Unwanted expenses can leave anybody scrambling for cash. Luckily, with the best cash advance apps of 2025, you don’t have to stress.

This is where those apps that loan you money come in, without making you go through the headaches of the traditional loan process.

These apps get you fast cash without ever going through the headaches of traditional loans.

Such applications basically allow you to borrow for last-minute expenses to bridge the gap, hopefully with as little hassle as possible.

If you're searching for an emergency cash app to help get through unexpected bills or a payday advance app to keep you through your next paycheck then - welcome.

This blog explores the best instant loan apps of 2025, and how no credit check cash advances can save your day.

Okay, ready to check out the best options available to get you quick cash? Let's go!

What Exactly Are Cash Advance Apps?

Before we get to know some of the best apps for cash advances, you should first know “What is a cash advance app?”

A cash advance app also known as an emergency cash app or payday advance app allows you to access a small amount of money via a mobile app, before your payday.

It's a very simple and quick option for covering any unexpected expenses without the anxiety of traditional payday loans or credit cards.

Some will charge you just a minimum amount for the advance, and others sometimes even provide you with a zero-interest advance.

With just a few taps on your phone, you can borrow money and have it directly deposited into your account in no time.

Most cash advance apps are straightforward to use: They look at your income and give you access to a portion of what you have already earned.

It's kind of like borrowing against your future paycheck but without all the complex paperwork and lengthy approval processes.

But, if you are wondering, “Can I use cash advance apps with bad credit?” Yes, you can.

Several apps like EarnIn and Brigit, don’t need credit checks, making them a good option for people with poor credit scores.

Overall, they're increasingly a popular means for people who meet sudden expenses and need to get cash quickly without the hassle or debt that comes along with conventional loans.

Why Are Cash Advance Apps So Popular in 2025?

Did you know that 40% of Americans can’t cover a $400 emergency expense?

That's where simple cash advance apps come in.

Whether it is a surprise bill or having to wait for a paycheck to clear, quick cash has become the only answer for that.

However, people turn to cash advance apps for short-term cash loans many reasons including the need for urgent cash, the convenience of no credit check cash advances, or the flexibility of instant loan apps.

Honestly, call it early pay solutions, or cash advance apps, they are already making waves to offer fast, easy income access.

Knowing the Best cash advance apps for 2025 will help you streamline borrowing, making it much quicker and more convenient.

In case, you are questioning why people seek these types of services? The reasons are many:

1] Quick Cash Availability

Cash advance applications give quick and immediate access to cash, with some offering money within minutes.

No more waiting for approvals, or filling out hefty paperwork.

If you need cash urgently, Instant loan apps like Chime provide an easy option for quick funds.

It would not be wrong to say that with growing mobile app development, cash advance apps are setting new standards for financial convenience.

2] No Credit Checks

One of the huge factors that made these apps famous is that several apps offer the facility of accessing cash without performing credit checks.

If you are looking for no credit check cash advances? Apps like EarnIn and Brigit can help.

With these apps, you can get quick funds without costly delays or hassle in situations where credit checks are typically completed without thorough consideration.

3] Low Fees

Unlike loans that can pile on the fees, cash advance apps would generally have lower fees.

This gives you a more pocket-friendly solution should you need small cash to help you get through.

But the question here is then “How do cash advance apps make money?” Well, they have their own ways such as some charging optional tipping or providing premium features for a subscription fee.

4] Flexibility

Do you need that extra cash before payday? Cash advance apps allow you to borrow just what you need and return it once you are paid.

This flexibility lets you manage your finances freely, without stress or pressure from strict repayment schedules.

Now that you know the basics, let’s not waste any time and jump straight into the top cash advance apps you should be using in 2025. Let’s get started!

Best Cash Advance Apps To Use in 2025

If you need quick funds without facing any trouble? The best cash advance apps of 2025 are here to save your day.

Be it instant approvals or poor credit scores, these apps got you covered to help you with any kind of financial needs.

Here are the best instant cash advance apps to consider in 2025:

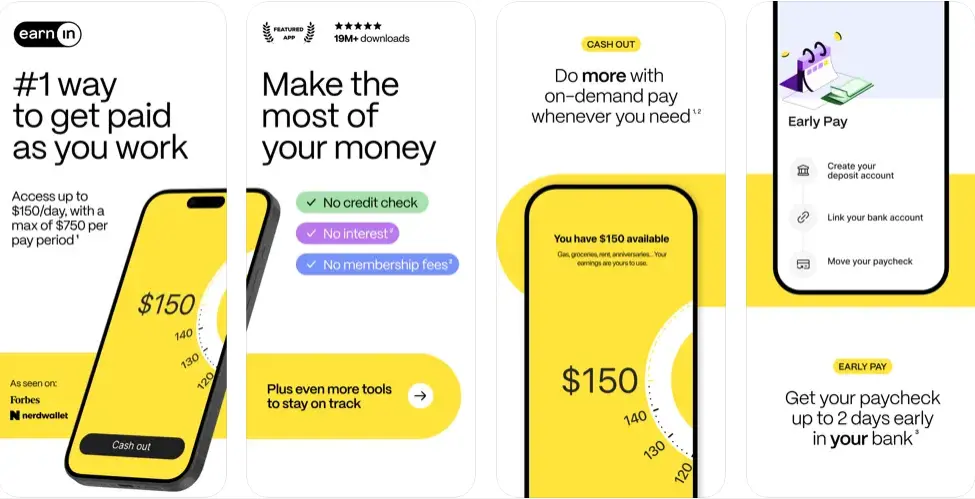

1. EarnIn: Access Your Wages Instantly!

Have you heard of EarnIn? A successful example of how to create a money lending app.

EarnIn is one of the best cash advance apps for 2025 out there that offers the facility to earn your wages before the payday.

With this app, you can cash out a maximum of $150 in a day. The best bit? No credit check, and a small tip if you like the service.

EarnIn is one of the most popular apps that loan you money without requiring a credit check. Apart from that, it offers a very transparent and flexible way to get the needed money at the right time.

Whether you are short of cash or an emergency arises, EarnIn is your instant solution.

Pros:

-

- Instant access to earned wages

- No interest or hidden fees

- Flexible and transparent tipping model

Cons:

-

- The tipping model may not be ideal for everyone

- Dependent on employer participation

Cash Advance: $150/day, with a max of $750 per pay period.

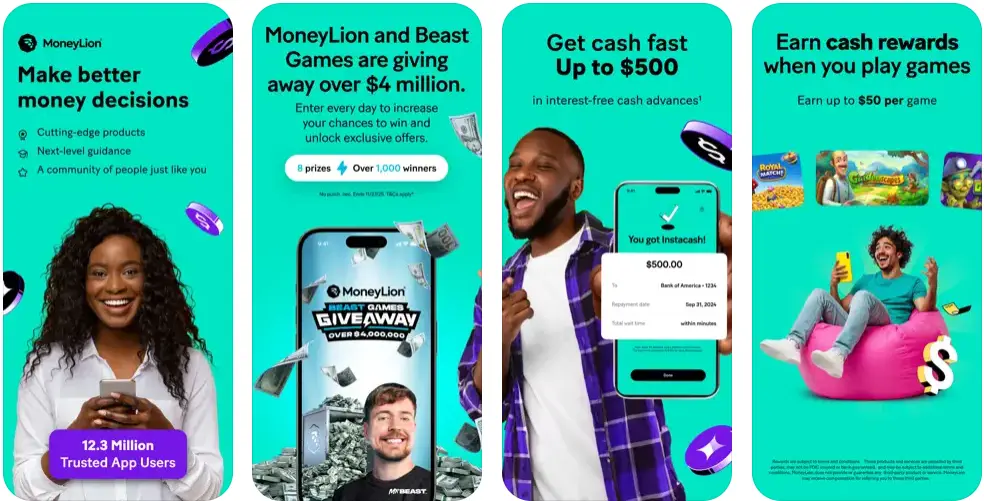

2. MoneyLion: All-in-One App for Instant Cash and Financial Wellness

MoneyLion has become a household name in the fintech world, inspiring many to create an app like MoneyLion that offers users seamless access to funds.

It offers a solid financial service through its Instacash feature, allowing you to borrow amounts up to $500 without fees.

It is one of the best apps for cash advances because it offers a full suite of services. Besides cash advances, Money Lion provides credit monitoring, budgeting tools, and loans.

Pros:

-

- Access up to $500 with no fee.

- Includes credit monitoring and financial tools

- No credit check required

Cons:

- Only available to MoneyLion members

- Advanced options come with fees for non-members

Cash Advance: $500

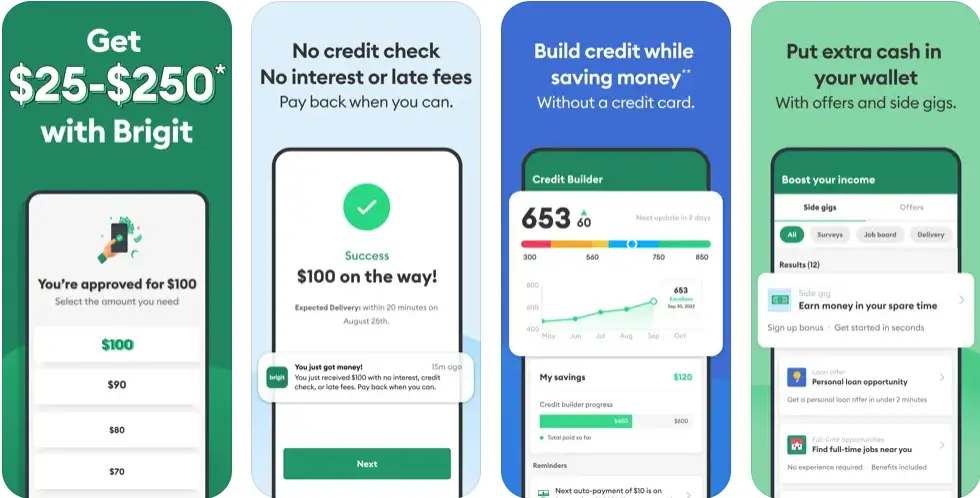

3. Brigit: Your Go-To App for Financial Relief Between Paydays

Brigit is a famous quick cash advance app for Android & iOS. It grants up to $50- $250 per cash advance, no interest or credit checks.

What makes Brigit stand out, is its proactive system: the app will analyze your spending habits and anticipate when you'll need money, offering you a cash advance before you even ask for it.

This means it's not only a free cash advance app but also a good financial tool that can help you avoid overdraft fees while honing your budgeting skills.

If you are looking for the apps that let you borrow money based on your income and spending habits? We suggest going for Brigit.

Pros:

-

- No credit checks or interest charges

- Proactive support based on your spending patterns

- Easy-to-use interface

Cons:

-

- The free version has limited cash advances

- Cash advances are based on income levels

Cash Advance: $50 to $250

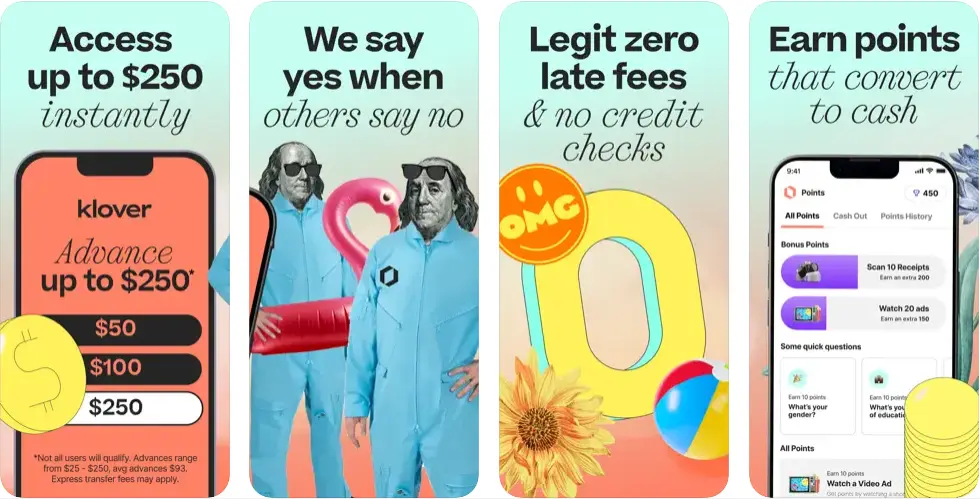

4. Klover- Instant Cash Advance: For Emergency Cash There's Klover

Need cash now? Klover is your instant cash application companion.

No credit checks, instant access to as much as $200, hassle-free!

Klover links to your bank account, finds out whether you're eligible, and gives you a fast no-nonsense, and transparent method of achieving a cash advance, with no hidden fees or interest.

It's rapid, easy, and perfect for those sudden expenses that just can't afford to wait. Try this instant cash advance app for your needs next time.

Pros:

-

- Instant access to up to $200

- No hidden fees or interest charges

- Simple and quick to use

Cons:

-

- Requires a bank connection for eligibility

- Cash advance amount depends on spending patterns

Cash Advance: $200

5. Beem: No Fees, No Interest, Just Fast Cash!

When you're in a finance jam and need a little help getting by, Beem is just the ticket.

You can get instant cash advances of anywhere between $10 to $1000, virtually interest-free and with no hidden fees.

No credit checks, no surprises, only fast and uncomplicated cash advance with generous allowances until payday!

Beem offers cash in emergencies with the least amount of hassle.

Pros:

-

- No fees, no interest charges

- Quick and easy application process

- Simple and transparent

Cons:

-

- Only available in select states

- Requires a bank account for verification

Cash Advance: $10-$1,000

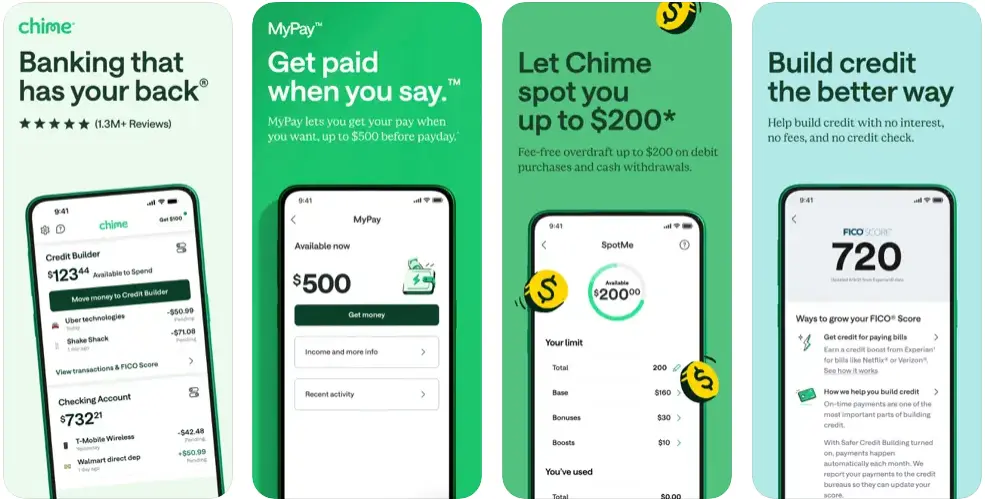

6. Chime - Mobile Banking: Instant Cash With a Bonus

Emergencies ask for no waiting - neither shall you! Chime is your companion in crises for fast, fee-free cash advances.

A true example of what one can achieve with a great idea and expert mobile banking app development.

If you use Chime's SpotMe feature today, up to $500 in cash advances is available at no interest and with no fee whatsoever.

Chime is a top cash advance app to access funds before payday and offers access to additional features like no-fee-finance and a full range of mobile banking features.

It is not only an easy cash advance app but also ensures direct deposit same day. In short, Chime is simply life on your own terms with full flexibility.

Pros:

-

- Instant access to up to $500 per day.

- No interest or hidden fees

- Additional mobile banking features

Cons:

-

- Only available to Chime account holders

- Cash advance limit may vary based on direct deposit

- Not available in all locations

Cash Advance: $500 per day

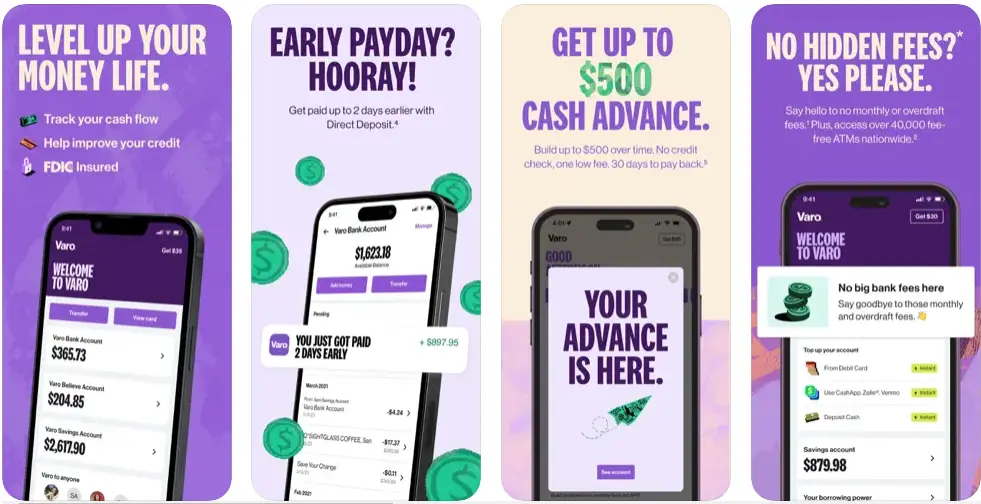

7. Varo Bank: Cash Advances Made Simple

Low on cash before payday? Varo Bank can be your emergency cash app with its instant cash advance feature, giving you access from $20 to $500.

And the best part? The advance will automatically be paid back on the next payday, so no more hassle for anyone who needs urgent access to cash.

The part of Varo's mobile banking services helps one access cash easily, without the usual complexity of hidden costs and processes.

Pros:

-

- Instant access to cash

- No hidden fees

- Automatic repayment on payday

Cons:

-

- Limited cash amounts

- Repayment tied to payday

Cash Advance: $20-$500

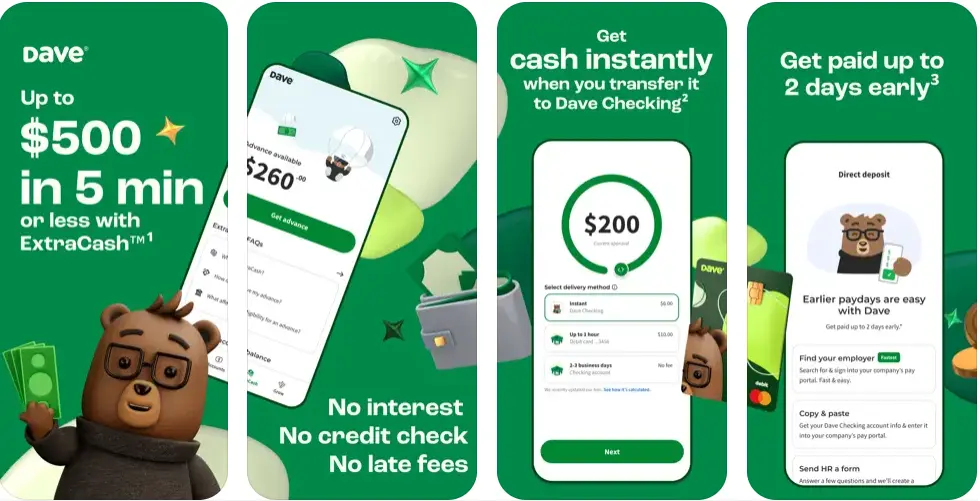

8. Dave: Fast Cash & Banking

When you need cash in a hurry, Dave has got your back.

Get instant access to up to $500 with no credit check or interest charges - a fantastic solution for those who a surprise expenses.

Plus, budgeting tools avoid future shortfalls.

Whether it is a surprise bill or needing a little extra between paychecks, Dave being a top money cash advance app is here to help.

Pros:

-

- No credit check or interest

- Instant funds access

- Budgeting tools included

Cons:

-

- Requires direct deposit

- Monthly subscription fee

Cash Advance: Upto $500

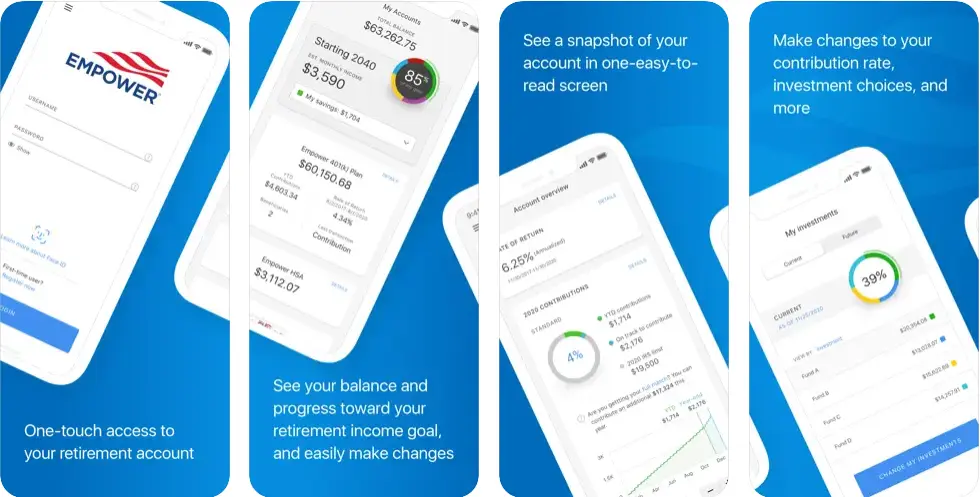

9. Empower®: Instant Cash and Smart Budgeting in One App

Need cash fast and a way to control your budget?

Empower® provides ultimate flexibility with its instant cash advance app! Up to $300 cash advance without credit checks or interest rates.

It has budgeting tools built in to help you control your financial spending.

Empower® is not just for short-term relief but for putting yourself in charge of your finances going forward.

Pros:

-

- Access up to $300 instantly

- No credit checks or interest

- Includes budgeting tools

Cons:

-

- Requires a monthly subscription for premium features

- Limited to Empower account holders

Cash Advance: $10 to $300

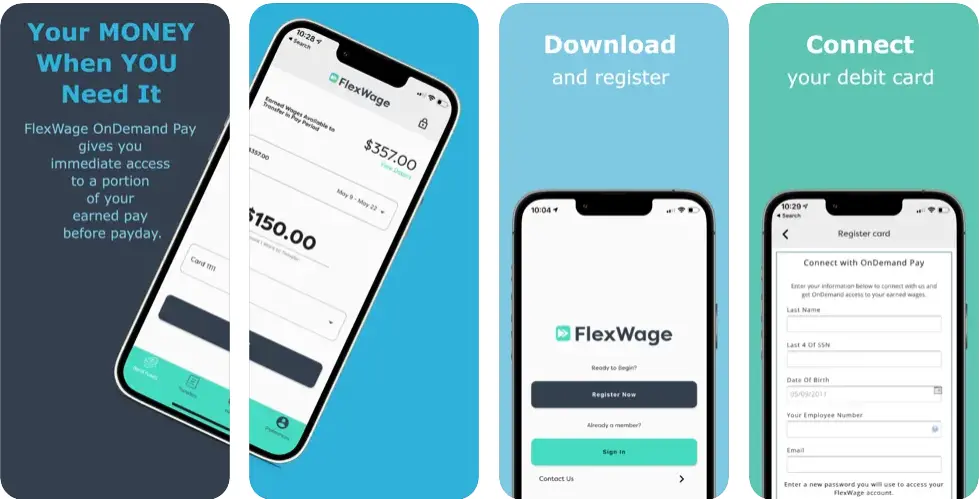

10. FlexWage: Get Your Wages Anytime You Need

FlexWage offers a unique approach for those looking for free instant cash advance apps.

If you’ve run low on cash, FlexWage will allow you to withdraw amounts up to $500 totally on your employer.

It works through your employer’s payroll system, making it easy to access the money you’ve earned already without payday loans or high-interest borrowing.

Fast, flexible, and without the excruciating wait of waiting until payday.

Pros:

-

- Access up to $500 of earned wages.

- No interest or credit checks

- Seamless integration with employer payroll

Cons:

-

- Only available if your employer partners with FlexWage

- Not ideal for smaller cash advances

Cash Advance: Varies

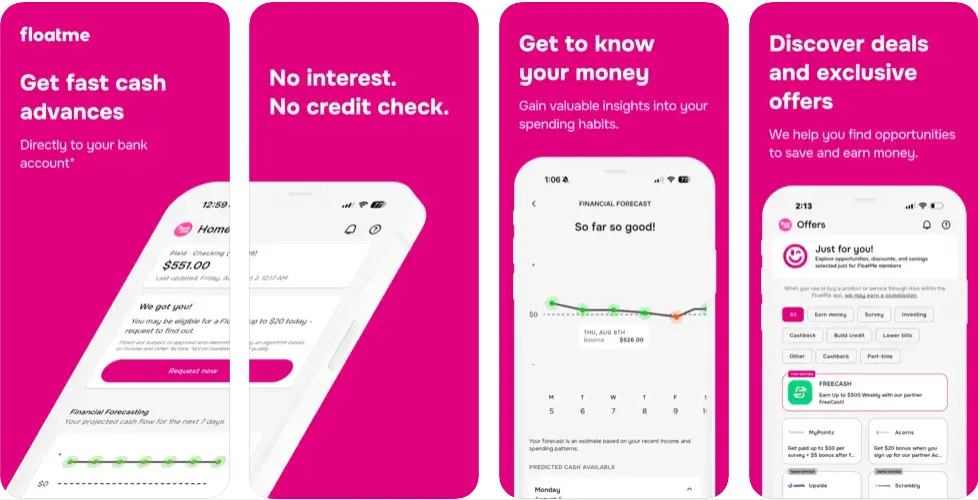

11. FloatMe: Quick Cash with No Surprise Fees

In case, you are after easy cash advance apps that offer funds hassle-free, FloatMe is a great recommendation.

It lets you borrow up to $50 to tide you over until payday. The platform functions very simply, doesn't incur interest, nor does it hide any fees.

If small amounts are what you need, FloatMe is the right pick for you. It can help you very quickly manage your finances.

Pros:

-

- Easy-to-use interface

- No interest or hidden fees

- Quick access to small advances

Cons:

-

- Limited to $50 per advance

- Not ideal for larger cash needs

Cash Advance: $50 between paydays (New Member)

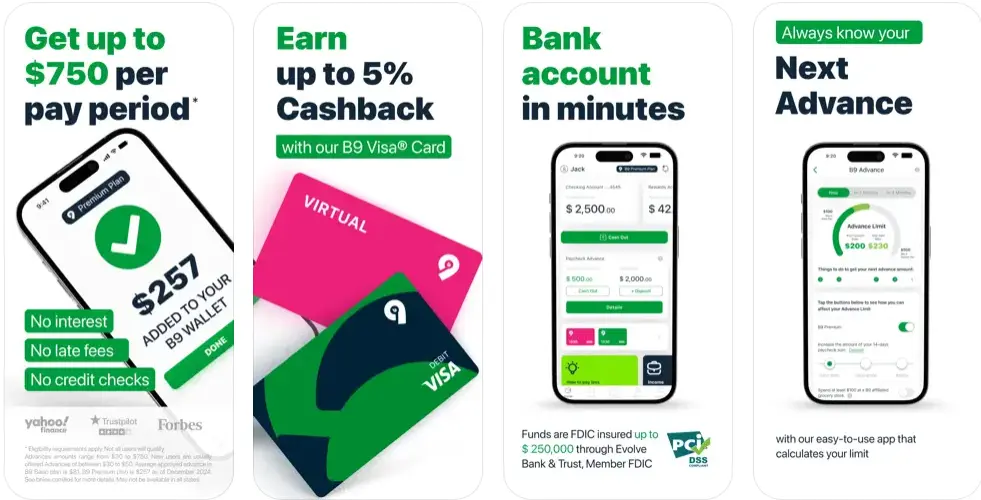

12. B9: Simple and Easy Cash When You Need It Most

B9 is a well-known in the list of cash-advance apps that permit you to access funding in a simple way. Up to $750 is available with no credit checks and interest.

The fast and reliable way to get the funds you need without the extra hassle is what makes it an easy cash app.

B9 is for those folks who want to get quick cash with none of the complex processes.

Pros:

-

- Up to $750 is available instantly

- No credit checks required

- Simple and fast

Cons:

-

- Limited availability for some users

- Requires linking your bank account

Cash Advance: $750 per pay period

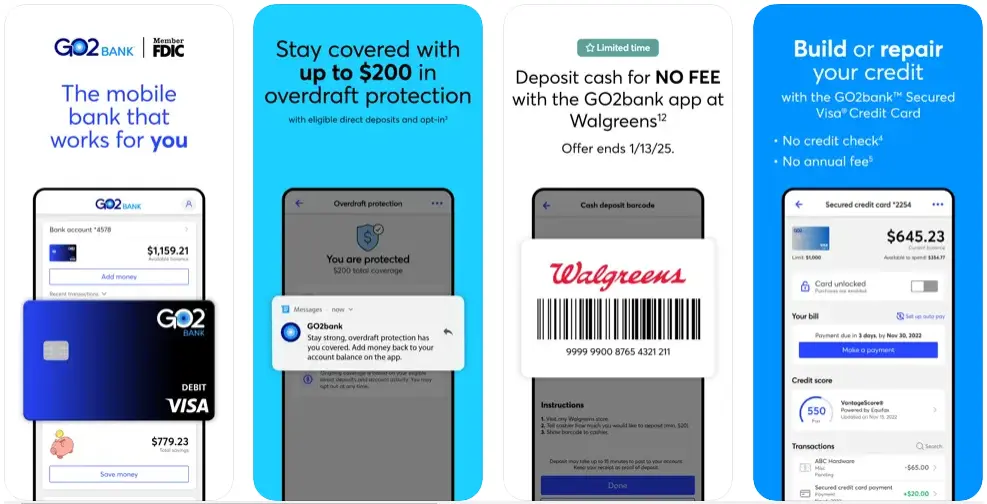

13. GO2bank: One-Stop-Shop for Cash Advances and Banking

Known for its Pay Advance, now, we are talking about ”GO2bank “ which lets you access up to $500 instantly.

Combining the features of cash advances with a full banking suite, it is one of the best cash advance apps for 2025.

With this, you can also become the manager of your savings and bills, all fee-free. Great for those looking for comprehensive financial services.

Pros:

-

- Access up to $200 instantly

- No interest or hidden fees

- Full banking services

Cons:

-

- Only available to GO2bank account holders

- Not available in all locations

Cash Advance: $500 per day

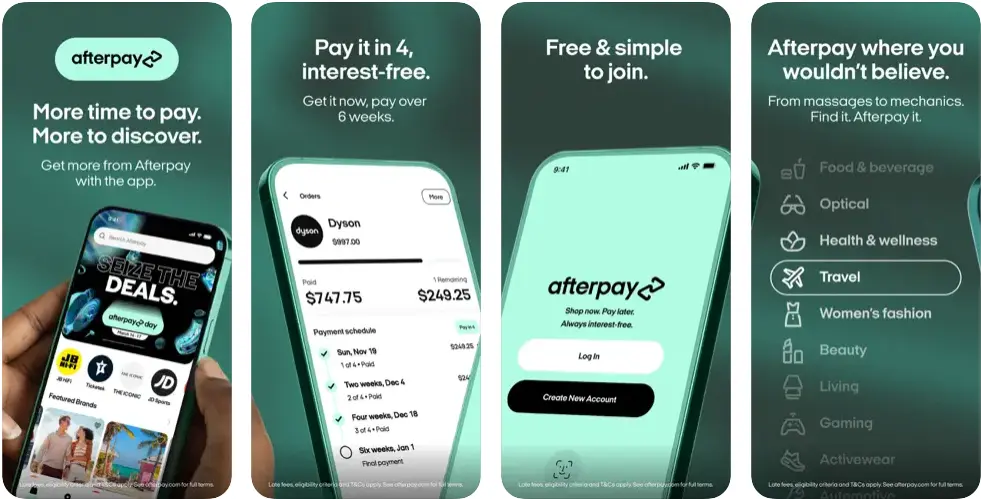

14. Afterpay: Shop Now, Pay Later with Flexibility

While it's not the traditional cash-advance app, Afterpay lets you shop now and pay later.

It is definitely among the best cash-advance apps that provide you with four equal installment payments after you have made a purchase.

This makes it very easy for someone to regulate their spending without any unnecessary upfront payment stress.

Pros:

-

- Flexible payment options

- No interest or hidden fees

- Simple to use

Cons:

-

- Limited to shopping purchases only

- Late fees if payments are missed

Cash Advance: Upto $2500

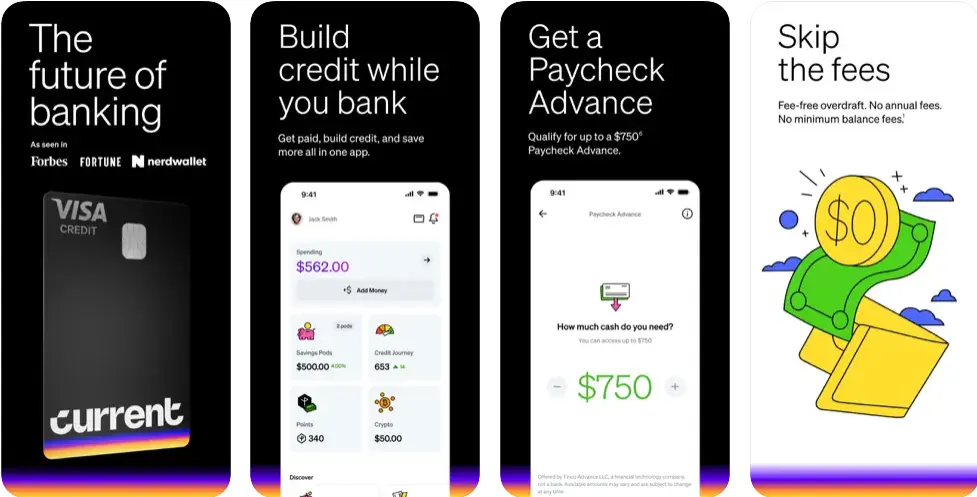

15. Current: Get Paid Early-No Fees

Current is one of the best apps for cash advances. You'll be able to get cash up to $500 (with no hidden fees and interest) with Overdrive.

Plus, you can take advantage of its full banking services.

Whether fast cash is needed or you want to take control of your finances, Current can help.

Pros:

-

- Access up to $500 instantly

- No fees or interest

- Full banking services

Cons:

-

Requires a Current account

-

Not available in all locations

Cash Advance: Upto $500

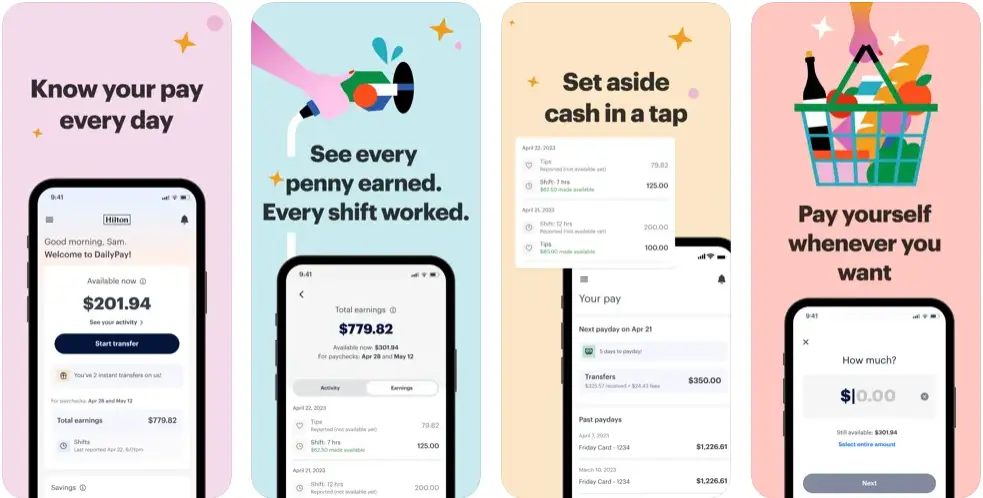

16. DailyPay: Access Your Wages Anytime

DailyPay is an on-demand payment service that allows employees to access wages before payday.

This makes it one of the best cash advance apps for employees who want to be able to access earned wages easily.

It's integrated with your employer's payroll system and is one of the most seamless money advance apps out there.

Pros:

-

- Instant access to earned wages

- No credit checks or interest

- Direct integration with employer payroll

Cons:

-

- Limited to participating employers

- Only available to employees with direct deposit

Cash Advance: $515.00 per transaction (Varies)

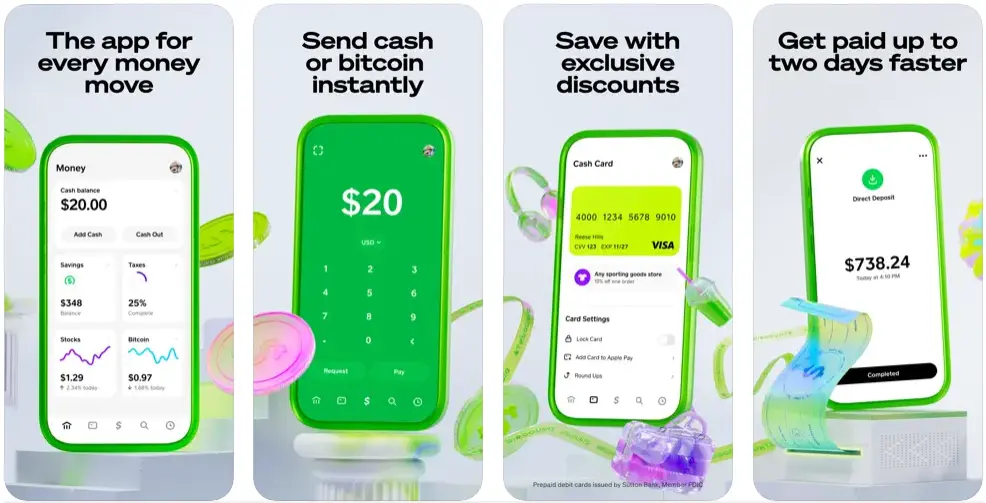

17. Cash App: More Than Just Cash Advances

Cash App is a household name.

It is more than just a quick cash advance app-it's a financial tool that you surely need.

It allows a cash advance for emergencies or urgent needs and also lets users send money, invest in stocks, and even buy Bitcoin- an all-in-one tool.

As it brings convenience and versatility to one app, Cash App has been rated as one of the top cash advance apps.

Imagine creating an app like Cash App- a powerhouse financial tool that offers more than cash advances. Well, that is for another day,

Pros:

-

- Instant cash advances with no interest

- Easy to use for both cash and investments

- Versatile financial features

Cons:

-

- Limited to Cash App users

- Advanced features may require fees

Cash Advance: $2,500 per day

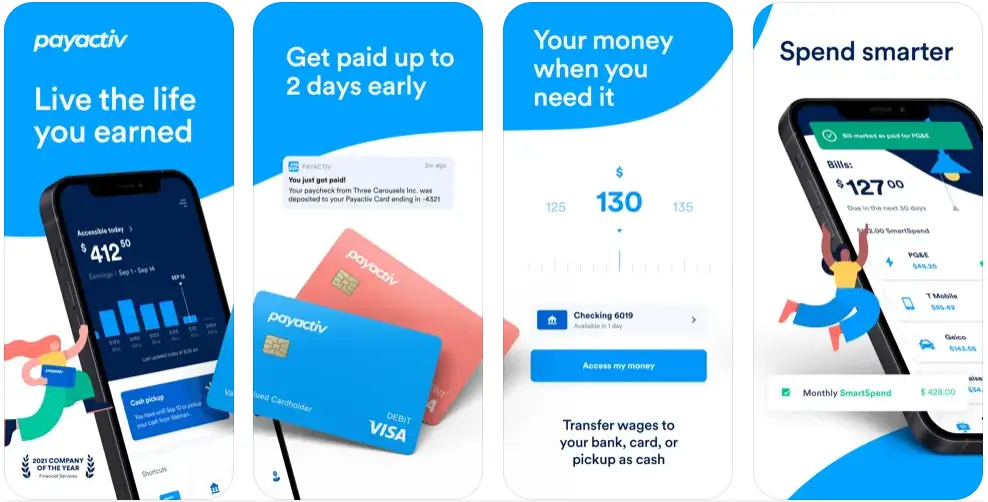

18. Payactiv

Payactiv is not just an instant cash advance app; it's an all-in-one financial wellness platform where workers earn wages before payday.

With Payactiv, you can say goodbye to worries about waiting for your paycheck and enjoy instant financial flexibility.

Be it an emergency medical expense, last-minute overdrafts, or managing cash flow, you can take control with Payactiv.

Pros:

-

- Access funds based on your earnings.

- Includes budgeting tools, savings options, and bill payment features.

- Connects with your employer’s payroll system.

Cons:

-

- Only available if your employer is a partner.

- Some services come with a subscription cost.

Cash Advance: Upto $1000

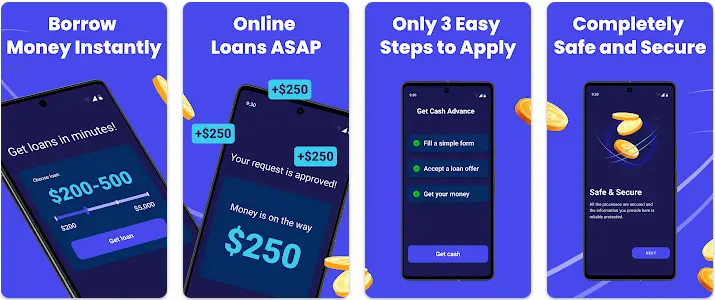

19. Borrow Money App: Simple and Straightforward Cash Advances

The Borrow Money App is one of the easiest & free cash advance apps.

As the name implies, you can borrow small amounts of money simply, without stress, & no credit check.

It is advisable for those people searching for an easy cash advance app without the hassle of complicated terms.

Pros:

-

- Quick and easy access to small loans

- No credit checks

- No hidden fees

Cons:

-

- Limited to smaller advances

- Requires a bank account for verification

Cash Advance: $100 and $2,500

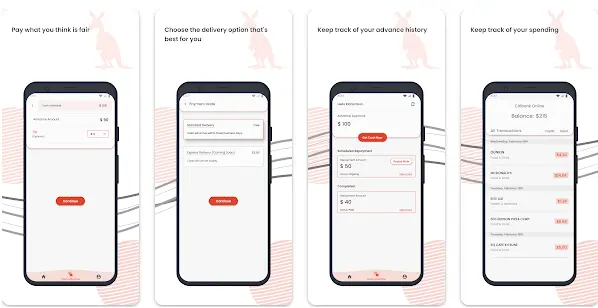

20. Rocco - Fast Cash Advance: Quick Access to Emergency Funds

Rocco is a great option as a instant cash-advance apps that provide cash within few minutes.

With Rocco, you can get the money you need quickly without any momentous procedure or credit check holding you back.

It takes care of the most basic requirement for people looking for an immediate, trusted solution to pass through a hard financial time.

Pros:

-

- Quick cash advances with no credit checks

- Straightforward and user-friendly app interface

- Fast approval and disbursement

Cons:

-

- Limited loan amount for first-time users

- Higher fees compared to traditional loans

Cash Advance: $20 – $100

So, these are some apps for cash advances that have been the talk of town for a long time, now summing up this in a table would look something like this:

|

Best For |

App Name |

Key Features |

Cash Advance Limit |

|

Instant Wage Access |

EarnIn |

Access earned wages early, no interest or fees, tipping model |

150/day, 150/day,750/pay period |

|

All-in-One Financial Tool |

MoneyLion |

Instacash advances, credit monitoring, budgeting tools |

Up to $500 |

|

Proactive Cash Advances |

Brigit |

Analyzes spending habits, offers advances before you ask, no credit checks |

$50 to $250

|

|

Emergency Cash |

Klover |

Instant access to $200, no hidden fees, simple eligibility checks |

Up to $200 |

|

No Fees or Interest |

Beem |

Small cash advances ( $20−100), no fees or interest, easy to use |

$20 to $100 |

|

Mobile Banking + Advances |

Chime |

SpotMe feature for overdrafts, no fees, full mobile banking services |

Up to $200 |

|

Automatic Repayment |

Varo Bank |

Cash advances are repaid automatically on payday, with no hidden fees |

$20−$500 |

|

Budgeting Tools |

Dave |

Up to $500 advances, budgeting tools, no credit checks |

Up to $500 |

|

Financial Wellness |

Empower® |

Cash advances up to $250, budgeting tools, no credit checks |

$250 |

|

Employer-Integrated |

FlexWage |

Access earned wages through employer payroll, no interest or fees |

Up to $500 |

|

Small Cash Advances |

FloatMe |

Borrow up to $50, no interest or hidden fees, simple interface |

$50 |

|

Quick Cash with No Fees |

B9 |

Access up to $750, no credit checks, fast and reliable |

Up to $750 |

|

Comprehensive Banking |

GO2bank |

Pay Advance feature, full banking services, no fees |

Up to $500 |

|

Instant Wages |

Payactiv |

Offer wages before Payday to cover crises. |

$1,000 cash advance |

|

Early Paycheck Access |

Current |

Overdrive feature for early wage access, no fees, full banking services |

Up to $500 |

|

On-Demand Wages |

DailyPay |

Access earned wages anytime, integrated with employer payroll |

$515/transaction |

|

Versatile Financial Tool |

Cash App |

Cash advances, stock investments, Bitcoin purchases, no interest |

$2,500/day |

|

Global Financial Services |

Revolut |

Cash advances up to $200, global money transfers, currency exchange |

Up to $200 |

|

Simple Small Loans |

Borrow Money App |

Small loans with no credit checks, a straightforward process |

$100−$2,500 |

|

Quick Emergency Funds |

Rocco |

Fast cash advances, no credit checks, user-friendly interface |

$20− $100 |

► Explaining Further:

-

- For Instant Cash: Look at EarnIn, Klover, or Beem.

- For Budgeting Tools: Check out Dave or Empower®.

- For No Fees: Consider Chime, Varo Bank, or Beem.

- For Employer-Integrated Solutions: Go for FlexWage, DailyPay, or Payactiv.

- For Small Advances: Try FloatMe or Rocco.

- For All-in-One Financial Services: Explore MoneyLion, or Cash App.

Conclusion

New Cash advance apps in 2025 are setting standards by offering a simple and fast way to take care of unexpected expenses without formal loans.

Whether you need apps that loan you money for emergencies or apps that let you borrow money to bridge the gap until payday, the options in 2025 are more accessible and user-friendly than ever.

These apps easy access to wages earned or small cash advances, usually with no credit checks and low fees.

Emergency cash, budgeting, short-term cash loans or employer-related? There is an app for any need.

Some famous cash advance apps such as EarnIn, MoneyLion, and Chime put an end to the payday gap without lending somebody into debt.

These apps are changing the face of personal finance: making it easier, transparent, and flexible to get help.

Pick your app for easy support fitting your financial state.

FAQs

Yes, most cash advance apps use bank-level encryption to protect your data. However, always read reviews and make sure the app has security policies before using it.

Of course, many apps such as EarnIn and Brigit, don’t require a credit check, making them perfect for users who have poor credit checks.

Most apps charge small fees and offer the option to tip or provide advanced features that you can utilize for a subscription. For example, EarnIn uses a tipping model, while Dave charges a monthly membership fee.

Some of the top cash advance apps to use in 2025 include EarnIn, MoneyLion, Brigit, Klover, and Chime.

Cash advances are often available instantly or within a few hours, with some apps offering immediate deposits into your bank account.

Share this blog