If you think your toaster is a smart machine, wait until you see what artificial intelligence can do! AI is transforming the scenario of industries from healthcare to farming, and it's also changing the way we work and live. It has a massive effect on the financial sector, especially when it comes to buying stocks.

AI-driven algorithms play an important role in optimizing trading systems, from portfolio management to risk assessment, making it a smooth process. These algorithms can specify market trends and changes, providing understandings that are usually missed by human traders. Companies looking to build a trading app like Robinhood can use AI models to enhance user experience and decision-making.

For those interested in developing a stock trading app, partnering with a reputable AI app development company can ensure that refined machine learning techniques are used for predictive analytics and computerized trading.

In this blog, we will examine how AI is shaping the future of stock trading. We’ll address key questions like How to use artificial intelligence in stock trading. And Why Is AI good for stock analysis? Join us as we dive into the exciting convergence of technology and finance!

Overview of AI in Stock Trading

Technologies like machine learning, deep learning, natural language processing, and artificial intelligence are completely changing the way stock trading is done.

AI allows traders to study vast information and find trends that guide trading choices. Its rising popularity covers hedge funds, private trading sites, and individual traders, making it an important tool in modern finance.

AI is particularly important in algorithmic trading, where computers perform deals at high speed and efficiency. These computers can handle millions of data points in real-time, allowing for fast decision-making that human traders simply cannot match. This feature improves the accuracy and efficiency of trade methods, solving the question of

The improved accuracy delivered by AI enables for better risk management and more educated trading selections. As a consequence, traders utilizing AI technologies may benefit from market opportunities more effectively than ever before.

Partnering with a professional fintech app development company that specializes in AI app development services helps ease the process. Such businesses may help incorporate powerful AI models into their trading software, providing features like automatic trading alerts and real-time market monitoring.

Also Read: How to Build a Trading App Like Robinhood

Leveraging AI for Profitable Stock Trading

To use AI to make money in stocks, traders can harness advanced technologies like machine learning, natural language processing, and automatic trading. These AI models study vast amounts of market data, finding patterns and trends that human traders might miss. By performing deals at high speeds and with accuracy, AI removes emotional flaws and improves decision-making.

Traders can utilize AI-driven data to improve their tactics, predict price changes, and handle risks effectively. Ultimately, adding AI into trade methods not only improves accuracy but also increases the possibility for revenue in the stock market.

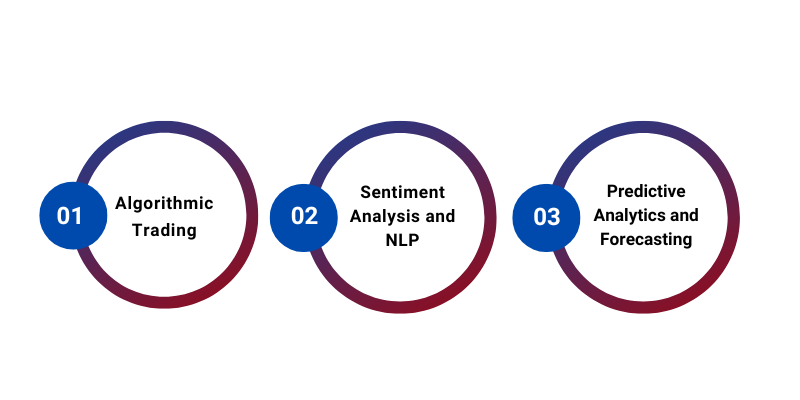

AI-Powered Tools and Technologies in Stock Trading

Algorithmic Trading

Algorithmic trading refers to the use of pre-programmed AI programs to perform deals based on predefined criteria. These AI-driven programs can study vast amounts of market data, allowing them to perform deals faster and more efficiently than human traders. By reducing delay and erasing emotional errors, automated trade improves decision-making processes. The benefits include speed, volume, and accuracy, allowing buyers to profit on brief chances.

Examples of algorithmic trading include High-Frequency Trading (HFT), where deals are made within milliseconds and automatic portfolio management systems that change asset ratios based on real-time market conditions. For those interested in stock trading app development, adding these methods can greatly improve user experience and trade results.

Sentiment Analysis and NLP

AI also excels in studying news, social media, and general market moods through Natural Language Processing (NLP). By handling unorganized data from platforms like Twitter or financial news sites, AI can gauge market mood and spot trends that may affect stock prices. This feature allows buyers to make informed choices based on real-time public opinion.

For instance, an AI model can study tweets about a particular market to determine if the mood is largely positive or negative, guiding traders on when to join or leave holdings. Utilizing AI app development services can help banking companies build tools that combine mood analysis for better decision-making.

Predictive Analytics and Forecasting

One of the most fascinating questions is: "Can AI predict the stock market?" The answer comes in AI's ability to examine past data and identify trends using models like regression and neural networks. These prediction analytics tools help traders forecast market trends and possible price changes.

AI models continuously learn from new data, improving their estimates over time. For example, a well-trained neural network can find minor patterns in market activity that might avoid human analysis. By working with an AI app development company, traders can create complex apps that use these predictive capabilities for improved trading strategies.

Utilizing tools like Perplexity AI can be highly beneficial for stock market predictions due to its ability to extract data from various sources.

Advantages of AI in Stock Trading

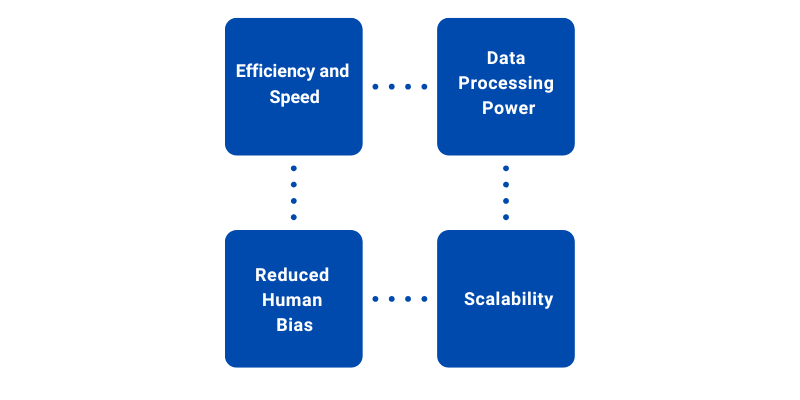

Efficiency and Speed

AI-driven deals greatly beat human traders in both speed and accuracy. With the potential to study data and perform deals within milliseconds, AI systems can capitalize on market opportunities that would be hard for humans to catch. This increased speed is important in the lively stock market, where timing can make a substantial difference in profits.

Data Processing Power

AI excels at handling huge amounts of information in real time, including past data, market news, and social media opinion. By combining AI models, traders can look through vast amounts of information quickly and efficiently, finding patterns and trends that guide better trading choices. For those looking to build a trading app like Robinhood, tapping AI's data processing skills can provide a competitive edge.

Reduced Human Bias

One of the most important benefits of AI in stock trading is its ability to reduce human biases. Unlike human traders, AI programs are not affected by feelings such as fear or greed, leading to more stable trading results. This neutrality allows for more reliable decision-making, eventually improving total trade success.

Scalability

AI allows traders to handle big accounts and various assets with minimal human input. By automating routine tasks such as watching market conditions and completing deals, traders can focus on strategy development rather than day-to-day operations. Collaborating with a reputable financial app development company that specializes in AI app development services can help build tools that improve scalability and efficiency.

Challenges and Risks of Using AI in Stock Trading

Data Quality Issues

High-quality, clean data is important for the effectiveness of AI models in stock trading. Poor-quality data—whether missing, old, or inaccurate—can lead to incorrect estimates and poor trade results.

When AI models depend on insufficient data, they may create false conclusions that can result in large financial losses. For users interested in stock trading app development, having access to accurate data is important for the success of their apps.

Overfitting and Model Risk

Overfitting happens when AI models become too reliant on past data, failing to change to new market conditions. This can lead to a situation where the model works well on past data but badly in real-time trade settings.

As markets shift quickly, an overfitted model may miss new trends or changes, weakening its effectiveness. Collaborating with an AI app development company can help minimize this risk by adopting strategies that improve model flexibility.

Market Volatility

AI systems struggle to predict unforeseen events or high-impact market changes, raising questions about "Can AI predict the stock market?"

While AI can analyze historical data and recognize patterns, it cannot foresee sudden global crises or economic shifts that may greatly affect market conditions. This limitation shows the need for human review in trade choices, especially during risky times.

Ethical and Regulatory Concerns

The question "Is AI trading legal?" points to the regulatory systems surrounding AI-driven trading practices. As AI technology changes, so do the laws guiding its use.

Many AI models work as "black boxes," making it difficult for traders to understand how choices are made. This lack of openness can lead to trust problems among users and authorities alike.

Case Study: AI Success Stories In Stock Trading

Example 1: Renaissance Technologies

Renaissance Technologies, started by scientist Jim Simons, is a top hedge fund known for its excellent success driven by quantitative trading methods. The firm uses AI models and complicated algorithms to study vast datasets, allowing it to predict price changes with remarkable accuracy. By utilizing high-frequency trading (HFT) methods, Renaissance performs deals at a fast speed, profiting on small price differences.

This new method demonstrates "how AI is used in trade finance," showing the power of data-driven decision-making in getting substantial profits.

Example 2: BlackRock’s Aladdin Platform

BlackRock’s Aladdin tool is another great example of AI's changing role in stock dealing. This advanced system combines AI for portfolio and risk management, allowing investment managers to examine risks and improve asset placements effectively. By leveraging machine learning techniques, Aladdin offers real-time insights that improve stock analysis. The platform's ability to handle vast amounts of market data helps BlackRock make informed financial choices and, eventually, better client results.

The Future of AI in Stock Trading: Trends and Innovations

AI-Powered Robo-Advisors

The rise of AI-powered robo-advisors is changing financial planning, making it more available to retail buyers. These automatic platforms utilize complex formulas to study individual financial situations, risk limits, and investing goals.

By offering personalized investment plans, robo-advisors are considered one of the best choices for stock trading app development. With lower fees compared to traditional planners, they open access to personalized financial advice, allowing a wider range of clients to benefit from advanced portfolio management.

Quantum Computing in Stock Trading

Looking ahead, quantum computing holds significant promise for improving AI programs used in stock trading. By leveraging quantum physics, these systems can handle vast amounts of information at new speeds, allowing more complicated calculations and faster decision-making. This development could lead to better predictive models and more efficient trading strategies, further changing the world of stock trading.

AI and ESG Investing

Another growing trend is the integration of AI in Environmental, Social, and Governance (ESG) investment. AI tools can evaluate vast amounts of data to find sustainable investments based on ESG criteria. This feature helps investors match their investments with social factors while still seeking financial gains. As socially responsible investing gets ground, AI's role in this area will likely grow, letting investors make informed choices that reflect their ideals.

Integration with Blockchain and Decentralized Finance (DeFi)

The intersection of AI with blockchain technologies and Decentralized Finance (DeFi) presents new possibilities for changing stock trading. AI can improve the efficiency and security of deals within decentralized systems, offering real-time data and automatic trading strategies. This combination could lead to more open and efficient markets, allowing for new trade solutions that leverage both AI and blockchain powers.

Conclusion: The Road Ahead for AI and Stock Trading

In conclusion, AI is set to play a changing role in stock trading, giving numerous benefits such as improved speed, accuracy, and data processing skills. However, difficulties continue, including data quality problems, market volatility, and social worries. Addressing these issues will be important for the successful integration of AI into trade methods.

To repeat key points from our discussion: AI trade is allowed, provided it meets with current rules. While AI can guess the stock market to some extent by studying past data and trends, it cannot foresee unforeseen events. Moreover, traders can effectively use AI to make money in stocks by leveraging advanced algorithms and data analytics to guide their choices.

As the financial scene continues to change, staying informed about improvements in AI technology will be important for traders and buyers alike. For those looking to develop new fintech solutions or stock trading applications, consider choosing Jploft, a top fintech app development company.

With skills in AI app development services, Jploft can help you build cutting-edge platforms that harness the power of AI to improve trade success and user experience.

Share this blog