Digital wallets are still one of the most impressive discoveries in fintech. eWallet app development trends have recently gained popularity for their easy and quick payment processes. Digital wallets, or fintech products, are a payment form allowing individuals to go cashless. Users can store money on their mobile apps and use them for both online and offline transactions. Digital wallets are becoming more popular, so many brands enter the market with exclusive features and benefits. In 2020, fintech transactions were estimated to have exceeded 779 billion. This figure is expected to grow at 13% per year in the following years. It will be fascinating to see how the future of digital payments looks as the trustworthiness and reliability of digital wallets increases. Digital wallets have been used more in the last five years, resulting in a positive outcome for consumers and businesses. They will also be more than a digital wallet by 2023 and in the future. Let's first explore the digital wallet concept.

How is Digital Wallet in 2023?

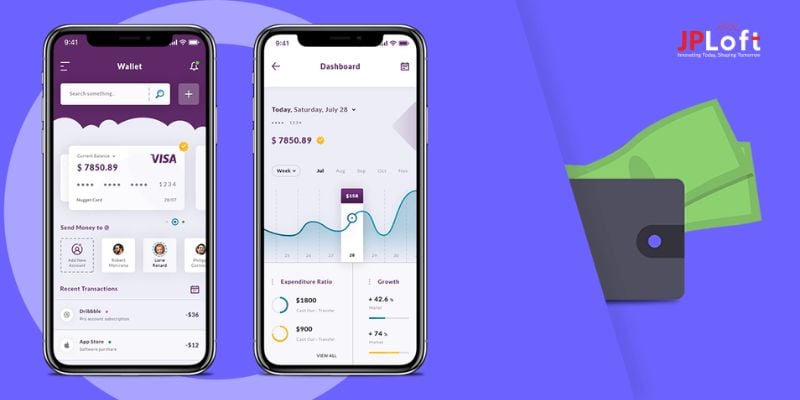

Digital wallets are expected to continue growing in popularity for several years. According to a study, the number of digital wallet users is expected to double between 2020-2025. Digital wallets were also used to make transactions totaling $5.8 in 2021. Digital wallets will be able to improve their services with the help of AI. Cashless payments using digital devices will become more popular, especially with younger age groups. New digital wallet providers such as Wallet Factory and other fintech giants like Google Pay and Apple Pay are gaining traction. While each eWallet is unique, they all share certain features.

- Register and login easily

- Protection layers

- Customers can be rewarded

- Integrate with credit or debit cards

- Virtual cash storage

Many online/offline shops and eCommerce platforms now accept payments via digital wallets. Even explainer videos are provided to educate the users. This is a great way to stay current in the digital age and improve their service.

The Evolution of the Digital Wallet

We've seen several transformations in the financial world, particularly over the last decade. The rise and evolution of eWallet app development services has driven this narrative. Look at this timeline to trace the history of digital wallets and understand their impact on consumers today.

Early Days

In 1997, Coca-Cola pioneered mobile payments by allowing Helsinki users to buy a drink via SMS. While not technically a digital Wallet, this innovation hinted towards the future of mobile transactions. PayPal was born in 1999. PayPal revolutionized online shopping as a safe intermediary for electronic commerce payments. In 2009, Bitcoin, which was then a decade old, was introduced as the most crucial factor driving the evolution of digital wallets. Bitcoin was more than just a currency. It introduced a new payment system without central oversight. This led to the creation "crypto-wallets" designed specifically for managing and transacting with this digital asset. These early ventures -- Coca-Cola’s mobile experiment, PayPal’s secure online transactions, and Bitcoin’s decentralized financial system - have collectively paved the way for today’s multifaceted digital devices, influencing how we interact with our finances on the digital front.

Mobile/Digital Wallet Genesis with Google

In 2011, replacing the old leather wallet with a digital version seemed impossible. During this time, Google launched the first digital wallet – 'Google Wallet.' Google created a "mobile wallet," which can only be used with a mobile phone. At the time, it was a bold move and an attempt at paving the way for the digital wallet we know today. Google Wallet initially only worked with a MasterCard from CitiBank. The concept of using a smartphone to pay was still revolutionary.

Beginning and Surge of Mainstream Adoption

Digital wallets have experienced a rapid rise between 2016 and 2022. In 2022, 45% (or more) of Chinese consumers were estimated to be using a digital wallet. Only 6% of Americans and Canadians used one. Businesses that wanted to remain current implemented wallet-friendly payment systems enabling faster transactions. But there is another major question that concerns businesses before they opt for eWallet app development. That is, eWallet app development cost and what are some of the major factors that affect eWallet app development cost. Well, you don’t have to worry about it. We have discussed factors affecting the cost of eWallet app development. In the years that followed, diversification in this area became more evident as cryptocurrencies such as Bitcoin and Ethereum rose to prominence. Modern digital wallets have evolved beyond their original design to become multifunctional platforms catering to traditional fiat transactions and the growing decentralized finance sector.

Where Are We Now?

From Coca-Cola’s first SMS-based vending machine transaction concept to today’s multifaceted financial hubs, digital wallets have come a long way. Digital wallets have become a part of our everyday lives. The services they offer include peer-to-peer payments, online shopping, and integrations, as well as cryptocurrency management. They reflect our dynamic and adaptable financial zeitgeist. Digital wallets will be used for over 9 billion US dollars in transactions by 2025, revealing a promising eWallet app future. Many of these transactions will occur in China and the Far East.

Also Read: What are the Challenges Of Developing an eWallet Apps

eWallet App Development Trends Not to Miss Out in Upcoming Years

Digital wallets will remain competitive in 2023 if they keep adding new features. What would be the next ewallet app development trend? Let's dig deeper into the major discussions. We've compiled a list of the eWallet App Development Trends that will likely be popular this year and in the future.

Crypto Wallets

Cryptocurrencies have been a trendsetter in the digital world despite their high volatility. Individuals and businesses increasingly use Bitcoin, Ethereum, and other cryptocurrencies to transact and invest. Many crypto wallets have risen in popularity as a result of their fame. These wallets help users to transact and invest safely. The number of users of cryptocurrency wallets has grown significantly from 6.7 million in Q1 2016 to 34.6 million in Q1 2019. Ewallets are a convenient and easy way to start investing in cryptocurrency. To store your digital currency, you will need a digital wallet.

Increase in QR Codes

We conduct many online transactions daily, and giving out your number to a random person can be unsettling. QR codes are designed to make it easy to scan, pay, and minimize the possibility of errors. QR code payments have surpassed NFC and are a great way to make contactless in-store payments. It does not require any additional infrastructure. Payment service providers regularly provide promotions and special offers to support QR codes. QR codes are a great way to pay and respond to mobile users. This technology has many uses for service providers and shops.

Smart Voice

Alexa, Siri, and Cortana have become part of our everyday lives. There has been much discussion about the potential for their use as payment. Nearly 50% of US adults (over 126 million) use voice assistance monthly. Amazon was one of the first companies to offer a voice wallet for its customers before Google and Apple followed suit. Voice assistants are a great way to purchase and send or receive money. The increasing trend to shop through smart speakers will likely lead to an increase in the use of digital wallets. Voice commands are more comfortable for smaller payments, such as paying for groceries, bills, and public transportation.

Artificial Intelligence & Machine Learning to The Rescue

AI-powered electronic wallets that automate transactions will make day-to-day payments more convenient. By integrating digital wallets, AI and machine learning will help prevent cyber fraud and theft. These technologies will also help identify software threats. Fraud detection using Artificial Intelligence and Machine Learning is possible thanks to Machine Learning algorithms. These solutions enable businesses to track any transaction history, identify fraud patterns, and detect them early to prevent future payments. ML Algorithms are much more efficient than humans when processing data.

Biometric Authentication

The addition of biometric authentication to digital wallets can provide additional layers of security for users. Biometric authentication is often used in digital wallets to improve security and reduce cybercrime. Digital wallets without a high-level security system are vulnerable to data theft and misuse. The biometric verification of the wallet will protect sensitive data frequently used for online transactions. Users need to provide personal information when booking products or travel accommodations. Biometric verification can be done in a variety of ways.

- Fingerprint scan

- Palm scanner

- Retina Recognition

- Facial Recognition

Buy-Now-Pay-Later

The buy-now, pay-later service (BNPL) is one of the ewallet app development trends we expect to continue to grow in 2023. According to a study, inflation is one of the main reasons why BNPL has become so popular. A second study predicts the BNPL to result in transactions worth 300 billion dollars. This number is expected to continue growing, reaching 576 billion by 2026. Moreover, the largest BNPL transaction is grocery shopping. BNPL provides a unique experience when purchasing products. The customer can buy the product they desire with installment payments. This type of installment payment is often free of interest and offers a variety of payment periods.

Virtual Cards

Digital wallet transactions are increasing. To adapt to the digital age, traditional transaction strategies have changed. Virtual cards have been a major development. Virtual cards can be created electronically and sent to recipients. You can use it for all transactions. You should add funds to the card before you use it. The cards are similar to plastic cards when supported. You enter the 16-digit number of the card, its security code (CVV),and expiration date to complete a transaction.

Hyperconnectivity and 5G on Digital Payments

Many businesses are now leveraging new technologies to their advantage. Digital payment methods are also expected to affect the speed at which transactions can be made from anywhere. Mobile payments based on IoT will also be a future trend. Payment options will vary and be integrated into the connected devices.

Near Field Communication (NFC)

In the last few years, there has been an increase in transactions that allow you to pay by tapping your card. NFC will be the basis of this technology, which is expected to grow rapidly in the coming years. NFC is a fast way to deliver encrypted data. This is a far more advanced technology than the standard PIN. UK Finance estimates that by 2027, 36% will be made using NFC-enabled cards.

Social Commerce

Social media is still a trendsetter in today's world. Social media platforms continue to add new features, including shoppable posts. Platforms are increasingly using digital wallets to enhance the shopping experience. Users can connect their digital wallets to social media accounts and buy products anytime. A quarter of social media users shop on these platforms. Social media can generate $1.298 billion in sales.

Foreign Remittance

A worldwide settlement is an exchange of money from a remote worker to his family, friends, or other people in the country of their origin. Global settlement is a significant part of the GDP in many nations. The rise of apps for foreign remittances is due to the acceptance of digital wallet solutions and the increasing use of mobile phones. The development of apps and smartphones has changed the financial management industry. Mobile app development and digital payment technologies have changed the perception of financial transactions. They have encouraged using digital money to reduce the risk that individuals will lose cash. They offer a variety of online payment methods for easy transactions.

Predictive Analysis

Data science's introduction into digital wallets is a game changer. Using predictive analytics, wallets can anticipate users' needs, customize offerings, and ensure that every transaction or service feels intuitive and individualized.

Digital Wallets: Blending Boundaries with Modern Technologies

Digital wallets are becoming increasingly sophisticated and will become essential tools in digital payment trends. Blockchain is not just about cryptocurrencies anymore. By leveraging decentralized databases, it promises increased transparency and rock-solid safety in digital wallets, making each transaction intrinsically trustworthy and tamperproof. Artificial Intelligence (AI),on the other hand, injects new intuitiveness levels into these wallets. AI-equipped wallets offer more than just transactional assistance. They also provide personalized insights into spending patterns and fraud detection. Digital payments are no longer exclusive to smartphones. IoT has expanded the reach of digital wallets by embedding them into wearable technology, home automation systems, and even vehicles. The seamless integration of devices will lead to a world where payments are as common as the technology, we use daily. Technology integrations are changing the digital wallet landscape and how financial transactions are performed.

Future of eWallet Design

It is not a far-fetched prediction that the next generation of consumers will use their smartphones to carry money instead of wallets. eWallets will continue to improve with faster transactions, more user-friendly applications, and instant redemption of loyalty points.

Voice Activation Payments and eWallet Design

Users should be looking for voice-activated payment systems that allow them to make payments without unlocking their phones or taking them out. It is also a great way to make payments for those with disabilities or older people with difficulty typing and swiping. It will improve the user experience, as passwords and other details won't need to be entered. Voice-activated payment adds another layer of protection with voice recognition that requires a voiceprint to authenticate, making it more difficult for someone to access your eWallet.

Solving Late Payments with Cloud

Cloud-based transactions are available 24/7 to provide users with seamless experiences and connect them to their money. Users can save money and time by making late payments without worrying about bounced checks or declined cards. Upgrades to cloud-based transactions will be a natural choice for users who want to avoid manual processes.

AI-Based Fraud Prevention

AI can detect fraud by analyzing online and offline behaviors. It will notify users of any unusual activity on their account, saving time and money. AI can reduce false declines using machine learning, which analyzes a user's behavior and spending patterns.

Contactless Payments

eWallets will transform the current contactless payment system. Users can pay at POS without using cash or cards. They can save time by not having to carry cash or cards around. Users will also feel safer paying with their phones due to the improved security of QR codes and NFC transactions.

The Digital Wallet Odyssey: Navigating the Challenges

Digital wallets App Deveopment Trends are a promising future, but they're not without challenges. Data privacy is a significant concern in a world flooded with information. Digital wallets and mobile apps must protect financial information. Unfortunately, security breaches are not just hypothetical risks. Digital wallets must be able to keep financial information confidential and secure. To stay on top of threats, security protocols must be continuously upgraded. The ever-changing regulatory landscapes worldwide are another challenge not just for digital wallets but also for decentralized finance. It can be difficult to adhere to regulations without compromising the user experience. Digital wallet providers must be agile and adaptable to the fast pace of technological change. This dynamic is not only about security but also about reliability in a constantly changing digital environment.

The Key Takeaway

Digital wallets are here to stay. With so many digital wallet applications gaining popularity, the future will appear cashless. It's time to take action and create your own financial technology company when you realize E-wallets' bright future. Our team is happy to help you achieve your goals. Our team has the necessary skills and is experienced in designing ewallets. JPLoft, a renowned eWallet app development company can help you develop an eWallet app for your business. Digital wallets will be a big hit in the future as AI and voice-based technologies will become more popular. JPLoft also helps companies to create digital wallet apps to make transactions easier with customers and clients. You will likely get one, as there is a lot of competition among digital payment providers.

FAQs

How can digital wallets be beneficial to transactions?

Digital wallets are the most convenient and secure way to conduct transactions. They are also suitable for consumers, as they only need to carry money with them sometimes. Cloud security allows users to store data, manage online transactions, and shop online.

What are the ewallet app development trends in digital wallets that can affect how you handle your finances?

These wallet apps make paying bills, managing the budget, and banking easier. Digital wallet apps are on the rise, all thanks to ewallet app development trends. It is changing the way individuals and businesses manage their finances.

What is an eWallet, and how does it work?

E-Wallets, also known as electronic wallets or virtual wallets, are tools that allow you to store information about your bank and payment methods such as cards. Data is kept safe by generating secure tokens.

What ewallet app development trends are affecting eWallets and digital payment?

The COVID-19 has accelerated the growth of contactless payments. Loyalty rewards and biometric safety enhance User experience. E-Wallets can be used for various payments.

What is the privacy and security of eWallets?

E-wallets use encryption and two-factor authentication for security. Machine learning detects fraud patterns. Regular updates fix vulnerabilities. Users must also adhere to best practices.