Are you wondering how to build a money transfer app that’s not only secure but also user-friendly and reliable? You’re in the right place.

Building a money transfer app isn’t just about writing codes, it is about creating a financial experience that users can trust.

In a digital age where convenience and security are non-negotiable, your app needs to tick all the boxes.

With the growing demand for seamless money transfer apps, each step in the development process is important.

This is where our guide to Money transfer app development comes to the rescue.

Ready to dive in? Let’s help you turn your idea into a secure, scalable, user-friendly money transfer app!

What is a Money Transfer App?

Serving as an all-in-one digital wallet at its core, a money transfer app is a mobile app that offers users the ability to send, receive, and manage funds electronically, typically via bank accounts, credit cards, or digital wallet.

These apps are famous for offering fast, secure, and convenient ways to transfer money, making it all an important tool for individuals and businesses.

It offers several features like real-time transfers, low fees, multi-currency support, and enhanced security that make such apps really popular.

Famous money transfer apps like PayPal, Venmo, and TransferWise have set benchmarks in the industry.

People often get confused between remittance app development and eWallet app development. But, they are not the same. Well, that is for some other time.

As of now, let’s take a step back and remind you why you’re here.

You came to this blog because you’re eager to discover the essential steps to develop a successful money transfer app, right? Well, let’s get right into it!

Step-by-Step Guide to Build a Money Transfer App

So, you’re thinking “How to make a money transfer app?”

Building a money transfer app needs proper planning and careful development. In this section of the guide to create a money transfer app, we will explore the same.

Ready to get started? Let’s dive in!

Step 1: Define Your App Concept

Money transfer app development starts with having a clear vision. This is the foundation for everything else that comes later.

-

-

Discover Objectives

-

The first question you need to answer is, “What do I want this money transfer app to do?”

There are many different types of money transfer apps out there. Are you creating a peer-to-peer payment system like Venmo?

Or, a traditional bank transfer app like PayPal?

Defining your objective will not only guide your app’s features but also shape its branding and marketing efforts.

A clear understanding of your app’s purpose will set you up for success as you continue developing.

-

-

Competitor Analysis

-

Let’s be honest here: You’re not the first one to make a money transfer app. And, that’s a good thing!

It means, there are plenty of established competitors to analyze and learn from.

Take time to research some remittance solutions including Venmo, PayPal, Zelle, and Revolut.

What features do they offer? How do they charge for their services? And more.

Knowing what works and what doesn’t will help you build a better app and allow you to differentiate yourself.

If you can offer something unique or do things better, that’s your edge.

-

-

Select Platform

-

The next important step is deciding which platform you’ll launch your app on first.

Knowing whether you want to opt for Android app development services, iOS app development services or both has a lot to do with the development part.

Developing for iOS may be a great choice if your target audience skews towards iPhone users, whereas Android might be the better option if you’re aiming at global markets, especially in developing countries.

If you want to target a variety of target audiences, consider cross-platform to make a money transfer app saving time and effort.

-

-

Choose Monetization Model

-

Time to choose the right money-making model for your app.

Understanding this will guide both your business model and user experience.

For a money transfer app, you might choose to charge users a fee per transaction, offer premium accounts with additional features, or charge a small percentage of international transfers.

Another option is offering the app and generating revenue through advertisements or partnerships.

Remember, you should choose the model that aligns the best with your target audience as well as the app’s objectives, keeping in mind that users are typically cautious when it comes to paying for financial services.

Offering value is key.

Step 2: Analysis and Planning

With your strategy in place, it’s time to move on to the technical details.

This step in how to make a money transfer app is all about planning how the app will function and what technology you’ll use to build it.

-

-

Essential and Desirable Requirements

-

In this phase, you’ll define the key features of your app. Think about everything that your money transfer app will need to do. Some common features of a money transfer include:

-

- User Registration and Authentication: Users must securely log in and register to use the app.

- Transaction Processing: The app should allow users to send and receive funds.

- Notifications: Users need real-time updates on the status of their transactions.

- Security: Ensure your app has strong encryption and secure payment processing.

Non-functional requirements are just as important. This includes making sure the app works smoothly, has high uptime, and handles large numbers of transactions. Your app should be fast, reliable, and scalable.

-

-

Product Roadmap

-

Now, it’s time to plan out the development phases.

Your product roadmap should outline the timeline for development, including MVP (Minimum Viable Product) features and planned updates.

Start with the core features, what’s absolutely necessary for the app to function? From there, plan out additional features that can be introduced in future versions.

This roadmap helps prioritize resources and keeps your team focused on what’s important at each stage.

Step 3: UI/UX Design

If you are wondering how to build a money transfer app that’s successful in the market, then you should know user experience is everything.

Making your app complicated or hard to use will lose all credibility from the user side. This way people won’t trust it with their money.

The goal here is to create a clean, intuitive, and offer a seamless experience.

-

-

Structure and User Flow Design

-

The first step in UI/UX design is creating an information architecture and mapping out workflows. This is why it is an important part to create an app.

You want to lay out how the users will interact with the app from start to finish.

This includes everything from login into sending money to viewing transaction history.

Think about how to reduce friction in the user journey. Can the user complete a transaction in as few steps as possible? How easy is it to check a payment’s status to view transaction history?

-

-

Wireframes

-

Wireframes are simple, low-fidelity designs that show the basic layout of each screen.

These are your building blocks and help you visualize the app’s structure before diving into the details.

Moreover, wireframes ensure the user experience flows smoothly and that everything is where users would expect it to be.

-

-

Mockups & Prototypes

-

Now, it’s time to bring your wireframes to life with detailed mockups.

These are high-fidelity designs that closely resemble the final version of your app.

You can also build an interactive prototype, allowing users to click through and experience the app as if it were real.

Prototypes are a great way to test your app’s usability before moving into development.

Step 4: App Development

Now, comes the real work- building the money transfer app.

At this point, the team will begin writing code, and translating the designs and requirements into an actual product.

-

-

Backend Development

-

The backend is where the magic happens.

This is where all your transaction processing, user management, and security features will live.

To make a money transfer app, it’s important to have robust APIs that allow you to send and receive money securely.

You’ll also need to integrate with third-party payment processors like Stripe or PayPal to handle financial transactions.

Security is paramount, so don’t skimp on encryption, authentication, and compliance with financial regulations (PCI DSS).

-

-

Frontend Development

-

Frontend development is what users will interact with directly. Your front-end developers will use frameworks like React Native, Swift, or Kotlin to bring the design to life. The goal is to make the app smooth, intuitive, and responsive.

Make sure the app works well on different screen sizes, and test extensively to ensure the interface is bug-free.

Step 5: Mobile App Testing

Before launching, testing is very important.

-

-

Functional Testing

-

Make sure to ensure all features work correctly. Can users send money? Do they receive confirmation notifications? Is the payment gateway processing transactions properly?

-

-

Security Testing

-

Having solid app security is one of the huge concerns of a money transfer app. Test your app for vulnerabilities, weak encryptions, or anything that could compromise user data.

-

-

Usability Testing

-

This is where you run tests with real users to ensure the app is easy to navigate.

Can users complete a transaction in under a few taps? Are there any confusing steps? Having answers to these questions will help you make sure your app is usable.

-

-

Performance Testing

-

Make sure the app performs well under stress. You need to know what happens when there’s a spike in transactions or if it slows down or crashes to ensure it can handle high volumes of users.

Step 6: Deployment

Now, as soon as everything checks out in testing, it’s time to go live.

Submit your app to the App Store or Google Play Store for review. Be sure to follow each platform’s submission guidelines to avoid delays.

In addition to the technical submission, optimize your app listing with engaging descriptions, high-descriptions, high-quality screenshots, and relevant keywords.

This ensures visibility and encourages users to download your app.

After approval, monitor your app’s performance closely for any issues and be ready to respond to user feedback quickly.

A successful launch sets the stage for continuous growth and updates.

Step 7: Support and Performance Monitoring

The launch isn’t the end - it’s just the beginning!

Now, you need to monitor the app’s performance and handle customer support.

-

- User Support: Offer 24/7 support via in-app chat or email to resolve any issues users might face.

- Monitoring: Use tools like Google Analytics and Firebase to track performance, user engagement, and bug reports.

- Updates: Make sure to update the app with bug fixes, security patches, and new features based on user feedback.

Now that, we’ve covered how to create a money transfer app, let’s dive into the exciting part. Discovering the must-have features that will bring your one such app idea to life and make it stand out in the market.

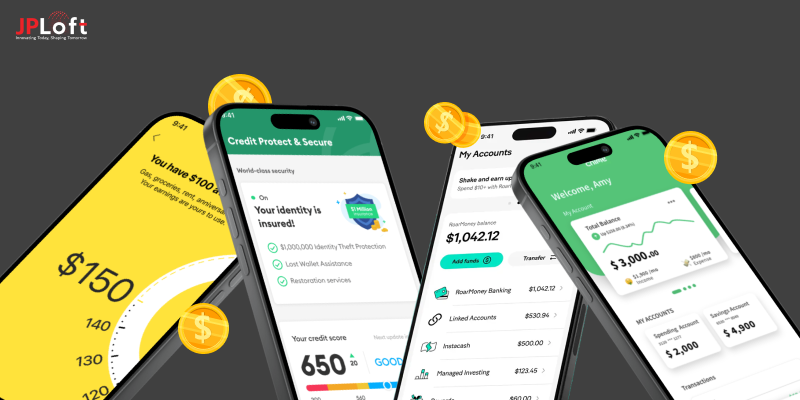

Essential and Advanced Features to Have in a Money Transfer App

Be it eWallet app features or money transfer app features, emphasis is always on ease of use.

This is why if you want to develop a money transfer app that has a strong launch in the market- you need the right blend of essential and advanced features.

When done right, your app can deliver smooth, secure, and lightning-fast transactions, making it a must-have tool for users looking for both convenience and innovation.

|

Feature Category |

Essential Features |

Advanced Features |

|

User Registration & Login |

Simple and secure sign-up, email or phone verification, multi-factor authentication |

Biometric login (face/fingerprint), Social media login options |

|

Transaction Management |

Send and receive money, transaction history, notifications |

Recurring payments, scheduled transfers, transaction analytics |

|

Payment Methods |

Bank account, credit/debit card integration |

Cryptocurrency payments, integration with mobile wallets like Apple Pay |

|

Security |

End-to-end encryption, two-factor authentication, fraud detection |

AI-driven fraud prevention, blockchain-based security |

|

User Interface (UI) |

Easy navigation, intuitive design, multi-language support |

Dark mode, personalized themes, real-time currency exchange rates |

|

Cross-border Transfers |

International payments, competitive exchange rates |

Instant international transfers, multi-currency support |

|

Customer Support |

In-app chat support, email assistance |

24/7 live chat, chatbots with AI assistance, multilingual support |

|

Fees & Charges |

Transparent fees for transfers, clear pricing details |

Dynamic fees based on transfer speed, VIP/loyalty benefits |

It’s not enough just to know the features, to truly develop a money transfer app, you also need to take a look at some of the top apps dominating the market right now.

Top Money Transfer Apps to Inspire Your Development Journey

Want to develop a money transfer app that makes waves in the fintech world? The secret lies in understanding what’s already out there, and how these apps are changing the way we send money.

Let’s dive into the top money transfer apps that have become household names. By breaking down their game-changing features, you’ll get inspired to make a money transfer app that’s just as awesome.

1. PayPal

PayPal is a pioneer among top eWallet apps, and its influence is undeniable.

From splitting dinner bills to paying for online shopping, it’s a go-to for millions. What sets PayPal apart is its trust factor, providing buyer protection and seamless transactions.

If you’re thinking about Money transfer app development that people trust, PayPal has the blueprint you need.

2. Venmo

Venmo isn't just about sending money- it’s a social experience.

You can send, receive, and even a share funny note about why you’re paying someone, Venmo makes money transfers feel casual and effortless.

With instant deposits for a small fee, it’s ideal for quick transfers that feel casual and effortless.

Want to create a money transfer app with a bit of personal and social flair? Venmo’s your inspiration.

3. TransferWise (now Wise)

Say goodbye to hidden fees with Wise.

Originally known as TransferWise, this app takes international money transfers to the next level. With real-time exchange rates and no crazy markups, it’s a game changer for sending money across borders.

If you want to create a money transfer app with transparent fees and a global reach, take a cue from Wise’s straightforward approach.

4. Zelle

Zelle’s all about speed-send money in minutes, directly from one bank account to another.

No need for additional downloads or long wait times. Zelle is integrated right into your bank’s app, making it easier than ever to transfer funds with just a phone number or email.

Want to develop a money transfer app that’s fast and frictionless? Zelle’s the perfect example of seamless, real-time payments.

5. Cash App

Cash App isn’t just a money transfer app-it’s a powerhouse.

Along with sending and receiving money, the Cash App lets users invest in stocks and even buy Bitcoin!

With a sleek interface and added financial tools, it’s the all-in-one app everyone’s talking about.

If you want to create an app like Cash that’s not just a payment tool but a full financial problem. Cash App is the way to go.

6. Western Union

Western Union has been a giant in the money transfer app for years, with a global network that reaches millions.

Whether it’s a wire transfer or cash pickup, this app lets users send money across countries. With both online and physical options.

For anyone looking to build a money transfer app with a massive international reach, Western Union’s legacy is a testament to what’s possible when you combine trust and accessibility.

7. WorldRemit

WorldRemit is an app that lets you send money to over 130 countries, all from your phone.

It’s fast, low-cost, and offers multiple ways to send cash, including bank transfers and airtime top-ups.

If you’re thinking of how to build a money transfer app with a focus on low-cost, instant global payments, look no further than WorldRemit.

8. Revolut

Revolut is a fintech unicorn that’s much more than just a money transfer app-it’s a digital banking revolution. With everything from currency exchange to cryptocurrency trading, Revolut lets users manage their finances in one sleek app.

If you’re dreaming of how to build a money transfer app that appeals to a global audience, Revolut’s all-in-one platform is a major inspiration.

Now that you have an idea of how these apps have mastered the art of money transfers in unique ways, you can understand and utilize their features to understand the market needs and separate yourself from the market.

The future of money transfers is exciting-get ready to create something amazing!

Key Challenges in Money Transfer App Development

Developing a money transfer app is not all sunshine and rainbows-there are several challenges you need to overcome.

But, don’t worry! With the right strategies and tools, these hurdles can be tackled, making your app both functional and user-friendly.

Let us dive into some of the key app development challenges that you need to overcom

1] Security and Fraud Prevention

When dealing with money, security is a top priority.

Users need to trust that their financial data is protected from cyber threats. Without strong security measures, your app won’t gain big traction.

You better integrate top-notch encryption protocols, multi-factor authentication, and AI-based fraud detection systems. These features will not only secure users' data but also boost their confidence in using your app.

2] Cross-border Transactions and Currency Conversion

Sending money across borders can involve high fees and slow processing times and that can be seen as a huge obstacle in Money Transfer app development.

We believe you should partner with trusted third-party payment processors or blockchain technology.

To tackle this, partner with trusted third-party payment processors or blockchain technology.

This will reduce transaction fees and improve speed. By offering real-time currency conversions with low rates, you can attract users who make frequent international transfers, enhancing your app’s value.

3] Compliance and Legal Challenges

Navigating the complex regulations around financial services and transactions can be overwhelming,

Each country has its own set of rules for money transfer services.

Thus, work with legal experts to ensure your app complies with the regulations in each market you want to serve.

Research the requirements for anti-money laundering and Know Your Customer policies.

By staying compliant, you avoid fines and keep your business running smoothly across borders.

4] User Experience and Interface Design

Without any doubt, design is what attracts users in the first place.

Make sure to provide a seamless and intuitive interface. If your app is too complicated to navigate, people will move to the next section.

So, we suggest focusing on simplicity and clarity, and Invest in high-quality UI/UX design that makes the user experience fluid and enjoyable.

Offer easy navigation, quick transfers, and clear navigation, by creating a visually appealing and user-friendly design, you’ll make sure your app stays top of mind for users.

5] Integration with Banks and Payment Gateways

When developing a money transfer app, it's important to ensure seamless communication between the app and different financial institutions to facilitate smooth transactions.

Integration with different banks and payment gateways can be tricky and time-consuming.

What we say is, to choose reliable and secure APIs that allow seamless integration with various banks' growth.

Ensure that these integrations are scalable so they can handle future growth.

6] Scalability and Performance

Trust us, as your user base grows, so does the pressure on your app’s infrastructure.

In this case, performance can slow down, causing frustration and potential loss of users.

You should design your app’s backend to scale as your business grows. Thus, invest in cloud-based infrastructure that allows you to handle large volumes of transactions and users.

With proper load balancing and system optimization, your app will maintain high-performance even during peak times, keeping users satisfied.

7] Cost of Development

Creating any kind of app requires a substantial development cost.

Developing a money transfer app can get expensive, especially if you’re building from scratch with all the necessary features like security, payment gateways, and user interfaces.

So make sure you plan your budget carefully and prioritize essential features to ensure a successful launch.

With a solid understanding of the challenges part, time to know the next important part: Cost.

How Much Does it Cost to Develop a Money Transfer App?

If you have an idea of a money transfer app, you must have at least once Googled “How much does it cost to create a money transfer app?”

An estimated Money transfer app development cost can be $25,000 to $180,000 or more.

While each project is unique, understanding the different elements involved can help you get a better picture of the overall investment.

But, we suggest you take the help of an expert mobile app development company to find the true cost of your requirements.

|

Factors |

Cost Range |

Details |

|

App Features |

$5,000 - $20,000+ |

Basic features (payments, transfer history) to advanced (security, crypto support). |

|

Design & UI/UX |

$5,000 - $20,000 |

User-friendly design, custom interface, and branding. |

|

Platform (iOS/Android) |

$15,000 - $40,000 |

Costs vary based on platform (native or hybrid). |

|

Security & Compliance |

$10,000 - $30,000 |

Incorporating encryption, user verification, and compliance with financial regulations. |

|

Backend Development |

$20,000 - $60,000 |

Includes server-side integration, APIs, and databases for transaction management. |

|

Testing & QA |

$5,000 - $15,000 |

Ensuring functionality, usability, and security are all up to standard. |

|

Maintenance & Updates |

$2,000 - $10,000/month |

Ongoing updates, bug fixes, and adding new features. |

The cost to develop an app can vary as many factors affect the overall cost.

These include:

-

- Features of the App.

- Complexity of the Project.

- Development Team Location.

- Complexity of Your Idea.

And, more.

As we explored many key details of how to build a money transfer app, there’s one important detail left to address:

How Money Transfer Apps Make Money?

If you are looking for a monetization model for your money transfer apps, to your luck, you can make money from such apps through several options.

The apps can grow via different tactics and offer a good amount of revenue while providing a user experience:

► Transaction Fees

Sometimes money transfer apps will charge users a nominal fee per transaction, you can utilize this to cut a percentage or charge an amount.

For example, PayPal will charge a fee to send money overseas, or if the currency of your account and the one of the recipient differ they charge for converting these currencies.

► Subscription Plans

A number of such apps have subscription options for premium features such as lower fees, quicker transfers, or even bigger transaction limits.

TransferWise( Now Wise ) provides a subscription service for businesses that open up more great rates & tools across international payments.

► Currency Exchange Charges

Usually, money transfer apps charge spread (the difference between the bid and ask) on currency exchange rates. They operate by selling less favorable exchange rates.

Revolut makes money from currency conversion using fair yet a little inflated rates.

► Partner with Businesses

Business partnerships are a great way for your money transfer app to make money.

E.g. Venmo (owned by PayPal) partners with merchants to give users a " Pay with Venmo" option and gets paid off the cuff from them.

How JPLoft Can Help You Develop a Money Transfer App?

Do you want to create a Remittance App? Now is the right time to act.

JPLoft, the best Fintech app development company can help you tap into this niche with a user-friendly, secure and scalable app.

We offer end-to-end services to make sure your app is compliant and meets industry standards and user expectations.

Conclusion

An app to manage money transfers is a strong solution to meet the needs of people who want to access financial services in a digital, secure, and hassle-free way.

With the intention of providing a great user experience, secure methods or implementation, and new approaches, you can develop a money transfer app that is convenient trustworthy reliable.

No matter if you want to create a peer-to-peer transfer system (e.g., Venmo) or a more global solution like PayPal.

If done well and then scarily monitored after the launch of your app, your app has the potential to become a go-to tool for users everywhere.

FAQs

Features of the Money Transfer App include Infrastructure features (Secure user registration, transaction processing made it easier for each end user, notifications and data encryption to keep users protected) being offered in multiple payment methods, and real-time updates are necessities for the smooth operations of the users.

Utilize end-to-end encryption, two-factor authentication, and fraud detection mechanisms Ensure that the application also complies with financial regulations (PCI DSS) in order for them to be able to ensure the security of their app.

This depends on the user base. If your base of users is primarily on iOS, you should start with a version for iOS first. If you are going after more of a global audience — especially in emerging markets, you could currently do better on Android. Cross-platform development could also be a solid solution for satisfying both audiences with a single code base.

Monetization strategies such as Transaction commission, premium accounts with added features, or differentiating services (international currency transfers with a fee) you may think about also partnership/revenue streams and ads, but always deliver some value to the user.

This includes friendly interfaces, fast and secure transactions, visible pricing, and most importantly unique features like social integrations or fraud prevention features. Major ingredients in long-term success are regular updates, responsive client support, and the ability to scale for high volumes of transactions.

Share this blog