Many individuals and businesses alike have turned to Fintech mobile apps - as a game-changer in business operations. Fintech mobile apps make electronic transactions simpler for customers while meeting customer demand for more effective financial systems with its businesses founded to address that need. Fintech experienced a dramatic transformation in 2021. What had seemed like an obscure corner of tech a decade earlier (that few took seriously) has grown globally into one of the largest-funded tech domains. This article will give an in-depth view into some of the top fintech Mobile apps and their working models; please read through them for more.

With the proliferation of neobanks, buy-now-pay-later platforms, and contactless payment services on the rise, it can be hard to predict where this industry will head next. Yet its growth potential cannot be ignored. Revenue projections show an expected 12% annualized revenue increase for this sector by 2024 - giving rise to new Fintech trends that aim to simplify life for customers while creating jobs and revenue growth. This post will look at several potential fintech start-up app ideas for 2023. Before getting into it, let's briefly look at where fintech stands today.

Market Overview of Fintech Applications

It is well known that the COVID-19 virus has enormously impacted Fintech development. Certain players in the finance industry have increasingly turned towards digital-only formats to maintain survival, with even established banks that were once reluctant to adopt new ideas now embracing start-ups and creating fintech applications themselves. According to a Research report, the fintech mobile apps market will reach $305 Billion By 2025, with growth estimated at 20% annually. Fintech is one of the fastest-growing sectors globally due to the COVID-19 outbreak opening many commercial opportunities.

What Is a Fintech App?

People often inquire about fintech concerning what constitutes a "fintech app." Here, we shall offer our answer. FinTech stands for Financial Technology and covers any technology in the finance industry, such as network technology, digitalization, and electronic payment systems used for payment processing or financial services. Fintech app development technologies continue to revolutionize the financial industry, as each innovation makes traditional methods obsolete and much faster, cheaper, and more effective in many respects.

Top 10 Fintech Applications in Market Inspiring Start-Ups

Some top fintech applications, like Robinhood, Revolut, and Coinbase, are globally successful products and companies thriving within fintech, each boasting unique features, businesses, and revenue models that thrive worldwide.

Coinbase

Coinbase is an app that enables users to buy and sell all types of cryptocurrencies, such as Ethereum and Bitcoin, as well as more than 50 others. Furthermore, this platform enables conversion between them and sending or receiving crypto between other app users. Coinbase's business model centers on charging fees for cryptocurrency trading services. Other revenue sources for Coinbase include:

Coinbase is an app that enables users to buy and sell all types of cryptocurrencies, such as Ethereum and Bitcoin, as well as more than 50 others. Furthermore, this platform enables conversion between them and sending or receiving crypto between other app users. Coinbase's business model centers on charging fees for cryptocurrency trading services. Other revenue sources for Coinbase include:

- Referral fees from advertising courses.

- Credit card transaction fees.

- Custody services fees.

- Profits from investments.

Established in 2012 and widely accepted since its introduction, Coinbase remains one of the first widely embraced cryptocurrency businesses today. #How Does Coinbase Work? Coinbase offers four products tailored specifically to investors' needs:

- Coinbase: It provides a straightforward online and mobile platform for purchasing, selling, and trading cryptocurrency tokens and coins.

- Coinbase Pro: offers similar functionality but is tailored for professional traders with its user interface and selection of tools tailored specifically for them. Trading fees on Coinbase Pro are significantly reduced.

- Coinbase Wallet: This wallet allows users to store crypto assets securely.

- Coinbase Card: Coinbase offers its users a Visa debit card to make spending cryptocurrency convenient for businesses that accept Visa payments.

If you plan to create a fintech product like Coinbase, here is your ultimate guide to Fintech app development. Learn which features you should incorporate to reduce fintech application development costs, how to differentiate yourself in the market, and earn billions of dollars.

Mint

Mint is one of the leading budgeting fintech mobile apps available, offering features like budget tracking, bill reminders, and credit score monitoring - and linking all your accounts together in one convenient app for quick analysis of your financial picture.

Mint is one of the leading budgeting fintech mobile apps available, offering features like budget tracking, bill reminders, and credit score monitoring - and linking all your accounts together in one convenient app for quick analysis of your financial picture.

- Budget tracking: Mint provides users with tools to track and budget expenses like groceries, entertainment, and transportation.

- Bill-tracking: Mint allows users to monitor due bills and send reminders when payments are past due to help avoid late payments and fees.

- Investment Tracking: Mint can keep tabs on investment accounts, giving users an in-depth view of their finances.

- Credit Score Monitoring: With Mint, users can monitor their credit report and score to identify any potential issues in their credit health and possible solutions.

- Goal Setting: Mint allows users to set financial goals and monitor their progress toward them - such as saving for a down payment on a home or reducing debt.

- Personalized recommendations: Mint offers tailored recommendations based on users' spending habits and financial goals, helping them make informed financial decisions.

- Security: Mint uses bank-level security to protect its users' financial data, while two-factor authentication can provide even further protection.

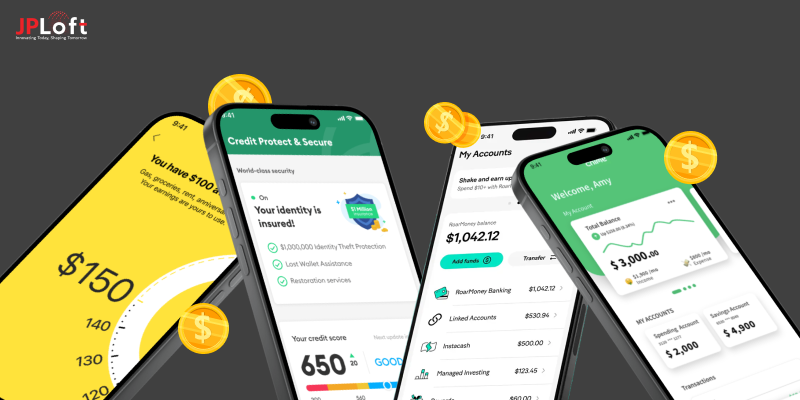

MoneyLion

MoneyLion, one of the top FinTech mobile apps in the US, provides its users with financial advice and loans. MoneyLion, a six-year-old start-up that allows managing personal finances, acts as part lending, savings, and wealth management platform. They acquired Even Financial in 2021 to expand their distribution network and improve client access to finance. #How MoneyLion Makes Money MoneyLion generates revenue through subscription-based service at $19.99 a month, as well as premium banking solutions, cash advance facilities, and credit builders. #How Does MoneyLion Differ From Other FinTech Mobile Apps?

MoneyLion, one of the top FinTech mobile apps in the US, provides its users with financial advice and loans. MoneyLion, a six-year-old start-up that allows managing personal finances, acts as part lending, savings, and wealth management platform. They acquired Even Financial in 2021 to expand their distribution network and improve client access to finance. #How MoneyLion Makes Money MoneyLion generates revenue through subscription-based service at $19.99 a month, as well as premium banking solutions, cash advance facilities, and credit builders. #How Does MoneyLion Differ From Other FinTech Mobile Apps?

- 15 Investors Have Backed MoneyLion, Apollo, and BlackRock, among them.

- MoneyLion app also offers a 5.99% APR loan to keep savings progress on track. This exclusive facility can only be found with a MoneyLion Plus membership.

Top features of MoneyLion:

- Instant Transfer and Zero Fee Checking

- Direct Deposit APR Cash Advances

- Track Credit Score

- Real-time Notifications of Spending

Revolut

Revolut offers multiple financial products to both businesses and consumers alike. Revolut stands out with its powerful fintech mobile app for iOS and Android; no physical branches exist to house this business. Revolut is one of the UK's most valuable private tech start-ups, created by two Russians with experience in fintech. Revolut has amassed over $836 million in funding, more than 10 million users, and operates across more than 30 nations globally. #What Is Revolut Used For?

Revolut offers multiple financial products to both businesses and consumers alike. Revolut stands out with its powerful fintech mobile app for iOS and Android; no physical branches exist to house this business. Revolut is one of the UK's most valuable private tech start-ups, created by two Russians with experience in fintech. Revolut has amassed over $836 million in funding, more than 10 million users, and operates across more than 30 nations globally. #What Is Revolut Used For?

- Revolut app lets users transfer funds domestically or globally between bank accounts.

- Budget Plans within the app help manage funds and spending habits within an individual budget plan.

- The savings option automatically sets aside money for you in savings accounts.

- Users can utilize it for trading various stocks or investing in cryptocurrencies.

- It generates revenue by offering users subscription services, with benefits including extended customer support, premium cards for withdrawing cash fee-free, lounge passes, and more.

- Revolut charges a fee on international money transfers and loans.

Acorns

Acorns is an automated investment app that invests your spare change automatically. Connected to debit and credit cards, Acorns rounds up transactions to the nearest dollar before investing it into an investment portfolio of your choosing. In addition, Acorns provides various investment options and educational resources.

Acorns is an automated investment app that invests your spare change automatically. Connected to debit and credit cards, Acorns rounds up transactions to the nearest dollar before investing it into an investment portfolio of your choosing. In addition, Acorns provides various investment options and educational resources.

- Round up Savings: Acorns allows users to save spare change by rounding up purchases to the nearest dollar and investing the difference.

- Recurring investments: Acorns provides users with an easy way to set up regular investments daily, weekly, or monthly - helping create an automatic savings habit.

- Investment portfolios: With tailored options designed to fit users' risk tolerance and financial goals.

- Found Money: Acorns offers a feature called Found Money, which offers user’s cash back when shopping with partner brands.

- Educational Resources: Acorns provides educational materials, including articles and videos, to help its users learn about investing and personal finance.

- Acorns Later: Acorns offers a retirement account called Acorns Later that allows users to save for their future through a traditional or Roth IRA.

- Acorns Spend: Acorns Spend is Acorns' checking account, which features debit card access and cash-back rewards on eligible purchases.

NuBank

Like Revolut, NuBank is a neobank that offers various financial products through one app: loans, savings accounts, and more. Established in 2013, it now has more than 40 million customers globally. Customers can access its services by visiting its website or downloading fintech mobile app for Android and iOS. Its business model involves developing an ecosystem of services that it provides directly to consumers on one platform. Neobanks typically aim to offer consumers lower interest rates and easier access to their bank accounts; NuBank is no different in this respect. The role of AI and server other technologies has helped NuBank to revenue through several streams:

Like Revolut, NuBank is a neobank that offers various financial products through one app: loans, savings accounts, and more. Established in 2013, it now has more than 40 million customers globally. Customers can access its services by visiting its website or downloading fintech mobile app for Android and iOS. Its business model involves developing an ecosystem of services that it provides directly to consumers on one platform. Neobanks typically aim to offer consumers lower interest rates and easier access to their bank accounts; NuBank is no different in this respect. The role of AI and server other technologies has helped NuBank to revenue through several streams:

- Interchange fee: An interchange fee will be assessed when users utilize Nubank's credit or debit cards as payment.

- Subscriptions: Their signature product is a premium card, which costs about $10 monthly and provides numerous advantages, like free WiFi at airports and travel insurance coverage - among many others. NuBank operates like any traditional bank by lending cash to its customers at interest, collecting overdraft fees when an overdraft limit is extended, and collecting an interest charge on that amount.

- Interest on cash: NuBank charges customers interest when borrowing funds and collects interest on them as with traditional banks.

- Overdraft fee: As is common when expanding credit limits.

NuBank also generated revenue streams such as cash withdrawal fees, referral fees, and loans; according to Crunchbase, NuBank raised $2.3 billion in funding from various investors.

Chime

Chime is a type of fintech money saving app offering high-yield accounts with no minimum balance requirement or monthly fees. Chime also features an automatic savings feature that rounds up transactions and automatically transfers the difference to your savings account.

Chime is a type of fintech money saving app offering high-yield accounts with no minimum balance requirement or monthly fees. Chime also features an automatic savings feature that rounds up transactions and automatically transfers the difference to your savings account.

- No fees: Chime is proud to provide no fees on overdrafts, monthly maintenance fees, minimum balance requirements, or foreign transactions.

- Automated savings transfers: Chime allows users to set up automatic weekly or monthly savings transfers that make saving effortless.

- Early direct deposit: Chime offers early direct deposit up to two days earlier for quicker access to their funds.

- Debit card rewards: Debit card rewards provide cash-back on qualifying purchases using its card.

- Mobile app: Chime offers a mobile app that enables users to manage their accounts, check balances, and track spending from any location.

- Budgeting tools: Chime also allows users to track spending and set savings goals.

- ATM Network: Chime provides access to over 38,000 fee-free ATMs throughout the United States.

Qapital

Qapital is an app designed to help you set savings goals and automate their fulfillment, using rules like rounding purchases up or saving a percentage of income. Furthermore, Qapital also offers investment opportunities and cash-back rewards. Qapital offers several key features:

Qapital is an app designed to help you set savings goals and automate their fulfillment, using rules like rounding purchases up or saving a percentage of income. Furthermore, Qapital also offers investment opportunities and cash-back rewards. Qapital offers several key features:

- Goal Setting: Users can set multiple savings goals, like saving for a vacation or an emergency fund, with target amounts and due dates attached for each goal.

- Rules: Qapital allows users to set rules that automatically save money based on their spending patterns. For instance, users can save a set amount whenever they purchase from certain stores or round up to the nearest dollar when rounding purchases up to the nearest dollar amount.

- Automated Savings: Qapital can automatically transfer money from a user's linked bank account into their Qapital account based on their savings rules or goals.

- Customizable Savings Rules: Users can create customized saving rules based on their financial goals and behaviors.

- Spending analysis: Qapital provides users with insight into their spending habits and suggests ways to save more money.

- Social savings: With Qapital's social savings feature, users can bring together friends and family to save for shared goals such as vacation expenses or wedding gifts.

- Investment Opportunities: Qapital provides users who wish to invest their savings with exchange-traded funds (ETFs) and socially responsible investments with various investment options such as an ETF and socially responsible portfolios.

Robinhood

Robinhood is an investing app that provides commission-free trading. You can buy and sell stocks, ETFs, options, and cryptocurrencies using Robinhood; additionally, it provides educational resources that will help you understand more about investing.

Robinhood is an investing app that provides commission-free trading. You can buy and sell stocks, ETFs, options, and cryptocurrencies using Robinhood; additionally, it provides educational resources that will help you understand more about investing.

- Commission-Free Trading: Robinhood offers commission-free trading of stocks, ETFs, options, and cryptocurrencies, so users don't need to pay any trading fees or commissions when trading them.

- Easy-to-Use Interface: Robinhood's user-friendly interface makes buying and selling stocks and securities simple for all users.

- Fractional shares: Robinhood's fractional shares feature allows users to buy and sell fractional shares of stocks and ETFs, enabling them to invest in higher-priced securities with smaller capital.

- Cryptocurrency Trading: Robinhood provides users access to cryptocurrency trading platforms that allow them to purchase and sell cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, etc.

- Robinhood Gold: Robinhood Gold is a premium subscription service offering extended trading hours, larger instant deposits, and other features at an annual subscription cost.

- News and Research: Robinhood provides users with real-time market data and research from third-party providers, providing real-time news updates and market data analysis from real-time events.

- Security: Robinhood takes security seriously by employing industry-standard encryption to safeguard users' personal and financial data.

Stash

Stash is an investing app offering stocks, ETFs, and fractional shares as possible investment options. Furthermore, Stash provides educational resources that will assist with learning more about investing and personalized investment recommendations for its users.

Stash is an investing app offering stocks, ETFs, and fractional shares as possible investment options. Furthermore, Stash provides educational resources that will assist with learning more about investing and personalized investment recommendations for its users.

- Fractional Shares: Stash allows users to buy fractional shares of stocks and ETFs, making investing in high-priced securities with smaller amounts possible.

- Investment Options: Stash provides users with various investment opportunities, such as individual stocks, ETFs, and mutual funds.

- Goal Setting: Stash makes goal-setting simple by offering users multiple financial goals - such as saving for vacation expenses or building an emergency fund - with each goal having its target amount and deadline date.

- Auto-Stash: Stash users can set up automatic investments to help save and invest regularly. They can choose how much and when they want to put away.

- Personalized portfolios: Stash offers customized portfolios tailored to users' investment goals, risk tolerance, and interests.

- Their fees are low: Stash charges an affordable monthly management fee per asset under management with no transaction or commission costs to worry about.

- Budgeting tools: Stash offers tools to help users track expenses and save money.

- Educational content: Educational content to teach more about investing and financial planning.

Types of FinTech Mobile Apps

Today's various FinTech app ideas are suited for businesses and consumers. Some of the more commonly used FinTech applications are:

Mobile Banking App

Mobile banking applications were one of the pioneering products in the FinTech market, making money access easy from any location. Also, account opening and funding have never been quicker or easier - while there are also applications designed specifically to monitor account balances or send money transfers.

Personal Finance App

A personal finance application enables customers to easily consolidate all their financial data from various bank accounts into one consolidated dashboard, making it much simpler to stay up-to-date on their finances and manage budgets more effectively. A personal finance app is especially helpful for managing budgets and understanding money matters; many are customer-targeted for personal use, while there are also wealth-tech fintech mobile apps designed for professional investors ranging from novice traders to expert traders.

Investment Apps

Digital platforms that simplify trading are called investments fintech mobile apps. These platforms can be used by amateur investors and wealthy big fish with lots of capital in their pockets. An added advantage of using apps is eliminating intermediaries and offering lower commissions while meeting minimum balance requirements.

Blockchain and Cryptocurrency Apps

Within the expansive list, FinTech blockchain and cryptocurrency fintech mobile apps are platforms for peer-to-peer transactions, smart contracts, and decentralized ledgers - perfect examples being trading platforms powered by blockchain technology.

RegTech App

RegTech App (Regulation Technology Apps) is a relatively new market within FinTech applications used by financial service companies to assist their customers with regulatory compliance. They focus on building technology to enhance the delivery of regulatory requirements with state-of-the-art solutions to achieve secure integration of regulations into everyday business life.

The Key Takeaways

While fintech mobile apps have grown increasingly popular as people seek simpler ways to manage their finances, we have identified 10 of the best ones you should look into in 2023. From budgeting and saving apps to investing and borrowing money, whatever your financial goals may be, there's sure to be an app out there to help achieve them! FinTech mobile apps are rapidly emerging as an integral component of our economy, revolutionizing banking services such as instant money transfers. Soon, they may overshadow traditional bank accounts and financial transactions completely. These top fintech mobile apps should inspire you to create your start-up in 2023. If you have an idea for a fintech product, contact JPLoft Fintech App Development Experts, who can create an incredible and profitable product!

FAQs

1. What is a Fintech Mobile App, and How Can it Inspire My Start-up?

A fintech mobile app is developed for mobile financial technology devices designed to deliver various financial services like payments, lending, investment, or budgeting services through mobile phones. Such applications provide innovative approaches for solving financial issues with user-friendly interfaces and customer acquisition and retention strategies, which may prove inspirational for launching and growing a start-up business.

2. Please provide me with examples of fintech mobile applications which could serve as models for my start-up.

Absolutely! Some notable fintech mobile apps that may serve as inspiration for your start-up include PayPal, Robinhood, Square Cash, Acorns, and Venmo. These applications have revolutionized payments, investing, and financial management - learning their features and strategies could provide invaluable lessons for your venture.

3. How can I incorporate inspiration from fintech mobile applications into the development process for my start-up?

To draw inspiration from fintech mobile apps, study their user interfaces, functionality, and business models. Determine what makes these successful and user-friendly; consider adopting similar features if possible or making improvements based on what will suit the needs and preferences of your target audience—Likewise, study marketing/customer acquisition strategies these fintech mobile apps use to expand user bases.

4. What are some key trends in fintech mobile apps for start-ups to watch out for?

Fintech mobile applications have recently seen several key trends emerge, including blockchain and cryptocurrency technologies, the rise of neobanks and digital wallets, enhanced security measures (biometric authentication),AI-powered financial advice from financial advisors, and "Buy Now, Pay Later" solutions. Staying abreast of these developments can help your start-up remain innovative.

5. How important is regulatory compliance for fintech mobile apps, and how can start-ups ensure they adhere to regulations?

Compliance in fintech is of utmost importance in maintaining user security and trust, so start-ups must remain aware of applicable financial regulations and data protection laws in their target markets. To ensure compliance, consult legal professionals, establish robust data protection measures, and stay abreast of evolving regulations. Partnering with regulatory technology (RegTech) companies may also help automate compliance processes and minimize risks.

Share this blog