In a digital world that is constantly evolving, everyone is dependent on online services. We rely on digital services that are instantly available and transform businesses in all sectors. Digital wallets are a major game changer in how we manage our finances. They have transformed our business and helped us move towards a cashless society. It is not only convenient, but it also represents a progressive society. Digital Wallet Web App Development is in high demand as traditional payment methods have become less common. Many businesses accept online payments to make transactions easier and faster. This blog will discuss the evolution of eWallet app development trends and how they will likely share the future of digital wallets in the next few years. Imagine you tapped your phone to send money overseas or tapped it at the checkout. These simple, easy actions highlight the relationship between technology and our changing needs in the digital era. This article explores the evolution of digital wallets, their rise to prominence in society, and the promises that they make. These promises will shape the future of digital wallets.

Growing Demand for Digital Wallets

In 1997, Coca-Cola launched its first mobile payment system that allowed users in Helsinki to buy a beverage via SMS. PayPal transformed online shopping in 1999 by providing a safe intermediary for e-commerce payments. Bitcoin was introduced in 2009, creating crypto wallets to manage and transact with this new digital currency. Google Wallet was the first digital wallet to work only on mobile phones in 2011. Users can pay with just a smartphone. By 2022, over 45% of Chinese consumers will use digital wallets, and only 6% from the US and Canada. Digital wallet app development firms are a trusted partner for many businesses to integrate wallet-friendly payment systems and move ahead. Digital wallets have changed lives since Coca-Cola introduced the first SMS-based machine transactions. Today, they are multifaceted financial hubs that offer services such as peer-to-peer payments, online shopping, and integrations. They also manage cryptocurrency. Digital wallets are expected to be used by 2025 for more than $9 billion US dollars in transactions around the globe, promising a bright future of digital wallets.

How Does a Digital Wallet Work?

Digital wallets are mobile applications that take advantage of the capabilities of mobile devices to provide better access to financial services and products. They eliminate the need for a physical wallet because they store all payment information compactly and securely. They rely on the wireless capabilities of mobile devices like Bluetooth, WiFi, and magnetic signals to securely transmit payment data from your device to an electronic point-of-sale designed to receive and connect these signals. Digital wallets are used for in-person payments. They use magnetic, Bluetooth, and wireless capabilities to send payment data from a customer's mobile device to a card reader or payment terminal that is enabled. Users unlock their devices, choose their payment method, and hold the device near the card reader to conduct a transaction. Digital wallets can make contactless payments in a matter of seconds.

Near-field communication (NFC)

Near-field communications (NFC) are the most common technology for contactless payments. NFC allows devices such as smartphones, smartwatches, and certain credit cards to securely transmit payment information without physical contact with card readers or payment terminals.

Magnetic Secure Transmission (MST)

Magnetic secure transmission (MST) is a technology that allows smartphones to emit an encrypted signal that works like the magnetic stripe of credit or debit cards. Digital wallets using MST send encrypted payment data when the device (usually a few centimeters away) is held or tapped.

QR Codes

QR codes are matrix barcodes that can be scanned by mobile devices using their cameras. This will initiate the transmission of data. These codes can be used in digital wallets to make payments. The POS terminal will send the payment information that the customer has sent via their digital wallet to the payment processor. This payment processor will then communicate with the issuing and acquiring bank to complete the purchase. Your device transmits the card information you have stored in your wallet for use during a transaction to the terminal at the point of sale, which is linked to payment processors. Payments are then routed to the banks and credit card networks through processors, gateways, and acquirers.

Super apps: All-in-one digital powerhouses

Super apps are a new phenomenon in the future of digital wallets. But what exactly is a super application? Super apps are a digital hub that unifies a variety of services. It turns your device into a versatile tool for any daily need. These super apps can be referred to by many as "multi-service tech platforms or a market for micro-apps." Super apps offer a single sign-on experience, which means users only have to remember one password. They can also switch between applications seamlessly.

Examples SuperApps

Super apps symbolize the convergence of platforms, primarily in Asia. These digital giants have evolved far beyond their original functionalities to create ecosystems that cater to various user needs. From repetitive tasks to complicated financial operations. Here are some of the global leaders that are upscaling the future of digital wallets:

- WeChat. From a simple messaging app, WeChat has transformed into an amazing super-app. WeChat users can now shop online, pay for services, enjoy entertainment, and book doctor's appointments, all from a single platform.

- Alipay. Alipay, originally a payment system in China, has expanded significantly. Alipay now provides utility bill payment, investment services, and travel booking, making it a vital tool for millions.

- Grab, Southeast Asia. Grab's ride-hailing app has expanded into other areas, including digital payments and insurance.

- Omni Central America. Omni Central America combines transportation, delivery, and digital payments to create a seamless user experience.

- Revolut Europe. Revolut is more than just a fintech company. It has also expanded to include cryptocurrency trading, stock market trading, and travel insurance.

How are digital wallets different from traditional methods?

Online transactions are turning to be a major part for future of digital wallets. They simplify the lives of customers! Knowing their pros and cons and how they differ from traditional payment methods is important. Pros

- Speed: reduces waiting time by processing transactions instantly.

- Adaptability: Serves different financial transactions - from bill payment to online shopping.

- Convenience: No more need to carry cash or multiple cards. Just scan and pay.

- Compactness: No more bulky wallets or purses.

Cons

- Security: Vulnerable attacks and breaches

- Tech dependency: Internet access is required for the transaction to be completed.

- Misuse: Phones with digital wallets may be used for unauthorized transactions.

- Limited Acceptance: Not all merchants accept digital wallet payments

- Tangibility: Some still prefer cash payments.

Adoption at a Global Scale

According to a report by Facts & Factors, the future of digital wallets payment is expected to reach $607.9bn in 2030. This will grow at a 35.5% CAGR between 2023 and 3003. GlobalData, for example, has compiled data that surpasses Facts & Factors' predictions. It is expected that the Indian market will be worth more than $5trn in 2027. All analysts agree that despite the disparity, virtual wallets will explode in the coming years. Virtual wallets are gaining popularity, and there are many reasons for this. Customers are gaining acceptance as they offer convenience, better customer experiences, and a flourishing e-retail and e-commerce landscape.

A World-Wide Potential

Deloitte’s latest findings show that nearly every developed country is over 90% smartphone-penetrated, with each having the potential to have a virtual wallet. Except for China, less than 15 percent of the population in these countries uses a smartphone as a means of payment due to concerns about security and lackluster benefits. Virtual wallets have a lot of potential but are not widely used. Also, as eWallet app development cost is not much higher, businesses trust them or see the benefits. Some regions are racing to catch up with the future of digital wallets, while others need to catch up. China China is a leader in the mobile payment market, where Alipay and WeChat Pay dominate the market. WeChat boasts 1,67 billion active monthly users, which is staggering. Southeast Asia McKinsey interviewed field experts from Southeast Asia and noted that virtual wallets offer many opportunities for payment. Around 60% of the region's citizens are unbanked, and only 17% of transactions are cashless. Africa M-Pesa, a digital payment wallet, has become a huge success in Kenya. It opened up payment options to the unbanked. M-Pesa has over 50 million (and growing) users in Africa as of 2021. Middle East Research and market surveys revealed that future of digital wallets is brightning the Middle East and Africa. Respondents say digital wallets will become the preferred payment method by 2025. USA According to YouGov, 60% of Americans will use mobile payment wallets by 2021.

How will digital wallets look in 2023?

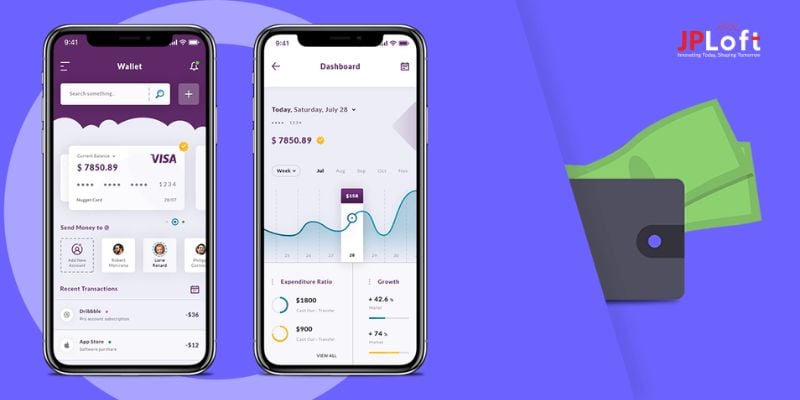

Digital wallets are expected to continue growing in popularity for several years. Digital wallets were also used to make transactions totaling $5.8 in 2021. New digital wallet providers such as Wallet Factory and other fintech giants like Google Pay and Apple Pay are making their mark. While each eWallet is unique, they all share certain digital wallet features.

- Register and login easily

- Protection layers

- Customers can be rewarded

- Integrate with credit or debit cards

- Virtual cash storage

Many online/offline shops and eCommerce platforms now accept payments via digital wallets. Even explainer videos are available to help educate the users. This is a great way to stay current in the digital age and improve their service.

Emerging Digital Wallet Trends and Opportunities

Like the rest of technology, digital payments are constantly evolving. As we look ahead, we see various digital payment trends that promise to improve our transactional experience and enhance the functionality of digital wallets.

- Predictive analytics. Infusing data science in the digital wallet space presents a new opportunity. With predictive analytics, wallets can anticipate users' needs, customize offerings, and ensure that every transaction or service feels intuitive and individualized.

- Biometric authentication. The days of cumbersome and inconvenient passwords are over. Security is improved by biometric authentication. This trend, whether fingerprint scanning, facial recognition, or voice patterns, ensures that access to financial assets will remain convenient and secure.

- Crypto Wallets. Digital wallets are expanding their support for cryptocurrencies as the world embraces them. Users can now store traditional currencies and seamlessly manage their cryptocurrency portfolios as they integrate with the decentralized financial system.

- Virtual Card. Plastic cards are undergoing virtual transformation. Virtual cards are now available in digital wallets, which allow users to transact with their primary cards without divulging the details.

Digital Wallets and Modern Technologies

Digital wallets are becoming increasingly sophisticated and will become essential tools in the future. Blockchain is not just about cryptocurrencies anymore. By leveraging decentralized databases, it promises increased transparency and rock-solid safety in digital wallets, making each transaction intrinsically trustworthy and tamperproof. Artificial Intelligence (AI),on the other hand, injects new intuitiveness into these wallets. They also provide robust fraud detection and personalized spending insights, allowing users to customize their experience according to their patterns and needs. The seamless integration of devices will lead to a world where payments are as common as the technology we use daily. Technology integrations are changing the digital wallet landscape and how we conduct financial transactions.

Evolution and Development of Digital Wallets

Digital wallets, once viewed as simple tools to perform transactions, are experiencing a renaissance. These wallets play a role beyond financial boundaries as the future of digital wallets is revealed. Several ways are becoming apparent that are overcoming the challenges of developing an eWallet apps with latest techs that can be added to the system:

- Integration of Loyalty Programs. No need to manage multiple loyalty programs and apps. Digital wallets integrate programs like cashback and reward points, which are credited instantly and are easily redeemable.

- Tickets Systems. Digital wallets simplify ticketing processes by allowing users to book, store, and share tickets in a single place.

- Government Services. Advanced digital wallets bridge the gap between citizens and governments. They can be used to pay taxes, renew licenses, and even fines.

This paradigm shift is a testament to the goal of digital wallets, which have evolved from simple transactional platforms into multifunctional hubs catering to everyday needs.

What future promises can digital wallets make?

In the future, consumers can expect access to AI-powered financial assistants offering them personalization and budget automation. AI-driven data analysis will allow merchants to target their customers better, improving conversion rates. Super apps of the future are a combination of banking, insurance, investment products, and payment methods. Users can store documents and access bank information, biometric data, and medical records, all on their smartphones. Super apps and super wallets that reduce online payment friction increase sales and store and confirm the customer's shipping and payment information will come and leave based on adoption by consumers. FAST's one-click checkout startup has already launched and failed within a few short years. Other companies may fail to create the future consumers desire. A clear battleground exists to create a seamless app that provides the key financial services that mainstream consumers require. Bolt, Shopify, Klarna, PayPal, and Stripe make this area look crowded. This could lead to consumers needing clarification when managing their online lives.

Takeaway

Digital wallets are a promising future, but they're not without challenges. Data privacy is a major concern in a world flooded with information. We've seen how digital wallets have evolved and the potential they hold. Innovation and challenges will continue to influence our financial interactions. If you want to easily navigate this complex landscape of financial software, selecting the right partner will be crucial. JPLoft offers top-tier eWallet mobile app development services for financial applications. This ensures a solution that is future-proof and tailored to your specific needs. Join us as we define the next chapter in digital finance.

FAQs

1. What are digital wallets, and how do they operate?

Digital wallets are software applications designed to safely store, manage, and transact digital assets such as payment cards, cryptocurrencies, or user loyalty points. By securely storing this data and providing easier transactions through mobile phones or computers - making online and in-store payments much more straightforward - a digital wallet offers users greater convenience for both payment options.

2. In what ways have digital wallets expanded beyond payments?

Digital wallets have evolved beyond simple payments by becoming "SuperApps," comprehensive platforms offering ride-sharing, food delivery, and shopping that have become integral parts of users' daily lives.

3. Which benefits can digital wallets offer to consumers?

Digital wallets combine convenience, security, and efficiency for users. Users can make fast and safe transactions while taking advantage of loyalty programs or managing various financial assets from one central place - particularly SuperApps, which provide an engaging user experience.

4. Are digital wallets secure to use?

Absolutely, digital wallets put security as their top priority. They use encryption, biometrics, and multi-factor authentication technologies to protect user data and transactions; users should practice safe computing behaviors such as setting strong passwords and safeguarding their devices securely.

5. Can Cryptocurrencies Support Digital Wallets in the Future?

Cryptocurrencies have increasingly integrated themselves with digital wallets, providing users with easy ways to purchase, sell, and hold digital assets within them. This provides new opportunities for investment as well as borderless transactions.

6. Can digital wallets completely replace physical wallets?

While digital wallets provide several advantages over physical ones, physical wallets will only partially go away in everyday life. There may still be instances that call for physical cards or cash; however, digital wallets have slowly reduced this need.

7. In what ways are SuperApps shaping the future of digital wallets?

SuperApps have transformed digital wallets into multifunctional platforms that integrate messaging, transportation, food delivery, and entertainment services - making digital wallets indispensable tools in users' daily routines.

8. What challenges have digital wallets encountered as they evolve into SuperApps?

Some challenges in digital wallet provision include competition, regulatory concerns, and providing seamless user experiences across services. Digital wallet providers also must take measures to maintain users' trust as their offerings expand and grow.