Digital payment markets have seen steady expansion over time and are projected to profit. At present, two-thirds or more of the global population uses electronic payment systems, with 89% using them within their nation (in this instance, the United States).

As more businesses and clients recognize the convenience, security, and efficacy of digital payments, demand for these methods has never been higher.

PayPal, Samsung Pay, Google Pay, and Apple Pay have been leading the effort to develop online wallet applications and advance this field. Mobile purchases could represent up to 80% of online shopping within five years.

As technology changes the world around us, digital wallet (e-wallet) apps signify an exciting transformation in financial transactions. The global market for digital payments is expected to surpass $14.79 trillion by 2027, meaning our society's shift away from cash payment methods towards cashless solutions.

This article delves deep into the details of digital wallet app development, discussing market trends, user benefits, and technological components that matter for success in creating wallet apps. Whether you are just starting or running an established company, understanding the nuances and benefits of digital wallet application development is vital to staying competitive and relevant in an ever-evolving digital marketplace.

Introduction to Digital Wallets

The digital wallet, called mobile wallets or e-wallets, has changed how we manage transactions in today's digital world. With the rapid development of technology and the growing dependence on smartphones and other devices, digital wallets have become an integral component of our lives.

In this section, we will explore the basics of developing digital wallet applications to understand their importance and potential growth in 2024. Then, we will discuss the reasons why creators should look into the creation of an online wallet.

What Are Digital Wallets?

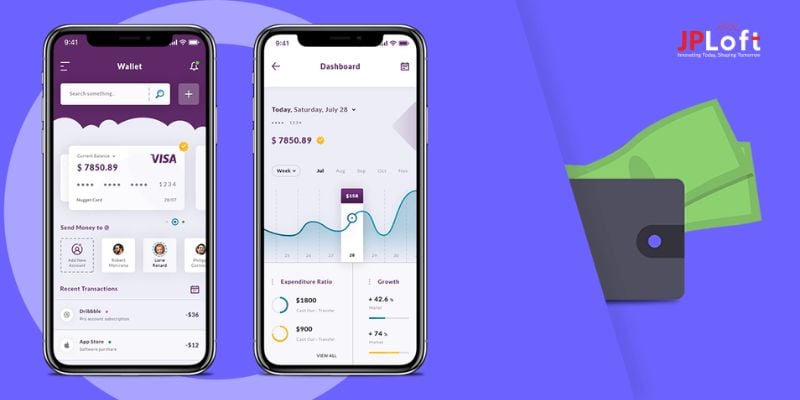

In its essence it is a container in which a user secures payment information like the bank's account number, as well as cryptocurrency-related holdings. It is a convenient and secure method for users to purchase online, pay for bills, transfer money to relatives and friends and perform different financial transactions without having to use physical cash or credit cards.

Digital wallets come in many types, such as online wallets and mobile ones, as well as desktop-based wallets. Mobile wallets, particularly, have seen a surge in popularity due to the increasing usage of mobile phones. They are usually accessed through mobile apps specifically developed by banks as well as technology companies or other third party service suppliers.

One of the most important features in eWallet app development is their capability to simplify the checkout process by allowing users to save their personal information about payment securely and then access it with several clicks or taps. This is not just time and effort, but can also improve protection by decreasing the chance of divulging sensitive financial data in transactions.

Importance and Growth of Digital Wallets in 2024

The significance for digital wallets within our digital world cannot be overemphasized. As more and more consumers take to online shopping, digital payment as well as contactless transactions and transactions, the need for easy and secure payment options is increasing. In 2024 this trend will be amplified by other factors like the COVID-19 virus that has resulted in an increase in the number of online stores as well as a shift towards cashless payment.

According to research conducted recently, the electronic wallet development industry is predicted to grow at an unprecedented rate in the near future caused by factors like the growing smartphone penetration, expanding internet connectivity, and increasing demand from consumers for digital payments and banking. By 2024 alone the market is projected to see a rapid growth with a plethora of new customers who are joining the digital wallet community.

This rapid growth is attributable to many reasons, such as the convenience, security and flexibility offered with digital wallets. With features like biometric authentication, tokenization as well as encryption, these wallets offer customers the security of knowing that their data is secure from fraudulent access and unauthorized access.

In addition digital wallets are more than a tool to make payments. They now provide a broad array of other features and services like loyalty programs and budgeting tools, rewards points and peer-to-peer (P2P) transfer, which make these wallets essential to today's adept customers.

Why Founders Should Consider Creating a Digital Wallet?

Entrepreneurs and founders in the fintech field the possibility of launching the digital wallet applications offers an exciting opportunity for the development of new and disruptive ideas. In order to tap into the growing demand for payment services that are digital, entrepreneurs can create an attractive niche in an ever-growing marketplace and become leading players in the new economy of digital.

Developing a digital wallet application can provide many benefits to founders that include:

-

-

Revenue Generation

-

Digital wallets offer a variety of sources of revenue, such as subscription fees, transaction fees, agreements with merchants and service providers. If you have the correct business model and monetization strategy the founders can make substantial profits from their digital wallet platforms.

-

-

Customer Acquisition and Retention

-

Offering an effortless and user-friendly payment experience, entrepreneurs are able to attract new customers as well as keep existing customers. Digital wallets can be expected to become a vital part of everyday routines, resulting in increased satisfaction and loyalty in the long run.

-

-

Competitive Advantage

-

In a competitive marketplace it is essential to differentiate yourself and distinguish yourself from competitors. By developing an electronic wallet with distinctive capabilities, new functionalities and a superior user experience, entrepreneurs can achieve a competitive advantage and establish themselves as an innovator in the field.

-

-

Innovation Opportunities

-

The world of digital wallets is filled with opportunities for innovation with new trends and technologies continually developing. The founders are able to explore advanced technologies like blockchain as well as artificial intelligence and biometrics, to design the next generation of digital wallet solutions that meet the changing demands of customers.

-

-

Social Impact

-

Beyond the financial gain, establishing digital wallets can make an impact on society through promoting financial inclusion and helping underserved communities. Through giving access to digital payments services, the founders

Also Read : Top eWallet Apps in Dubai for 2024

Understanding the Digital Wallet Ecosystem

In this digital age the notion of carrying around a physical wallet that is filled with cards and cash is becoming more and more obsolete. Today, consumers are opting for digital payment systems and using electronic wallets in order to handle their money easily and safely.

The ecosystem of digital wallets by providing a brief overview of the digital payment methods, discussing the different types of digital wallets that are available and highlighting the major players in the world of digital wallets application development.

Overview of Digital Payment Systems

The term "digital payment system," also referred to by the name electronic payment system, or electronic payment systems, are the technologies and methods that make it easier to conduct electronic transactions with sellers and buyers. These systems permit people and companies to transfer funds or make purchases and make financial transactions online without the requirement of physical cash or checks.

Digital payment systems have developed dramatically over time thanks to advances in technology and shifts in the way consumers behave. There are a variety of kinds of digital payment systems that are available, each with distinct functions and features to satisfy the different demands of consumers.

The most popular kinds of digital payment methods are card-based that use credit or debit cards to purchase items either online or in stores. These types of payments depend on payment systems like Visa, Mastercard, and American Express to process transactions quickly and securely.

Another well-known method for digital payments is bank transfers. They allow customers to transfer funds directly from their bank accounts to accounts of merchants or individuals. Bank transfers are usually employed for large-scale transactions or for payments between people who have built the trust of one another.

In addition to card-based payment and bank transfer, there are other kinds of digital payment methods that include the mobile wallet and cryptocurrency-based payments. These systems make use of technology like Near Field Communication (NFC) as well as QR codes and blockchain to allow rapid, efficient and secure transactions on multiple platforms and channels.

Also Read : List of Top 10 eWallet Apps

Types of Digital Wallets

Digital wallets, sometimes referred to as mobile wallets or e-wallets are digital containers that safely store payment data like details of credit cards and bank account numbers and crypto holdings. They allow users to purchase online, settle for bills, pay bills, transfer money to family and friends and perform various financial transactions without the need of cash or cards.

There are many types of digital wallets with each one catering to distinct requirements and preferences of the user. A popular and popular type is mobile wallets which can be accessed via specific mobile apps that are installed on mobile phones or other devices. Mobile wallets are convenient and mobility, allowing users to make payments while on the move through their phones.

Web wallet app development, in contrast, are wallets made of digital technology which are accessible through web browsers that run on desktop computers as well as other internet-connected devices. These wallets save payment data securely on the cloud, allowing customers to use their money on any device that has Internet access.

Alongside Web wallets as well as mobile wallets there are desktop wallets too that are software programs which are installed on desktop computers and laptops. These wallets provide traditional methods of digital wallet management, which allows users to manage and store the funds on local devices.

Key Players in the Digital Wallet Industry

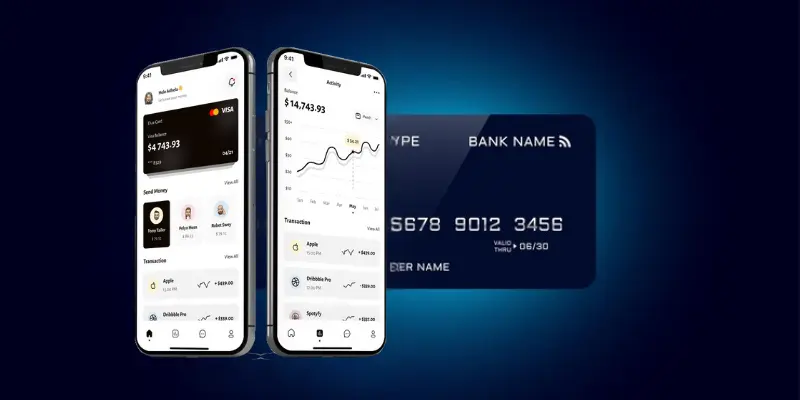

The market for digital wallets software development is extremely competitive, with a broad variety of organizations and companies competing to dominate the market and gain market share. The major players in the world of digital wallets are tech companies as well as financial institutions, payment processors, as well as Fintech start-ups.

One of the biggest players in the field of digital wallets is Apple through the Apple Pay platform. Apple Pay allows users to make payments with their iPhones and iPads Apple Watches, and Mac computers at millions of shops restaurant, stores, and other merchants around the world. Its easy integration to Apple devices and a strong emphasis to security, privacy and safety Apple Pay has become one of the top mobile payment services on the marketplace.

Another significant player in the world of digital wallets is Google with the Google Pay platform. Google Pay enables users to pay online, through apps, as well as in retail stores using Android smartphones or internet browsers. With its array of services and features such as loyalty programs, peer-to–peer transfers, as well as contactless payments, Google Pay has gained popularity among both customers as well as merchants.

Alongside Apple and Google in addition, there are a number of other players that are important to the world of digital wallets that include PayPal, Samsung Pay, and Amazon Pay. They offer their own digital wallets each with their distinct features, benefits and positioning in the market.

In addition traditional financial institutions like credit card issuers and banks are also getting into the digital wallet market by having its own banking mobile apps as well as digital payment platforms in order to be competitive with tech giants and fintech start-ups.

Market Analysis and Opportunities

The world of digital wallet mobile application development is rapidly changing, driven by technological advances, shifting consumer behaviour, and the shifting regulatory frameworks. An analysis of market trends in the adoption of digital wallets, look at the opportunities to founders and entrepreneurs, and examine the risks and risks associated with the world of digital wallets.

Current Market Trends in Digital Wallet Adoption

Digital wallet adoption has experienced an increase in popularity in recent years, driven by factors like an increase in smartphone usage, growing internet connectivity, as well as the increasing demands from consumers for simple and secure payment options.

Nowadays, digital wallets have become ubiquitous with millions of customers all over the world using them for a range of types of transactions.

One of the major factors driving the adoption of digital wallets is the trend towards cashless transactions and transactions that are not requiring contact. Due to the rise of the COVID-19 epidemic, people are becoming more cautious when handling cash and credit cards that are physically opting instead for digital payment methods to limit the chance of transmission of viruses.

This has led to a rapid increase in the use of digital wallets because consumers want more secure and safe ways to pay for purchases and make transactions. Another significant development in the marketplace for digital wallets is the addition of extra features and services in addition to the standard payments.

Digital wallets nowadays come with a range of options, such as loyalty programs including savings points and budgeting instruments, peer-to-peer (P2P) transfers as well as investments options. These added value services can increase customer engagement and loyalty, which will further increase use of digital wallets.

In addition, the emergence of alternative payment options like crypto and decentralized financing (DeFi) has created new challenges and opportunities for the market of digital wallets. While traditional digital wallets based on fiat remain the dominant choice however, there is a growing demand for wallets based on blockchain which allow customers to keep, transmit cryptocurrency securely and effectively.

Overall, current trends in the market indicate a significant increase in the use of digital wallets, with an expected increase in the next few years as technology advances and consumer preferences continue to change.

Opportunities for Entrepreneurs and Founders

The rapid expansion of the market for digital wallet application development provides numerous opportunities to entrepreneurs and business owners looking to profit from the growing need for new payment solutions. Some of the most important opportunities available in the realm of digital wallets include:

-

-

Niche Markets

-

The market for digital wallets is getting increasingly competitive and there is a chance for entrepreneurs to focus on special segments of users that are not being served by the existing solutions. Through identifying unmet requirements and pain points in these markets, entrepreneurs are able to create specific digital wallets that are tailored to the specific needs of their targeted customers.

-

-

Value-added Services

-

As digital wallets expand beyond the basic functions of payment there is a growing demand for additional services that improve the user experience, and also provide added benefits to customers. Entrepreneurs can profit from this trend by incorporating features like loyalty programs and cashback rewards, rewards points and personalized recommendations into their wallet platforms, which will help in making it easier to attract and retain customers more efficiently.

-

-

Emerging Technologies

-

The market for development of digital wallet solutions is always changing and emerging technologies like artificial intelligence, blockchain and biometrics altering the landscape. Entrepreneurs can benefit from these emerging technologies to design innovative digital wallets that provide increased security, privacy and user-friendliness. For instance, blockchain-based digital wallets could offer decentralized and censorship-resistant solutions, and biometric authentication may provide an additional layer of security for accounts of users.

-

-

Global Expansion

-

With the rapid growth of smartphones and the internet's connectivity, digital wallets hold the potential to be accessible to users across the globe, overcoming the boundaries of geography and culture. Entrepreneurs can take advantage of the opportunity to expand their digital wallets worldwide, tapping into new markets and meeting the demands of a variety of user groups. By making their platforms localized and adapting to local requirements and laws entrepreneurs will gain an edge in the global market for digital wallets.

Challenges and Risks in the Digital Wallet Landscape

Although the market for digital wallets provides many opportunities for founders and entrepreneurs, it's also rife with risks and dangers which must be managed carefully. The most significant threats and challenges that exist in the world of digital wallets are:

-

-

Security Concerns

-

One of the major issues that digital wallets face is security. Because digital wallets are able to store sensitive financial data they are a prime target for cybercriminals and hackers looking to steal financial and personal information. To ensure the security of digital wallets is a matter of strong security measures, such as multi-factor authentication and proactive monitoring to identify and counter potential security threats.

-

-

Regulatory Compliance

-

The industry of digital wallets is a complicated regulatory framework, with rules that differ from one state to the next. Entrepreneurs have to navigate through a myriad of regulations and legal rules, such as the anti-money laundering (AML) and know your customer (KYC) regulations as well as data protection laws in addition to consumer protection legislation. Infractions to these laws could result in huge fines, legal obligations as well as reputational harm.

-

-

Competition

-

The market for digital wallets is extremely competitive, with many companies competing for market share and supremacy. Established technological bigwigs and financial establishments and fintech start-ups are trying to grab more of the market. This makes it difficult for new players to make a mark. Entrepreneurs need to make their digital wallets stand out by providing distinctive features, exceptional experiences for users, as well as new functions to differentiate themselves from their competitors.

-

-

User Adoption and Trust

-

In order to convince consumers to use a new digital wallet system is a matter of overcoming obstacles such as resistance, doubt, and scepticism. A lot of users are reluctant to switch to a brand new digital wallet because of fears about privacy, security and accessibility. Entrepreneurs should invest in education for users and marketing as well as customer service to establish faith and trust in the digital wallets, thus encouraging user adoption and retention.

Planning Your Digital Wallet Venture

In order to launch a successful application, a digital wallet application development company needs to follow thoughtful planning and strategic planning. In this section, we will discuss the key aspects to designing your digital wallet venture such as determining your target customers, establishing your unique value proposition, as well as conducting feasibility studies and market research.

Identifying Your Target Audience

The first step in developing your digital wallet business is identifying your ideal customers. Understanding who your possible customers are and what their wants or preferences may be are crucial to create an online wallet system that is a hit with them.

Your ideal customer for an online wallet platform might include:

-

-

Generation Z: Younger demographics who are at ease with technology and favor digital methods of managing their money.

-

Small Entrepreneurs and Business Owners: Individuals who run small-scale businesses and require an easy and secure way to accept payments as well as control their financials.

-

Populations for underbanked and Unbanked: People who do not have access to traditional banking services or have limited access to financial services and are searching for other financial options.

-

Frequent Online Shoppers: Consumers who frequently purchase online and are seeking an easy and secure way to pay for products and services.

-

Tourists and Digital Nomads: Individuals who often travel and require a digital wallet system that allows international transactions as well as can provide services for currency conversion.

-

Once you've identified your market, you can modify your digital wallet system to their particular requirements and preferences, increasing the probability of acceptance and retention.

Defining Your Unique Value Proposition

In a competitive marketplace having a distinctive value proposition is crucial to distinguishing your digital wallet platform development from the competition and attracting customers. Your value proposition must be clear about the benefits and benefits of the digital wallet over other options.

The elements that could form the unique selling proposition of a venture in digital wallets might include:

-

-

Protection and security: Emphasizing the robust security measures and privacy safeguards that are built into your digital wallet platform in order to assure users that their financial data is secure and safe.

-

Seamless user Experience: The user-friendly interface and the intuitive style of your wallet which makes it easy for users to make transactions quick and efficiently.

-

Integrating with Other Services: It allows seamless interconnection with other platforms and services including e-commerce websites and social media platforms along with financial and management software to offer more convenience and value for users.

-

Valuable Features: Offering additional functions and capabilities, including loyalty programs such as budgeting tools, rewards points as well as personalized recommendations to improve the overall user experience, and to encourage participation and building.

-

Customer Assistance and Support: Offering responsive customer assistance and support to resolve any issues or concerns users might encounter when using your digital wallet creating trust and a sense of loyalty among users.

-

With an unambiguous and compelling value proposition you are able to make your digital wallet stand out from the competition and draw people who are searching for specific advantages and benefits that your platform can provide.

Conducting Market Research and Feasibility Studies

Before you launch your digital wallet application, it is essential to conduct thorough market research as well as feasibility studies to evaluate the feasibility and viability of your business. Market research is the process of gathering and analyzing data about the market for digital wallets including growth rates, market size, competitive landscape, and the regulatory environment.

Feasibility studies are aimed at assessing the financial, technical, and operational viability that your online wallet business by looking at the resources and expertise required, estimating development costs and operating costs, and identifying risks and issues that could be posed.

The most important elements of feasibility and market research for a digital wallet business could comprise:

-

-

Market size and Growth Potential: Analyzing the potential size of the market for digital wallets and predicting future growth trends to evaluate the potential need for a digital wallet.

-

Competitive analysis: Examining the landscape of competition to pinpoint key competitors as well as their advantages and disadvantages, as well as possible threats and opportunities to your venture in digital wallets.

-

User Preferences and Needs: Conducting surveys, focus groups, and interviews to collect information about the needs preferences, needs and concerns of your targeted group, which will inform what you are designing and developing for your online wallet.

-

Compliance with Regulatory Laws: Understanding the regulatory environment that governs digital wallet services which includes license requirements as well as data protection laws and consumer protection laws, for compliance, and to minimize the legal risk.

-

Technical Possibilities: Assessing the technical possibility of creating and maintaining your digital wallet platform, as well as testing the technology resources available in terms of scalability, requirements for scaling, and the integration of third-party systems and services.

-

When you conduct thorough study of market and feasibility, you are able to discover opportunities and issues as well as refine your business strategy and make educated decisions about the viability and the success of your wallet business.

Legal and Regulatory Considerations

The process of launching and managing the digital wallet platform requires dealing with a maze of regulatory and legal requirements. Let’s look at the most important regulatory and legal considerations for digital wallet application development services such as compliance requirements, licensing requirements, regulatory frameworks, as well privacy and data protection laws.

Compliance Requirements for Digital Wallet Operators

Digital wallet providers are subject to numerous regulations aimed at ensuring the integrity, security, and reliability of their platforms as well as protecting the rights of their users. Some of the most important requirements to comply with for digital wallet operators are:

-

-

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

-

Digital wallet providers must implement strong AML as well as KYC procedures to stop the laundering of money, financing terrorists and other illegal activities. This involves confirming the authenticity of users, observing transactions for suspicious activities, and reporting suspicious transactions to appropriate authorities.

-

-

Payment Card Industry Data Security Standard (PCI DSS)

-

Digital wallets that accept credit card payments must comply with the PCI DSS, a set of security standards created to safeguard cardholder information and avoid data security breaches. This includes the implementation of secured payment processors, encryption of sensitive data, as well as regularly conducting security audits as well as tests.

-

-

Consumer Protection Laws

-

Digital wallet providers must abide by the consumer protection legislation and rules that aim to protect the rights and the interests of customers. This includes ensuring clear and clear terms of service, revealing charges and fees upfront and resolving disputes and complaints promptly and in an equitable manner.

-

-

Financial Services Regulations

-

Based on the state of operation that the digital wallet provider operates in, they could be subject to rules regarding financial services as well as electronic money issues. This might include obtaining authorizations or licenses from regulators, ensuring minimal capital requirements, and following specific reporting and operational rules.

-

-

Cross-Border Regulations

-

Digital wallets that provide international payment services could be subject to additional rules governing international transfer of funds as well as foreign exchange transactions and conversion of currency. This may include compliance with the foreign exchange control regulations, reporting requirements, as well as sanctions regulations enforced by regulatory authorities.

In ensuring compliance with these laws and other applicable regulations, online payment wallet applications can establish trust and build credibility with customers, decrease regulatory and legal risks and provide a secure and reliable platform to conduct financial transactions.

Licensing and Regulatory Frameworks

The regulatory and licensing system for digital wallet operators is different from one state to another, and is dependent on a variety of factors, including the type of services provided, the intended market, as well as the regulatory framework. The general rule is that digital wallet providers are required to obtain permissions or licenses from authorities in order to legally operate and provide users with financial services.

A few of the most commonly used types of authorizations and licenses digital wallet operators might require are:

-

-

Electronic Money Institution (EMI) License

-

In a number of countries digital wallet companies that issue electronic cash or offer payment services must get an EMI license from the appropriate regulator. The license usually requires rigorous requirements in capitalization as well as governance, risk management and compliance.

-

-

Payment Institution License

-

In certain jurisdictions digital wallet providers might be required to get an authorization from a payment institution to provide payment services like money transfer or payment processing as well as currency exchange. This license might be subject to the same conditions similar to the EMI license, based on the regulations.

-

-

Money Service Business (MSB) Registration

-

The United States and certain other countries, digital wallet providers who deal in money transmission or exchange of currency may be required to sign up with the government as a Money Service Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) or other regulators. The registration process involves ensuring compliance to AML and KYC regulations as well as reporting requirements.

-

-

Banking License

-

In some countries digital wallet providers who offer banking services, like deposit-taking and lending might be required to obtain an authorization at the bank's central office or the banking regulator. This license is generally dependent on strict regulations related to liquidity, capitalization and risk management as well as regulatory compliance.

-

-

Cryptocurrency License

-

Digital wallet operators that offer cryptocurrency-related services such as digital asset custody, trading, and exchange may be subject to specific licensing requirements for cryptocurrency businesses. The requirements can differ based on the policy of regulatory authorities regarding cryptocurrency in the respective jurisdiction that ranges from strict rules to more flexible frameworks.

The legal and regulatory frameworks for digital wallet providers is a complex and difficult task that requires careful study of the regulatory landscape as well as consulting with compliance and legal experts, and continual monitoring and reporting of compliance.

Data Protection and Privacy Laws

Privacy and data protection laws regulate the use, storage and dissemination of user information by digital wallet companies in order to protect the private rights of users as well as the personal data of their users. Respecting privacy and protection laws is crucial to maintain the trust of users while minimizing the chance of data breaches and unauthorised access, as well as avoid legal and regulatory penalties.

The most important principles and rules of privacy and data protection laws that apply to digital wallet operators are:

-

-

Consent

-

Digital wallet operators must get an acceptable consent from the users prior to collecting or processing the personal data of users. This means providing transparent and clear information regarding the purpose of collecting data, the categories of data that are collected, as well as the rights of users with regard to their personal information.

-

-

Purpose Limitation

-

Digital wallet providers must only process and collect personal data only for specific and legitimate reasons and should not make use of it for reasons which are incompatible with the primary purpose of the collection. This means that personal information is not stored for longer than it is required and then securely removed or anonymized once it is not required anymore.

-

-

Data Minimization

-

Digital wallet providers must only process and collect personal information necessary to provide their services. They must not gather more information than what is needed. This means implementing strategies to limit any personal information that is collected, including employing anonymization and pseudonymization methods.

-

-

Security Measures

-

Digital wallet operators should take appropriate technical and organizational measures to ensure the security and privacy of personal information from any unauthorized information, access or disclosure modification or destruction. This includes the implementation of encryption, access control, and procedures for responding to data breaches to minimize the threat of data breaches as well as cyber-attacks.

-

-

User Rights

-

Digital wallet providers must recognize the rights of users with regard to their personal information, which includes the right to inspect and rectify, erase or limit any processing they do with their personal data. This means providing users with ways for exercising their rights, and responding to any requests in a timely and clear way.

In compliance with privacy and data protection laws, digital wallets can increase confidence and trust, establish an image of privacy and security, as well as reduce the threat of regulatory and legal penalties.

Technology Stack for Digital Wallet Development

Utilizing a robust stack of technology that includes infrastructure for backend and frontend of digital wallet application development tools. In addition, the implementation of stringent security procedures as well as best practice is vital to protect the financial details of users. This section we'll examine the tech stack that is required for the development of digital wallets and will cover the infrastructure needed for backend development as well as frontend development techniques and security measures, as well as best methods.

Backend Infrastructure Requirements

Backend technology of the digital wallet platform acts as the base for managing authentication for users as well as processing transactions, managing accounts, and keeping sensitive financial information securely. The most important elements that comprise the backend system are:

-

-

Server Architecture

-

Digital wallets typically depend on server architectures that are scalable to manage changes in user traffic and ensure the best performance. This can involve cloud-based infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) to set up and manage containers, virtual servers, and microservices.

-

-

Database Management System (DBMS)

-

A secure and reliable Database management system is crucial to manage and store the user's accounts, transaction history as well as other important information. Most commonly utilized DBMS solutions for the development of digital wallets are MySQL, PostgreSQL, and MongoDB and Redis each with distinct capabilities and features that are suited to particular use cases.

-

-

Application Programming Interface (API)

-

APIs play an important role in facilitating interaction between frontend user interfaces and backend infrastructure of a wallet platform. APIs let users connect and interact with the various functions and features that the system offers, including managing accounts transactions, transaction processing, along with security verification.

-

-

Payment Gateway Integration

-

Integration with payment gateways is crucial to making payments secure and seamless processing on the electronic wallet system. Payment gateway APIs permit users to connect to their accounts at banks, credit cards or any other payment method to their digital wallets, and to allow transactions to be made securely.

Front End Development Technologies

The front-end interface of the digital wallet plays an essential role in offering users an effortless and user-friendly experience on mobile and web devices. Frontend development tools are utilized to develop and design your user experience, incorporate interactive features, and guarantee the compatibility of cross-platform devices. Important frontend development technologies that are essential to develop digital wallets include:

-

-

HTML, CSS, and JavaScript

-

HTML, CSS, and JavaScript are the basis of web development. They're utilized to design the style, structure and behaviour of web pages within the online wallet. These technologies allow developers to design flexible and visually pleasing user interfaces that can adapt to various resolutions and screen sizes.

-

-

Frontend Frameworks

-

Frontend frameworks like React.js, AngularJS, and Vue.js offer developers tools and libraries to create interactivity and interactive user interfaces, with the least amount of programming complexity. These frameworks include components like a components-based architecture as well as state management and even virtual DOM rendering, which makes it easier to build and maintain complicated frontend applications.

-

-

Mobile Development Platforms

-

To develop mobile apps for iOS or Android devices developers can use mobile application development platforms like React Native, Flutter, or native development frameworks (e.g., Swift for iOS, Kotlin for Android). These platforms allow developers to create native-looking mobile applications using the same codebase, thus reducing the time required to develop and also the effort.

-

-

Progressive Web Applications (PWAs)

-

PWAs blend the most effective mobile and web app development technologies to provide fast, efficient, reliable, and enjoyable user experiences across all devices. PWAs make use of modern web technologies like service workers, manifests for apps on the web and responsive design principles to allow users with offline accessibility, push notification and similar experiences to apps in the browser.

Security Measures and Best Practices

Security is a top priority in the development of digital wallets, due to the nature of sensitive financial transactions as well as the potential risk of data breaches as well as cyber-attacks.

Implementing security measures that are robust and adhering to the best practices is crucial to protect the users' confidential financial data and to guarantee the security and integrity in the development of the wallet's platform. The most important precautions to protect your wallet and the best practices for developing digital wallets include:

-

-

Encryption

-

Securely encrypting sensitive information such as credit card numbers as well as payment information and details of transactions employing standard encryption techniques (e.g., AES, RSA) to stop unauthorised access and data theft.

-

-

Secure Authentication

-

Implementing secure authentication techniques like multi-factor authentication (MFA) biometric identification (e.g. fingerprints or facial recognition) as well as strong password guidelines to confirm the identity of users and to prevent unauthorized access to accounts.

-

-

Secure Communication

-

Securing the communication channels between frontend interface and backend infrastructure by using encryption protocols like HTTPS/TLS to ensure data transmission is secure and stop man-in-the middle attacks.

-

-

Conformity to Regulatory Standards

-

Ensuring compliance with regulations and best practices of the industry like The Payment Card Industry Data Security Standard (PCI DSS), General Data Protection Regulation (GDPR) as well as ISO/IEC 27001 to protect user privacy and maintain compliance with regulations.

Periodic Security Audits, and Penetration Testing conducting regular audits of security as well as penetration testing to find and fix weaknesses in this digital wallet system such as vulnerabilities in code or configuration weaknesses as well as security issues.

-

-

Data Backup and Disaster Recovery

-

Implementing backups of data and disaster recovery strategies to ensure the availability and security of data stored by users in the eventuality of system failures or natural disasters or other unforeseeable situations.

Implementing these security precautions and best practices, digital wallet providers can improve its security as well as the reliability of their platforms, establish trust and confidence among users, and decrease the risk of security breach as well as financial crime.

Also Read : Ultimate Take on Developing a Digital Wallet App in 2024

Designing User Experience (UX) and User Interface (UI)

and User Interface (UI).webp)

A compelling customer interaction (UX) and a user-friendly interface (UI) is vital to the development of a successful electronic wallet. Designing for UX/UI that is effective will not only improve the user experience and satisfaction, but also boost engagement and retention of users.

In this section we'll look at the key principles behind effective UX/UI design of eWallet app development. We will create user-friendly interface and navigation elements as well as making sure that accessibility and inclusion are included in the design of digital wallet applications.

Principles of Effective UX/UI Design

Designing for effective UX/UI is based on guidelines that emphasize accessibility, usability, as well as user satisfaction. Some of the key elements of successful UX/UI design are:

-

-

User-Centered Design

-

In the design process, it is important to keep the user in mind and prioritizing needs of the user as well as preferences and objectives during every step of the process. This includes conducting user research by creating user personas and collecting information from the users in order to guide design decisions and subsequent iterations.

-

-

Consistency

-

Consistently implementing design elements like colors, icons, fonts, and layout across multiple screens and interactions in order to provide an intuitive and seamless user experience. Consistency allows users to understand and navigate through the digital wallet platform better and lessens cognitive burden.

-

-

Simplicity

-

Maintaining the interface as simple and easy by minimizing the amount of clutter, removing the number of unnecessary components, while prioritizing important functions and features. An intuitive and simple interface allows users to perform tasks, locate information, and reach their objectives without a lot of confusion or frustration.

-

-

Clarity

-

Communication of information effectively and clearly using easy-to-read and concise words, visual hierarchy and clear patterns of interaction. Clarity aids users in understanding how to utilize the digital wallet platform and the actions they should use to reach their goals.

-

-

Feedback and Affordance

-

Offering immediate feedback and clear options for users to display the state of their actions, and to guide users to the right direction. This can be done by making use of visual cues, such as animations, tooltips and micro-interactions that acknowledge input from users and provide feedback on the result from their choices.

-

-

Flexibility and Customization

-

The ability to tailor the user experience and tailor the interface to their personal preferences and usage habits. This can include offering user-friendly settings, personalization options and user-controlled features that enable users and improve their feeling of control and ownership.

Creating Intuitive Navigation and Interface Elements

The interface and navigation elements play an essential part in guiding users around the digital wallet platform, and in making it easier for them to interact. The process of designing intuitive navigation and interface elements requires:

-

-

Clear Information Architecture

-

Organising features and content in an organized and logical structure that is a reflection of the user's mental model and allows for an easy navigation. This could include putting related features, using relevant labels and categories, as well as giving multiple routes to accommodate a variety of user needs and preferences.

-

-

Visible and Predictable Navigation

-

Placing navigation menus, buttons and hyperlinks in prominent and consistent areas which users can easily find and navigate to. Offering visual clues such as navigation bars, breadcrumbs and call-to-action buttons that help users navigate the interface and highlight the actions available.

-

-

Hierarchical Menus and Navigation Paths

-

The creation of hierarchical menus and navigation routes that allow users to move between various levels of functionality and content effectively. Utilizing dropdown menus, navigation links that are nested as well as breadcrumb trails assist users to understand where they are in this digital wallet system. Users can also return to an earlier screen or section.

-

-

Contextual Navigation

-

Provide context-based navigation options pertinent to the user's present situation and the task at hand. This could include providing context-specific buttons, links to navigation and actions buttons that are based on where the user is within the interface, as well as the functionality or content they interact with.

-

-

Search and Filter Functionality

-

Integrating search and filter functions that allows users to find specific information or execute specific actions within this digital wallet system. It offers advanced options for searching, filters and sorting rules that permit users to narrow their search results and find relevant content more efficiently.

Accessibility and Inclusivity in Digital Wallet Design

Accessibility and inclusion are crucial aspects of designing digital wallets to ensure that the platform is accessible and usable to people with different abilities, disabilities, or demands. The design process for accessibility includes:

-

-

Providing Alternative Text and Descriptions

-

Include the descriptive alt text of icons, images and other visual elements, to make sure that people who have visual impairments are able to comprehend the functionality and content that the platform for digital wallets offers. This assists screen readers as well as other assistive technologies to convey information to those who rely on tactile or auditory feedback.

-

-

Using Semantic HTML

-

The structure of the HTML mark-up of digital wallets with semantic elements like lists, headings and landmarks to improve accessibility and aid in the use of assistive technologies. Semantic HTML assists users with screen reading and similar assistive technology comprehend the structure and meaning of the text more clearly aiding in the user's navigation and understanding for those who are disabled.

-

-

Keyboard Accessibility

-

Making sure that all interactive elements and features on the platform for digital wallets are available and accessible via keyboard navigation. This includes supplying key shortcuts such as focus indicators, focus indicators, and logical order of tabs to enable users to navigate to, interact with or control the user interface with the keyboard only.

-

-

Color and Contrast Considerations

-

Utilizing colors with contrast and color ratios which are in line with the accessibility requirements (e.g., WCAG guidelines) to ensure that interactive and content elements are easily viewed by those who suffer from visual impairments or blindness. A good color contrast can help users to distinguish different elements and allows them to read text with greater ease, increasing accessibility and readability for everyone.

-

-

Flexible and Adaptable Design

-

Create the digital wallet platform with flexibility and adaptability in mind, to accommodate people with different requirements, preferences as well as assistive technology. This could include resizable text as well as adjustable font sizes and styles, as well as customizable color schemes that enable users to customize their experience while maximizing accessibility.

Also Read : Ewallet Mobile App Development: Cost and Monetization Strategies

Building a Scalable and Secure Platform

The creation of a secure and scalable platform for digital wallets is crucial to allow for the growth of the market, ensure reliability and secure the data of users. This includes selecting the best development method as well as scalability and security considerations. The implementation of robust security measures.

Selecting which is the Right Development Approach (In-house vs. Outsourcing)

One of the initial options when creating an online wallet platform is to decide between outsourcing or in-house mobile app developments. Each method has its advantages and disadvantages:

In-house Development

#Pros

-

-

More control over the development process and the product roadmap.

-

Control of the development team and its resources.

-

Easy integration with existing infrastructure and systems.

-

#Cons

-

-

It requires hiring and managing an experienced team of designers, developers and other experts.

-

More upfront costs for personnel, equipment and infrastructure.

-

More time to develop, particularly in cases where specialized knowledge is required.

-

Outsourcing Development

#Pros

-

-

Access to a wider range of expertise and talent that includes specialized skills and knowledge.

-

Speedier time to market, since outsourcing companies could already have components and frameworks.

-

The potential for lower costs of development, particularly for one-off or short-term projects.

-

#Cons

-

A lesser degree of control over the creation process and the quality of the product.

-

Timezone and communication issues particularly when working with overseas development groups.

-

Risk of relying on external vendors and the lack of knowledge transfer in-house.

In the end, the decision between outsourcing and in-house development depends on factors like the budget, the timeline, resources, as well as strategic objectives. Many companies opt for a hybrid strategy, which combines the resources of outsourcing and in-house to maximize the advantages of both approaches.

Scalability Considerations for Handling Growth

The ability to scale is essential for digital wallet platforms in order to handle the growth of transactions, user traffic and features that are complex. When developing for scalability, take into consideration the following aspects:

-

-

Cloud Infrastructure

-

Utilizing cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) permits scalable and flexible resource allocation in accordance with the need. Cloud services have auto-scaling capabilities which automatically adjust server capacity to accommodate the fluctuations in traffic.

-

-

Microservices Architecture

-

The adoption of a microservices-based architecture allows the breaking down of this digital wallet system into smaller, separate services that can be individually scaled. Microservices allow flexibility as well as modularity and the ability to scale by allowing each service to be created and deployed independently.

-

-

Horizontal and Vertical Scaling

-

Implementing both vertical and horizontal scaling strategies to cope with increases in the volume of transactions and user volume. Horizontal scaling involves the addition of additional instances of components to spread the load, whereas vertical scaling involves enhancing those resources (e.g. memory, CPU) of existing instances in order to meet the demand.

-

-

Caching and Database Optimization

-

Making use of caching and optimization mechanisms to improve performance of databases to decrease latency and increase the speed of response. Utilizing cache layers (e.g., Redis, Memcached) and optimization of database methods (e.g. indexing or query optimization) will significantly increase the performance and scalability under high load.

-

-

Load Testing and Performance Monitoring

-

Conducting regular load tests and monitoring performance to find bottlenecks, improve the utilization of resources, and make sure that the platform is able to handle high load and spikes in traffic. Monitoring important performance indicators (KPIs) like response time throughput, throughput, and error rate helps to detect scalability issues and improve the performance of your system.

Implementing Robust Security Measures (Encryption, Authentication)

Security is the most important aspect of digital wallets to safeguard sensitive data of users along with financial transactions. Implementing security measures that are robust requires:

-

-

Encryption

-

Securely encrypting sensitive information such as the user's credentials, payment information and transaction data by using encryption algorithms that are strong (e.g., AES, RSA) to block the theft of data and unauthorized access. Encrypting data from end-to-end ensures that data is encrypted when it is transferred and stored.

-

-

Secure Authentication

-

Implementing secure authentication techniques like multi-factor authentication (MFA) and biometric authentication, as well as strong password policies to confirm the identity of users and block the unauthorized access of accounts. Making use of OAuth, OpenID Connect, or any other standard protocols used by industry for authorization and authentication will improve security and enhance interoperability.

-

-

Access Control and Authorization

-

Implementing access control systems to limit access to specific resources and functions depending on roles of users as well as privileges, permissions, and roles. Access control based on role (RBAC) or attribute-based access controls (ABAC) or any other access control methods can aid in enforcing least privilege rules and limit the threat of unauthorised access.

-

-

Security Monitoring and Incident Response

-

Implementing real-time monitoring of security and logging methods to identify and address security incidents and abnormalities. Making use of security event and information management (SIEM) systems and Intrusion detection systems (IDS) and the management of security incidents and events (SIEM) solutions can assist in identifying and reducing security risks promptly.

-

-

Compliance and Regulatory Compliance

-

ensuring that the platform is in compliance with applicable security regulations, standards and best practices in the industry like that of Payment Card Industry Data Security Standard (PCI DSS), General Data Protection Regulation (GDPR) along with ISO/IEC 27001. Regular security audits and vulnerability assessment and checks for compliance helps to ensure the platform complies with the requirements of law and regulation and is in a secure position.

Integration of payment gateways and the establishment of alliances with banks and other finance service firms are essential aspects of creating an online wallet platform. These integrations facilitate smooth transaction processing. They also improve the user experience, and guarantee the security and reliability for financial transactions.

Also Read : How to Plan Cryptocurrency Wallet App Development to Achieve Maximum Results in Business

Understanding Payment Gateway Integration

Integration with a payment gateway involves integrating an online wallet app development platform to other payment processing systems in order to ensure safe, efficient and safe financial transactions. Payment gateways function in the role of intermediaries for merchant’s consumers and financial institutions, which allows the processing, authorization and payment of online transactions. The process of integration typically includes these steps

-

-

Selection of Payment Gateway

-

Choose a reliable payment gateway provider on the basis of factors like coverage in the geographic area and payment methods that are supported transactions, fees for transactions as well as security features and integration options. The most popular payment gateways include PayPal, Stripe, Square and Braintree and Braintree, all of which offer various characteristics and options.

-

-

Integration with API

-

Connect the platform for digital wallets and the payment gateway's API (API) to facilitate communications and exchange of information among both systems. The API includes endpoints as well as ways to initiate payments, obtaining the status of transactions, and managing transactions that are related to payments, such as credit card refunds as well as chargebacks.

-

-

Configuration and Testing

-

Configure the settings for your payment gateway that include merchant account credentials and the payment method, currencies options and processing rules for transactions. Test this integration in order to verify compatibility, performance and security across various devices as well as browsers and operating systems.

-

-

Compliance and Security

-

Make sure that you are in compliance with the relevant security standards and regulations, such like security standards and regulations such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR). Implement encryption, tokenization as well as other measures that protect sensitive information about payment transactions and to prevent fraudulent access or theft.

-

-

Monitoring and Maintenance

-

Check for the activity of transactions, performance metrics and error logs to find and resolve problems in real-time. Continuously update and maintain the integration of your payment gateways to eliminate security flaws, increase reliability, and to support the latest functions and features.

Forming partnerships with Financial Service Providers

The establishment of alliances with banks and other finance service firms is crucial to ensure the availability of essential features and functions within a digital wallet platform like account financing, money transfer as well as currency exchange. These partnerships allow access to banks' infrastructure and regulatory experts as well as financial services and products. Establishing alliances with banks and other financial institutions includes:

-

-

Identify Potential Partners

-

Explore and find potential financial service providers who offer complementary products and services that are aligned with the digital wallet's goals and the market it is targeting. Take into consideration factors like the reputation of the bank, its regulatory compliance geographical coverage, integration with the tech stack.

-

-

Negotiate Terms and Agreements

-

Start conversations with partners you might be interested in in order to negotiate conditions, terms and agreements that govern the partnership. Determine the scope of collaboration as well as the roles and responsibilities of each partner as well as revenue-sharing arrangements. Contractual obligations to guarantee mutual understanding and aligning of interests.

-

-

Compliance and Due Diligence

-

Complete thorough checks of due diligence as well as compliance in order to confirm the status of regulatory approval, licensing and compliance histories for potential partners. Make sure that the partners comply with the industry standards, regulations and best practices in privacy, data security and protection of consumers.

-

-

Integration and Testing

-

Integration of the wallet's digital platform into the APIs and systems of your partner to facilitate seamless data exchange and communication. Check the connection to verify compatibility, performance and security across multiple platforms as well as devices as well as user-specific scenarios.

-

-

Launch and Rollout

-

The partnership collaboration should be launched and then roll out the features and functions that are integrated inside this digital wallet system. Inform users about the partnership through announcements, marketing campaigns and promotions to encourage adoption and increase engagement.

Ensuring Seamless Transaction Processing

Transparency in transaction processing is crucial to provide customers with a smooth and easy experience while making use of a wallet. To ensure smooth transaction processing take note of the following guidelines:

-

-

User-friendly Interface

-

Create a user-friendly and intuitive interface that assists users through the process step by step and gives clear instructions, prompts and feedback. Reduce your number of interactions for completing a transaction in order to minimize friction and improve the conversion rate.

-

-

Fast and Reliable Performance

-

Improve efficiency of your wallet's digital platform in order to guarantee fast response times, low latency, as well as high availability. Implement load balancing, caching as well as other performance optimization strategies to manage the peak traffic and load spikes without any impact on the user experience.

-

-

Error Handling and Recovery

-

Develop robust errors handling and recovery methods to manage unexpected interruptions, errors, or issues in transaction processing. Offer clear and concise errors, solutions for resolution, and alternatives for retrying or repairing mistakes to reduce frustration and avoid abandonment.

-

-

Real-time Notifications

-

Send real-time updates and notifications to customers at each step of the transaction, including confirmation of the payment's beginning, status updates, and notifications of completion. Keep users updated and informed throughout the entire transaction process to help build confidence and trust on the platform.

-

-

Security and Compliance

-

Verify that the processing of transactions adheres to strict security and conformity standards to guard sensitive financial information and to prevent theft or unauthorised access. Use encryption and tokenization as well as other measures that protect transactions in payment and meet the regulations, such as PCI DSS as well as GDPR.

Through integrating payment gateways, creating relationships with banks and Financial service firms, and providing smooth transaction processing digital wallet platforms are able to provide users with a safe, reliable, easy, and convenient platform for managing their money paying for transactions, as well as performing transactions. By prioritizing security, usability and reliability, digital wallet providers can create trust and confidence among users and increase the adoption and engagement on the part of their platform.

Testing and Quality Assurance

Quality assurance and testing play an essential part in ensuring the integrity of the digital wallet application, its functionality, as well as security of digital wallets. Tests that are thorough can help detect and eliminate issues, enhance performance, and improve your overall experience. This section we'll look at the various kinds of tests for digital wallets and the significance of testing for user acceptance (UAT) as well as beta tests, and the best practices to ensure compliance with security standards and compliance.

Types of Testing for Digital Wallet Applications

Digital wallets undergo a variety of kinds of tests to verify the various aspects of their function as well as security, performance, and reliability. The most tests that are common for digital wallets include:

-

-

Functional Testing

-

Functional testing is the process of ensuring that the digital wallet's functions and features meet the specifications and function properly. This includes testing registration of users as well as managing accounts and transfer of funds, payment processing along with transaction history, as well as other functions that are essential to.

-

-

Usability Testing

-

Usability testing assesses users' interface (UI) and the user encounter (UX) that is built into the app to ensure that it is user-friendly and easy to use and user-friendly. Usability testing involves collecting feedback from real-world users through surveys or interviews as well as sessions for testing usability to determine areas to improve and optimize.

-

-

Performance Testing

-

Performance testing evaluates the speed as well as the responsiveness and scalability of the wallet application under varying loads. This includes testing the response time as well as throughput and resource utilization to determine if the application is able to withstand peak demand and traffic spikes with no any degradation in the performance.

-

-

Security Testing

-

Security testing focuses on the security mechanisms, controls and protocols used in the digital wallet software to find weaknesses, vulnerabilities and potential risks. This includes testing for security threats like injection attacks as well as cross-site scripting (XSS) as well as security breaches, data leakage, as well as security weaknesses in encryption.

-

-

Compatibility Testing

-

Compatibility testing assures that your digital wallet app is compatible with various devices and operating systems, browsers as well as screen resolutions. This involves testing on a variety of platforms and devices to ensure that the application is functioning well and properly in different environments.

-

-

Regression Testing

-

Regression testing ensures that the latest modifications or modifications on the electronic wallet application do not create new problems or a regression in existing functions. This is done by retesting previously tested functions and features to verify that they work according to their intended function after modifications or improvements.

-

-

Localization and Internationalization Testing

-

Testing for internationalization and localization confirms that the digital wallet app supports different languages, currencies, and preferences for cultural aspects. This includes testing the translation of language dates and times formats currencies, currency symbols, as well as regional settings to make sure that it's available and usable for users around the world.

User Acceptance Testing (UAT) and Beta Testing

Testing for user acceptance (UAT) along with beta testing is crucial steps in the lifecycle of software development which involves conducting tests of the wallet app using real-world users in real-world situations.

-

-

User Acceptance Testing (UAT)

-

UAT is the process of testing the application for digital money using users to ensure that it is in line with their expectations, needs and requirements. UAT typically happens towards the final stages of wallet application development prior to the release of the application to the public. Users are encouraged to try the application and offer feedback regarding its usability capabilities, and overall experience. UAT assists in identifying any issues or issues that could have been missed in the process of development. It also ensures that the app meets expectations of users prior to its release to a wider audience.

-

-

Beta Testing

-

Beta testing is the process of releasing an early software version to a restricted number of users from outside or beta testers to test and feedback. Beta testers are usually selected from the targeted user population and are given the opportunity to use applications in real world situations.

Beta testing helps to uncover problems within the digital wallet solutions with usability, bugs and performance issues that might not have been identified in internal tests. Beta testers offer valuable feedback and information that help inform the final adjustments and refinements before the application is released to the public.

Ensuring Compliance and Security Standards

Making sure that you are in compliance with the regulations and best security practices is crucial for digital wallet applications in order to ensure the security of user data, stop fraud, and ensure trust and credibility. Strategies to ensure conformity and security standards include:

-

-

Compliance Testing

-

Conducting tests to verify your digital wallet app conforms to relevant regulations standards, regulations, and best practices. This involves testing to ensure compliance with data protection laws (e.g. GDPR) and payment industrial standards (e.g. PCI DSS) and the financial regulatory framework (e.g., PSD2) as well as other laws and rules.

-

-

Security Audits and Penetration Testing

-

Conducting regular security audits and penetration tests to discover and address security weaknesses as well as risks and weaknesses within the digital wallet application. Security audits require a thorough review of the application's code, architecture settings, configurations and controls to determine whether it is in the security standards that are in place and to identify areas that could be improved.

Penetration testing is the process of simulating cyber-attacks that occur in real life to test the effectiveness of security safeguards and defenses as well as identify security vulnerabilities and loopholes.

-

-

Encryption and Data Protection

-

Encryption and security measures to safeguard sensitive information about users as well as payment information and transactions. This means encrypting data in transit and at rest by using encryption algorithms that are strong as well as protocols (e.g. SSL/TLS or AES) for protection against unauthorized access, interception and altering.

-

-

Authentication and Access Control

-

Implementing secure access control and authentication methods to validate the authenticity of users and limit access to restricted functions and resources. This includes the implementation of multiple-factor authentication (MFA) and biometric authentication, and robust password policies to block unauthorised access and safeguard user accounts from being compromised.

-

-

Compliance Documentation and Reporting

-

Documentation and records of security tests, compliance assessments, as well as remediation initiatives to prove compliance with regulations as well as industry-wide best practice. This may include proving compliance via the audit report, documents of certification and attestations of compliance, which might be required for compliance reasons or to assure those who use the platform of its security capabilities.

-

-

Secure Development Practices

-

Implementing secure eWallet app development practices in the lifecycle of software development (SDLC) to preventively tackle security risks and vulnerabilities. This involves applying guidelines for safe coding and code reviews, delivering security education for developers and utilizing software for security tests that are automated to detect and fix security problems earlier in your development.

-

-

Incident Response and Incident Management

-

Initiating the processes for managing and responding to incidents for a swift response to security breaches, security incidents and other security-related events. This involves the definition of the roles and responsibilities of each, setting up communications channels, and establishing incident response procedures and plans to recognize, control and reduce security threats in time and in a coordinated manner.

-

-

Continuous Monitoring and Improvement

-

Continuously monitoring and improving methods to assess the security status that is built into the wallet, to identify emerging vulnerabilities and threats and implement proactive measures to increase the security of your wallet over time. This involves the use of security information and event management (SIEM) systems as well as intrusion detection systems (IDS) as well as security analytics software that monitor any suspicious activities, study security logs, and provide relevant insights to improve security measures and defenses.

Through the implementation of solid testing and quality control procedures, including UAT as well as beta tests, and by ensuring conformance with the regulatory standards and best security practices, digital wallets provide users with a safe solid, reliable, and trustworthy platform for managing their money as well as for making payments and making transactions.

Security is a top priority throughout the mobile application development lifecycle, from the initial design and development, through the deployment phase and ongoing maintenance aids in building trust and confidence among the users of the application and minimizes the threat of data breaches, security breaches as well as financial crime.

Launching Your Digital Wallet Platform

The development of an online wallet application requires careful planning, execution and marketing in order to ensure its successful launch and long-term viability. This section we'll review pre-launch marketing strategies including onboarding new users as well as beta testers, as well as managing the launch day and subsequent actions.

Pre-launch Marketing Strategies

Marketing prior to launch plays an important part in creating anticipation as well as generating awareness and attracting new users towards your online wallet. Here are a few tips for pre-launch marketing:

-

-

Develop a Comprehensive Marketing Plan

-

Create a thorough marketing plan that outlines your objectives, target audiences, messaging channels, as well as strategies to promote your wallet's digital platform. Think about using a mixture of offline and online marketing channels, like email marketing, social media and influencer partnerships, content marketing as well as news releases, conferences and promotions.

-

-

Build a Landing Page and Teaser Campaign

-

Create an attractive web page to promote your wallet that highlights the key advantages, features and benefits. Create a teaser marketing campaign to create excitement and interest in your intended audience by providing sneak peeks, exclusive previews and opportunities to gain early access to encourage registration and participation.

-

-

Leverage Social Media and Influencers

-

Make use of social media platforms like Facebook, Twitter, LinkedIn, Instagram, and TikTok to create anticipation and connect with your followers. Post teaser videos, behind-the-scenes updates, and testimonials from users to build buzz and create recommendations via word-of-mouth. Work with bloggers, influencers and experts in the industry to increase your reach and build credibility with their followers.

-

-

Content Marketing and Thought Leadership

-

Create relevant and useful content on digital wallets financial, personal financial matters, fintech trends and payment solutions that establish your company as a thought-leader in the market. Post blog posts, whitepapers, articles and other content such as whitepapers information graphics, case studies as well as videos, on your site along with your social media platforms in order to draw and educate your targeted audience.

-

-

Email Marketing and Newsletter Campaigns

-

Create an email database of customers who are interested in your online wallet platform. You can regularly send announcements, newsletters, and updates information to ensure they are updated and active. Offer special discount codes, access too early and beta test opportunities in order to encourage registrations and encourage them to sign up.

Onboarding Initial Users and Beta Testers

After you've created excitement and interest for your digital wallet, now is the time to add the first beta testers and users to gather feedback, evaluate the platform, and improve your user interface. Here's how to welcome initial beta testers and users effectively:

-

-

Launch a Beta Testing Program

-