Over 80% of the global population owns smartphones, meaning most are likely using one or more mobile apps for cashless payment and shopping platforms for the first time to comply with socially distancing norms in 2020. This staggering statistic may seem staggering until you consider that social and economic lockdowns caused billions to adopt cashless payment as cash was no longer accepted as payment in any form - forcing many others to adopt cashless payment and shopping platforms for the first time to maintain social distancing norms and remain economically independent. Digital wallets are a safe and efficient way to manage financial transactions as technology progresses and society moves toward a cashless system. Digital wallets allow individuals to make payments quickly and efficiently while enjoying rewards and discounts. This document will explore the challenges of developing eWallet applications and offer strategies to overcome them. This report will provide valuable insight for individuals and businesses interested in adopting digital wallet solutions and help them navigate the complexity of developing and implementing these wallets.

Market Insights of eWallet Apps

Digital wallet applications have proven themselves successful for both consumers and companies alike. Digital transactions have become more prevalent than ever in today's marketplace regardless of business type, with digital eWallet apps predicted to gain in popularity as they offer an easy and efficient means to process payments. Hire eWallet app development services to develop your customized eWallet app efficiently and cost-effectively. According to global market insights, the global mobile wallet market will surpass $100 billion by 2020 and is predicted to experience compound annual compound annual growth rates exceeding 20% between 2021-2027. Furthermore, global mobile transaction volume exceeded 100 billion, with transaction costs estimated at nearly USD 6 trillion for this year alone. Trends surrounding EWallets are revolutionizing the fintech marketplace. By 2023, its global EWallet market should reach USD 2.1 trillion with an expected compound annual growth rate of 15%. Research indicated that by 2025, 4.4 billion will use digital payments - representing over half of humanity! Each year, the number of digital wallet users grows exponentially, with some (32%) having more than one mobile wallet app installed on their phones.

Importance of Building an EWallet Mobile App

Here are a few essential points that will help you better comprehend how developing an eWallet mobile se could benefit you:

Easy Accessibility

Businesses that adopt mobile wallet applications provide their customers with easier accessibility. Transactions become easy and seamless - even those without technical know-how can easily make payments with these convenient mobile apps, elevating both user experience and relationship to the brand.

eWallet Applications Make Transferring Money Easy

Online wallet applications allow users to easily add funds through multiple methods - net banking, credit/debit card, etc. - making adding funds simple. Furthermore, this app also securely saves your banking details so that future transactions won't require entering them repeatedly. At its heart lies its strength: configuring bank details within the eWallet application is also invaluable; no longer must you worry about funds running low in your wallet; all payments made using the bank are made automatically through this convenient means.

EWallet Mobile Apps Are Multi-Purpose

For every transaction imaginable, from postpaid, data card & internet subscription services to buying travel tickets & hotel accommodations, no matter what industry you are in, these eWallet apps help users in different aspects of transactions for a more effortless user experience, which ultimately builds stronger relationships.

Timely Payment and Quick Transfer

EWallet mobile app development enables the feature of autopay to enable future bills to be automatically paid from within your eWallet app. In addition, these wallets make sending and receiving money easy as no additional transaction charges are charged upon its transfer. EWallet mobile apps also boast numerous money-saving features like discounts, cashback, offers, cash points, and gifts that help users save.

Types of EWallets

EWallets fall into three categories - closed, semi-closed, and open eWallets - each providing basic features like encryption, secure transactions, and transaction history for its wallet users.

Closed Mobile Wallets

A closed mobile wallet is a digital payment system designed exclusively for a specific brand or merchant, also called a "closed-loop." As its name implies, closed-loop wallets can only be used by its associated business when purchasing items from them; examples include Starbucks Mobile Pay and Amazon Pay as examples of such wallets. Closed-loop mobile wallets offer businesses two distinct advantages. First, their design can be tailored specifically to your company. Furthermore, closed wallets are more secure than other payment systems because they're not connected directly with customer bank accounts or credit cards but instead funded directly from customer deposits into them in advance. However, these wallets can only be used at select merchant locations - which makes using one payment method for all their purchases cumbersome and inconvenient for customers who desire a single method to streamline payments.

Semi-Closed Mobile Wallets

Semi-closed mobile wallets provide multiple merchants with payment access while not fully opening themselves up as credit or debit cards do. Semi-closed mobile wallets offer more versatility than their closed counterparts due to being accessible anywhere; however, being connected to multiple financial services networks may not provide as much security.

Open Digital Wallets

An open digital wallet is a digital payment system that enables consumers to purchase goods at any merchant that accepts its associated payment method without being explicitly tied to one store or platform. They don't restrict purchases only within certain stores and platforms but can be used anywhere where it accepts such payment methods. Open wallets offer one of the most flexible solutions for making purchases and payments and additional features like tracking expenses or earning reward points. Unfortunately, however, they remain one of the more insecure digital wallets.

Challenges Faced During the Development of an eWallet App

Building a practical and secure eWallet application presents many obstacles; creating fintech apps is no small undertaking. Here are some key challenges of developing eWallet apps:

Compliance for Fintech Businesses

Where money is involved, there will also be stringent regulatory compliances; fintech businesses are subject to both consumer-based and financial regulations. Moreover, they depend upon which eWallet technology they utilize for payment processing.

Utilization of appropriate technologies for perfect delivery

Constructing an eWallet app that is secure and reliable requires experienced developers. Working with an organization that understands technology provides more scalable solutions. Therefore, selecting one with relevant experience helps develop apps that run seamlessly.

Fraud Risk

Fraud risks are one of the primary reasons customers may avoid EWallets in 2022. Mobile payments and digital wallets present unknown risks like hacking, data leakage/theft/leak, vulnerabilities, and malware as major eWallet concerns. This issue adds another wrinkle to this growing eWallet controversy. A practical solution to this dilemma lies in choosing an eWallet development company that offers GDPR-compliant eWallets. Also, improving KYC processes with blockchain will prove more helpful in combating fraudulent activities.

Integration with existing systems

Digital wallet apps often need to integrate with existing payment systems like credit card networks and banks; this process may involve working with multiple partners to ensure seamless integration. Mindset of Customers Customer Mindset Many customers still believe there is no added value in using an eWallet; most still prefer cash or credit cards for online payment and purchasing expensive items, so most remain unaware of mobile wallets' advantages over using cash and cards for this transaction. Pinging customers about any offers associated with payments for specific merchants might help build customer awareness, thus becoming one of eWallets’ significant challenges.

Consumers don't trust mobile wallets.

Customers say using mobile wallets to pay is promising but unrealistic; users perceive they give up some control when using these payment services, with 43% trusting mobile wallets less and 38% fearing losing their phone would render any payments unavailable. Research conducted by YouGov indicates this disparate response; 38% fear losing control due to lost payments (compared with just 19% who trust mobile wallets completely). Experian conducted research concluding that 55% of consumers feel safer using credit cards. In contrast, Auriemma conducted a poll indicating those using mobile wallet integration do not promote it to friends and family members.

No Rewards

Since mobile wallets do not offer rewards like cards or cash-back programs, consumers using credits and cash may receive discounts, rewards, or coupons in their accounts instead. Financial marketers looking to promote the usage of mobile wallets should take this as an opportunity to acquire more consumers for mobile wallets.

Steps to build an eWallet app

Conceivably, developing a digital wallet from scratch is an intricate and time-consuming task with numerous factors and considerations that need to be considered before beginning this project. That is why having an organized plan with clear objectives will be essential - here are the steps necessary for building mobile wallet apps:

Step 1: Discovery Phase

Begin your project by clearly outlining its goals and purpose for your app, whether its focus lies with payments, loyalty rewards, or something else entirely. Conduct market research to understand target audience needs and preferences before conducting competitor analysis to identify unique functionality to set your app apart.

Step 2: Select Your Platform and Tech Stack

When we refer to selecting a platform for an eWallet, this refers to either building a native mobile application for only iOS or Android or cross-platform solutions that cover multiple mobile OSes; native mobile applications typically boast more extraordinary feature richness but often cost more due to increased resource requirements; additionally, if covering another platform is decided upon then basically new apps must be written from scratch for each. Consult eWallet app development service providers to minimize the eWallet app development cost. Cross-platform apps utilize one codebase that works across various platforms like Android, iOS, and the web. While cross-platform applications are cheaper and require no extra programming for each platform they support, some device features may not be accessible through them - your approach depends entirely upon your business requirements and technical constraints.

Also Read: Fintech Application Development Costs in 2023

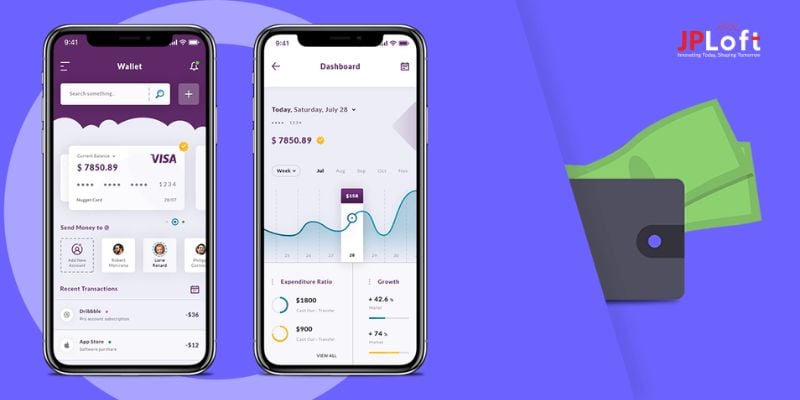

Step 3: Design a Prototype and UX/UI Design

The prototype represents the initial visual implementation of your product, typically consisting of wireframe screens depicting its main flow and core design errors that should be fixed early so costs won't escalate quickly. When stakeholders approve your prototype, your team can begin designing user experience and user interface elements with intuitive designs featuring clear navigation pathways and an engaging aesthetic style. This approach ensures the long-term success of digital wallet designs!

Step 4: Draft an MVP

You don't need all your features from the beginning; we suggest creating an MVP (Minimum Viable Product). Begin with core functionality, like adding payment methods and transactions, before sharing it with target audiences and receiving their feedback.

Step 5: Test Your App

To ensure the stability and reliability of your digital wallet app, automated and manual tests can be conducted both manually and automatically to test it across a range of platforms and operating systems. Testing should include various devices and operating systems in the testing process depending on where your digital wallet app will be released.

Step 6: Launch and Support

Once your app is live, start marketing it to its target audience through social media campaigns, email marketing, or partnerships with relevant businesses or organizations. As users provide honest feedback through their use, continue updating and improving it so it remains valuable and relevant for them.

Conclusion

Digital wallets are undoubtedly the future, with internet user numbers rapidly expanding yearly. EWallet app development will soon replace credit/debit cards and virtual currencies as the primary form of payment; mobile device transactions make eWallet transactions one of today's trendiest industries thanks to mobile connectivity, so before embarking upon their development, it would be prudent to assess critical challenges and trends surrounding its launch carefully; the first step should involve hiring an expert eWallet development company who understands both processes as well as rules about developing apps, e.g., mobile payments. Are You Planning on Launching an EWallet App? Understanding the difficulties in building eWallet Apps and Trends associated with its development can provide crucial guidance when embarking upon this endeavor. Assemble an experienced app development company well-versed with all laws and regulations before proceeding.

FAQs

How Can I Launch an eWallet Business?

To start an eWallet Business, first design an application with advanced features and security; for this task, you may contact an eWallet App Development Company. When your app goes live, promote it aggressively to attract users; investors may provide funding if your idea has strong user support and your concept appeals strongly enough.

Are EWallets Secure?

Digital wallets provide an efficient means of transacting online. Most digital wallets employ stringent security measures such as point-to-point encryption (P2PE),password protection, and tokenization when protecting payment details.

How much time does it take to develop an electronic wallet app?

Development times vary significantly based on app complexity, features and platforms used, and development company location. Basic applications take 3 -6 months, while more complicated versions might need 6-12 months before completion.