Today, we live in a digital world where we rely on mobile apps to the extent that we order everything online whether it is products or services. This has made our lives easier by saving our time and making us more organized.

Loan lender apps have saved the day for people waiting for loan approval, much like the majority of other apps that have made our lives much easier. Loan lending app development is emerging as a rapidly growing industry. If you are searching for the best loan lending apps and details about them. Look no further! In this article, we have picked out the best loan lending apps and different aspects of using these apps.

What is a Loan Lending Mobile Application?

Loan lending mobile apps act as a digital bank from where you can borrow money from any finance firm or bank in your country with interest rates set by them. These apps give you the opportunity to compare interest rates and choose the one that can lend you money for a particular time period with minimal interest. You can consider these apps as credit cards that enable users to take an instant loan. The user just needs to download the loan lender apps and create an account on it. Next, they should check for their financial eligibility and add their personal details along with their bank details.

Also Read: Security Solutions For Mobile Banking App Development

The best loan lending apps are reliable and this is the reason most people use these apps to check their credibility and their credit score with the app and see how much loan they are eligible for. It cuts down on the amount of time spent visiting banks, waiting in line, and interacting with employees over the counter.

Top Loan Lending Apps

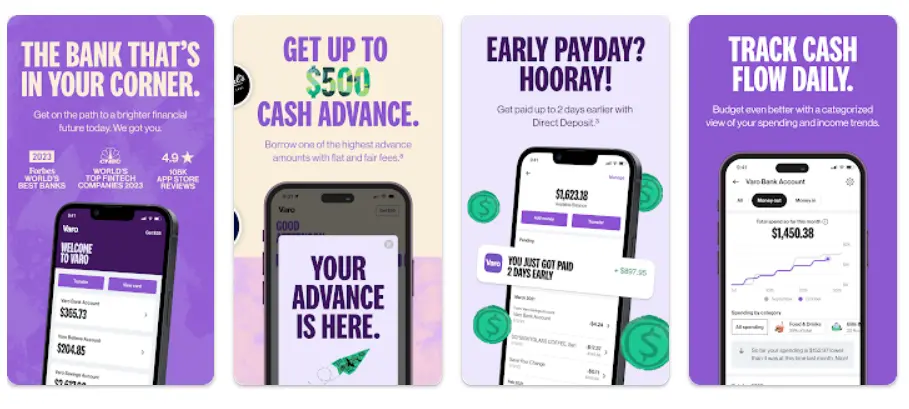

Varo

Varo is an intuitive mobile banking app that offers personal loans and many financial services without charging any hidden fees. You can register for the app and apply for loans. The approval process is quite fast and funds are deposited into your Varo account. Varo aims to provide an enhanced banking experience to its users by eliminating the minimum balance requirements and early direct deposit. Hence, it earned a top position in the list of best loan lending apps.

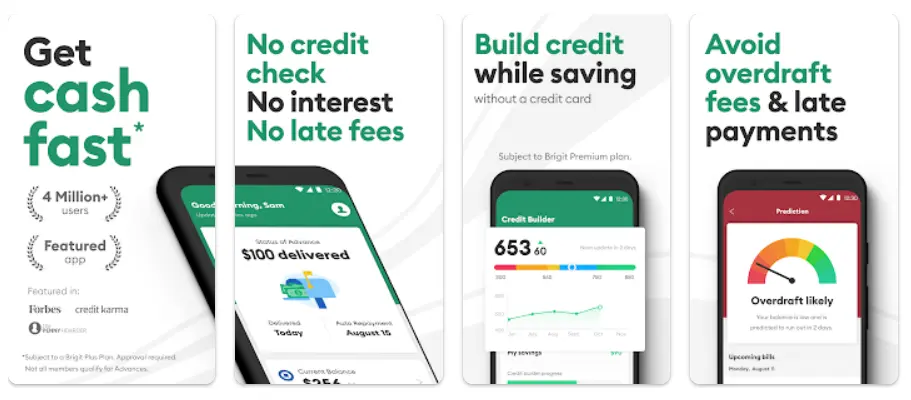

Brigit

Brigit is in second place among the best loan lending apps designed to help users avoid overdraft fees and financial stress. It offers many benefits, including small cash advances, budgeting tools, and all the relevant financial information. Brigit gives you an advance on your paycheck without demanding any interest or hidden fees, making it a preferable option for emergency funds.

Chime

Just like other best loan lending apps, Chime also offers a wide range of digital banking services with no hidden fees. This app is known for its advanced banking features which make the application and receiving process very convenient. In addition, Chime also provides a feature called "SpotMe" which lets users overdraft their accounts up to a particular limit with no incurring fees. If you need a small or short-term loan, then this app may be the ideal choice for you.

SoLo Funds

SoLo Funds is a unique lending platform that takes an interesting approach to lending. On this app, you borrow money from individual investors rather than taking loans from a finance company. It is a community-based platform where members borrow and lend money, earning a small amount in return. Solo does not charge any common loan fees, giving you the advantage of setting your own terms for repayment. It promotes a sense of community by encouraging peer-to-peer lending trust and transparency.

Earnin

EarnIn is a leading loan app, using which users can get access to their earned wages before their payday. It helps you manage cash flow while avoiding high-interest payday loans. It also charges 0 interest and hidden fees. You simply need to connect your bank account, track your hours worked, and withdraw the money you have already earned, making it one of the best loan lending apps for quick cash advances.

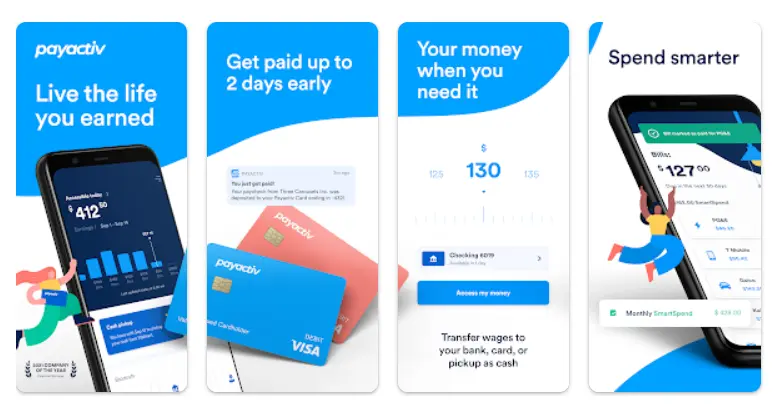

Payactiv

Get your wages before you are officially paid with Payactiv. It allows you to borrow up to 50% of your total earnings and transfer it to your bank account. You also get options like adding money to a prepaid card or using your PayActiv Visa card. You are free to use the money wherever you want and repay the loan when you get your paycheck. The app also comes with many financial tools, like budgeting, savings, and bill payment services, making it a robust lending platform.

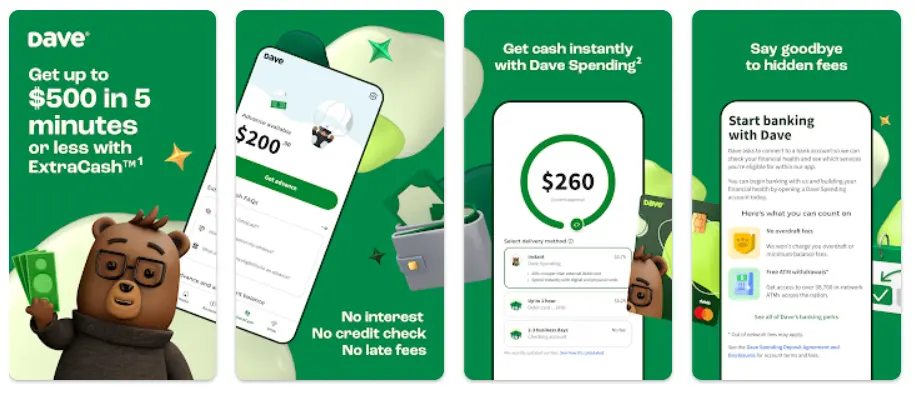

Dave

Dave is the next name on our list of the best loan lending apps. This app offers small cash advances based on your upcoming paycheck, helping you avoid overdraft fees. Dave opens your ExtraCash account using which you can borrow up to $500 within five minutes or less. And you will receive the money in your Dave Spending Account instead of your bank account. You must repay the loan on the agreed-upon date. It also offers budgeting tools and alerts to help users manage their finances more effectively.

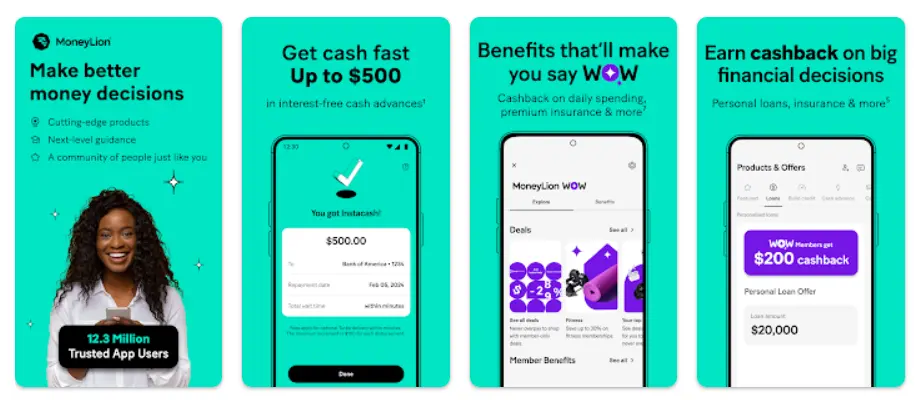

MoneyLion

MoneyLion is a versatile financial app that offers mobile banking and investment accounts, granting personal loans with low interest and flexible terms. It also provides credit-building tools, along with features like early paycheck access and cashback rewards. Anyone with a qualifying checking account can get Insta Cash up to $500. The users of MoneyLion get larger advances and have the fastest funding times, unlike the other loan lender apps. The app aims to provide a full suite of financial services to help users manage and grow their money.

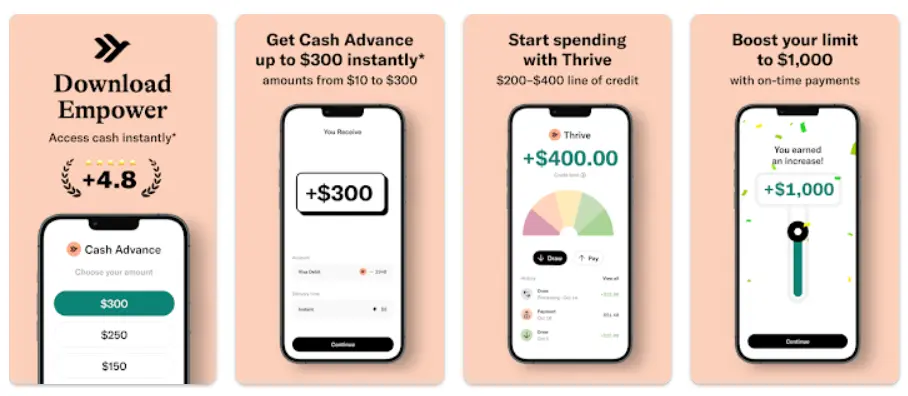

Empower

Empower is a financial app that offers cash advances, budgeting tools, and personalized financial advice. The app’s funding time is much faster than that of its competitors where users can pay instant delivery fees to get their funds within an hour. Empower has an automatic saving feature which makes it stand out among the other best loan lending apps. You can either select a certain amount from each paycheck to transfer from your checking to your savings account or the app will use its AI capability to transfer money to your savings account based on the weekly savings goals you set.

Klover

Using Klover, users can withdraw small cash advances based on their income and spending habits. It offers advances up to $100 depending on your bank account eligibility and another $100 advance based on your participation in the points program. To earn points–which can be converted to money that users can use as advances or to pay for fees—users must upload receipts, do quizzes, and view videos. Klover generates revenue by collecting user data and sharing insights with its partners, increasing the threat of data leakage.

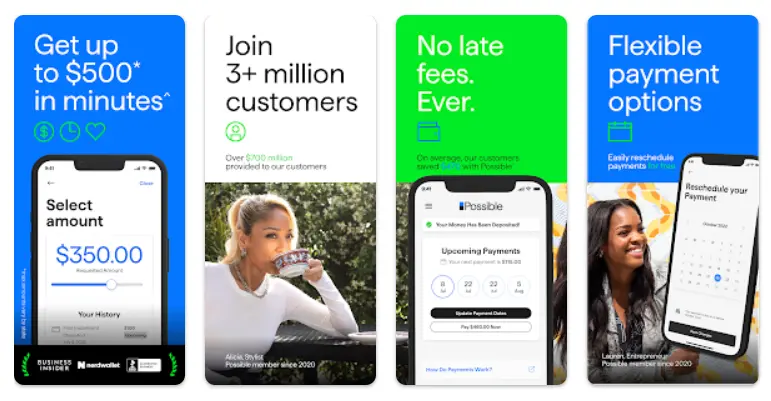

Possible Finance

Possible Finance is designed to offer small, short-term loans with flexible repayment options. Unlike traditional payday loans, Possible Finance allows users to repay their loans in installments over several months. This app is one of the best loan lending apps for those with less-than-perfect credit, as it reports payments to credit bureaus to help improve credit scores.

How Do Loan Lending Apps Work?

-

- The loan lending app is for users, borrowers, and lenders. To use the app they must download it and register themselves on it.

- They must input their personal information like a contact number or email ID for their profile verification and add their previous bank accounts.

- In a similar manner, the lenders have to add their bank account details for smooth financial transactions.

- Borrowers are free to choose from the loan options that they want offered by their lenders. To initiate the process, they should submit a loan request to the money lender with a reason for taking a loan.

- The lender will accept or reject the rationale based on his assessment of its appropriateness.

- After agreeing on all terms and conditions, both parties finish the loan sectioning process, either online or in person.

- The money will transfer from the borrower's account to the lender's.

Also Read: Mobile Banking App Development: Complete Guide

Why Should You Use Loan Lending Apps?

-

-

If you have a loan lending app on your phone then you can access money quickly in any emergency. These apps are more affordable than a personal loan especially when you only need a small amount. But you should keep in mind that some of the best loan-lending apps charge “express” or “instant” funding fees.

-

You can avoid overdraft fees. A loan app can save you from overspending your bank account balance, also helping you avoid the penalties at the same time. Though loan apps charge fees, they are still lower than those you have to pay to your bank for an overdraft.

-

You can get your paycheck in advance. A loan lending app can act as your personal bank, providing you with advance cash whenever you are struggling with low money and need help until your payday. As long as you promise to return the loan when it's due, some lenders let you access all or part of your salary ahead of time.

-

Avoid taking riskier short-term loans. Best loan lending apps are more affordable and less risky than traditional payday loans. They have a goal of providing you with quick money when needed, but they don't charge the same predatory interest rates and fees.

-

With loans, you can also get access to other financial tools. Some of the other loan apps also offer credit monitoring, deposit accounts, budgeting features and more. The lenders that provide the benefits you most want can be given priority.

-

Loan lending apps make it easy for their users to make timely payments with better record management. Automated transactions are manageable and more accessible. The app also sends prompt alerts and notifications when reading transactions.

-

Loan lending apps save you from the lengthy process of investing and borrowing money. You just go through background checks, convince the lenders to grant a loan, sign the paperwork, and you are done with the loan. Instead, a borrower can simply apply to an investor for a loan, go through the necessary background checks, and receive money in their account.

-

How Do You Choose the Best Loan App?

There are plenty of loan lending apps available on both the Google Play Store and the App Store. You can choose the app that suits your requirements while considering the following factors.

-

-

Firstly, you should determine the amount of money you need to borrow. It will help you narrow down the suitable apps because each loan app has its own maximum loan amount.

-

Observe the loan costs carefully as some of the top loan lending apps offer loans with no fees while others charge certain fees. If an app charges fees, then it should have some exclusive features that can justify the fees. However, only you can decide whether it is worth it or not.

-

Analyze the repayment terms of each loan lending app. Most of the loan apps ask for a repayment on the same day your net paycheck arrives. If you require more time to repay your loan, then select an app with longer repay terms.

-

Take the feedback of past and current customers seriously. You can read their reviews which can explain how the app works, how a lender deals with the customer, and what security features the app has. It will help you create an unbiased opinion.

-

Are Loan Apps Safe?

Loan lending apps are integrated with advanced security measures to ensure the safety and privacy of your data and money as well. However, these apps should not be considered completely risk-free. To use these apps, first, you have to connect your bank account with the loan app and then also fill in all your personal information including your social security number.

You should follow safety guidelines like choosing a strong password or doing two-factor authentication to minimize the risk of unauthorized access and hacking of your account or your financial information.

You should always remember that taking loans frequently is not a wise decision for your personal finances. Though the app does not directly pose a risk, the habit of borrowing money can lead to a cycle of debt, damaging your financial and mental health as well.

An experienced mobile app development company like JPLoft always prioritizes the security of users' data. We utilize advanced technologies like blockchain, AI, ML, etc. to back our loan lending app development. We know how to create a secure investing environment for your robust loan app.

Conclusion

The money lending apps are a topic of discussion and with the popularity of these apps, the changes in investments in this field have increased. If you want to build a loan lending app for your business, then you might stand out among your competitors and create a vast audience base by slowly providing bank loans to easily accessible loans through these loan lender apps. Hire dedicated developers for banking app development, and revolutionize the finance industry with a robust loan lending app.

Share this blog