Here we have give best fintech app ideas for startups if you want to lunch an an for your fintech startup then it will help you. FinTech is a broad category. Technology has helped the finance sector in more than one way. From loans to investments, wealth management, and asset value calculation, one can not think of doing anything without the guidance of a FinTech app. Banking institutions and finance corporations are adopting new technologies without hesitation and revolutionizing the finance sector. Most institutions and corporations are investing and experimenting to attract the attention of more consumers. People are becoming more aware of the unprecedented changes around them and becoming financially literate. The FinTech apps and government support have brought such changes in such a short time.

- Fintech App Market Analysis

- Best FinTech App Ideas in 2023

- Blockchain-Based Payment Gateway

- Crypto Exchange Finance app

- Robo Financial Advising app

- Investment & Trading app

- Money lending App

- Crowdfunding Solution App

- Peer-to-Peer Money Transfer App

- Personal Finance App

- InsurTech Solutions

- Digital Banking App

- Bill Reminder Mobile App

- E-Mortgage App

- Digital Wallets

- Development Process of a Beneficial FinTech app

- Development cost of developing a FinTech app

- Best Technology Integration in FinTech App Development

- FinTech App FAQs

- Conclusion

Fintech App Market Analysis

Mobile application usage has increased over the past years. Affordable mobile data packages, an increase in usage of smartphones, especially in developing countries such as China, India, Brazil, South Africa etc, and on-demand services have prompted the financial sector to cater to public demand. The global mobile application market is estimated to reach $206.73 billion by 2022. It is estimated to grow to $565.40 billion by 2030, at a CAGR of 13.4% from 2022 to 2030, considering India is the largest smartphone user marketplace. All the financial services with technology integration have resulted in a great amount of secure mobile app developments for its consumers. People are likely to opt for mobile or web applications to fulfil their financial needs rather than using the traditional banking system, which includes wasting time in long queues and going through complicated processes of clearance and validation, which sometimes take days to finish. Times have changed, and many banking sectors have invested in FinTech. India has emerged as the biggest FinTech market, with 7,441 FinTech startups with 33 soonicorns. Study says that the market witnessed $50 billion in revenue generation in 2021 & it is expected to reach about $150 billion by the end of 2025 at a CAGR of 24.57% and raise $200 billion in revenue in the Indian FinTech market by 2030. As of July 2022, 22 Indian FinTech companies have gained ‘Unicorn Status’ with a valuation of over $1 billion & India’s Unified Payments Interface (UPI) system has seen the participation of 338 banks and has recorded 5.9 billion monthly transactions worth over $130 billion.

Mobile application usage has increased over the past years. Affordable mobile data packages, an increase in usage of smartphones, especially in developing countries such as China, India, Brazil, South Africa etc, and on-demand services have prompted the financial sector to cater to public demand. The global mobile application market is estimated to reach $206.73 billion by 2022. It is estimated to grow to $565.40 billion by 2030, at a CAGR of 13.4% from 2022 to 2030, considering India is the largest smartphone user marketplace. All the financial services with technology integration have resulted in a great amount of secure mobile app developments for its consumers. People are likely to opt for mobile or web applications to fulfil their financial needs rather than using the traditional banking system, which includes wasting time in long queues and going through complicated processes of clearance and validation, which sometimes take days to finish. Times have changed, and many banking sectors have invested in FinTech. India has emerged as the biggest FinTech market, with 7,441 FinTech startups with 33 soonicorns. Study says that the market witnessed $50 billion in revenue generation in 2021 & it is expected to reach about $150 billion by the end of 2025 at a CAGR of 24.57% and raise $200 billion in revenue in the Indian FinTech market by 2030. As of July 2022, 22 Indian FinTech companies have gained ‘Unicorn Status’ with a valuation of over $1 billion & India’s Unified Payments Interface (UPI) system has seen the participation of 338 banks and has recorded 5.9 billion monthly transactions worth over $130 billion.

Best FinTech App Ideas in 2023

Growing online payment users, on-demand mobile applications, advanced technology integration globally, financial literacy, and various government schemes are why the financial sector has changed people’s lifestyles tremendously in financial services. We will discuss some of the top FinTech startup ideas and a few successful businesses that have brought enormous changes to the Financial sector.

1. Blockchain-Based Payment Gateway

Blockchain is a highly secure distributed ledger technology (DLT) that provides encrypted data transactions and stores them in a record called ‘blocks.’ A FinTech app idea based on the technology provides a secure and smooth data transfer, verification, and execution flow. Unlike the traditional banking system, the transfer of money doesn’t need the involvement of financial institutions, third-party interference, and additional fees. It will automatically handle the complete process between two parties, and in case of any fraud, it can halt the process in an instant keeping your finances secure. It simplifies and speeds up the process of international payments, including all B2B & B2C, large investments, and money borderless with transparency & minimal operating cost. The payments segment dominated the market in 2021 and shared about 44.0% of the total global revenue. The global blockchain technology market was worth $5.92 billion in 2021 and is estimated to reach a CAGR of 85.9% from 2022 to 2030. Some of the most famous companies working on such types of payments systems are-

- Crypto.com Pay

- Metamask

- Veem

- Circle

2. Crypto Exchange Finance app

In the recent development of technology, the crypto exchange startup idea has emerged as the most beneficial app idea based on blockchain technology. It is used in various sectors like entertainment, art, gaming, health, etc. People from this field like exchanging one cryptocurrency for another or trading one cryptocurrency in exchange for fiat money. Fast processing, low cost, secure transactions, encrypted data transfer, and high security attract more users to this trend. The global cryptocurrency payment apps market was worth $545.4 million in 2021 and is expected to grow at a CAGR of 16.6% from 2022 to 2030. Some of the most used FinTech apps in this field are-

- Coinbase

- Paypal

- Coingate

- Blockonomics

3. Robo Financial Advising app

Robo financial advisers are a digital platform that offers help in financial planning, portfolio building, and wealth management techniques using modern portfolio theory with less human intervention. From setting up an account at a low cost to robust goal planning, account management & monitoring, instant customer services, extensive education research, and security measurement, Robo-advisers handle all for you. The low-cost and easy user interface helps small retailers or traditional investors manage their investments, such as retirement planning. However, such apps can not handle large & complex financial management systems or estate planning.  Assets under management in the Robo advisors segment are projected to reach $1.66 trillion in 2022 & estimated to grow to $3.22 trillion by 2027 at a CAGR of 14.19% in 2022-2027. Some of the most useful Robo advisers in the market are-

Assets under management in the Robo advisors segment are projected to reach $1.66 trillion in 2022 & estimated to grow to $3.22 trillion by 2027 at a CAGR of 14.19% in 2022-2027. Some of the most useful Robo advisers in the market are-

- Wealthfront

- M1Finance

- Betterment

- The Vanguard Group

4. Investment & Trading app

Investment apps let you pick the right stocks, assets, shares, and forex with the right knowledge and give you a clear idea of the value of your assets. It also helps in budget planning to help you achieve the goal and make the right decision. Investments & Trading FinTech app offers negligible commission, lists of public & private companies in the stock market, trading options and advice, company valuation, secure payment gateway, etc. Some of the best investment & trading apps are-

- Zerodha Kite

- Upstox PRO Trading App

- Angel Speed Pro

- Groww

5. Money lending pp

The money lending app is a great alternative to fall upon in times of need. When you are short of money or in times of financial crisis, the app connects you with various money lenders who lend you money at low or zero interest costs. The app is developed to help people with quick and flexible loan techniques to fulfil their financial needs, such as quick fix their home, paying credit card bills, buying concert tickets, buying a car, or any short-term personal goal. Some of the best money lending apps are-

- Dhani

- LazyPay

- ZestMoney

- PaySense

6. Crowdfunding Solution App

Crowdfunding is a great way to generate money for SME businesses, personal needs, non-profit causes, and small enterprises. The app connects various investors to people with unique business ideas and gives them a chance to grow in the market. Your family, friends, neighbours, or even strangers lend you money to fund your startup or small business through the app.  Crowdfunding is worth $1.02 billion in 2022 & is expected to grow to $1.15 billion by 2027 at a CAGR of 2.33%. The highest transaction value in the crowdfunding segment is reached in the USA, with US$526.40 million in 2022. Some of the best crowdfunding solution apps are-

Crowdfunding is worth $1.02 billion in 2022 & is expected to grow to $1.15 billion by 2027 at a CAGR of 2.33%. The highest transaction value in the crowdfunding segment is reached in the USA, with US$526.40 million in 2022. Some of the best crowdfunding solution apps are-

- Indiegogo

- SeedInvest Technology

- StartEngine

- GoFundMe

7. Peer-to-peer money transfer app

A peer-to-peer money transfer app is an instant cash transfer app via a linked bank account, app account, or credit card to another bank account, phone number, or app account. Users register on the app using an email ID or phone number. Then they need to link a bank account or credit card to transfer money. You can also put money in the app account. Some banks allow users to transfer money to people with accounts in the same bank with no transfer fees. Some apps allow users to transfer money instantly from app account to bank account with nominal fees. Some of the best P2P money transfer apps are-

- Venmo

- Zelle

- Cash App

- Google Pay

8. Personal Finance app

A Personal Finance app is essential to budget your finances. The app not only keeps a keen eye on your spendings but also gives you financial advices, offers multiple money-saving options, tax advices, and stops you from splurging money on unnecessary things. After all, a good budgeting is necessary to live a quality life. Some of the most useful personal finance apps are-

- Acorns

- Mint

- Every Dollar

- Personal Capital

9. InsurTech solutions

Insurance has always been a co-running business of banks & financial institutes. With digital banking becoming an integral part of the banking experience, insurance schemes have taken a step ahead in providing the best digital experience to people. Latest technologies like Blockchain, IoT, Machine learning, and AI have helped companies and banks to provide the best FinTech services and reach out to more customers with promises of better family planning, retirement planning, and more. The latest solutions in the Insurance industry are transformative and revolutionising the user experience.  The value of life insurance premiums in India is over INR 6.28 trillion as of FY2021. It is forecasted that the Global Insurance market will reach $6.4 trillion by 2025 at a CAGR of 6%. Some of the leading InsurTech companies are-

The value of life insurance premiums in India is over INR 6.28 trillion as of FY2021. It is forecasted that the Global Insurance market will reach $6.4 trillion by 2025 at a CAGR of 6%. Some of the leading InsurTech companies are-

- AIA

- Marsh McLennan

- New India Assurance

- United Health

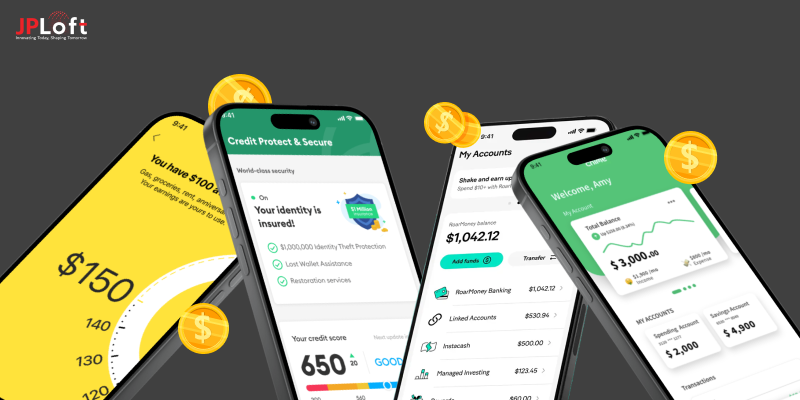

10. Digital Banking mobile app

A digital banking app is the digital version of the physical bank that provides every financial service through an app without any hussle. The app takes care of updating passbooks, international & domestic online money transfer and receiving, debit & credit card management, bill payments, loan instalments, insurance plans, investment options, and more. The new emerging app has completely changed how we manage our finances and update the balance. Almost every bank has its mobile app. The app lets users know about new offers and bank schemes. Some of the most famous digital banking mobile apps are-

- HDFC Bank Mobile Banking

- IDFC First Bank

- YONO Lite SBI

- Axis Mobile

11. Bill reminder mobile app

One of the best advantages of new technologies is that it has eased worry to some extent. Bill reminder mobile app is one of the FinTech apps that has helped manage their budget & keep track of expenses. Managing different bills, keeping them safe, and planning a budget considering previous expenses was a thing of the past. The app easily manages everything and reminds you about various payments in time. With just one click, you can save your bills in one place and stop worrying about losing them. Some of the best bill reminder mobile apps are-

- Mobills

- Bills Reminder, Budget Planner

- Prism

- TimelyBills

12. E-Mortgage App

After the outbreak of COVID-19, people are taking extra precautions in every area of their life, i.e., going for contactless dealings and digital interactions. An E-mortgage works similarly to a physical mortgage, where the lender lends money to the borrower for a specific period and specific reasons. Like in the physical mortgage process, e-documents or promissory notes are created with mutual consent and signed electronically for e-closing.  The USA leads with the biggest loan mortgage value of $18 trillion, following Germany with $1.69 trillion, Japan with $1.31 trillion, and France with a $1.21 trillion market. Some of the leading e-mortgage companies are-

The USA leads with the biggest loan mortgage value of $18 trillion, following Germany with $1.69 trillion, Japan with $1.31 trillion, and France with a $1.21 trillion market. Some of the leading e-mortgage companies are-

- Lloyds Banking Group

- Ally Bank

- New American Funding

- NASB

13. Digital Wallets

Digital wallets have always been a part of our life. However, after the Pandemic, the market has witnessed an exponential growth with more people adopting a contactless lifestyle as much as they can. One of the best advantages of digital wallets is that users don’t need to carry cash or credit cards around & there will be no need to worry about losing or stealing valuables. Total transaction value in the Digital Payments segment is expected to grow to US$8.49 trillion in 2022 & is expected to reach US$15.17 trillion by 2027 at a CAGR of 12.31% in between 2022 & 2027. Some of the leading digital wallet apps are-

- Apple Wallet

- Google Pay

- PhonePe

- PayTM

Development Process of a Beneficial FinTech app

Since integrating technology in the financial sector, FinTech apps have unfurled a myriad of opportunities to bring revolutionary changes. Many banks and financial institutes have come forward with unique and noteworthy FinTech apps to stand the test of time. Undoubtedly, technological advancements in the financial sector have brought unprecedented changes and set some milestones to compete with and learn from. The development process depends on the complexity of the FinTech app, business goals, array of services, customer needs, budget, and many more. Let’s discuss the fundamental requirements of a beneficial FinTech app-

-

Market research

The most common way to go forward with any app development process is by doing intense and comprehensive market research. The analysis process is a great way to understand the market trends, basic needs of such a business, market insights, user demographic, volatility of the market, and many more.

-

Learning about compliances

The finance sector is one of the most volatile markets. When developing a FinTech app, you must know all government schemes, rules, regulations, and policies. How are policies going to affect your business? What are the chances of them affecting your business if the government decides to bring changes to them? It would be best if you researched such an area too.

-

Unique startup idea

A unique startup idea is always welcome in the market & that’s what customers strive for. There is always a unique way to approach the problem and ease how people manage their finances. Make sure you do your market research well to understand the user demographic well.

-

Investors and funding

Every business idea needs a certain budget to survive the beginning stage after launching. Also, if app features are complex and essential, having a certain monetary value is necessary. Nowadays, you don’t have to worry about funding as people are inclined to invest in unique ideas and be a part of a possible future unicorn. Crowdfunding, personal loan, and finding an investor are some ways to raise money.

-

Selecting right FinTech developers

Now that you’ve reached the development part of the FinTech app development process. Hiring a local app development company will be the wise choice for a budget-friendly development process since they have experience, tools, teams, and cost-effective methods to develop an app. Some app development companies keep the pre-developed app model to accommodate your needs. They will modify or add new features if you wish so.

-

Technical challenges and growth

Without challenges, there will be no growth. When fully invested and involved in the development process, you learn deeply about your business goal and the kind of app you want. Make sure to choose such technology that will accommodate future advancements in the field and bring customer satisfaction to the maximum.

-

Launching an MVP

Once the development process is complete, it is time to launch an MVP (Minimum Viable Product). Your marketing team will help you in launching and promoting the app to your target audience. The feedback and reviews will be either your rewards or the lessons. Either way, it will be a great opportunity to grow and develop a user-centric FinTech app.

Development cost of developing a FinTech app

The development cost of a fintech app depends on many factors such as app software, app features, the complexity of the app, the developer’s cost, third-party integration, etc. Investing in a FinTech app can cost you a lot. Choosing a cross-platform software framework, faster animation, Sleek UI/UX, and budget-friendly features are some of features that determine the cost of your FinTech app.

Best Technology Integration in FinTech App Development

Since FinTech apps deal with crucial personal and commercial financial data, technologies that support such apps must work seamlessly and back hefty transactions effortlessly. A small change or upgrade in technology can disturb the function of an app up to a large scale. Due to this reason, many FinTech companies hesitate to introduce new major changes. A security breach is another issue that led FinTech companies to search for an alternate and secure technology that will accommodate future changes and keep the data encrypted & private. One of the issues that the FinTech app faces is OS compatibility. The software must be platform-independent, i.e. it must support all Android, iOS, and Windows web & mobile devices. Considering the recent developments in the technology world, Flutter by Google and React Native by Android are two of the most advanced software frameworks that offer cross-platform features along with budget-friendly, time-saving, sleek UI/UX integration, customizable widgets, faultless future adjustments in the application, and many more. According to the survey on cross-platform mobile frameworks used by software developers worldwide, in 2021, almost 42% of developers used the Fluter framework, while about 38% used React native framework. It is essential to develop high-quality mobile and web applications to stand out in the market. With over 3.5 million apps on Google Play Store and over 2.1 million apps on App Store (Based on the recent survey),choosing the right framework software for app development is essential. Another major issue that FinTech companies come across is a security breach. Cybercrime is a major issue that concerns the FinTech industry. Ensure that the app’s cloud storage model, in-app communication, and payment gateway methods adhere to data security rules and regulations. The app’s security features must be able to protect the sensitive data of personal & business transactions. Some of the data security precautions that most FinTech companies are using are blockchain technology integration, AI integration, two-factor login, biometric security, payment limits, employment of microservices, etc.

FinTech App FAQs

What latest technological innovations are used in the field of FinTech app development?

Artificial Intelligence (AI),Machine learning (ML),Augmented Reality (AR),Robotic Process Automation (RPA),Blockchain, Open Banking, Internet of Things (IoT),RegTech, Biometric Authentication, Virtual Cards, Voice Payments, and Cloud Computing are exemplary innovations used in the field of FinTech development.

What programming languages are essential in developing a FinTech app?

For software development, frameworks which are used include Flutter by Google & React Native by Android. Other than that, Python, Scala, Java, Ruby, C#, C++, etc., are also used.

How do FinTech apps make money?

The most obvious way of generating money from a FinTech app is through commercials. Every time a user clicks on the ad, the app owner gets paid by third-party ad networks. Banner ads, rich media, subscriptions, peer-to-peer lending, Robo-advisors, in-app purchases, etc.

Conclusion

You have understood how FinTech is bringing explosive changes to the finance sector. New technical inventions are making a better and more secure world to ease people’s lives. There is so much that yet needs exploring. People are moving towards more secure, private, and smooth FinTech apps that cater to their everyday needs. The FinTech market is yet to grow. You have learned about the top FinTech ideas for a successful startup business. Make sure you choose the right FinTech app development company that will give you the quality product on time and stays with you for future upgrades.

Share this blog