A person who keeps an all-day notebook every day to record the expenses. It's also not the most efficient time to track their expenses offline. It's not practical to carry around a journal whenever you purchase. This is both ineffective and absurd today when most transactions are conducted online. This is a fantastic opportunity for entrepreneurs to invest in an efficient Fintech application while also wanting to learn the cost of developing an application to keep track of expenses and evaluate its effectiveness.

To assess the efficacy of the application, it's crucial to know the need and purpose of the application. Keep track of your expenditures, and determine how you'll build your Fintech startup.

Apps to track expenses use technology that can automate expenses, generate reports, and provide insight into the amount of money being spent. This type of Fintech application helps users keep track of their expenses and aids them in figuring out how to control their spending. In addition, Fintech apps like budget tracking apps offer a level of accessibility and ease that traditional ways of tracking financials can't offer.

The development of Fintech has transformed the world of finance. Apps to keep track of your expenditures and expenses are a perfect example of how technology could provide new ways of monitoring your money. This has led to the need for a well-established expense tracking app development company to design the most effective Fintech applications for financial institutions.

What Makes it Essential to Develop an Expense-Tracking Application?

Making an app to track expenses is a popular choice for businesses to efficiently track expenses and manage budgets. In contrast, individuals use spending tracking to manage their budgets and prevent unintentional expenditures. Companies develop apps for monitoring spending to monitor their cash flow and production and prepare for tax time.

Because cloud-powered data streaming enables automated computation at each step, cost tracking is now much simpler for businesses. Any business that is required to deal with the regular traveling of personnel from outside receives a flood of invoices for expenses. This is the reason the cost tracking software and invoice software can help.

Businesses with a large number of field employees use expense tracking apps, which use cloud-based data streaming and mobile apps that allow real-time bill creation and expense tracking. They offer cost-monitoring software that enables employees to monitor their travel expenses and send invoices to the accounting team in real-time. This can also help promptly reimburse expense invoices to employees who travel for business.

Expense Tracker App: Features to Include

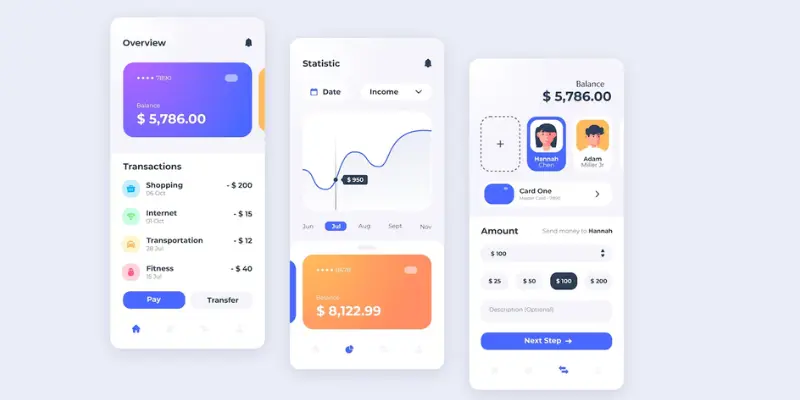

Look at every expense tracking app's details in the image above.

Track Income and Expenses

It's a given. The most important feature of an app for tracking expenses is keeping track of income and ensuring that you keep track of the expenses incurred against it. Transferring transactions from your bank account, mobile wallet, or credit card is easy without worrying about personal details.

This will give you a clear view of the amount you're earning and the amount you're spending. You will be able to easily get an idea of whether how much you spend is reasonable or in line with your earnings.

Capture and Organize Receipts

You will likely be late on certain transactions or completely neglect certain expenditures. This feature can solve this issue. Taking an image of your receipt each time you receive a cash or digital payment is enough. Place it in the correct category; the spending tracker will ensure you don't miss it.

The pictures are stored in a cloud, so you won't lose them. The receipts are arranged so that they can be retrieved whenever you need to.

Organize Tax Deductions

In the event of filing taxes, simply import your documents into a financial tracking software. It will classify the tax-related income and expenditure into tax-related categories.

Spending tracking software will categorize your business expenses into tax-related categories that are appropriate, letting you keep more of what you earn.

Accept Payments and Manage Invoice

The app for tracking expenses will accept debit, credit cards, net banking, and bank transfers directly on the invoice. You can also track the status of your invoices and credit card payments using the application.

The app can send reminders to pay and match payments automatically to invoices. If you'd like, you can also design professional invoices that are custom-designed with your logo. You can send via any device.

Run Reports

The app for daily expenses allows you to create and run reports on profit and loss and income, expenses along with balance sheets. It is also possible to create your own report so that you gain important information regarding your specific business requirements. If you need to, you can ask to prepare advance reports and also reports on inventory and budgeting.

Track Sales

Use your expense tracker app to make an e-commerce option and more. It is likely to accept credit card payments by integrating a mobile card reader. Additionally, you have the option of synchronizing with other popular apps.

You may also connect to the e-commerce APIs you prefer to use. The finance tracking application will automatically calculate taxes for your invoice.

Manage Vendors and Contractors

You can include contractors' and vendors' information in the app and classify them. Keep records of all payments you've made to these suppliers- who, how much, and when you paid the money.

Secure Access

Managing all transactions on your own is impossible, but you can allow your accountant to have encrypted access to your accounts. You can also give them access to certain functions of the software for managing expenses to minimize the chance of errors.

The most effective budgeting software helps assign tasks to specific users and improves your team's efficiency. Additionally, you can create individual permissions for deposit expense reports, sales transactions, and balance sheets, manage personal capital, and much more.

This allows the entire team to remain on the same track by communicating reports without jeopardizing the sensitive security of data.

Track Projects

The most effective budgeting applications let you track the progress of your projects in one spot. Additionally, you can keep track of the amount of resources used to accomplish the various elements in your venture.

It is possible to keep track of the cost of labor, payroll, and other expenses by using job costing. This helps determine the project's financial viability with a glance at the dashboard and reports.

Track Inventory

Some companies develop unique software to manage their inventory for their company, but the expense tracker application for business will track your inventory on your behalf.

This tool helps monitor the cost of goods and products and provides alerts when stock is low on a particular product. It also lets you know the most popular products and which ones are not in accordance with your needs.

The app for tracking expenses lets you create a purchase order and also manage vendors. You can directly import data from a spreadsheet you already have, meaning that you don't have to input all the data in a new spreadsheet.

Analytics and Insights

This feature enables you to create customized and presentation-ready reports that are also easy to understand graphs and visuals. It is also possible to look over these reports for information.

The top budgeting applications include deep analysis tools that you can evaluate how your company is doing. You can also analyze the recent and the past reports and forecast the future sales.

Recurrent Expenses

The best budgeting software will monitor certain payments to bills and vendor transactions that happen regularly. It is possible to grant access to the application to handle these regular expenditures. This can streamline and automate the repetitive expense, check, and invoicing.

Automate Workflows

This will save you significant time you usually spend creating reports, sharing information, and studying. You can set up reminders to notify you of the requirements of your business solutions. These automated reminders also help improve customer relations, sales, and cash flow.

Based on the requirements, these features are present in the majority of expense-management applications. However, if you have an additional requirement, you may include specific functions that meet your needs and integrate them into the app.

Unique Features for Expense Tracking App Development

There are some innovative features of expense tracking app development solutions. Check them out below.

Micro-investing

This feature allows you to begin investing in small amounts. It is easy to see how tiny savings add up without considering bigger investments. You can automate your investments each month or manually invest depending on your balance.

Robo-investing

This feature creates algorithmic investment solutions that analyze, monitor, and enhance the diversification of investment portfolios. You can improve the quality of your portfolio data and convert the massive information into actionable, independent investment insights.

It's hard to find an impartial financial opinion. However, Robo-investing can help this issue be easily solved. For novice investors, we've developed the Paper Trader app that lets investors trade stock in real time at actual prices without risking any real funds.

Budget vs. Actual Spend

Most apps for managing expenses show the distinction between income and expenses. This is helpful, but you must look at the entire view for more detailed information.

This is why you should be able to provide complete information about the budget and the amount being spent in real-time. This will help you follow the budget and formulate strategies to cut unnecessary costs.

Credit Check

At first, you had to pay TransUnion or Equifax around $20 to obtain the credit score. This is no longer required to be done with this feature. The feature displays an actual credit score, which is daily updated by both TransUnion or Equifax and provides the score a grade, like fair or good.

Advancement within the same component will also send push notifications alerting you about changes in your credit score and personal suggestions for credit products based on your credit rating.

Technology never ceases to amaze us with its innovations. Be prepared for the fact that we are talking about humans, who probably don't have anything to do with cost management or financial solutions. Artificial Intelligence will take over entirely and will not allow for errors.

There are AI-based features we could create to increase your knowledge of spending patterns.

Cost of Developing an Expense Tracking App

The expense tracking software development cost depends on several factors, including its features, complexity, platform, and developers' geographical location. The average cost could be between $10,000 and $50k.

Application's Complexity

The most important factor affecting the development cost of an app is its complexity. An expense-tracking application with basic features like creating budgets, tracking expenses, and producing reports is likely to cost less than an app with sophisticated tracking options like investment management or tax calculations.

The Platform of App Development

The platform you choose to build your application can influence the cost of development. iOS and Android are two of the most popular mobile operating systems used to develop apps. Generally speaking, iOS tends to cost more than Android because of strict App Store policies. However, both operating systems may require thorough testing due to users' various OS versions.

Location of Developer Teams

The location where developers work is a significant aspect when calculating app development costs. India, Pakistan, Bangladesh, Ukraine, and Vietnam tend to have lower development costs than teams in countries like the US or the UK.

However, costs alone shouldn't be considered the only criteria for determining teams. Assessment should consider the performance of each developer and the communication skills of every developer team member before deciding on the cost of development on its own.

Factors Affecting the Cost of an Expense Tracking App

Personal Expense Tracker App Development is a lengthy process that involves many phases and expenses of the process of creating it; therefore when discussing app development costs, it is essential to consider each step as well as any costs or fees that could be incurred during each stage before presenting an overall cost estimate to develop it. Here are some points you may want to be aware of when estimating the cost of developing apps that track expenses:

The Complexity of Expense Tracking App Development

Complexity is certainly one of the most important aspects of app costs and complexity, with more complicated apps requiring higher development costs, and the reverse is true. Complexity is measured by the features that are added, the platforms used, and the programming languages used, such as accounting for expenses or budget creation, are generally less expensive than more complex features such as tax computation or keeping track of investments, etc. - generally speaking, an app that has these features could cost around $20000, whereas one that has more complicated features (super apps, for instance) will likely surpass this amount by $100,000-150,000.

Platform Selection in Making a Expense Tracking Application

The platform you choose to build expense-tracking applications is essential to precisely estimating the development cost. While some platforms offer services with no fees, the entrepreneurs and developers ultimately choose which platform they prefer to develop expense-tracking applications.

The operating system determines the amount an app developer will charge to build it on that platform. Native app development typically costs less than hybrid or cross-platform development. In the case of hybrid development, which can be priced between $10000-$150,000 USD, the native development cost could be $30000-80000.

Location of Developers

Your decision to hire developers also affects the cost of application development; however, this is likely to have little effect as specific features, such as frameworks, generally cost the same regardless of where they originate. However, the costs for developers can vary from place to place, and employing an app development company will save you money compared to hiring an expense management app development service in America or other countries.

Technology Opted to Develop an App to Track Spending

The technology stacks and tools used to create the budget tracking app are the primary sources of expense. Budgeting applications requires a significant amount of engineering for proper functioning; consequently, picking the best tech stack to develop is crucial. The app has many options beyond simply displaying products or tracking expenses. It requires many frontend and backend tasks that guarantee smooth operation. The cost of the tools and technology is unknown.

Develop Finance Tracking App

While the process of creating apps is typically identical, it is possible to have variations that impact its price significantly in the end; it all is a matter of which decisions the business owner decides to order the development of their application. It is possible to engage an agency for app development that can manage all stages of development, from research to deployment, and even maintenance for full-cycle development. This makes the experience smooth and easy for their customers. This kind of full-cycle development should not be overlooked over app developers who try to do everything themselves.

Many opt for different service providers for each stage of development to give professionals or developers more autonomy and freedom. This also tends to raise costs, usually between $10000 and $60000 for each project.

UI/UX Design

User experience designed to provide an easy budget-tracking application

The app's design for budget trackers is a sign of its popularity. The more appealing it appears, the higher its popularity with users who download it and then come back. The user interface and experience should be of the highest quality to reach this goal. The users are less concerned about a program's features and performance and more about its appearance and aesthetic appeal in our modern, aesthetic-driven society.

Making user experiences for any app, regardless of the field, can be expensive. If creative minds are part of the design process, costs rise according to the design process. Although precise figures on the expenses related to UX/UI design can't be determined with certainty here's an estimated cost for the process of designing its UX/UI 50000

Integration is Key for Effective Fintech App Utilisation

Since apps for tracking expenses have sophisticated features such as tax calculators. They might need integration with other applications or sources to use these features and pay for extra costs associated with the integration process and systems costs. Integration costs can vary from $5,000 to $300,000. Remote developers could be your team on the integration process for other technologies or needed features.

Tips to Develop A Profitable Expense Tracker App

If you're worried about the expense of creating an app for tracking expenses, we will examine the steps needed to develop it. This will help you make an effective and profitable application.

Focus on User Experience

An expense-tracking app's success depends on the user experience and interface. Thus, concentrate on creating an intuitive and user-friendly interface that makes it simple for users to keep track of their expenses.

Offer Appealing Features

To make your application more appealing, you should incorporate attractive and practical features that satisfy users' demands. These features could be as simple as categorizing expenses and budgets, establishing budgets, tracking expenses in a specific category, setting up alerts for spending too much, and much more.

Use Data Analytics

Examine the user's data to gain insights into the user's behavior, preferences, and usage patterns. Then, you can use that information to improve your app's features and capabilities to satisfy the users' demands.

Customize The App

Users can modify the app to meet their requirements and preferences. It can be customized with categories, spending limits, alerts, and more.

Ensure Data Security

Security is crucial when developing apps that track expenses. Be sure that your app complies with the highest security standards and safeguards users' data from hackers.

Monetize The App

Offering premium features, such as charging a subscription fee or making money through advertisements, is one way to profit from the expense-tracking app.

Conclusion

All is about the money. It is your job to run a business to make as much money as possible. This is quite normal, and it is the way it should be. If you cannot track your expenditures and spending, it could result in enormous losses in the long run. Although it may seem modest initially, these tiny expenditures add up and negatively burden the company.

This is why it is so essential to control your spending. In addition to managing, you must cut out certain items and abandon borrowing and lending excessively. Saving money is great, but investing it is more beneficial. Of course, you have to know the basics of equity and stocks before you can do that. We won't go into the specifics of this. However, we can be a fantastic resource when you need to track expenses.

We are an Expense Management App Development Company with its headquarters in Canada. We have collaborated with clients across the globe and have developed apps that cover a range of areas, including financial apps, which is one of them.

We are known for our well-equipped and user-friendly applications. We have earned positive reviews from our customers and customers. We are experts in Android and customized iOS application development. We also design web-based applications and software using the same enthusiasm and high quality.

Share this blog