Investing was a hassle before investing in apps. Investors had to hire a financial adviser, spend countless hours on the telephone with them, and wait for the quarterly report to evaluate their investment strategies. The financial sector has modernized. The investment market is now more accessible and easier to understand thanks to new technologies. It's time to take a bite out of the investment app pie if you're inspired to do so by other startups. Suppose your product is secure, smart, and fills a niche in the market. In that case, you will be able to profit from the lucrative investing app market. Robinhood's revenue speaks volumes about the value of the market. The more people can invest, the larger the market. There is definitely a market for your innovative product.

Fintech App Development Services have made Fintech accessible and accessible, even to teenagers, making financial participation available even to teenagers and allowing even millennials to join the market. They find passive income increasingly appealing while grandparents gift shares of Apple to their grandchilden on birthdays thanks to these services. Their explosive growth can be directly traced back to this ease of access and convenience for users.

Investment App Development: It's Time

Several figures illustrate the profit margins of an investment mobile application. Here are some examples:

- Google searches for investment have increased by 115% per year.

- According to Statista, the global ecommerce market is expected to grow from $8.7 Billion in 2021 to $12.16 Billion in 2028. This represents a CAGR (Compound Annual Growth Rate) of 5%.

- In the past 12 months, 10 percent of all age groups have used online investment tools.

- According to a poll by Bankrate, 63% of smartphone owners have installed at least one financial application, with 17% being standalone investment apps.

In addition, 84% would like to consolidate their financial activities into one place. There are several different types of investment applications, but 81% of users would like to see additional digital features. Investment app development is, therefore, a promising business.

Types Investment Apps

It would be best if you prepared before you begin creating your investment application. You will need to decide the size of your team, the structure, and the technology you want to use based on what type of app you are going to build. Here are some examples of investment apps that are commonly used:

Investment apps centered on education

This category of investment apps is perfect for beginners to learn the basics of financial literacy. Example Invstr Apps to conduct trades This type of app allows you to trade stocks and make investments for you. Examples: Robinhood Charles Schwab Stash

Apps For Brokers

These apps are designed for customers who know what they want. You can usually trade fiat currency and cryptocurrency. Examples: WealthBase, Ellevest

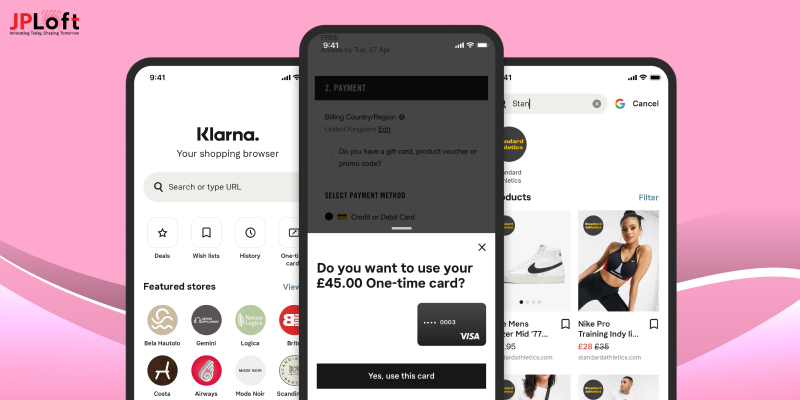

Banking applications

The numerous apps and services that are available online allow users to manage their accounts, make deposits, invest, take loans, and much more. Licensed financial institutions usually own these apps, sons. Examples include Chime Mobile, Ally Bank, and Bank of America

How to build an investment app: Ensure success

It is time-consuming and delicate to build an app that will impress investors. It is important to handle each step and phase with precision. This process will help you to make the final product perfect for your end users.

- Write down your idea

- Gather Information

- Examine your potential competitors

- Set your goals

- Hire A Development Firm

- Build and Finalize the Design

- Select Your Preferred Technologies

- Start with Investment App Development

- Test Your Investment App

- Launch Your App For The Audience

These steps provide a comprehensive view of how to build a great investing app. Let's go through each one in more detail.

Document your Idea & All Features

If you want to avoid being diverted later, the first step is crucial. Write down your ideas and features. List everything, from the final color theme to the number of screens and unique features. Once you have documented your knowledge, you can build on it. You'll learn how long the project will take and how much scope creep is acceptable during the development phase.

Gathering Information

After you have completed the brainstorming, documentation, and information-gathering steps, it is time to start the actual data collection. You will need to take several steps to collect concrete and valuable ideas and insights. You will need to read scholarly articles, visit forums, and meet people. To ensure that the information you've gathered is useful, you need to be able to analyze it and only store the relevant and valuable pieces. This step is very important and will affect what you build in the next stages.

Research your potential competitors.

You must study your competitors if you plan to enter the market. You don't need to invent the wheel every time, nor do you have to create something completely new. The same steps apply to every industry and every project. You can not only learn what your competitors are doing well but also where they may be falling short so that you can make up for it. It is important always to keep an eye on your competitors.

Set your goals

Now that you have completed all of the previous steps, it is time to set your goals and decide where you want to go. Determining your goals is crucial, whether you are building a mobile app for a small audience or the masses. After you have decided what you are going to build and where you plan to go, you will find that the path is clear and easy to follow. If you want to get from A to B, you can only be successful if both points are known. You will only be able to decide which path to take if you know both ends.

Hire A Development Firm

A solid idea is good, but you need a team that includes technical experts, designers, and developers, as well as project managers, to create a complete investment app. You have two choices when you start the development process to create an investment app. Build a FinTech company from scratch requires gathering a team of individuals with complementary skill sets. Or you could outsource it entirely, leaving it all up to a company experienced in FinTech solutions to create an investment app or engaging an experienced FinTech development firm for its development process.

Finalize and Build the Design

You will only be able to supervise their work or oversee it if you hire a group. Can give occasional instructions if necessary. You must first start designing your online investment app before you can even begin the project. In the design phase, all of the features and steps that were finalized in steps 1, 2, and 3 will be incorporated. Designers and managers will review and work in this phase. They will mainly work on frontend design, which includes UI (user interface) and UX. The design phase is where the screens and other techniques of the investing application will be developed. .

Select Your Preferred Technologies

After your design is complete, it's time to select the technology for your mobile investing app. You have a variety of options. Let's go through each one.

Native App Development

- You have several options if you want to create an investment app for iOS or Android.

- Two technologies or languages are used for native Android app development. Java is a very old language. Kotlin, on the other hand, is a relatively new addition to the world of programming languages.

- Two technologies or languages will be used for native iOS app development. The languages used are Objective C and Swift. Like the other platforms as well, Objective C is older, while Swift is newer.

Hybrid App Development

- Hybrid fintech mobile app development will help you build an app that can be used on multiple platforms with a single codebase. Here are some options for mixed app development.

- Flutter is your first choice for developing hybrid mobile applications. It is a Google technology that allows you to design and develop beautiful apps. Dart is used to create apps.

- React Native is the second option to develop hybrid mobile apps. It is an open-source JavaScript framework actively maintained and supported by Facebook (now Meta). It's used to create beautiful and robust hybrid apps that work on multiple platforms.

Other hybrid app development technology exists, including Ionic, TypeScript, and others. However, these technologies have a smaller share of the global development market.

Start with the development of your investment app

You have chosen the best technology stack to meet your needs. Great. You can now start developing your app. The app will be better if you build a seamless frontend and backend. You can also use XML to design the app. After you have completed your front end, the back end, and all of the designs, APIs, etc., it is time to integrate them so that they work together. Integration is more complex than it seems. However, with a few adjustments to variables, route corrections, and speed issues, you can move forward smoothly.

Test your Investing App Thoroughly

You built the app you wanted? Perfect. Software is only flawless once it has been QA'd. You will need to test it on many standards in order to ensure that it does not fail when the user is using it. You must go through all the steps, from functional and non-functional tests to white box and Black box testing. Remember also to test your app for modern cybersecurity threats. You wish to avoid having your app data or your users' information falling into the wrong hands. You can hire independent penetration and security testers. Still, it is best to hire an app development company that offers these services to create an investment app. You can also use Usability Testing to ensure that you test each feature and function of the app. Beta-testing your app is another way to achieve this.

Launch your App for Audience

You can launch your app to the entire world. Choose between the Apple App Store and Google Play Store for both Android and iOS apps. You must follow certain rules in the development phase to launch or publish your application. Don't need to worry because app development professionals will take care of all your requirements. You should also rethink this idea if you believe that your work is finished once your app has been launched. Once you have an audience using your app, it is important always to be vigilant. It would be best if you were prepared because you don't know when an issue will arise. It would be best if you also considered getting support and maintenance for your application.

How to develop an investment mobile app?

APIs (Application Programming Interfaces) are investment tools that you can use to build specific functions. It saves time and effort during the development phase. You may need to combine several substitutes depending on the specification. We have, therefore, curated a list of third-party APIs.

Plaid for Bank Account Connection

Plaid provides APIs to developers in order to introduce the main feature, which is the linking of bank accounts with the client. Users can also link their bank accounts with their login credentials in seconds. Plaid allows consumers to start using their banking services the very same day. This API will help you to gain more engaged and loyal users for your apps, such as Acorns.

Pricing: Free for up to 100 items. Monthly tailored solutions cost $500+.

Paybook API Financial Data: Paybook, an API created by Fintech Engineers, transforms raw financial data from banks and other financial institutions into a simple format that's easy to understand and use. It helps investors build a seamless network by synchronizing their software with those of financial institutions, governments, and utility providers. To gain access to the credentials, you will need to create a Paybook profile.

We are pricing $50/month (for an internal plan). A robust plan costs $250 per month.

Xignite Market Data API Xignite provides APIs for data feeds by industry. These APIs will help you implement the business data feed features in your iOS or Android apps like Acorns. The stock data feed and investment portfolio includes a variety of financial instruments such as equities, stocks, funds, ETFs, or fixed-income instruments. They also have futures trading, trading options, forex data feeds, as well as commodities like metals.

Pricing - Pay As You Go Yahoo Finance API for Stock Yahoo Finance is an online media company that provides financial news, statistics, and information, such as stock quotes, press releases, and financial reports. This API can be accessed in different languages and with various tools and frameworks. C, C# Go, Java JavaScript, Objective C, Ocaml PHP, Python Ruby, and Ruby are among the supported programming languages. You can also access it using cURL or HTTP from the shell. RapidQL is also supported, a querying language similar to GraphQL. It also supports Node.js.

Pricing: Free for up to 500 API Calls. $0.002 for each additional API call.

Currencylayer API for Currency Converter Currencylayer provides users with global currency exchange rates and translations. This is a great tool for new startups that are interested in obtaining reliable, real-time information on currency trading and foreign investment agencies. Sign up for an entry key to their website.

Pricing is Free with a basic plan. For tailored solutions, $9.99 per month. How much will it cost in the future to develop investment apps? To get a full cost guide, read the section below.

Development Costs of Investment Applications

App development costs can vary widely depending on factors like the complexity of an app, its features, its platform, development team rates, and geographical location. Here are some estimates, as it is easier to give precise figures than knowing the specifics of your project.

Basic

- Portfolio tracking, market information, and basic trading functionality

- From $25,000 to $50,000

Medium

- Features like real-time alerts and social investing, as well as advanced analytics, integration of news, and real-time notifications.

- From $50,000 to $100,000

Advanced

- Advanced trading capabilities, sophisticated algorithms, and complex functionalities

- $100,001 to $300,000.

Investment App Development Checklist

We will conclude with a few tips that can help ensure your financial app is developed smoothly.

- Search for full-stack developers with domain knowledge to create an investment app.

- Do not cut costs on testing. A formula may work fine on paper or an Excel spreadsheet, but not in code.

- The more specific your requirements are, the easier the developers will understand what needs to be done. This will also speed up the time to market.

- Third-party APIs are useful for addressing technical issues to create an investment app.

- You are the expert in investing, not the coders. You could hold workshops periodically to review the business logic and function set. Pick the best communication channel for your team.

Takeaway

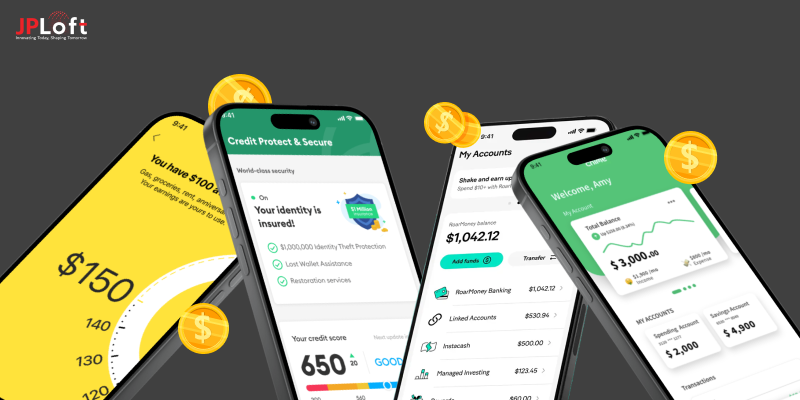

You can create an investment app to tap into a growing market. All you need is the right team to help you achieve your project's full potential. As more people sign up for these platforms to grow their money, investment apps become more popular. Low fees, simple trading and investment processes, and AI-powered advisors attract users. It may be a competitive market, but those who have innovative ideas are welcomed. You should quickly recoup your development costs if you create an investment app that is smart, secure, and meets the needs of users. JPLoft can bring your project to life. Our team of software developers can help you create an investment app that people will not only trust but also use. JPLoft is an expert in Android, iOS, and web app development.

FAQs

1. Why Create an Investment App for My Business?

An investment app for your business is vital because it gives your brand access to an increasingly tech-savvy market of investors, providing them with an efficient platform to manage investments, access financial info, and interact with your brand - ultimately increasing customer engagement and brand loyalty.

2. How can I determine my target audience for an investment app?

In order to identify your ideal user demographics and behavior patterns for potential users of your app, conduct thorough market research and glean from this information the factors such as age, income level, investment goals, and risk tolerance of prospective users; with this data at hand it should allow your app to meet those specific needs of its target market.

3. What features should my investment app include in order to be successful?

A successful investment app should offer features such as portfolio tracking, real-time market data, secure authentication, investment news alerts and push notifications, user-friendly interfaces, as well as educational materials and customer support to enhance user experience.

4. How can I ensure the security of my users' financial data in my investment app?

Security should always be top of mind in investment apps. Use encryption protocols, two-factor authentication, and secure data storage practices; regularly update your app with patches for vulnerabilities; comply with industry regulations like GDPR or HIPAA according to your target market; update periodically!

5. What technologies should I use to create an investment app?

Your choice of technology depends upon its complexity and goals to create an investment app. In general, fintech mobile app development tools such as React Native or Flutter may provide cross-platform compatibility. Backend technologies like Node.js, Ruby on Rails, or Django may enable server-side functionality. At the same time, cloud services such as Amazon Web Services (AWS) or Azure may handle data storage and scaling needs for server apps.

6. How can I attract users to download and use my investment app?

To attract users, utilize marketing techniques like social media promotion, influencer partnerships, content marketing, and app store optimization (ASO). Furthermore, developing an intuitive application with compelling features should help draw in potential investors.

7. What legal and regulatory considerations must I keep in mind when creating an investment app?

Compliance is of utmost importance for any target market; in the U.S., this would include SEC regulations. Consult legal professionals when necessary in navigating complex financial services, data privacy, consumer protection, or consumer relationship laws governing your target market. Transparency and clear terms and conditions are keys to building trust with users.

8. How Can I Monetize My Investment App?

Your app may monetize through various strategies, including subscription models, freemium features, in-app advertising or referral programs, and transaction fees - depending on its business model and user base. Conduct market research in order to select an effective monetization approach for your app.

Share this blog