Few industries are as exciting as the (Fintech) financial technology regarding speed and speed of technological advancement. From mobile banking to peer-to-peer lending to robo-advisors powered by AI, fintech application development has transformed the entire process of handling money. The days are gone when you were forced to wait endless hours in long queues. Today's customers expect nothing less than a quick and convenient financial service customized to their lifestyles and on time.

The industry is rapidly changing, with over 500 fintechs launched each year. New companies are entering the market, whereas existing players are focusing on increasing their services to offer customers more choices than they ever have before. If you're a fintech entrepreneur, you're probably thinking about what Fintech software solutions offer.

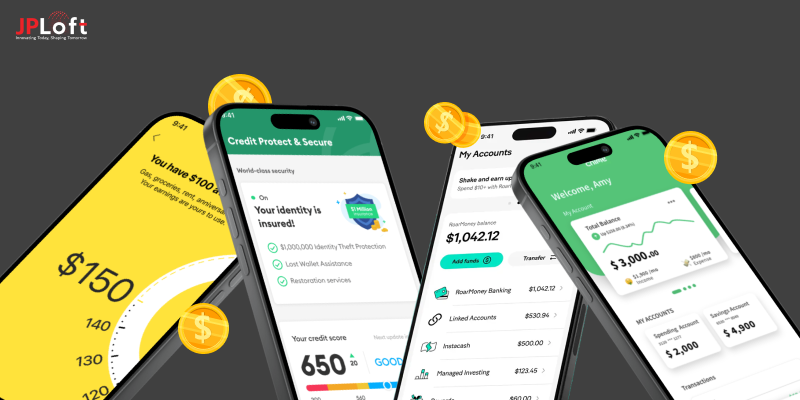

If you're considering creating a fintech-related app, take note of this as the signal to wait for. 2024 will be a year in which the fintech app development industry makes an incredible comeback following the dip in the pandemic. This article will cover the essential aspects of fintech mobile app development, including steps and market insights. Let's discuss them one by one:-

Market Insights and Statistics of Fintech Software Development

Fintech app development companies have probably had difficult times through the pandemic; however, in 2024, they are experiencing impressive growth. According to figures, the fintech app development industry between 2024 and 2032 is predicted to increase yearly by 16.8 percent and reach a staggering amount of 917 billion dollars by 2032. This is eight times greater than the market's worth at the beginning of 2020 when the pandemic became global.

Rapid digital transformation initiatives, strategic collaborations between banks, and artificial intelligence have led to a change in the traditional business model, resulting in new services and opening up new opportunities. Due to this, companies are experiencing increased funding tied to developing fintech-related apps.

There is a massive demand for fintech app development solutions, software, and other technologies to help businesses and consumers manage their money and conduct financial transactions. 78% of those under 40 said they would continue using their bank if it became completely digital. The demand from both customers and investors is evident, so 2024 is an ideal time to begin the first fintech app development process.

What is FinTech?

FinTech is shorthand for financial technology. It is the product that delivers and improves the quality of financial services. FinTech app development company offers a range of new technologies to enhance and simplify various sector areas.

The FinTech sector uses modern technology to compete with traditional banks. This includes online payments, transfers, financial services programs for managing money, financial planning tools, insurance, etc. Fintech app development technology improves the processing of financial information and enhances customer security by providing additional layers of protection against fraud.

Fintech Market Trends

One of the initial stages in creating a practical fintech application is understanding the market. This means that when you design the fintech application, you're making the correct assumptions and investing in developing features that align with the direction that the fintech app development industry is moving in. Venture capitalists want to invest in fintechs that can successfully use new technologies and develop niches. Let's look at some of these developments:-

Fintech is slowly helping underserved communities, minorities, and other age groups access diverse services. One instance is SilverTech is a service that focuses on seniors and allows them to retire and control healthcare costs.

Fintechs are pressuring increased mobility of banking banks and shifting to mobile and web-based apps to deliver their services while moving. The pandemic has increased this trend as neobanks challenge the traditional banking model in person.

API as a service

APIs enable connectivity and integration into the fintech ecosystem, with Open Banking as a major driving force. While they were once a tin can behind the scenes, APIs are becoming full-fledged products from which companies such as Plaid, Galileo, and Marqueta are making money.

Embedded Finance

Embedded financing is the method of linking financial services such as bill payment, insurance, and loans onto a non-financial platform. In the case of e-commerce platforms, integrated finance functions are especially advantageous since they offer a seamless user experience without leaving the application.

Blockchain & Smart contracts

Blockchain eliminates many hurdles for financial transactions, such as the need for authorization from intermediaries and banks. Smart contracts permit data exchange and storage using blockchain securely and transparently.

The increasing importance of alternative big data and data Fintechs use alternative data sources such as social media and wearable technology to improve their customer database and provide access to banking services for previously ineligible customers. With the information they gather, they are dealing with big data, a major concern for Fintechs.

Types of FinTech Apps

There are plenty of options if you're looking to build a FinTech application and are seeking fresh ideas. Let's look at the most common kinds of financial apps currently available.

Apps for digital banking

Digital banking and lending apps permit users to control their accounts at banks and access other financial services without visiting them. This category covers online or mobile bank services.

The lending and banking app features cover everything a customer can expect from the physical bank, including opening accounts with banks, checking and managing balances and transferring funds, mobile payments, applying for an advance or loan, etc. The primary advantage is that digital banking apps, mainly lending apps, offer accessibility and transparency to funds.

Apps for processing payments

Payment processing apps are used for all transactions for Fintech app development company. They are intermediaries connecting with payment service providers and the details of the client's account to enable mobile and web payments.

Payment processing perfectly fits the typical e-commerce marketplace and increases customer comfort. These apps allow even small companies to accept credit/debit cards and other online payment methods.

Technology for insurance (InsurTech) applications

InsurTech software helps improve the financial services industry by providing more precise ways to evaluate risks. It gives users faster methods of applying for coverage from insurance as well as processing claims.

There are numerous ways to implement InsurTech applications that cover automobiles, homes, pets, and life insurance. These applications help handle claims and assist insurance companies in conducting risk assessments at the site and creating better offers.

InsurTech's range is much more than simple software. It utilizes IoT devices, smart wearables, and AI to help evaluate a person's lifestyle and risk profile. Moreover, this is a relatively young segment; it is swiftly expanding. The market size was estimated to be $2.72 billion in 2020.

Apps for Investment

Investment apps are among the top platforms that democratize investment by making it available to everyone, not just the rich. A good investment app removes intermediaries, decreases commissions, and makes trading, making bids, and purchasing easier.

Robo-advisors go one step further. They offer an automated broker to manage clients' portfolios and make trades. They use AI machines to evaluate the client's financial status and potential risks.

Personal finance management applications for managing finances

Helping people manage their finances, which tracks and monitors how much they earn and spend. This is the main aim of all fintech software development firms, and personal financial apps help to deal with this effectively. These include budgeting apps. For personal finance management applications, the interaction with users is always easy, and they can select the desired goal, attach it to a bank account or a card, and track the flow of funds. The centralization of data in one location simplifies the management of finances and assists in keeping track of spending habits.

Tax management apps

Taxes are usually the most complicated element of financial planning. The rules and fine print can be complex, increasing the risk of making a mistake. Different rates of income taxation for businesses and individuals, as well as tax benefits and modifications to legislation, could be complicated.

The complexity of tax systems worldwide is one reason tax management software that assists in handling and filing taxes is so useful. FinTech app development firms develop applications that reduce the burden of creating, filing, submitting, and managing documents. There is no requirement to employ accounting professionals or possess knowledge since everything can be automated.

Exchange Services and services for the exchange market

These web-based platforms allow users to convert currencies over the internet. Many financial firms deal in electronic money and, therefore, require platforms through which their clients can transfer money or purchase desired currencies.

The booming industry relies on blockchain technology. A cryptocurrency exchange is an online trading platform where users can buy, sell, or exchange cryptocurrency. It operates like an online broker in that customers can deposit fiat currencies and buy cryptocurrency. Certain exchanges let users earn interest on the cryptocurrency stored in their accounts.

Step- By Step Guide To Create A Fintech App In Six Steps

Making a fintech application can't be accomplished in a single day. It requires lots of time and money. So, the first thing startups in Fintech should consider is a good idea and an area of interest. Every fintech app goes through many more stages. It is possible to create an application for mobile banking within five easy steps:

Step 1. Create an app concept

We've listed some features that are essential in every application. These include card-linking and security basics. While doing this, consider some features that differentiate you from your competitors. Use that feature to attract new clients. If they cannot find alternatives to your product, they will likely stick with you and give you money.

Step 2. Review the project

Conducting market studies is important in deciding the nature of future applications and monetization strategies. Note the evaluation of your project, and then establish the budget and timelines.

It's also the right time to determine your application's target audience. Choose a group of people that you'll concentrate on. This could be investors unfamiliar with the cryptocurrency market or anyone seeking to monitor their financials and determine how their cash is spent.

You could also choose people from your target audience to conduct a quick interview. In this way, you'll gain insights that will enhance your app.

Step 3. Create a design

Applications must be easy to use. Clients appreciate simplicity, transparency, and beauty. A well-designed UX and user interface can be the second step in developing FinTech applications. Locate references, determine your preferences, and create your design with the UI/UX team.

In the process of designing the following references, we begin with wireframes. We suggest doing something similar. These are the simplified screens of the application. They're white and black and don't feature any fancy or unique design elements at this time. The purpose of this step is to comprehend the logic of the app and to comprehend what users can do on any screen.

Wireframes are the backbone of the final screens of every mobile application. Once the design is completed, you just move to creating a UX kit. It's a document that contains every design element in your project, such as icons, buttons, fonts, and icons. A UI kit makes development easier and the creation of new screens much easier. You don't have to build the screens from scratch; simply make one using the parts available.

Step 4. Develop the app

Create a vision for your project and the functions of your FinTech application. Define the problems it can solve for users and how they could interact with it. Discuss your ideas with the FinTech App Development team and create your app.

If you're considering creating a fintech-related app, it is possible to make a minimum viable product (MVP),which is an initial version of the app that contains its core elements. This is a great way to test your concept on the ground. If, in the end, an application proves to be unprofitable, the business owner can decide to either stop the idea or alter it at no additional cost. If it's popular with its intended people, you can easily increase its size. You'll see more customers and generate more revenue with little effort.

Step 5. Test the app

Check for and try the Fintech app. Test runs allow you to test every aspect of the application's operation and prevent issues in its future operations.

One important thing to verify is whether the app functions in different resolutions. If you plan to release an app for iOS and Android users, the FinTech application must work properly on every mobile device. Correct the issue if smaller screens compress your content and appear overcrowded. This will guarantee you a successful app in FinTech.

Step 6. Let go of the application and take feedback

Launch the application and collect feedback from your first users. Your app will be available through the App Store and the Google Play Market.

Conclusion

Applications development to support FinTech are in high demand and will continue to grow. Traditional banks are in decline, and to compete with technology companies and digital banking, banks require advanced and sophisticated FinTech app development solutions. We have seen that even the top banks in the world invest in FinTech as they transform their internal business processes and look for innovative methods to communicate with customers.

Share this blog