EWallets (Electronic Wallets) have rapidly become essential tools in digital finance for modern consumers, offering secure transactions without hassle - revolutionising how people manage finances on the go. This introduction examines the costs and features of mobile wallet applications, shedding light on their vital role in digital economies.

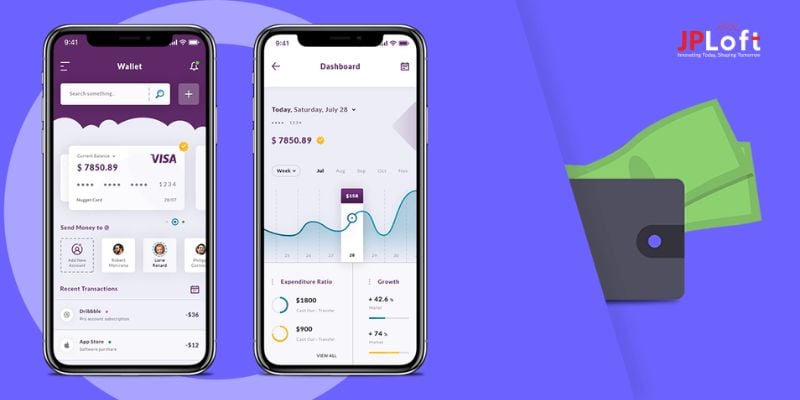

Features of an eWallet mobile application are varied and designed to maximise the user experience. From seamless fund transfers and contactless payments to transaction history tracking and budget management tools, these applications provide users with everything they need in one comprehensive suite of tools.

Secure features such as biometric authentication and encryption help protect sensitive financial information, enhancing user confidence.

The development of eWallet applications is an increasingly dynamic field, with several eWallets app development companies dedicated to their creation. At the forefront of innovation lies companies offering customised and user-friendly wallet apps as businesses increasingly transition towards digital transactions. These organisations provide innovative eWallet services that address evolving consumer needs.

Also read: eWallet App Development Cost: A Detailed Overview

Top Features of Google Pay that elevate it as the Best eWallet Mobile Application

Features of Google Pay that set it apart and remain popular with global users are presented here, outshone its competition and staying the first choice among many people around the globe.

Seamless Integration with Google Services:

Google Pay stands out by seamlessly integrating with various Google services, making accessing payment features within their ecosystem quick and effortless for users. This streamlined experience saves users both time and energy!

Google Pay's user-friendly interface is integral to its rising popularity, providing easy navigation even to users who need more technical experience. The seamless design and layout ensure a stress-free user experience and increase overall satisfaction levels among consumers.

Versatility of Payment Options:

Google Pay offers an expansive variety of payment methods - credit/debit/bank transfers/digital wallets are just some examples - for users to make payments using their preferred method, creating inclusivity while meeting diverse user preferences.

Security Measures:

Digital finance applications must take security seriously, and Google Pay excels. They feature robust encryption protocols to safeguard user information and transactions, biometric authentication, and PIN protection, which add extra assurance that users' financial data remains protected and safe.

Integration with Loyalty Programs:

Google Pay goes beyond basic transactions by seamlessly integrating with various loyalty programs, giving users access to rewards and cashback for every payment made - turning regular expenses into opportunities for savings! This feature increases engagement and loyalty among its users and is a preferred solution among those hoping to maximize benefits from their transactions.

Peer-to-Peer Transactions:

One of Google Pay's standout features is its peer-to-peer capabilities, making money transfers effortless for friends and family without needing physical currency or third-party platforms - perfect for sharing bills among yourself or paying back friends who've let you down! The speed and simplicity of Google Pay transactions make this solution ideal for bill splitting or reimbursement requests from others.

Bill Payment and Recharge Options:

Google Pay provides more than traditional transactions by allowing users to manage bills and refill prepaid services directly within its application, creating an all-in-one financial management solution and streamlining payment needs on one platform.

Real-Time Transaction Updates:

Google Pay provides real-time updates on financial transactions to keep users fully informed as the status of payments changes - offering peace of mind while helping users take control of their finances. This feature fosters confidence while assisting users in maintaining their finances.

Offline Payment Capabilities:

Google Pay stands out in an age when connectivity can often be inconsistent by offering offline payment capabilities for offline transactions; once connectivity returns, this data synchronization ensures uninterrupted service even under challenging network conditions. This offline functionality provides seamless services delivered without interruption in difficult network conditions.

Cross-Platform Accessibility:

Google Pay's cross-platform accessibility is one of its cornerstone features and has contributed significantly to its widespread popularity. Users on Android or iOS devices enjoy a similar user experience across devices - this broadened Google Pay's appeal, making it accessible and inviting across a broader spectrum of people.

In-App Purchase Support:

Google Pay's integration with various applications and online platforms enables seamless in-app purchase support, eliminating multiple payment methods as an efficient and seamless method for transacting within their favorite apps.

Advanced Analytics and Budgeting Tools:

Google Pay includes advanced financial management features that facilitate financial oversight. Users can track expenses, set budget limits, and gain insight into spending patterns - these features enable more informed financial decisions while encouraging responsible spending practices.

Steps to Build an E-Wallet App like Google Pay

Key steps to build e-wallet app like google pay are discussed here.

Market Research and Analysis:

Conducting thorough market research is paramount before initiating any development work on an e-wallet app.

By gathering insights about target users and competitor apps (like Google Pay) and gathering specific user needs and preferences data, this initial stage ensures your e-wallet app addresses market demands while standing out against competition in an increasingly saturated e-wallet marketplace.

Establish Key Features:

Google Pay's success can be attributed to its robust features streamlining transactions and enhancing user experiences. Identify what features will distinguish your e-wallet apps, such as peer-to-peer payments, bill payments, mobile recharges, QR code scanning, and integrations with various financial instruments like credit/debit cards or bank accounts.

Security Measures:

Security is at the core of every financial application, including an e-wallet. Implement advanced measures like encryption, biometric authentication, secure sockets layer (SSL) protocols, and multi-factor authentication to safeguard user data and transactions - building user trust by prioritizing data privacy while meeting industry standards.

Select a Development Platform:

Select an ideal development platform depending on your target audience and business goals, considering both native app development (iOS or Android) and cross-platform solutions with their respective advantages and disadvantages before making your choice.

Each approach has advantages and disadvantages, so evaluate technical requirements, development costs, and time-to-market considerations before making any decisions.

Technology Stack:

Selecting an optimal technology stack for your e-wallet app development is crucial to its performance, scalability, and long-term health. Consider which programming languages, frameworks, and libraries align with your development goals best, these could include React Native/Flutter apps and native Android/iOS languages like Java/Swift, respectively.

Designing User Experience and Interfaces (UI/UX):

User-friendliness in the form of a UI/UX is crucial to the success of any app. Spend time and money on creating an intuitive interface for seamless navigation and a positive user experience. When designing experiences, give priority to simplicity, consistency, and accessibility.

Integration with Payment Gateways:

Integrate your e-wallet app with secure, trusted payment gateways to facilitate efficient transactions. Work closely with financial institutions and payment service providers to ensure compatibility with various payment methods like credit/debit cards, net banking, and digital wallets.

QR Code Integration:

QR codes have become an indispensable feature of e-wallet apps, streamlining user payment processes. Implement a reliable QR code scanning feature to facilitate transactions between merchants and users while at the same time offering swift and accurate scanning processes that deliver maximum user convenience.

Real-Time Notifications:

Keep users up-to-date with transactions and account activities by offering real-time push notifications, such as successful transactions, account balance updates, and critical alerts. This feature increases user engagement while contributing positively to overall user experiences.

Compliance and Legal Considerations:

Navigating through the complex legal landscape by ensuring your e-wallet app complies with local and international regulations is crucial in successfully operating in an ever-evolving regulatory landscape—Prioritize data protection, financial rules, and anti-money laundering (AML) issues.

Consult legal experts as you negotiate this complex regulatory environment to identify any possible pitfalls ahead.

Testing and Quality Assurance:

Thorough testing is essential to identify bugs, glitches, or security vulnerabilities within an e-wallet app and address them quickly and efficiently. Conduct rigorous tests of each feature separately and audit the security of various devices, OSs to ensure compatibility is upheld for users and the application remains stable over time. Create a robust quality assurance process to provide users with a powerful app.

Launch and Marketing:

Plan an efficient launch strategy for your e-wallet app by considering timing, target audience demographics, and marketing channels. Leverage digital systems such as SEO/PPC advertising to build awareness quickly while using social media channels as part of a partnership campaign to target new users; consider offering promotional incentives early adopters may take up on early use.

User Feedback and Iteration:

After an initial launch, actively solicit user feedback to comprehend user experiences and fully identify areas for improvement. Regular app updates should address user concerns, fix bugs, and introduce features based on emerging market trends or user needs - keeping up-to-date and competitive are hallmarks of success for an e-wallet app.

eWallet App Development Trends Shaping the Digital Landscape

Trends changing the digital landscape and disrupting the financial ecosystem include key eWallet app development trends shaping its digital environment and economic ecosystem.

User-Centric Design and Seamless User Experience:

In the competitive arena of eWallet app development, user experience should be considered. Users require an intuitive, efficient, visually attractive interface that simplifies financial transactions.

Developers have increasingly prioritized creating user-centric designs in eWallet app development servicesto create seamless user experiences and facilitate transactions without friction or obstructions. From onboarding processes to personalized dashboards, user experience design forms the backbone of successful eWallet development services.

Enhancing Security Features:

Security has long been at the core of digital finance platforms like eWallets; with cyber threats increasing daily, customers require robust protection measures to safeguard their financial data.

Biometric authentication, multi-factor authentication, and end-to-end encryption have quickly become standard features of eWallet mobile applications. Developers are exploring blockchain technology as an additional layer of protection and transparency during transactions - giving users a more profound sense of trust within the ecosystem an eWallet wallet app provides.

Integration of AI and Machine Learning:

Machine learning and artificial intelligence have added intelligence to financial transactions by using eWallet apps. AI algorithms analyse user behaviour, including spending habits and preferences. They then deliver customised recommendations and offers.

They help eWallets to recognize and stop security threats instantly. Innovating eWallets provides tailored solutions to meet the specific needs of users, increasing user satisfaction and engagement.

Contactless Payments and Near Field Communication Technology:

COVID-19 has catalyzed an increase in contactless payments globally, with electronic wallets playing a central role. Near Field Communication (NFC) technology offers secure yet rapid transactions without using physical cards or cash as currency.

EWallet app development services have increasingly adopted NFC features into their apps to allow for contactless payments by tapping their smartphones on an electronic terminal, offering instantaneous convenience in today's fast-paced society. This trend coincides with consumers' desire for instant, contactless transactions - the ideal experience.

Cross-Border Transactions and Globalization:

With globalisation increasing at an impressive rate, electronic wallets are evolving to facilitate seamless cross-border transactions for users across geographical borders. Users expect their eWallets to support international payments and transfers beyond geographical barriers - they expect users to trust eWallets that support international payments to have this feature built right in.

EWallet app development trends have recently seen an increased emphasis on multi-currency support, giving users access to transact in the currency of their choice without complex currency conversion processes. Not only can globalizing an eWallet serve users more readily, but it can also open new doors for global enterprises operating internationally.

Blockchain and Cryptocurrency Integration:

Integrating blockchain technology and cryptocurrency wallets is an increasingly promising trend, providing a decentralized ledger for transactions to ensure transparency while decreasing risks related to fraud.

Some e-wallets have begun integrating popular cryptocurrencies, enabling users to seamlessly store, manage, and transact digital assets. As crypto regulations continue to emerge, app development services must navigate this space carefully, balancing innovation with compliance.

Open Banking and API Integration:

The Open Banking initiative revolutionises financial services by promoting collaboration between financial institutions, third-party developers, eWallets providers, and banks via Application Programming Interfaces.

EWallet providers have taken full advantage of this trend to integrate themselves with banks and financial service providers using APIs for accessible communication.

Apps that offer eWallet services allow users to access various services such as budgeting, account aggregation, and investment. Open banking's collaborative approach fosters innovation while providing access to an all-inclusive financial ecosystem in their eWallet.

Social and Peer-to-Peer Features:

EWallets have evolved beyond their original purpose of financial transactions by adding social and peer-to-peer features that enable users to split bills among friends, send money across borders, or make social payments from within an app. Social integration fosters user engagement and reflects how digital finance transactions have become increasingly collaborative over time.

Challenges of developing an eWallet Apps

Below are some challenges of developing an e-Wallet apps:

Security Considerations:

Security should always be of prime consideration when developing an eWallet app, given its nature of housing sensitive financial data that attracts cybercriminals. Therefore, developers must employ robust protection measures such as encryption protocols, secure authentication methods, and regularly scheduled audits to protect these apps against potential attacks from criminals.

Maintaining constant vigilance against evolving cybersecurity threats presents another daunting security challenge in projects' development and maintenance phases.

Compliance and Regulation:

Financial services have strict regulatory frameworks, with eWallet apps no exception. Developers must navigate a complicated network of regulations to make their apps compliant with regional and global standards.

Compliance standards are met by understanding and following anti-money laundering regulations, Know Your Customer rules (KYC),and data protection laws. Please comply to avoid legal risk and user distrust.

Interoperability and Integration:

In today's digital financial ecosystem, users typically leverage multiple services and applications. Therefore, ensuring interoperability among various banking systems, payment gateways, and financial institutions poses an immense challenge.

Developers should design eWallet apps that integrate smoothly across various platforms and allow users to link their wallets with accounts and services without encountering compatibility issues.

User Experience and Adoption:

Achieving wide adoption for an eWallet app relies heavily on creating an intuitive and engaging user experience, so developers must strike a delicate balance between functionality and usability, making their app accessible to people of varying technical expertise.

Promoting adoption requires informing users about the many advantages of electronic wallets while dispelling any concerns over security or privacy they might harbor. Educating and answering queries related to digital currency wallets are an ongoing priority in driving adoption forward.

Technology Stack and Scalability:

A deliberate selection of technologies must ensure successful eWallet app development. Developers should select technologies that meet an app's requirements and enable scalability when user numbers increase.

Ensuring an app can accommodate higher transaction volumes without impacting performance and speed is a constant challenge. Scalability issues can cause downtimes and delayed response times, eventually driving away users altogether.

Fraud Prevention:

Financial services and eWallet applications face several challenges in combating fraud. App developers must use advanced algorithms and AI systems to prevent fraud.

Staying ahead of emerging fraud techniques and updating security measures continuously remains an ever-present challenge in financial technology.

Connectivity and Accessibility:

Access to reliable internet is often intermittent across regions, necessitating developers to design eWallet apps that function perfectly even under limited bandwidth conditions.

Offline capabilities, robust error handling, and optimized data usage ensure that users can access and utilize an application even under less-than-ideal network conditions.

How much does eWallet App Development Cost?

Cost estimates to build an eWallet app on iOS and Android platforms may differ significantly based on various considerations such as features, complexity, and location of development teams.

Essential eWallet apps with basic functionalities typically cost between $20,000 to $50,000; more complex ones with advanced features can go anywhere from $50,000 up to over $100,000 in fees.

Principal elements affecting eWallet app development costs are security features, payment integration, user authentication, and design complexity.

Security in financial apps is of utmost importance, necessitating robust encryption and authentication measures and additional development expenses to accommodate multiple payment gateways, currencies, and seamless transactions - each impacting costs.

Deliberation over native or cross-platform development decisions impacts expenses significantly, with native apps built separately for iOS and Android typically costing more than cross-platform solutions. Furthermore, your development team's location is essential; rates differ dramatically across regions worldwide.

Conclusion

Studying the costs and features of an e-wallet mobile application reveals an ever-evolving landscape in line with an increasingly digital economy. Elements of an eWallet application play a central role in improving user experience, security, and overall functionality - these applications support this dynamic shift as they meet market needs.

From seamless transactions and integration with various payment methods to advanced security measures such as biometric authentication, these features contribute significantly to eWallets' widespread acceptance and success.

Mobile app development companies play an essential role in helping balance development costs with cutting-edge features that customers require for an eWallet application.

Investing in skilled developers, advanced technologies, and security protocols reflects our dedication to crafting an accessible eWallet platform for our users.

As digital payment solutions are popular, mobile app development companies must remain flexible and innovative to stay competitive.

Development, maintenance, and security costs must align with an eWallet application's value proposition to provide users with a safe and efficient platform while companies realize a return on their investments.

FAQs

1. What are the main features of an eWallet mobile application?

Electronic Wallet (eWallet) mobile applications typically provide secure digital transactions, fund transfers, and real-time balance updates with user-friendly navigational tools to facilitate seamless usage.

2. How are eWallet mobile applications protecting users and transactions?

EWallet applications utilize features like multi-factor authentication, encryption protocols, and biometric verification to offer users a safe environment to transact business.

3. Can I link multiple bank accounts to an eWallet mobile application?

Absolutely; most eWallet applications enable users to link multiple bank accounts in the app for easy fund transfers and flexible financial management.

4. What role do QR code payments play in mobile wallet applications?

QR code payments have become a standard feature of eWallet applications, enabling quick and contactless payments between parties involved in an exchange. Users scan a QR code to initiate payment or withdraw funds.

5. Are loyalty programs integrated into eWallet mobile applications?

Yes, many eWallet mobile applications feature loyalty programs integrated within them to enhance user engagement and encourage app use. Users may earn rewards like cash back or points when conducting transactions using these wallets - further increasing user engagement while incentivizing app use.

6. Why are push notifications important in an eWallet mobile application?

Push notifications keep users up-to-date about account activity, transaction updates, and promotional offers that might benefit them - helping enhance engagement while keeping them fully aware of financial transactions within their accounts. This feature ensures that their financial lives remain as transparent and efficient as possible.

7. Can mobile wallet applications be used for bill payments?

Yes, eWallet apps typically allow users to manage various bills, from utilities and mobile recharge to credit card bills, all within a single platform for ease and convenience.

8. Are budgeting tools included with mobile wallet applications?

Many eWallets now provide budgeting tools that assist users in effectively managing their finances, such as expense tracking and budget setting tools that enable users to make sound financial decisions. These features may also provide insights, allowing users to make better financial decisions.

9. How are eWallet mobile applications optimized to provide compatibility across various devices?

EWallet applications are built to work across devices, from phones and tablets to wearable devices like Fitbit. Cross-platform compatibility ensures users can seamlessly access their eWallet accounts regardless of their device.