If you've ever shopped online and wanted to split your payment into smaller chunks, chances are you’ve come across Klarna.

It's one of the most popular Buy Now, Pay Later (BNPL) platforms out there– and it's completely changed how people pay for things online.

But have you ever wondered how does Klarna makes money when it lets you shop now and pay later, often without charging you interest?

Well, Klarna isn’t just a payment solution. It’s a full-blown fintech platform operating with a multi-sided business model.

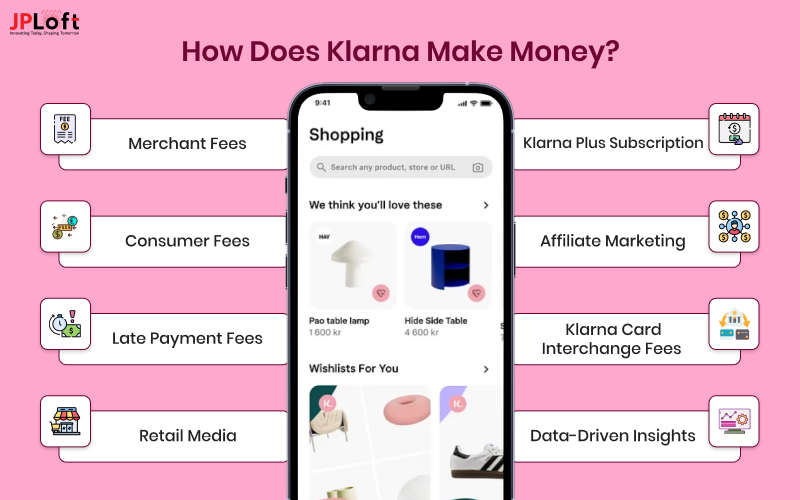

That means Klarna earns revenue from multiple sources: merchant fees, interest on financing, subscriptions, advertising, interchange fees, and more.

And what app do you use? It’s a smart money-maker built for both you and the merchants.

Let’s break it all down.

What is Klarna: Overview & Market Stats

Klarna is more than just a BNPL app– it’s a Swedish fintech powerhouse that's reimagining the checkout experience.

You can think of Klarna as your flexible payment tool. Whether you're buying sneakers, booking skincare, or shopping for tech, Klarna lets you split your payments over time, interest-free (for most options), directly from the app.

But Klarna doesn’t stop at payments.

Its app also features shopping deals, brand discounts, exclusive offers, and even financial tracking tools--all designed to make spending feel smoother and smarter.

And it’s not just growing– it’s booming.

Here are some quick stats to give you a sense of Klarna’s scale:

-

Over 150 million users worldwide

-

500,000+ merchant partners (from H&M and Sephora to Etsy and Nike)

-

Processes over 2 million transactions per day

-

Valued at $6.7 billion as of 2024

-

Operates in 45+ countries, including the US, UK, Germany, and Australia

With its own Klarna Card, a newly launched subscription service, and a powerful advertising platform inside the app, Klarna’s business model is much more diverse than it looks on the surface.

So let’s dive deeper into how Klarna’s app actually brings in revenue– and why it's a growing opportunity for both users and investors.

Klarna’s Business Model Explained

Klarna isn’t just a payment app– it’s a powerhouse of fintech innovation and a benchmark in mobile app development excellence

At the heart of the Klarna monetization model is a simple idea: let shoppers pay flexibly, while merchants cover the cost to boost their sales. But Klarna doesn’t stop there.

From merchant transaction fees and financing options to in-app ads and Klarna Plus subscriptions, the company has engineered multiple revenue streams designed for scale and sustainability.

This is where it gets interesting– how Klarna apps make money is by turning every interaction, swipe, or split payment into a potential revenue event.

Whether it's via card swipes, affiliate partnerships, or premium features, Klarna earns smartly, without weighing down the user.

How Does Klarna Make Money?

When you use Klarna, the app feels almost too good to be true--split payments, no interest, smooth checkout.

But Klarna is far from a charity. It has a clever and diverse revenue system running behind the scenes.

Let’s break down the Klarna monetization model and how its app brings in serious cash while staying user-friendly.

1. Merchant Fees (Core Revenue Stream)

Let’s start with Klarna’s primary revenue stream--merchant fees.

Klarna partners with over 500,000 retailers globally. From fashion giants like H&M to niche e-commerce stores, these merchants pay Klarna a fee for every transaction processed through the app.

Why? Because Klarna boosts their sales.

Here’s how Klarna helps merchants win:

-

Increases average order value by up to 41%

-

Reduces cart abandonment rates

-

Attracts younger, credit-averse shoppers

-

Provides instant credit to consumers with zero risk to the merchant

Klarna’s business model is centered on enabling fast, flexible payments that drive conversions for stores.

Interesting stat: Klarna earns a commission between 2%–5% per sale, depending on the merchant and region.

2. Consumer Fees and Interest Charges

While most “Pay in 4” or “Pay Later” plans are interest-free, Klarna still finds ways to earn from the consumer side--especially when you choose extended financing.

This is where Klarna also generates revenue through:

-

Late Payment Fees – Users who miss payment deadlines may be charged fees.

-

Interest on Financing – Klarna offers monthly financing plans (up to 36 months) with interest ranging from 0% to 29.99% APR, depending on the region.

-

Returned Payment Fees – In some regions, failed payments may also incur small penalties.

These fees are part of Klarna’s money lending app development capabilities, aligning it with digital credit providers.

3. Late Payment Fees

While Klarna is known for its flexible, interest-free payment plans, missed payments do come with consequences. If a user fails to pay on time, Klarna may apply a small late payment fee, depending on the region and the plan selected.

Here’s how it breaks down:

-

Pay in 4: You may be charged up to $7 per missed payment if Klarna is unable to collect after multiple attempts.

-

Pay in 30 Days: No late fees currently apply, but it's wise to review your individual terms to stay informed.

-

Pay Over Time (Financing): Late fees and interest may apply based on your credit agreement.

These late charges are part of Klarna’s business model strategy to encourage timely payments, manage lending risk, and maintain seamless service for all users, without burdening most shoppers with extra costs.

4. Retail Media and Advertising

Here’s where it gets even more interesting.

The Klarna app has turned into a shopping platform, showcasing products, flash sales, and exclusive brand promotions.

This is Klarna’s retail media network, and it’s a big deal.

Know how the Klarna app makes money here:

-

Merchants pay for sponsored placements in the app

-

Retailers run targeted ads based on user behavior.

-

Klarna earns affiliate revenue from promoted deals.

Klarna generated over $180 million in ad revenue in 2024 alone.

This model is a brilliant twist on traditional BNPL and positions Klarna as a hybrid between eCommerce and fintech.

5. Klarna Plus Subscription

In January 2024, Klarna launched Klarna Plus, a premium monthly subscription priced at $7.99/month.

With it, users enjoy:

-

Double rewards points

-

Exclusive deals

-

No service fees on certain transactions

-

Early access to partner sales

This is Klarna’s answer to loyalty-based revenue--a growing component of the Klarna app monetization model.

While optional, it adds recurring income and keeps users inside the Klarna ecosystem longer.

6. Affiliate Marketing and Partnerships

Klarna doesn’t just promote its own services. It collaborates with third-party brands and financial services through affiliate deals.

Here’s what that looks like:

-

Partner links within the Klarna app

-

Cashback promotions

-

Referral rewards

This is one of the more indirect ways Klarna also generates revenue, but it’s valuable--especially as Klarna becomes a shopping discovery tool.

It even mirrors monetization tactics seen in cash advance apps that promote third-party lending solutions.

7. Klarna Card Interchange Fees

Klarna’s not just online anymore. The Klarna Card allows users to make in-store purchases while still paying in installments.

Just like a credit or debit card, Klarna earns interchange fees--a small percentage of each transaction paid by the merchant’s bank.

Klarna earns money every time you swipe the card, without charging you anything extra.

This move expands Klarna’s business model strategy into the physical retail space, giving it more ways to earn from everyday spending.

8. Data-Driven Insights (With User Consent)

With user permission, Klarna collects anonymized behavioral data from app users to help merchants understand buyer habits, shopping trends, and preferred payment methods.

Of course, all of this is privacy-compliant and opt-in.

These insights are sold or bundled with Klarna’s merchant tools and advertising packages--another smart angle in Klarna’s business model strategy.

Think of it as Klarna turning data into dollars--without compromising trust.

How Strong Is Klarna’s Business Model? A Closer Look

When you look under the hood of Klarna, you’ll find a business model that’s agile, scalable, and built for today’s digital economy. But no business is without its challenges--and Klarna is no exception.

Let’s break down the company’s position with a simple SWOT analysis to understand better how the Klarna business model holds up in a fast-moving fintech space.

► Strengths

-

Klarna offers a seamless user experience that keeps customers coming back.

-

Its multi-channel revenue streams make the Klarna monetization model resilient to market shifts.

-

A huge global merchant network and strong brand trust.

-

First-mover advantage in the BNPL space, especially in Europe.

Klarna’s strengths lie in how well it balances user convenience with smart earning methods--an ideal combo for long-term growth.

► Weaknesses

-

Heavy reliance on merchant fees as its primary revenue stream.

-

Profitability concerns are due to rising operating costs and regulatory compliance.

-

Late payment risks and potential defaults can affect financial stability.

-

Intense competition from Apple Pay Later, Affirm, Afterpay, and traditional credit lenders.

While the business models of Klarna are diverse, overdependence on certain streams may make it vulnerable during economic slowdowns.

► Opportunities

-

Expanding into emerging markets with low BNPL adoption.

-

Growing demand for cash advances and money lending app models.

-

Potential for deeper personalization using AI and user data (with consent).

-

Partnerships with financial institutions or white-labeled fintech solutions.

Klarna has room to scale by evolving its offerings and strengthening the Klarna business model beyond retail.

► Threats

-

Stricter global regulations targeting BNPL services.

-

Market saturation and declining consumer trust in BNPL players.

-

Economic downturns may slow spending and increase repayment defaults.

-

New fintech disruptors are entering with lower fees or niche lending features

Klarna needs to keep optimizing its Klarna monetization strategies to stay competitive and adaptive in this dynamic space.

Klarna vs. The Competition: How It Stacks Up

Klarna isn't the only name in the Buy Now, Pay Later game, but it’s definitely one of the most recognized globally.

Still, strong players like Affirm and Afterpay are fighting hard for the same audience.

So, how does Klarna make money? And how does it stack up against its biggest rivals? Here’s a breakdown of the core features, business models, and monetization strategies behind the top three BNPL platforms.

|

Feature |

Klarna |

Affirm |

Afterpay |

|

Founded |

2005 (Sweden) |

2012 (USA) |

2014 (Australia) |

|

Business Model Type |

BNPL + Financial Super App |

BNPL + Consumer Financing |

Pure BNPL (Buy Now, Pay Later) |

|

Core Offering |

Pay in 4, Pay Later, Monthly Financing |

Pay over time with interest or no-interest options |

Pay in 4 (every two weeks) |

|

Revenue Sources |

Merchant fees, late fees, ads, subscriptions, partnerships |

Merchant fees, interest on loans, and virtual cards |

Merchant fees, late fees |

|

Interest to Users |

Mostly interest-free; financing options may apply |

Some plans include interest |

Always interest-free |

|

Credit Check |

Soft checks (for most services) |

Soft or hard checks, depending on the amount |

No credit check |

|

Mobile App Features |

Shopping feed, rewards, and budgeting tools |

Loan management, marketplace, spending limit |

Purchase tracking, notifications, basic user dashboard |

|

Monetization Approach |

Diversified—ads, insights, fees, subscriptions |

Finance-first with a clear fee structure |

Simple fee-based model |

|

Global Reach |

45+ countries |

Primarily US & Canada |

Strong in Australia, the US, the UK, and Canada |

|

Unique Selling Point (USP) |

Full shopping + payment ecosystem |

Transparent loans with no hidden fees |

Simplicity and instant approval |

|

Best For |

Shoppers who want flexibility + perks |

Users needing structured installment loans |

Casual shoppers who want interest-free, short-term splits |

What Startups Can Learn from Klarna?

If you're planning to launch your own money lending app or fintech app, there’s a lot you can pick up from Klarna’s journey.

For starters, Klarna didn’t just build a payment service– it built an experience. It focused on making the shopping and payment process smoother, faster, and more rewarding for both users and merchants.

The Klarna app monetization model is a perfect example of how a startup can generate revenue without compromising user experience. From merchant fees to in-app ads and premium subscriptions, Klarna figured out how to monetize every touchpoint while keeping things user-first.

For your startup, the big lesson is to diversify early. Explore multiple Klarna monetization strategies– not just one. Whether it’s offering premium features, partnerships, or ad placements, create revenue streams that scale as you grow.

How JPLoft Can Help You Develop a Profitable App like Klarna?

Thinking about building the next big BNPL or loan lending app? That’s where we come in.

At JPLoft, we specialize in building powerful, scalable apps that don’t just work– they generate revenue. As a trusted fintech app development company, we know what it takes to create platforms like Klarna that blend smart design with solid monetization.

From custom payment flows and user-friendly interfaces to backend security and revenue models, we handle it all. Whether you're aiming for pay-later features, data-driven insights, or affiliate revenue streams, we build with growth in mind.

Ready to launch your own Klarna-style app? Let’s bring your idea to life.

Conclusion

Klarna’s success isn’t accidental– it’s the result of smart strategy, seamless UX, and diversified revenue models.

If you’ve been wondering how Klarna apps make money, the answer lies in its ability to earn from every angle– merchant fees, subscriptions, advertising, interest, and beyond.

For startups, it’s a blueprint worth studying. The key takeaway? Don’t rely on one income stream. Learn from Klarna’s playbook and explore multiple Klarna monetization strategies that serve both users and partners.

Whether you're entering the BNPL market or building your own loan lending app, Klarna proves that combining convenience with monetization is the real fintech formula for success.

FAQs

Klarna earns through merchant fees, interest on financing, late fees, subscriptions, interchange fees, and in-app advertising.

Yes, Klarna is safe to use. It uses advanced encryption, fraud detection, and buyer protection policies to secure your personal and payment information.

No major catch—but missing payments can lead to late fees, and extended financing may include interest.

In most cases, Klarna uses soft credit checks. However, financing plans may involve hard checks and affect your credit score.

Yes, Klarna uses encrypted transactions, fraud protection, and buyer safeguards to ensure secure and reliable payments.

Share this blog