |

Pricing:

- Free version, premium $7.99/month.

13. Goodbudget

For those who like the envelope method of budgeting, Goodbudget offers a digital version of this method.

Even if you need apps like Dave with no subscription or you're seeking a more straightforward way to manage cash flow, Goodbudget is a solid choice.

It helps you stay on top of your finances by tracking your expenses and savings goals, making it easier to budget without confusion.

Features:

-

- Digital envelope budgeting system.

- Provides savings goal tracking.

- Expense Tracking.

|

Pros |

Cons |

|

Syncs across multiple devices. |

No bank syncing feature. |

|

Great for tracking cash flow. |

Some users find it less intuitive. |

Pricing:

- Free Version Available.

14. Quicken Simplifi

Simplifi by Quicken is designed for those looking for an intuitive and easy way to manage finances.

This app helps you track your expenses in real time and set personalized financial goals.

In case you're after loan apps like Dave or just want a better way to budget and save, Simplifi by Quicken helps you stay organized and achieve your financial goals without hassle.

Features:

-

- Automatic expense tracking.

- Personalized Budget Recommendations.

- Cash Flow & Spending habits.

|

Pros |

Cons |

|

It provides actionable insights into your spending. |

It lacks some features of the full Quicken desktop. |

|

Syncs with multiple accounts. |

Some users may miss advanced features. |

Pricing:

- $5.99/month (14-day free trial). No ads or interruptions.

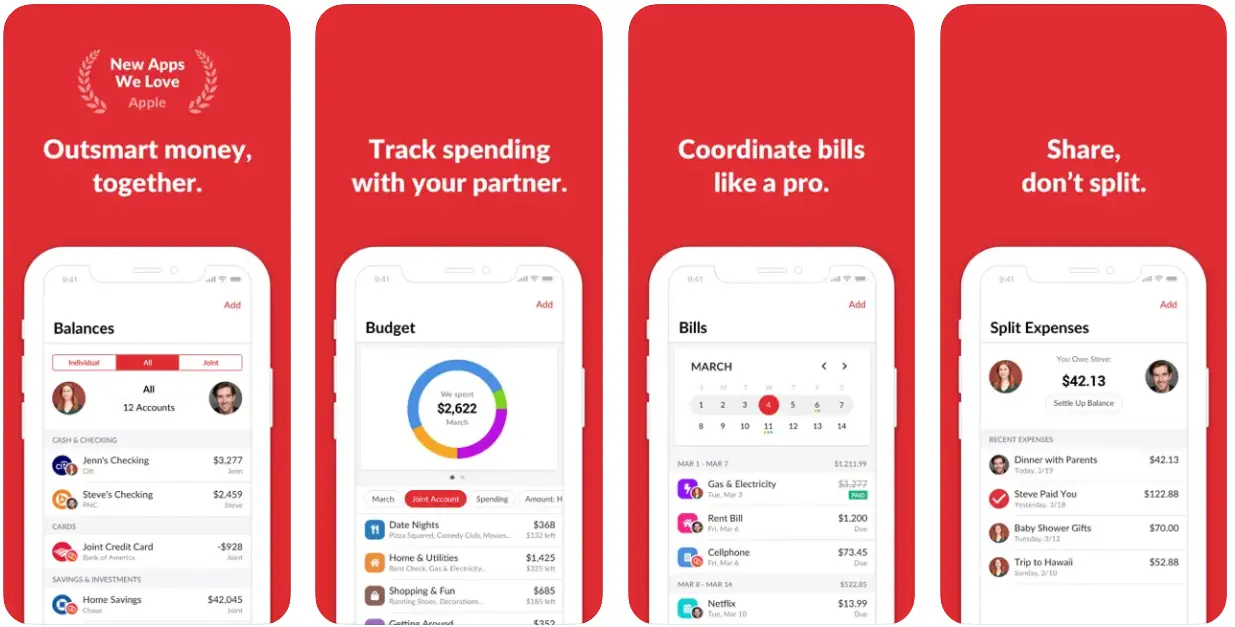

15. Honeydue

Managing finances as a couple? Honeydue is designed to help couples stay on top of their shared and individual finances.

With features tailored for partners, it lets you track spending, set budgets, and even split bills.

If you're searching for apps like Dave to keep your finances organized as a couple, Honeydue is the perfect solution to make managing money a team effort.

Features:

-

- Tracks both shared and individual expenses.

- Bill Splitting feature.

- Bank account syncing.

|

Pros |

Cons |

|

Great for couples managing joint finances. |

Lacks advanced investment tracking. |

|

Provides detailed budgeting tools. |

Can have syncing issues at times. |

Pricing:

- Free to use. Premium Starts at $8/month

16. Wally

Wally helps you understand exactly where your money is going. Introducing Wally, your AI-driven personal finance assistant.

Fueled by advanced GPT technology, Wally is here to help manage your finances with ease and precision.

It's one of the best money apps like Dave, offering a simple way to track your expenses and savings goals.

Wally is perfect for users who prefer a cash advance app like Dave, providing a clear view of your financial health with its intuitive design.

Features:

-

- Budgeting & Financial Goals.

- Expense Tracking & Categorization.

- Receipt Scanning & Income Tracking.

|

Pros |

Cons |

|

Simple interface for easy tracking. |

Lacks automatic bank syncing in the free version. |

|

Great for saving and budgeting. |

Some advanced features are locked behind a paywall. |

Pricing:

- Free to use. Premium starts at $4.99/month.

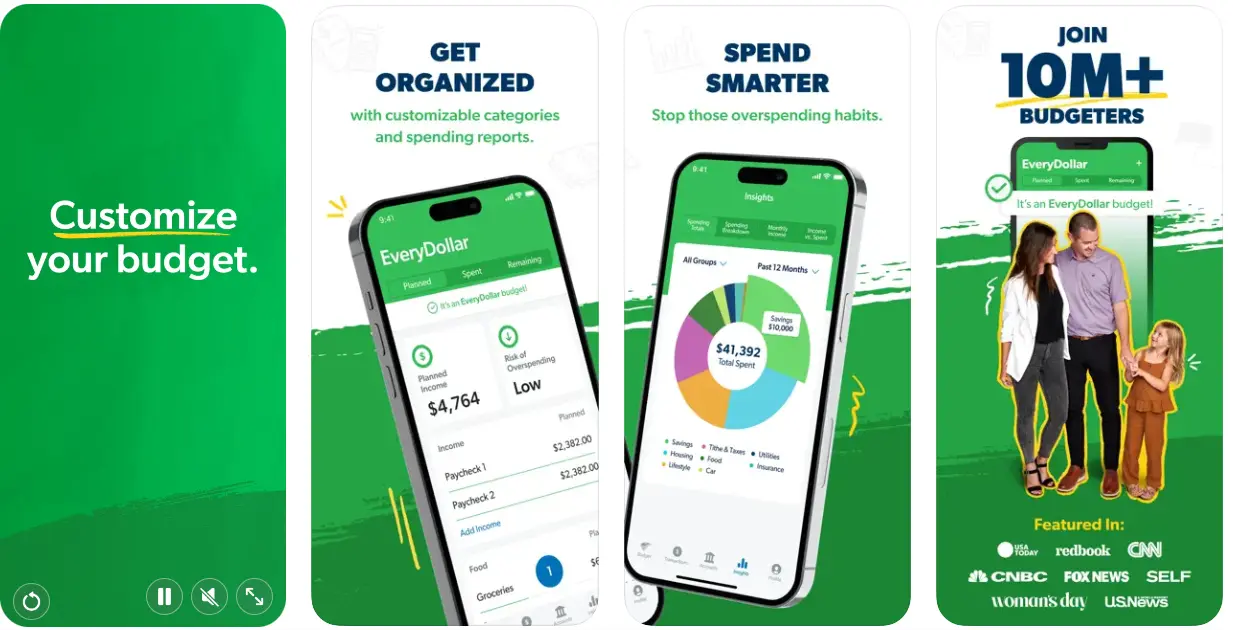

17. EveryDollar

EveryDollar is a powerful budgeting app that helps you organize your money with a zero-based budgeting approach.

Whether you’re looking for loan apps like Dave or just need a tool for efficient money management, EveryDollar simplifies the budgeting process, making it easy to stick to your financial goals every month.

Features:

-

- Zero-based budgeting System.

- Detailed Snapshot of Your Budget.

- Financial Goal Setting.

|

Pros |

Cons |

|

Easy to use and intuitive. |

The free version doesn’t have automatic syncing. |

|

Can link to bank accounts in the premium version. |

The premium version costs a bit more. |

Pricing:

- Free version, Premium $17.99/month or $79.99/year.

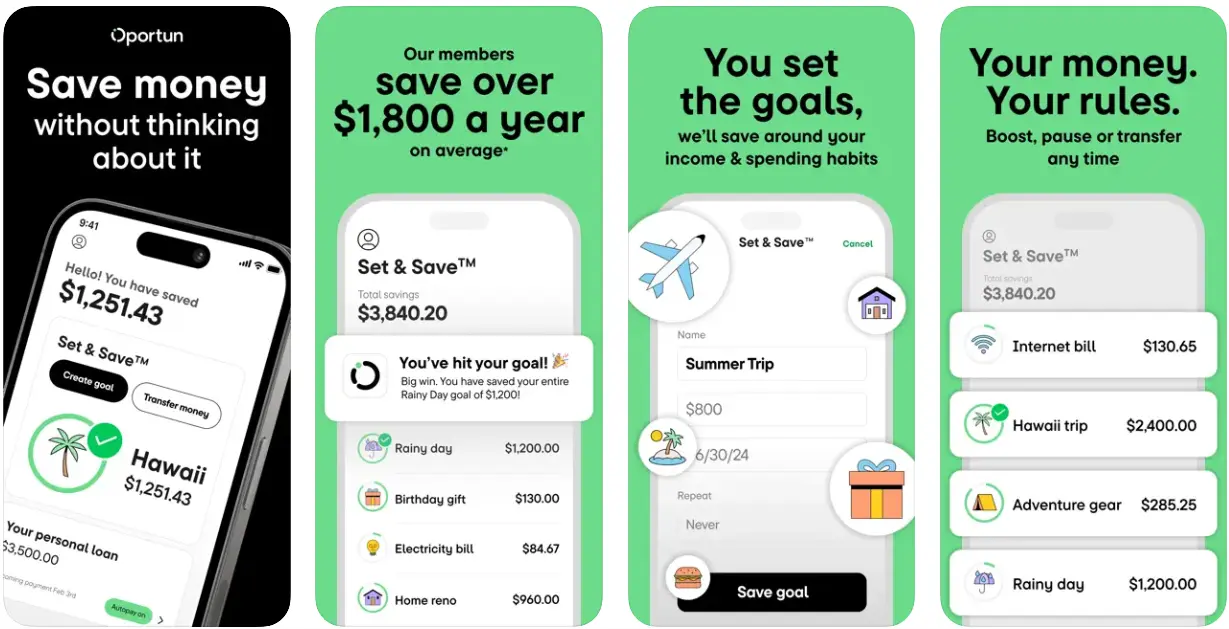

18. Oportun

Opurtun is an automated savings app that analyzes your spending habits and transfers small amounts into savings automatically.

If you're looking for an instant loan app like Dave, Opurtun provides a unique way to save money effortlessly, helping you build your savings without thinking about it.

Features:

-

- Automated Savings.

- No credit check required.

- Customer Support.

|

Pros |

Cons |

|

Save small amounts of money daily. |

Doesn’t offer direct cash advances. |

|

Customizable savings goals. |

Limited financial tracking tools. |

Pricing:

- $5/month. Subscription required after trial.

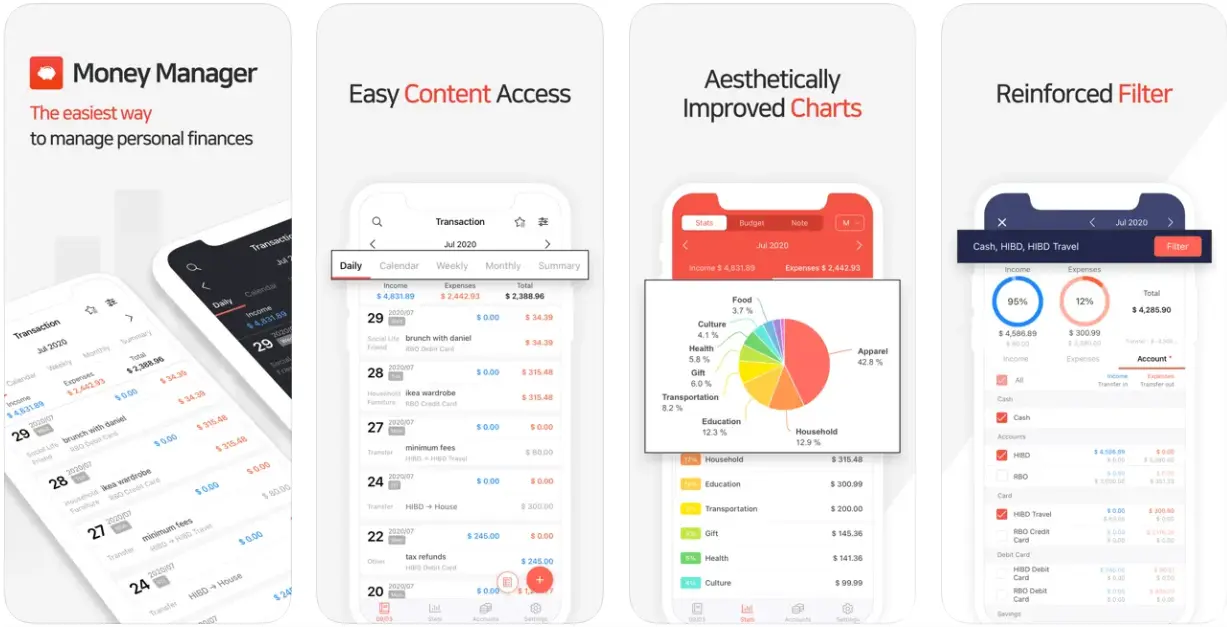

19. Money Manager Expense & Budget

Money Manager Expense & Budget is your ultimate companion for mastering your finances.

If you're looking for a cash advance app like Dave to help you track spending and stick to a budget, this app is perfect for you.

It offers a simple, user-friendly interface that makes managing your expenses easy and intuitive, helping you stay on top of your finances and avoid overspending.

Whether you're saving or planning, this app has got you covered!

Features:

-

- Effortlessly track expenses and set budgets.

- Budgeting Tools.

- Income Tracking

|

Pros |

Cons |

|

Simple and intuitive design. |

Limited features in the free version. |

|

Categorize your spending for better control. |

Bank syncing can be a little slow. |

Pricing:

- Free version available, Premium $2.49/month.

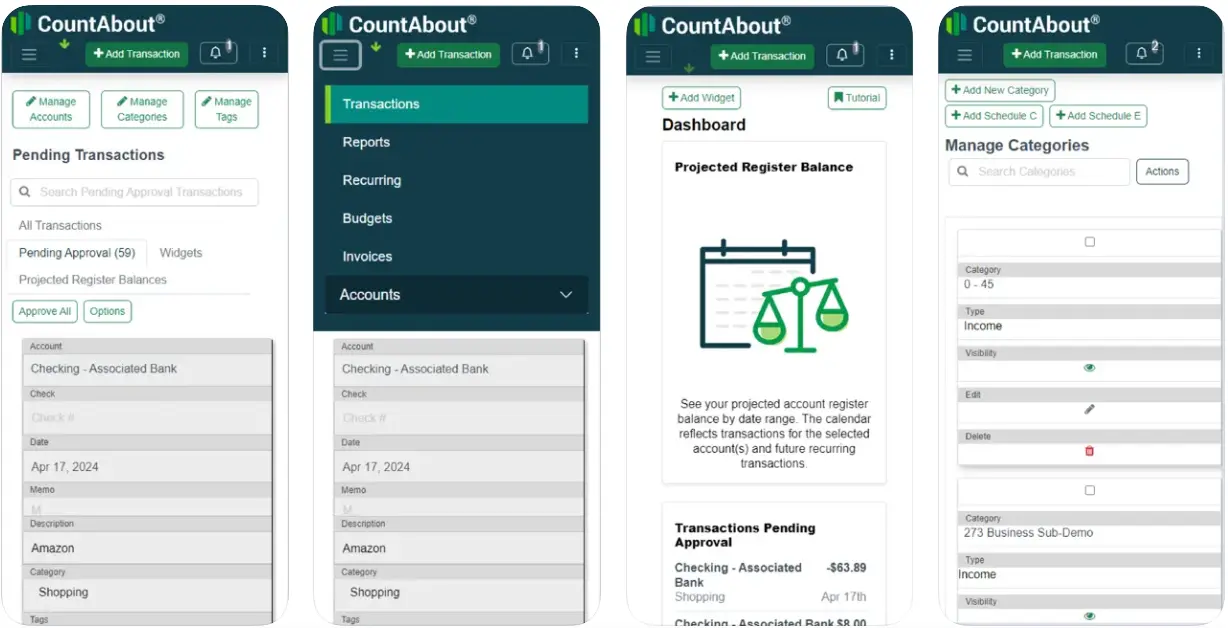

20. CountAbout

CountAbout is an easy-to-use budgeting app that helps you stay on top of your finances with its powerful tracking tools.

If you're looking for an app like Dave to manage your spending, CountAbout is a fantastic choice.

It allows you to track your expenses, set up budgets, and categorize transactions, all while offering seamless syncing with your bank accounts.

Whether you're looking to save or simply keep track, CountAbout makes budgeting effortless!

Features:

-

- Track expenses and categorize them easily.

- Set budgets and financial goals.

- Income Tracking.

|

Pros |

Cons |

|

Syncs with bank accounts for automatic updates. |

No free version available. |

|

User-friendly interface. |

It lacks some advanced features compared to others. |

Pricing:

- $9.99/year for the basic plan, premium plan $39.99/year for additional features.

► Small Loan and Financial Assistance Apps

Here are some other money-borrowing apps like Dave for small loans that you should know about:

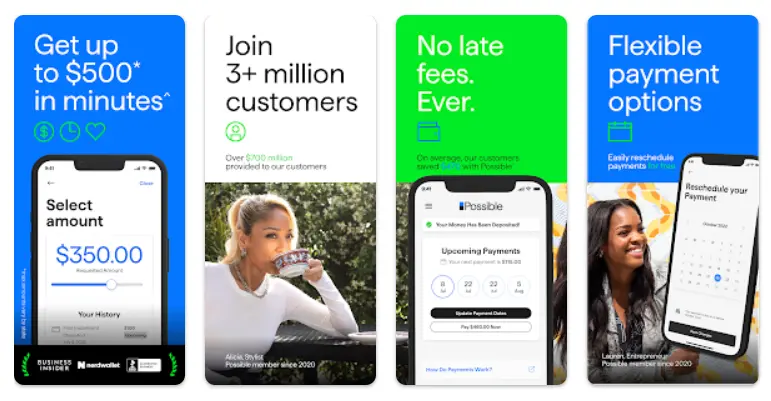

21. Possible Finance

Possible Finance takes it a step further by providing small loans and financial assistance through a fast and flexible platform.

With no credit check required, Possible Finance allows you to access quick loans directly through your phone.

So long as you're looking for money apps like Dave or simply need a small loan app, Possible Finance is an excellent alternative.

Features:

-

- No credit check is required.

- Loans up to $500 are available.

- Clear Fees & Terms.

|

Pros |

Cons |

|

Fast approval and disbursement. |

High interest rates. |

|

No hidden fees. |

Only available in certain states. |

Pricing:

-

- Fees range from $5 to $15, depending on loan size.

- Borrowing fees may apply.

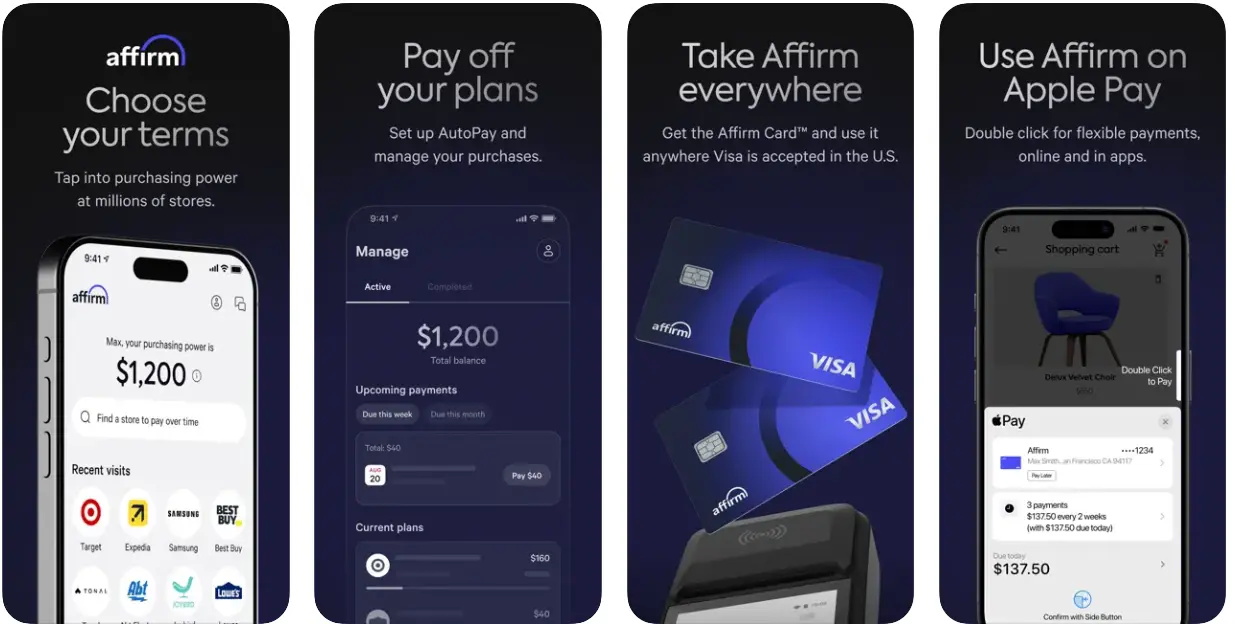

22. Affirm

Looking for a loan app like Dave that offers flexible payment plans? Affirm lets you break up your purchases into easy installments.

Even if it's for small loan assistance or large-ticket purchases, Affirm is a reliable financial partner.

Affirm is designed to give you quick access to financing with transparent terms- no hidden fees and no compounding interest.

Features:

-

- Transparent Pricing.

- Instant Credit Decision.

- Flexible payment tools.

|

Pros |

Cons |

|

Transparent payment plans with no hidden fees. |

Higher interest rates on longer terms. |

|

No late fees. |

Limited to participating merchants. |

Pricing:

- Interest rates vary based on loan terms. Pro starts at $7.99/month.

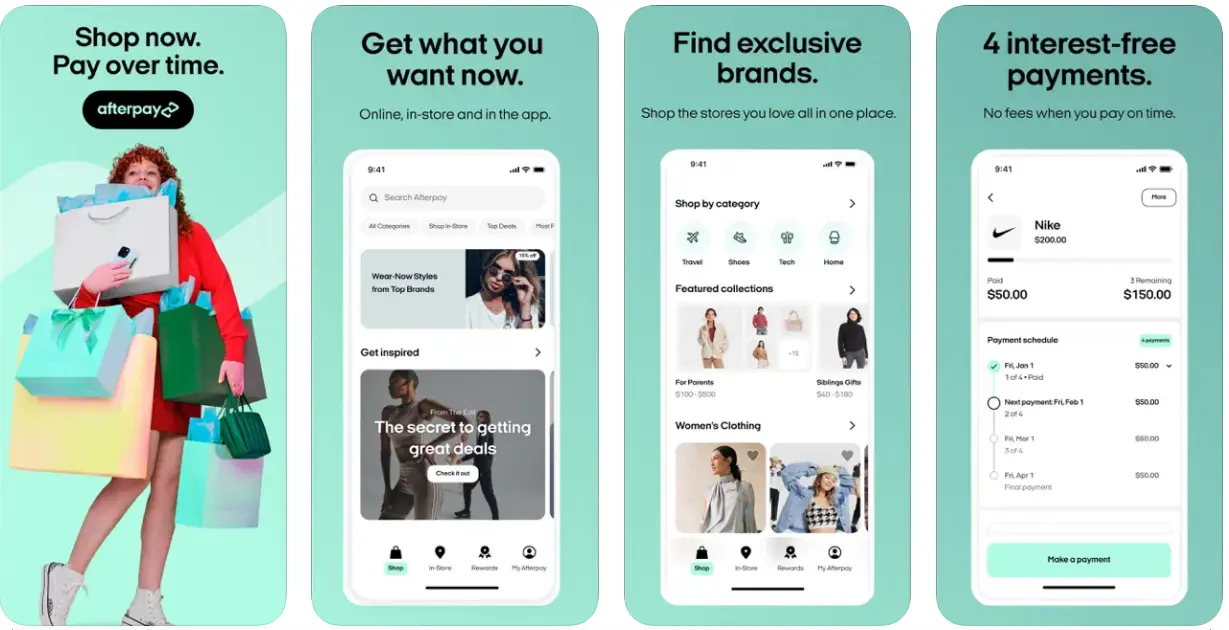

23. Afterpay

Afterpay is revolutionizing the way you shop by allowing you to pay for purchases in installments.

It’s a great option for those searching for cash advance apps like Dave but want more flexibility.

Afterpay helps you break up payments into four equal installments, interest-free, making it easy to manage purchases without putting a strain on your budget.

Features:

-

- Split payments into four installments.

- Used by major retailers globally.

- Instant Approval.

|

Pros |

Cons |

|

No interest or fees if paid on time. |

Late fees for missed payments. |

|

Easy and convenient for budget management. |

Available only at participating stores. |

Pricing:

- Free to use, Premium starts at $9.99/month.

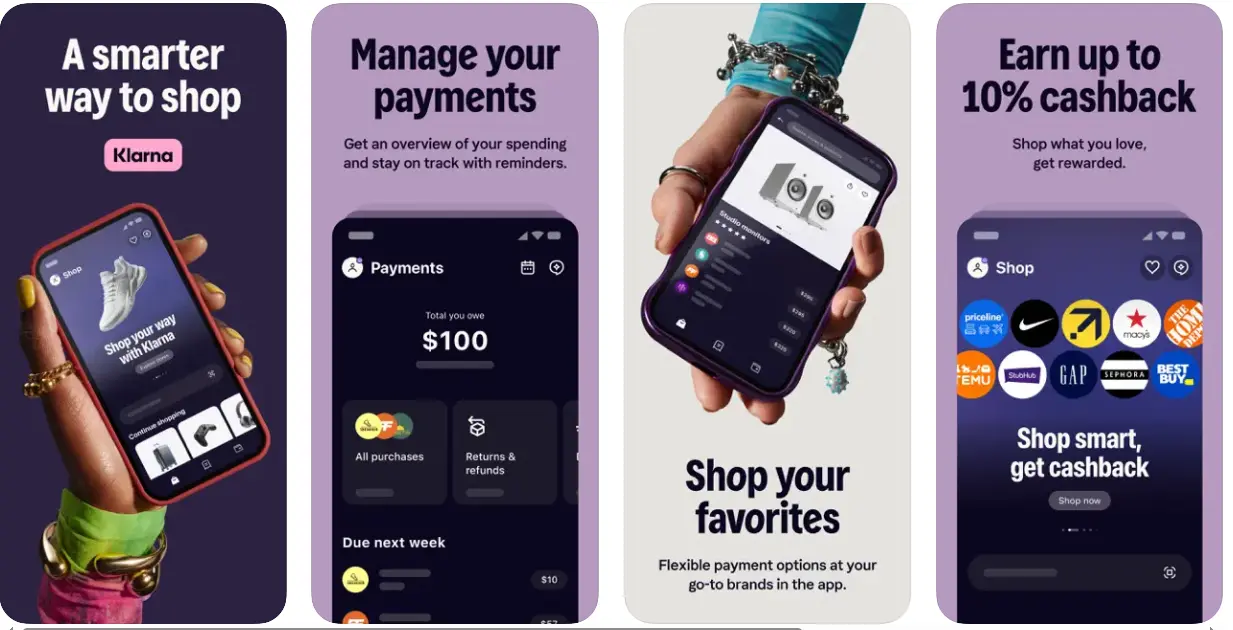

24. Klarna

Klarna offers flexible payment solutions for purchases, providing an excellent alternative to traditional credit.

It’s one of the small loan and financial assistance apps for those who want to manage payments in installments.

If you're searching for money apps like Dave, Klarna offers an easy way to pay over time, enhancing your purchasing power without hidden fees.

Features:

-

- Pay later or split payments into 4 Installments.

- Accepted at thousands of online retailers.

- Easy returns.

|

Pros |

Cons |

|

Interest-free if paid on time. |

Charges high fees for late payments. |

|

Simple payment options. |

Can encourage overspending. |

Pricing:

- Free to use. Premium $7.99/month

25. PayActiv

PayActiv provides financial assistance apps to help you access your earned wages before payday.

Perfect for those seeking cash apps like Dave to manage their finances in real-time, PayActiv allows you to get early access to your wages and avoid payday loans.

It's an ideal solution for those who need short-term financial relief.

Features:

-

- Instant access to earned wages.

- Bills payment service.

- Financial Wellness Tools.

|

Pros |

Cons |

|

Helps avoid payday loans. |

Only available through participating employers. |

|

Helps with budgeting and avoiding high-interest loans. |

May require employer registration. |

Pricing:

- Free, pricing depends on the employer’s plan.

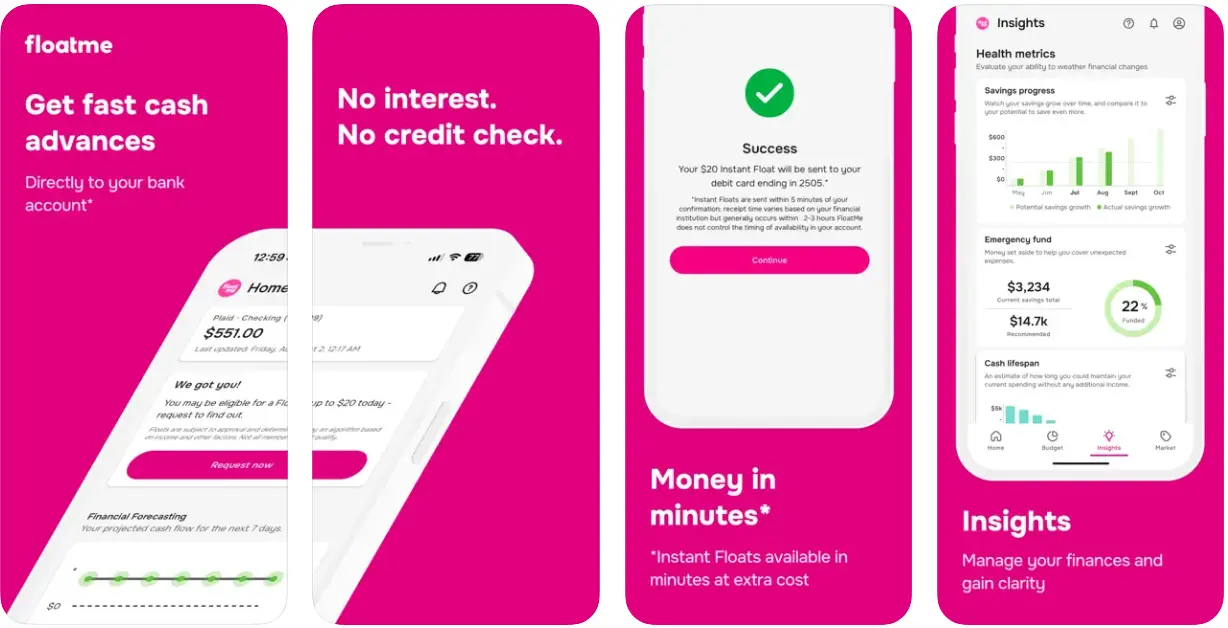

26. FloatMe

FloatMe offers a quick solution for small loan needs, allowing you to access a cash advance of up to $50 before your payday.

If you're looking for a payday app like Dave with no credit check or fees, FloatMe could be a good alternative.

You get quick cash with no interest, making it a great option for urgent expenses.

Features:

-

- Cash advances up to $50.

- Helps avoid payday loans.

- Personal Financial Management.

|

Pros |

Cons |

|

No credit check is required. |

Loan limit is lower than other platforms. |

|

No interest charges. |

Available only to members in select states. |

Pricing:

- Free for the first two weeks, subscription at $4.99/month

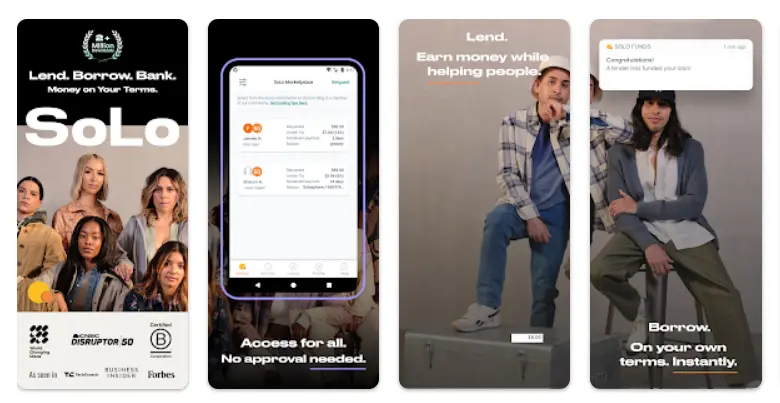

27. SoLo Funds

SoLo Funds is an instant cash advance app like Dave, designed to provide peer-to-peer lending.

This app allows you to borrow small amounts of money quickly from other users.

If you’re in need of a small loan and are looking for a money app like Dave, SoLo Funds gives you access to funds with flexible repayment options, making it a unique solution for short-term financial help.

Features:

-

- Peer-to-peer leading model.

- Borrow up to $625.

- No credit checks.

|

Pros |

Cons |

|

Flexible repayment terms. |

Not suitable for large loans. |

|

Fast and easy application process. |

May require verification before funding. |

Pricing:

- Custom Pricing

28. ZippyLoan

Looking for loan apps like Dave? ZippyLoan is an excellent choice for those who need small loans with quick approval.

With ZippyLoan, you can apply online, get approved quickly, and access funds without hassle.

If you're in need of emergency financial assistance, this is one of the fastest small loan services available.

Features:

-

- Loan amounts up to $15,000

- Available in many regions.

- Quick loan approval.

|

Pros |

Cons |

|

Fast approval and funding process. |

High interest rates depending on loan size. |

|

Good option for emergency loans. |

Requires minimum credit score for approval. |

Pricing:

- Fees may vary.

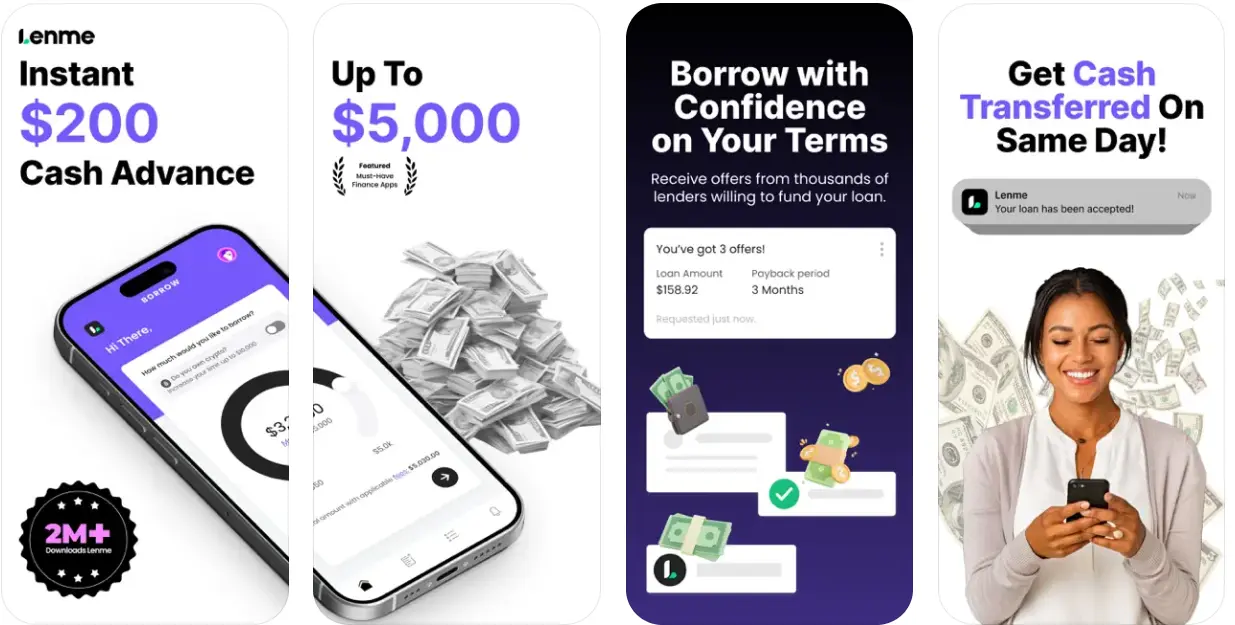

29. Lenme

Lenme is a peer-to-peer lending app that connects borrowers with lenders, offering a fast and simple way to access personal loans.

If you're searching for Dave alternatives, Lenme provides an innovative solution. It allows users to request and lend money directly, without the need for traditional banks.

Whether you're in need of a quick loan or want to lend to others, Lenme offers a convenient, flexible, and community-driven approach to personal finance.

Features:

-

- Peer-to-peer lending.

- Quick loan approval.

- Transparent terms.

|

Pros |

Cons |

|

Quick and easy access to personal loans. |

Interest rates may vary depending on the lender. |

|

No credit check is required for borrowing. |

Limited availability depending on your location. |

Pricing:

- $1.99/month

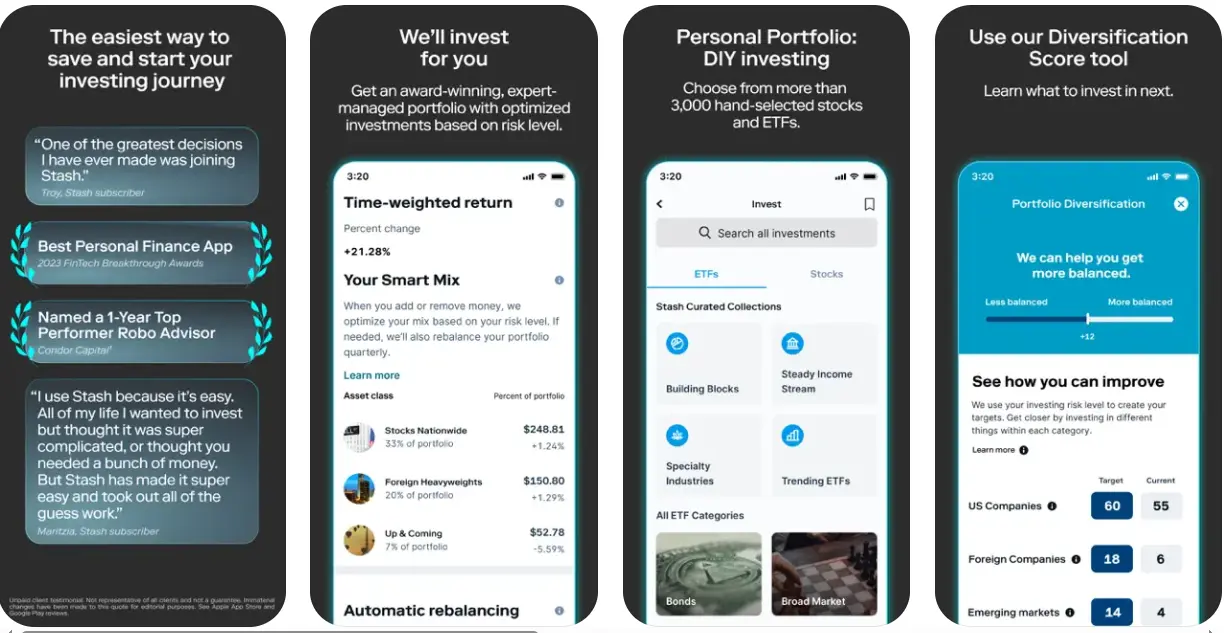

30. Stash

Stash is a payday app like Dave but with a stronger focus on simplifying the process of investing and saving.

It allows users to start investing with as little as $5, making it perfect for beginners and experienced investors alike. If you're searching for apps that loan you money, Stash offers a similar level of financial flexibility by helping you save, invest, and manage your money in one place.

With personalized recommendations and low fees, it’s a great way to build your investment portfolio without feeling overwhelmed.

Features:

-

- Invest in stocks, bonds, and ETFs with ease.

- Personalized Investment recommendation.

- Automated savings.

|

Pros |

Cons |

|

Start investing with just $5. |

Fees can be higher than on some other platforms. |

|

Simple, user-friendly interface. |

Limited investment options for advanced users. |

Pricing:

-

- Stash Beginner $3/month.

- Stash Growth $9/month

Now, that you have the finest alternatives to Dave, you might be confused as to how to choose the best via a comprehensive table.

Quick Comparison: Choose the Best App for Your Needs

To help you make an informed decision, we’ve provided a detailed table comparing top money-borrowing and payday apps like Dave.

|

App Name |

Features |

Pros |

Cons |

Pricing |

Eligibility Criteria |

How to Apply |

|

Earnin |

No interest or fees, hour tracking, flexible repayment options |

No hidden fees, tracks work hours |

Limited to selected regions, requires location services |

Free-to-use, optional tipping |

Must have a steady paycheck, bank account, and consistent work hours |

Download the app, connect your bank account, and verify your employment |

|

Brigit |

Up to $250 advance, budgeting tools, no credit checks |

No interest or hidden fees help track spending |

Cash advances may take 1-2 business days, with limited availability |

Free version available, $9.99/month for premium |

Must have a bank account with regular deposits |

Download the app, link your bank account, and sign up for membership |

|

Chime |

No monthly fees, early direct deposit, SpotMe feature (up to $500 overdraft) |

No fees, no minimum balance required |

Limited to Chime account holders, cash advances capped at $500 |

Free to use |

Must open a Chime bank account |

Sign up for a Chime account and enable the SpotMe feature |

|

MoneyLion |

Cash advances, credit monitoring, automatic savings tools |

Offers investment tools, no credit checks |

Premium features require membership |

Free basic account, $19.99/month for premium |

Must have a bank account and meet income requirements |

Download the app, create an account, and link the bank account |

|

Empower |

Cash advances up to $350, automatic savings, no interest or fees |

No credit checks track spending |

Requires connection to U.S. bank accounts |

Free to use, $8/month for premium |

Must have a U.S. bank account |

Download the app, link your bank account, and sign up |

|

Varo |

Cash advances up to $100/day, no interest fees, fee-free ATM access |

No credit checks, instant transfers |

Only for direct deposit customers |

Free to use |

Must have a Varo bank account |

Open a Varo account and enable the Advance feature |

|

Albert |

Cash advances up to $250, no interest or fees, automatic savings |

Budgeting tools, no hidden fees |

Premium features require a subscription |

The free basic version is $11.99/month for premium |

Must have a U.S. bank account |

Download the app, link your bank account, and sign up |

|

Cleo |

Cash advances up to $100, AI-powered budgeting, spending insights |

Fun and easy-to-use, AI-powered assistant |

Limited features without premium membership |

Free basic version, $5.99/month for advanced features |

Must have a bank account |

Download the app, connect your bank account, and sign up |

|

ONE@Work |

Instant access to earned wages, budgeting tools, flexible repayment |

No interest or hidden fees, no credit checks |

Limited to participating employers |

Fee through participating employers |

Must be employed by a participating employer |

Check if your employer participates and sign up through their platform |

|

Branch |

Early wage access, budgeting tools, no hidden fees |

No interest or fees, direct deposit features |

Only available through certain employers |

Fee through employer participation |

Must be employed by a participating employer |

Sign up through your employer’s platform |

|

YNAB |

Zero-based budgeting, goal tracking, detailed reporting |

Helps build realistic budgets, detailed financial tracking |

The learning curve for new users |

Free for 34 days, then $9.08/month |

Must have a bank account |

Download the app, create an account, and link the bank account |

|

PocketGuard |

Tracks spending, provides savings tips, in-app budgeting |

Prevents overspending, simple design |

Limited customization in the free version |

Free version, $7.99/month for premium |

Must have a bank account |

Download the app, link your bank account, and sign up |

|

Goodbudget |

Digital envelope budgeting, expense tracking, savings goal tracking |

Syncs across devices, great for cash flow tracking |

No bank syncing in the free version |

Free version available |

Must have a bank account |

Download the app, create an account, and set up a budget |

|

Quicken Simplifi |

Automatic expense tracking, personalized budget recommendations |

Provides actionable insights, syncs with multiple accounts |

Lacks some advanced features |

$5.99/month (14-day free trial) |

Must have a bank account |

Download the app, link your bank account, and sign up |

|

Honeydue |

Tracks shared and individual expenses, bill splitting, bank account syncing |

Great for couples, detailed budgeting tools |

Lacks advanced investment tracking |

Free to use, premium starts at $8/month |

Must have a bank account |

Download the app, create a joint account, and link bank accounts |

|

Wally |

Budgeting, expense tracking, receipt scanning |

Simple interface, great for saving and budgeting |

No bank syncing in the free version |

Free to use, premium starts at $4.99/month |

Must have a bank account |

Download the app, link your bank account, and sign up |

|

EveryDollar |

Zero-based budgeting, financial goal setting, detailed budget snapshot |

Easy to use, links to bank accounts in premium version |

The free version lacks automatic syncing |

Free version, premium $17.99/month or $79.99/year |

Must have a bank account |

Download the app, create an account, and set up a budget |

|

Oportun |

Automated savings, no credit check required, customizable savings goals |

Saves small amounts daily, no credit checks |

Doesn’t offer direct cash advances |

$5/month after trial |

Must have a bank account |

Download the app, link your bank account, and set up savings goals |

|

Money Manager |

Expense tracking, budgeting tools, income tracking |

Simple and intuitive design categorizes spending |

Limited features in the free version |

Free version available, premium $2.49/month |

Must have a bank account |

Download the app, link your bank account, and sign up |

|

CountAbout |

Budgeting, expense tracking, income tracking |

Syncs with bank accounts, user-friendly interface |

No free version is available |

$9.99/year for basic, $39.99/year for premium |

Must have a bank account |

Download the app, link your bank account, and sign up |

|

Possible Finance |

Small loans up to $500, no credit check required |

Fast approval, no hidden fees |

High interest rates, limited to certain states |

Fees range from $5 to $15 |

Must have a steady income and bank account |

Download the app, complete the application, and verify the income |

|

Affirm |

Transparent pricing, instant credit decisions, flexible payment tools |

No hidden fees, no late fees |

Higher interest rates on longer terms |

Interest rates vary based on loan terms |

Must be 18+, have a valid bank account, and meet credit requirements |

Apply at checkout with participating merchants |

|

Afterpay |

Split payments into 4 installments, interest-free |

No interest if paid on time, easy budget management |

Late fees for missed payments |

Free to use |

Must be 18+, have a valid debit/credit card, and meet credit requirements |

Sign up at checkout with participating retailers |

|

Klarna |

Pay later or split payments into 4 installments, easy returns |

Interest-free if paid on time, simple payment options |

High fees for late payments |

Free to use |

Must be 18+, have a valid debit/credit card, and meet credit requirements |

Sign up at checkout with participating retailers |

|

PayActiv |

Instant access to earned wages, bill payment service, financial wellness tools |

Helps avoid payday loans, no credit checks |

Only available through participating employers |

Free, pricing depends on the employer’s plan |

Must be employed by a participating employer |

Sign up through your employer’s platform |

|

FloatMe |

Cash advances up to $50, no interest fees |

No credit checks, no interest charges |

Low loan limit, limited to select states |

Free for 2 weeks, then $4.99/month |

Must have a bank account and steady income |

Download the app, link your bank account, and sign up |

|

SoLo Funds |

Peer-to-peer lending, borrow up to $625, no credit checks |

Flexible repayment terms, fast application process |

Not suitable for large loans |

Custom pricing |

Must have a bank account and meet peer lender requirements |

Download the app, create an account, and request a loan |

|

ZippyLoan |

Loans up to $15,000, quick approval, available in many regions |

Fast approval and funding process |

High interest rates, require minimum credit score |

Fees may vary |

Must have a steady income, bank account, and meet credit requirements |

Apply online, submit the required documents, and wait for approval |

|

Lenme |

Peer-to-peer lending, quick loan approval, transparent terms |

No credit checks, fast access to personal loans |

Interest rates vary by lender |

$1.99/month |

Must have a bank account and meet lender requirements |

Download the app, create an account, and request a loan |

|

Stash |

Invest in stocks, bonds, and ETFs, automated savings, personalized recommendations |

Start investing with $5, user-friendly interface |

Higher fees compared to some platforms |

$3/month for Stash Beginner, $9/month for Stash Growth |

Must have a bank account and be 18+ |

Download the app, create an account, and link the bank account |

How to Choose the Right Loan App like Dave?

When it comes to finding a loan app like Dave, you want something that offers convenience, flexibility, and fast access to funds.

Whether you're looking to get $50 instantly or need an app for recurring financial assistance, there are plenty of options available.

But with so many choices out there, you may wonder: Are there any other apps like Dave that provide similar features without the hassle? To make sure you choose the best loan app, consider these important factors:

Here’s What to Look for When Choosing a Loan App Like Dave

-

- Fast Access to Funds: Look for apps that offer instant access to cash. If you need $50 instantly, some apps allow you to get funds within minutes.

- No Hidden Fees: Be sure to check for any hidden fees or high interest rates. A good app should offer transparency on all costs.

- Flexible Repayment Options: Choose an app that allows you to repay your loan on your own terms, such as weekly, biweekly, or monthly.

- Easy-to-Use Interface: The app should have a simple and user-friendly interface, making it easy to navigate and apply for a loan.

- Customer Support: Make sure the app offers reliable customer support in case you need assistance or have any questions.

- User Reviews and Ratings: Check reviews and ratings on app stores to see if other users have had positive experiences with the app.

With these key factors in mind, you can find a money-borrowing app like Dave that fits your needs and helps you manage your finances with ease!

Create Your Own App Like Dave and Shine in the Fintech World

Ready to make a splash in the fintech world? Creating an app like Dave can set you on the path to success.

Imagine offering users a seamless way to access funds instantly, track spending, and even get paid early.

With the growing demand for cash advance solutions, this is your chance to create something truly impactful.

Partnering with a trusted Fintech app development company such as JPLoft will help bring your vision to life and ensure your app delivers an exceptional user experience.

Don't wait- step into the future of finance today and start building your own fintech app!

Conclusion

In conclusion, there are plenty of money apps like Dave that provide convenient and flexible financial solutions, helping users manage their cash flow and avoid costly overdraft fees.

Whether you’re looking for loan apps like Dave or exploring other apps like Dave, there’s a variety of options to choose from, each offering unique features tailored to different financial needs.

As digital finance continues to evolve, these apps are making it easier for individuals to manage their money and gain financial independence.

So, if you’re asking, “Is there any other app like Dave?”, rest assured that you have many great alternatives to consider.

FAQs

Apps like Earnin and Brigit are similar to Dave, offering cash advances, early payday features, and no hidden fees. They help users access funds quickly without relying on traditional payday loans.

Earnin and Brigit let you borrow money instantly. They offer cash advances based on your income, providing quick access to funds without interest or hidden fees.

You can get $50 in instant cash through apps like Earnin, Brigit, or FloatMe, which provide cash advances based on your earned wages.

Top alternatives to Dave include Earnin, Brigit, Chime’s SpotMe, and MoneyLion. These apps offer similar features, including cash advances and financial management tools.

Earnin is better for no fees and instant access to funds based on hours worked. Dave offers more features like budgeting tools, but Earnin may be a more flexible option for some users. Both are great for quick financial assistance.

Share this blog